Overføring til Bangladesh

- Low fees — fees get cheaper the more you send

- Lightning fast — money typically arrives in seconds

- Perfectly predictable — lock in an exchange rate for up to 48 hours

- Bank transfer fee0 NOK

- Vårt gebyr157,51 NOK

- You could save up to 324,24 NOK

Should arrive by søndag 6. april

Sammenlign de beste pengeoverføringskursene til Bangladesh

The cost of your transfer comes from the fee and the exchange rate. Many high street banks offer “no fee”, while hiding a markup in the exchange rate, making you pay more.

At Wise, we’ll never do that. We only use the mid-market exchange rate, and show our fees upfront. This table compares the fees you’d really pay when sending money with the most popular banks and providers, or with us.

How do we select providers and collect this data?| Sending 17 416,15 NOK with | Recipient gets(Total after fees) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 200 000,02 BDT | ||||||||||

Transfer fee 157,51 NOK Exchange rate(1 NOK BDT) 11,5884 Exchange rate markup 0 NOK Cost of transfer 157,51 NOK | |||||||||||

| 196 242,64 BDT- 3 757,38 BDT | ||||||||||

Transfer fee 64,90 NOK Exchange rate(1 NOK BDT) 11,3100 Exchange rate markup 418,41 NOK Cost of transfer 483,31 NOK | |||||||||||

Slik sender du penger til Bangladesh med 3 enkle trinn

Skriv in beløp å sende i NOK.

Betal i NOK med debetkortet eller kredittkortet ditt, eller send pengene fra nettbanken din.

Velg mottaker i Bangladesh.

Velg mottaker av pengeoverføringen og utbetalingsmåte.

Send NOK, motta BDT.

Mottakeren får pengene i BDT direkte fra Wise sin lokale bankkonto.

Larger transfers. Lower fees. Premium support.

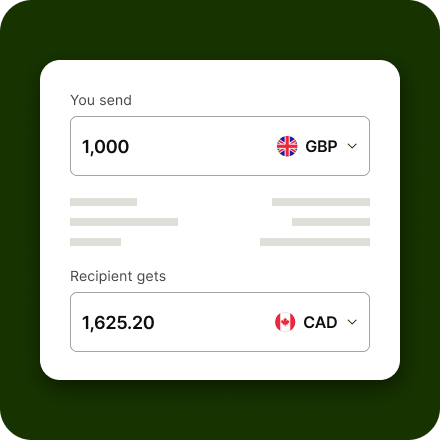

Pay less when you send over 20,000 GBP or equivalent. Plus get dedicated support from our expert team

Slik sender du penger til Bangladesh fra Norge

Slik sender du penger til Bangladesh fra Norge

- Bare tast inn hvor mye, og til hvor.

- Then make a local payment to Wise, whether it's with a bank transfer, swift or your debit or credit card.

- Og det er alt.

Wise omregner pengene dine til interbank-kurs – den reelle kursen – så du sparer mye sammenlignet med dem som sier det er «null» provisjon.

Hvor mye koster det å overføre penger til Bangladesh?

Betal en liten fast avgift og en prosentandel

For å sende penger i NOK til Bangladesh betaler du en liten fast avgift på 17,71 NOK + 0,81% av beløpet som konverteres (du ser alltid den totale kostnaden på forhånd).

Gebyret avhenger av hvilken overføringstype du velger

Noen overføringstyper har ulike gebyrer, som oftest er lave.

Ingen skjulte gebyrer

Ingen store gebyrer, hverken skjult eller annet. Så det er billigere enn hva du er vant til.

Hvor lang vil en pengeoverføring til Bangladesh ta?

En pengeoverføring fra Norge (NOK) til Bangladesh (BDT) bør ankomme by søndag 6. april. Enkelte ganger kan tidspunktene variere på grunn av betalingsmåte eller endringer i verifiseringen. Vi holder deg hele tiden oppdatert, og du kan følge med på hvert trinn i prosessen i kontoen din.

På mange populære ruter kan Wise sende pengene dine innen én dag, som en overføring samme dag eller til og med som en umiddelbar pengeoverføring.

Overføringsruten din

Bør ankomme

by søndag 6. aprilDet du trenger til din pengeoverføring på nett til Bangladesh

Registrer deg gratis.

Registrer deg på nettet eller i appen gratis. Du trenger bare en e-postadresse eller en Google- eller Facebook-konto.

Velg et beløp du skal sende.

Fortell oss hvor du mye vil sende. Vi viser gebyrene på forhånd og forteller deg når pengene skal komme fram.

Legg til mottakerens bankinformasjon.

Fyll inn informasjonen om mottakerens bankkonto.

Bekreft identiteten din.

For visse valutaer, eller for store overføringer, trenger vi et bilde av din ID. Dette helper oss til å beskytte pengene dine.

Betal for overføringen din.

Send pengene dine med en bankoverføring eller et debit- eller kredittkort.

Det er alt.

Vi tar hånd om resten. Du kan spore overføringen i kontoen, og så sier vi fra til mottakeren at den er på vei.

