How to make money online and from home: For beginners, students and more (MY)

Learn more about how to make money online in Malaysia through platforms like YouTube, TikTok, and more.

There are plenty of choices of eWallets, each with their own features and benefits. This guide will walk through 9 of the best, to help you choose the right one for you.

| Check out our updated 2025 review of best e-Wallets in Malaysia |

|---|

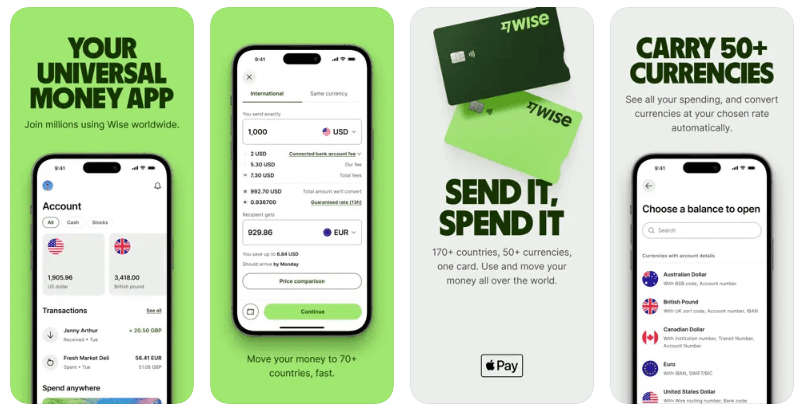

If you're an expat or traveller in Malaysia, you might need to send money abroad regularly. With Wise you can send money from Malaysia to 70+ countries with the real exchange rate and transparent fees.

|

|---|

A crucial thing to remember when sending money abroad is to always check exchange rates. The true cost of an international transaction isn’t just the upfront transfer fees. Wise uses the real exchange rate and is up to 4 times cheaper than Malaysian banks.

Example of sending 5,000 MYR (including transfer fees) to a GBP account in UK1

| Provider | Transfer fee | Exchange rate (1 MYR → GBP) | Recipient gets |

|---|---|---|---|

| Wise | 58.02MYR | Real exchange rate (0.1845) | 911.82GBP Send money |

| Maybank | 10.60MYR | Exchange rate Maybank decides (0.1844) | 905GBP ▼-6.82GBP |

| Public Bank | 12MYR | Exchange rate Public Bank decides (0.184) | 890GBP ▼-21.82GBP |

(Fees and exchange rates correct at time of research 26 January, 2026)

Moreover, you can receive money to a Wise multi-currency account from the UK, US, Australia, New Zealand and any Eurozone country, just as if you had a local bank account in those countries. Hold your money in 50+ different currencies, and switch it using the mid-market rate whenever you want to.

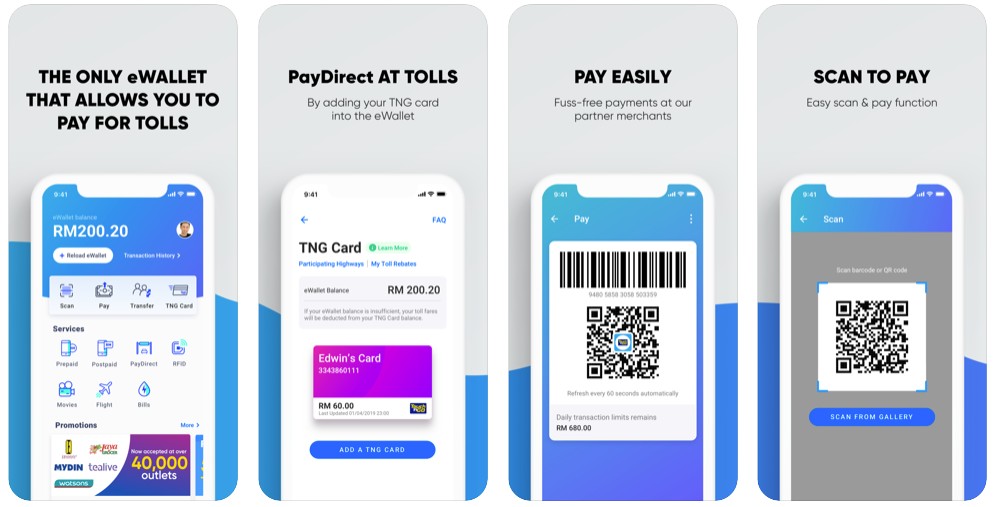

Originally a physical card used for paying your road tolls, Touch ‘n Go now also offers digital services through the Touch ‘n Go eWallet.2

