How to make money online and from home: For beginners, students and more (MY)

Learn more about how to make money online in Malaysia through platforms like YouTube, TikTok, and more.

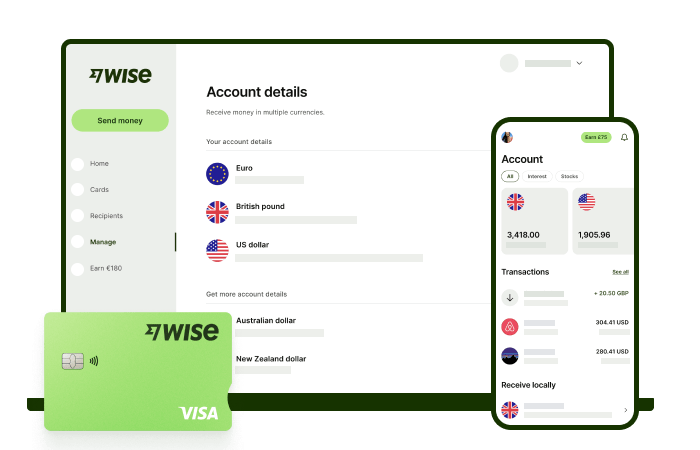

Wise (formerly known as Wise) is global technology company, building the best way to move and manage the world’s money. With Wise, Malaysians can hold 40+ currencies, move money between countries, and spend money abroad - with a multi-currency account and an international debit card.

If you’re looking for easier, faster and cheaper ways to manage your personal money across currencies, you may be wondering how to use Wise in Malaysia. This guide has you covered, looking at:

Before we look in more detail at how to use Wise money transfer or how to use the Wise card, let's answer the most important question: Is Wise legit?

Wise is regulated under the Malaysian law as a remittance, money-changing and e-money issuance business. It’s also overseen by other regulatory bodies all around the world. That means that you can trust it’s safe and legit for all payments and account services.

In fact, Wise is already trusted by over 12 million customers worldwide and has a 4.3 star rating on Trustpilot¹, from 224,000+ reviews. Learn more about how Wise keeps customers and their money safe and Terms of Use.

Wise was launched with a mission to make it faster, cheaper and more convenient to send international payments. To this day, Wise is driving down the costs of transferring funds around the world, with simple online and in app services which get your payments where they need to be, quickly. Let’s look at a few key questions about Wise money transfers, and then a step by step on how to set one up.

Wise international transfers are fast, cheap and secure. But before you can send a Wise international money transfer you’ll need to create a Wise account. That can be done online or in the Wise app, with a smooth onboarding process which you can do right from home - here’s how:

If you don't have a Wise account yet, sign up by clicking the button below. Opening a Wise account is completely free.

This list is for information purposes only and is not meant to be a comprehensive list of all of the items that Wise may request to verify a customer's identity

Once you have your new Wise account up and running, you’re ready to make an international payment. Here’s how to do it in just a few simple steps²:

Learn more from Wise's Help Centre.

Wise money transfers are fast. In fact, 45%+ of Wise transfers arrive instantly - and the vast majority arrive within a day. That’s compared to an average of 3 - 5 days for a SWIFT transfer sent with a regular bank.¹²

This works because Wise built its own payment network instead of using the 50+ year old SWIFT preferred by banks. This moves your money faster, and cuts out on intermediary fees at the same time.

The speed of transaction claim depends on funds availability, approval by Wise’s proprietary verification system and systems availability of our partners’ banking system, and may not be available for all transactions.

Ditching SWIFT fees isn’t the only way customers can save money when using Wise instead of a regular bank to send an international payment. Wise transfers use the mid-market exchange rate with no markup or margin, and no hidden fees¹³. There’s just a low, transparent charge - which is split out clearly so you can see exactly what you’re paying for your transfer.

Overall, that can make Wise cheaper than traditional Malaysian banks.

Please see Terms of Use for your region or visit Wise Fees & Pricing: Only Pay for What You Use for the most up-to-date pricing and fee information

The amount you’ll pay for your transfer with Wise depends on a few things - how much you’re sending, how you want to pay, and the exchange rate from MYR to your desired currency⁴.

Wise always uses the mid-market exchange rate, which is the one you’ll find on Google. In addition there are 2 other fees which are split out clearly:

Use this handy Wise cost calculator which displays the exact cost for your next transfer. Learn more about Wise fees in Malaysia - and model your payment - here.