Den beste måten å sende penger på til Bangladesh

Bankoverføring

Bank transfers are usually the cheapest option when it comes to funding your international money transfer with Wise. Bank transfers can be slower than debit or credit cards, but they usually give you the best value for your money. Read more how to use bank transfers as a payment option.Google Pay

If you’ve enabled Google Pay on your phone, you can use it to pay for a transfer with Wise. Paying with Google Pay is a convenient and quick way to send money abroad. If you’re using a credit card, watch out for extra charges. Some banks consider these payments as cash withdrawal, and they may charge you extra fees.Apple Pay

If you’ve enabled Apple Pay on your phone, you can use it to pay for a transfer with Wise. Paying with Apple Pay is a convenient and quick way to send money abroad. If you’re using a credit card, watch out for extra charges. Some banks consider these payments as cash withdrawal, and they may charge you extra fees.Debetkort

Paying for your transfer with a debit card is easy and fast. It’s also usually cheaper than credit card, as credit cards are more expensive to process. Read more about how to pay for your money transfer with a debit card.Kredittkort

Paying for your transfer with a credit card is easy and fast. Wise accepts Visa, Mastercard and some Maestro cards. Read more about how to pay for your money transfer with a credit card.Wise account

Hvis du har en Wise-konto for flere valutaer, kan du bruke pengene på kontoen til å betale for overføringen. Det er billig og går raskt – du konfigurerer bare pengeoverføringen som vanlig, og så velger du en Wise-kontooverføring når du skal betale.

Trust Wise with safe & secure money transfers til Bangladesh

Beskyttet via verdensledende banker

Vi oppbevarer pengene dine hos etablerte finansinstitusjoner, slik at de er separat fra våre egne kontoer, og at de under våre normale forretningsvirksomheter ikke er tilgjengelige for partnerne våre. Les mer her.

Overføringer med ekstra sikkerhet

Vi bruker totrinnsverifisering for å beskytte kontoen din og transaksjonene dine. Det vil si at det er du — og kun du — som kan få tilgang til pengene dine.

Personvern

Vi gjør alt vi kan for å holde personopplysningene dine trygge, og vi er åpne om hvordan vi samler inn, behandler og lagrer opplysningene.

Dedikert team for svindelbekjempelse

Vi arbeider året rundt for å holde kontoen din og pengene dine beskyttet mot selv de mest sofistikerte svindelforsøkene.

Send penger til Bangladesh fra Norge med den mest internasjonale appen

Ser du etter en app du kan bruke til å sende penger utenlands? Send penger, motta betalinger fra utlandet, sjekk valutakurser – alt i én app.

- Billigere overføringer utenlands – ingen skjulte gebyrer eller påslag på valutakursene.

- Sjekk valutakurser – se i appen hvordan valutakursene endrer seg over tid.

- Gjenta tidligere overføringer – lagre opplysninger og utfør månedlige betalinger på en enklere måte.

Wise fungerer nesten overalt

- Norwegian kroneSwift/BIC og IBAN

- British poundSwift/BIC, IBAN, Sort code og Account number

- EuroSwift/BIC og IBAN

- United States dollarRouting number, Swift/BIC, Account number og Account type

- United Arab Emirates dirhamSwift/BIC og IBAN

- Australian dollarSwift/BIC, Account number og BSB code

- Bulgarian levSwift/BIC og IBAN

- Canadian dollarSwift/BIC, Account number og Institution number

- Swiss francSwift/BIC og IBAN

- Chinese yuanSwift/BIC og IBAN

- Czech korunaSwift/BIC og IBAN

- Danish kroneSwift/BIC og IBAN

- Hong Kong dollarSwift/BIC og IBAN

- Hungarian forintSwift/BIC, IBAN og Account number

- Israeli shekelSwift/BIC og IBAN

- Japanese yenSwift/BIC og IBAN

- New Zealand dollarSwift/BIC og Account number

- Polish złotySwift/BIC og IBAN

- Swedish kronaSwift/BIC og IBAN

- Singapore dollarBank name, Bank code og Account number

- Turkish liraIBAN

- Ugandan shillingSwift/BIC og IBAN

- South African randSwift/BIC og IBAN

- United Arab Emirates dirham

- Australian dollar

- Bangladeshi taka

- Bulgarian lev

- Canadian dollar

- Swiss franc

- Chilean peso

- Chinese yuan

- Colombian peso

- Costa Rican colón

- Czech koruna

- Danish krone

- Egyptian pound

- Euro

- British pound

- Georgian lari

- Hong Kong dollar

- Hungarian forint

- Indonesian rupiah

- Israeli shekel

- Indian rupee

- Japanese yen

- Kenyan shilling

- South Korean won

- Sri Lankan rupee

- Moroccan dirham

- Mexican peso

- Malaysian ringgit

- Nigerian naira

- Norwegian krone

- Nepalese rupee

- New Zealand dollar

- Philippine peso

- Pakistani rupee

- Polish złoty

- Romanian leu

- Swedish krona

- Singapore dollar

- Thai baht

- Turkish lira

- Tanzanian shilling

- Ukrainian hryvnia

- Ugandan shilling

- United States dollar

- Uruguayan peso

- Vietnamese dong

- West African CFA franc

- South African rand

See why customers choose Wise for their international money transfers

It's your money. You can trust us to get it where it needs to be, but don't take our word for it. Read our reviews at Trustpilot.com.