|

|---|

Touch ‘n Go lets users load up to 5,000 MYR per month, through DuitNow transfer, using a credit or debit card, or via Reload PIN. You can then use your balance to pay for ecommerce shopping, buying tickets, picking up your groceries and more. There is enhanced security and a money back guarantee which means you’re protected if your account is charged for unauthorised purchases.3

Read more about using Touch 'n Go here.

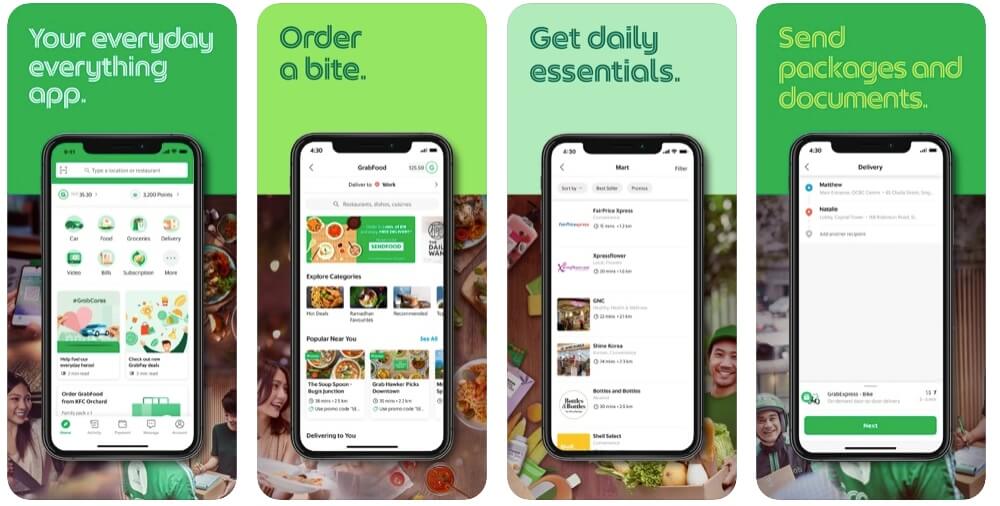

One of Malaysia’s leading eWallets, GrabPay lets you earn reward points as you spend online, in stores, on GrabFood, or getting a ride.4

|

|---|

If you use Grab already to book rides or buy food, using GrabPay might make good sense. You’ll get seamless payments for purchases, as well as earning points on every transaction which you can then use to offset future payments. You can also send money to friends, shop in stores and buy prepaid mobile top up, confident your payments are secured using top notch technology and fraud detection systems.

Learn more about GrabPay eWallet here.

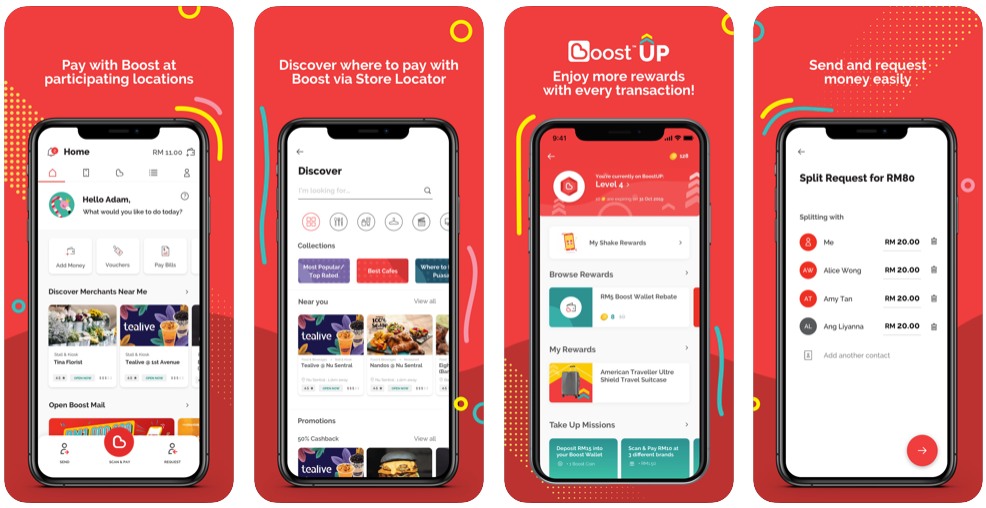

Boost is proudly Malaysian, and has 7 million members, making purchases at 140,000 different physical and online touchpoints. 5