For a detailed breakdown of transaction fees, use our pricing calculator.

Wise limits are set according to the currencies involved. If you’re sending a payment from MYR to another currency, you’ll usually find the following limits in place:

Here's more information about Wise limits for MYR transfers.

As well as sending a one off payment with Wise, you can also sign up for a Wise multi-currency account - a smart alternative to regular foreign currency accounts.

It’s free to get a personal account and you can sign up online or in the Wise app in just a few steps.

Here’s what you’ll get:

When you have your Wise multi-currency account, you’ll be able to add funds in any of the 10 supported currencies easily. Here’s what you need to do⁵:

Your Wise account can also be a very useful way to get paid by anyone looking to send you money abroad or in Malaysia. You'll get personal account details in 10 currencies which makes it easy to receive money into your Wise account - as senders can simply transfer money to your Wise account with a regular bank transfer. Here’s how to get your account details⁶:

Here's more information about receiving money from Wise's help centre.

In Malaysia, Wise personal customers can hold a maximum of 20,000 MYR in their Wise accounts at any time⁷. This limit applies to the sum of all currencies held.

If you’ve sent a payment of more than 20,000 - or if you’ve sent a payment which pushes your total balance above this limit - you’ll need to withdraw the excess to your bank account.

You’ll be notified if your account hits this limit, and will have 7 days to withdraw the excess funds to your external account. After this time, your Wise account will be automatically frozen until you’re able to withdraw the funds, to comply with Malaysian laws.

For convenient spending online and in person, and cash withdrawals all over the world, check out the Wise Visa card⁸. This international debit card is linked to your Wise account, and lets you spend and make withdrawals in 150+ currencies.

With your Wise card you could save up money on every transaction when transacting in foreign currencies. Which is excellent for traveling abroad or shopping online.

For added security, whenever you spend with your Wise card you’ll see an instant notification in the app, and you can freeze and unfreeze the card in just a few clicks any time you need to.

| Read more here: Wise card Malaysia - why is it worth it? |

|---|

Ordering a Wise card couldn’t be easier⁹:

Your card will be shipped as soon as all your details have been verified - you can also start using your virtual card right away as soon as your application has been approved. All the currencies in your Wise account are linked to the card, so you can conveniently spend wherever in the world you are.

Once your Wise physical debit card has arrived, you’ll have to activate it by making a chip and PIN purchase or cash withdrawal. After that you can make contactless payments for convenience.

It’s free to spend any currency you hold in your account - and even if you don’t have the right currency to hand, the smart auto convert technology will switch your funds from the currency which attracts the lowest fees. So you’ll always get the best deal on your spending.

You’ll just pay a one off 13.7 MYR fee to get your card - and you can start shopping immediately with your digital card for online and mobile payments. Your physical card will arrive in the post within a couple of weeks.

There are fees for withdrawing cash from ATMs with your Wise card - you can make up to 2 cash withdrawals from Visa-supported ATMs to the value of 1,000 MYR per month for free. After that there’s a low fee of 5 MYR + 1.75% per withdrawal.

Wise is a safe global provider of money transfers and multi-currency account services, fully licensed and regulated in Malaysia, and trusted by millions of customers around the world.

You can make a one off payment with Wise easily online or in the Wise app, with the mid-market exchange rate and low, transparent fees. That can work out cheaper than using a normal bank. And because Wise processes transfers through its own payment network rather than relying on SWIFT like traditional banks do, your money could arrive far faster too.

For even more convenient ways to manage your money across currencies, check out the Wise multi-currency account and card. Hold dozens of currencies, and get paid like a local from 30+ countries. You can spend with your card around the world, and manage your entire account online and in the Wise app, with the great exchange rates and low fees Wise is famous for.

Sources:

Sources checked on 31.08.2022

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn more about how to make money online in Malaysia through platforms like YouTube, TikTok, and more.

Learn more about the RHB Multi Currency Debit card in Malaysia, including benefits, requirements, fees and whether it’s worth getting.

Learn more about Bank Islam transfer limits as well as how to set, increase and change them.

Learn more about HSBC foreign currency accounts like the Everyday Global and CombiNations account - including requirements, fees, and more.

Learn more about how to change Maybank transfer limits as well as transfer time, fees, and more when making an online transfer.

We compared the top Affin Bank cards in Malaysia. Whether you’re looking for points, fees or rewards on travel spend, find out which credit card is for you.