Thomas Cook exchange rate

How does the foreign exchange rate offered by Thomas Cook compare to Wise?

From the same people

that built Skype

Sir Richard Branson invested in Wise. Learn why.

45,000+ reviews on Trustpilot

Customers love Wise

Authorised by the UK Financial Conduct Authority)

Planning to use a Thomas Cook money transfer? There might be a cheaper option

When sending money internationally, it pays to go beyond your bank and look for the cheaper options available. Avoid hidden fees by choosing a provider who'll show you where your money is going. Finance isn't fair unless it's transparent.

Wise gives you the mid-market exchange rate, with our small, fair fee – so you always know what you’re getting.

Compare Thomas Cook money transfer rate vs Wise

How expensive is the Thomas Cook money transfer rate? If you convert £1000 to EUR with Thomas Cook, you could lose almost £16 on each transfer. We regularly check our prices against banks and other providers to show you how much you could save with us (these prices were collected on 07/11/2018 and might have changed).

Wise was founded on transparency. It’s your money. We believe you should know where it’s going. It’s only fair.

| With Thomas Cook money transfer you will get | With Wise you will get | You could save | |

|---|---|---|---|

If you send £1000 to EUR | €1121.30 | €1,140.78 | €19.48 |

If you send €1000 to GBP | Not possible | £867.76 | |

If you send £1000 to USD | $1284.10 | $1,310.21 | $26.11 |

If you send $1000 to GBP | Not possible | £752.86 |

How do exchange rates work?

Banks use the mid-market rate, also known as the interbank rate, when exchanging currencies between themselves.

They add hidden fees to the rate they give their customers. This is why you’ll see different exchange rates across providers – you’re paying the difference between the mid-market rate and the rate quoted by your bank.

Customers lose money to these hidden fees when they make a transfer – often without even realising.

What's the Thomas Cook exchange rate for online money transfer?

There’s only one true exchange rate – the mid-market rate. Banks and money transfer providers use this rate to exchange foreign currencies between themselves, but add hidden fees to the rates they give their customers. That means you get a more expensive exchange rate.

There’s no such thing as 0% commission – the fee is just hidden in the rate.

| Thomas Cook exchange rate | Wise exchange rate | |

|---|---|---|

GBP to EUR | 1.1213 | 1.14570 |

EUR to GBP | Not possible | 0.87280 |

GBP to USD | 1.2841 | 1.31650 |

USD to GBP | Not possible | 0.75956 |

GBP to CAD | 1.6713 | 1.72218 |

CAD to GBP | Not possible | 0.58092 |

Does Thomas Cook exchange currency?

Yes. Thomas Cook offers currency exchange in bureaux de change, in their stores and online. But when you buy travel money in cash – either in store, online or with click and collect – you could be subject to an unfair exchange rate with hidden fees. Use a travel money card instead to save when travelling abroad.

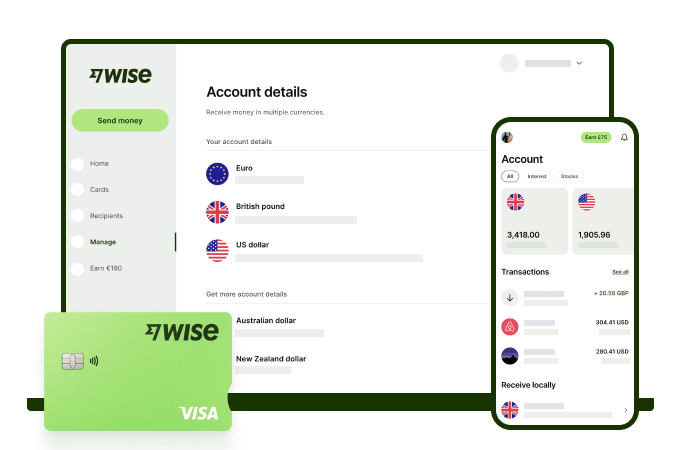

With the Wise multi-currency debit card, you can:

- hold over 40 currencies at once

- convert them at the real exchange rate

- and withdraw up to £200 per month for free from ATMs around the world

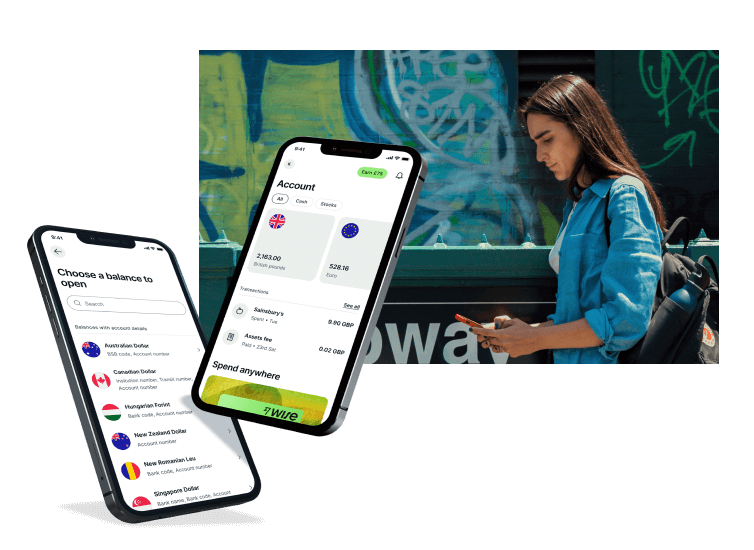

Buying travel money with Thomas Cook?

Buying travel money in cash can be expensive, as you won’t get the true mid-market rate. Use a travel money card – like the Wise borderless card – to store money in multiple currencies, convert at the mid-market rate, and withdraw or spend at ATMs and shops worldwide.