|

|---|

One of Boost’s selling points is the range of opportunities to get a little extra when you spend. Earn Boost cashback rewards as you shop, get Boost coins as part of the eWallet loyalty program, and take part in specific competitions and promotions to get unique prizes. All with the convenience of an eWallet which can be used for everything from buying a flight to splitting a restaurant bill or picking up your groceries.

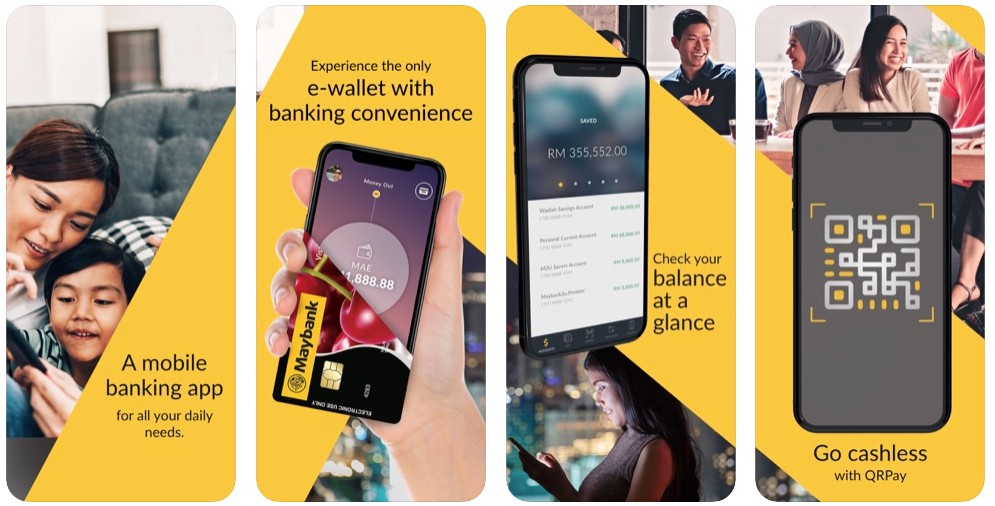

MAE is MayBank’s eWallet product, which can be used to spend easily, but also comes with some helpful features to help you manage your money, budget and save.6

|

|---|

MayBank suggests MAE as a smart way of tracking and controlling spending by transferring only your monthly budget to MAE, so you don’t accidentally overspend. You can then transfer any remaining at the end of the month to savings to help keep on top of your finances. There’s an account limit of MYR4,999 to help stop accidental overspending, too.

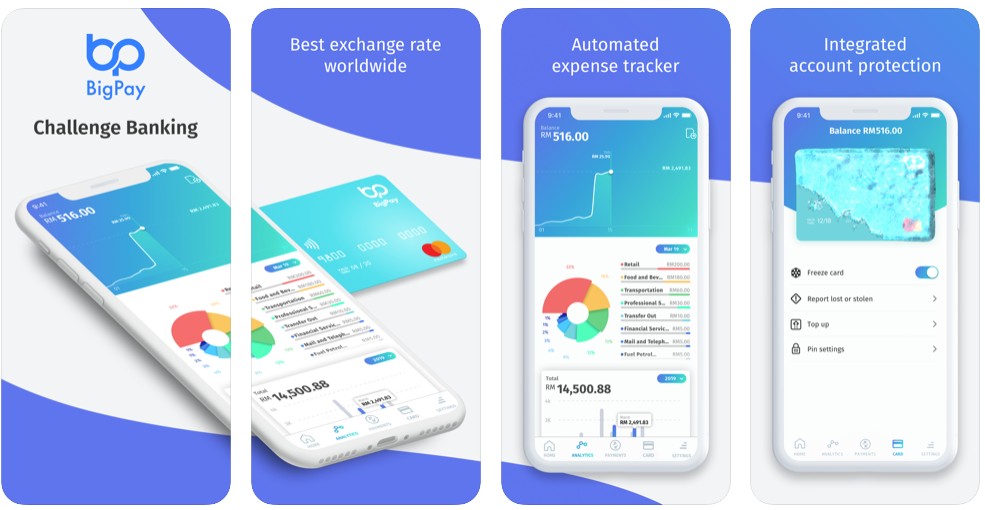

BigPay offers an eWallet account which also comes with a BigPay card. This can be handy if you find yourself somewhere eWallet payments aren’t available - such as when you travel - or if you want to make an ATM withdrawal.7

|

|---|

Use the BigPay eWallet for digital and physical payments, and have the card as a backup for ATM withdrawals and when travelling. Send money to friends, get discounts on AirAsia, and make international transfers to the Philippines, Indonesia, Singapore and Thailand, too. You’ll also earn reward points which you can redeem against later purchases.

Here's a full review of using BigPay in Malaysia.

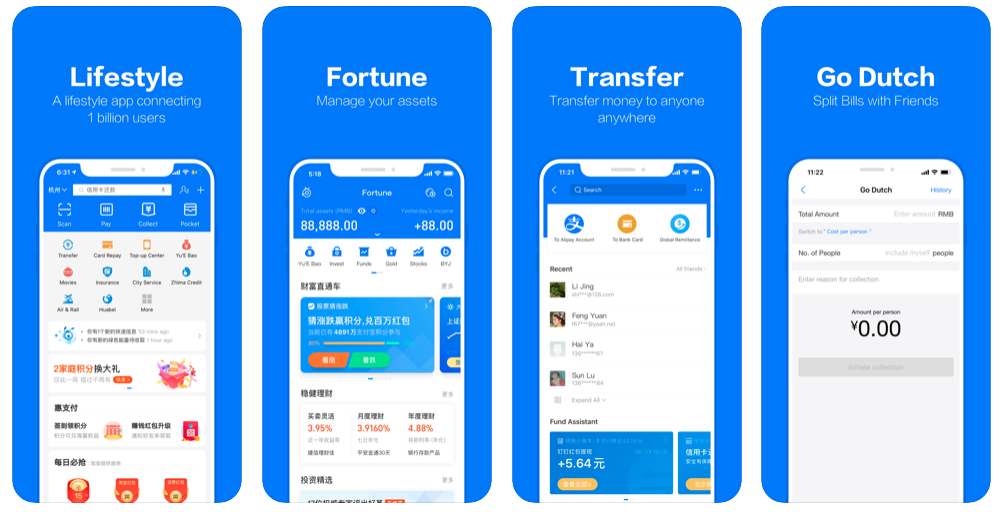

AliPay has 1 billion users globally, making it a leading force in digital payments. Although AliPay’s main market is China, changes to the company’s policy recently have made it easier to use AliPay with an international debit card.8

|

|---|

Use AliPay like other digital wallet products, to scan and pay for goods in stores, or when you’re shopping online. It’s worth noting that not all services which are used by Chinese subscribers are available on the AliPay international version, so check you can get the functionality you need if you’re planning on using a Malaysian bank card with your account.

Learn more about AliPay in Malaysia.

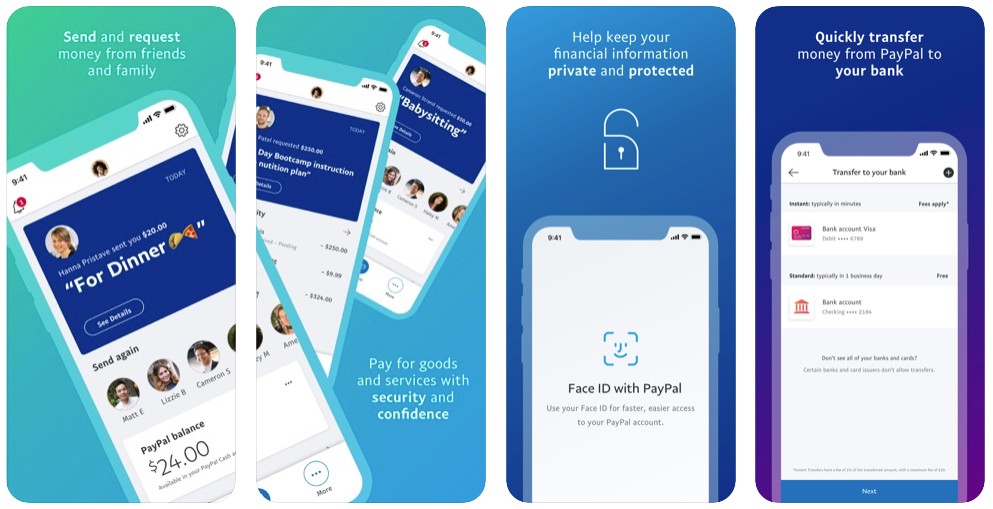

.With PayPal’s own app you can send and receive money to other PayPal users - if you want to pay in store for goods using a Malaysian PayPal account you’ll likely need to pair PayPal with another application like Google Pay.9+10

|

|---|

Send money to friends and family using the PayPal app, without needing their bank details. It’s worth noting that your recipient will need a PayPal account, if you’re sending money this way. They’ll be guided to create a new account if they don’t already have one.

You can also easily link your PayPal account to another app to get enhanced functionality.

Read also about PayPal's fees in Malaysia📖

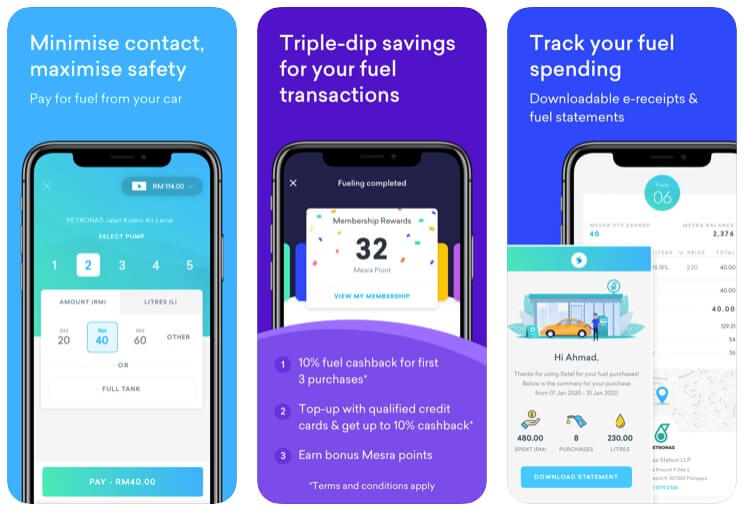

Setel is used to make it easier, faster and safer to fill up your car with fuel. Get your fuel and pay electronically without needing to leave your car, to skip the queue.11

|

|---|

Setel is a different sort of eWallet as it is designed specifically to make it faster and easier to pay for your fuel. In fact with Setel you don’t even need to leave the car when you want to pay at a Petronas station - just pay using the app up front, pump and go.

When you’re choosing an eWallet, you’ll want to think about the features which matter most to you. If you’re planning on sending money abroad, for example, you might benefit from a specialist provider such as Wise for a multi-currency account which comes with local bank details for major regions, low cost international transfers and a linked card for ATM withdrawals.

See if you can save with Wise,

with the "real" exchange rate🚀

Sources

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn more about how to make money online in Malaysia through platforms like YouTube, TikTok, and more.

Learn more about the RHB Multi Currency Debit card in Malaysia, including benefits, requirements, fees and whether it’s worth getting.

We compared the top Affin Bank cards in Malaysia. Whether you’re looking for points, fees or rewards on travel spend, find out which credit card is for you.

Learn more about Revolut and Wise, including exchange rate comparisons, and whether the product can be used in Malaysia,

Want to know how much transaction fees you’re paying when using your Malaysian credit card overseas? Learn more about the types of fees and how to avoid them.

Learn more about the Maybank World Elite Mastercard in Malaysia, including benefits, requirements, fees and whether it’s worth getting.