Global payments for growing businesses

Global payments for growing businesses

Trusted by over 600k+ businesses, big and small, moving billions with Wise

4.3/5 from 200k+ reviews

All you need to do business worldwide

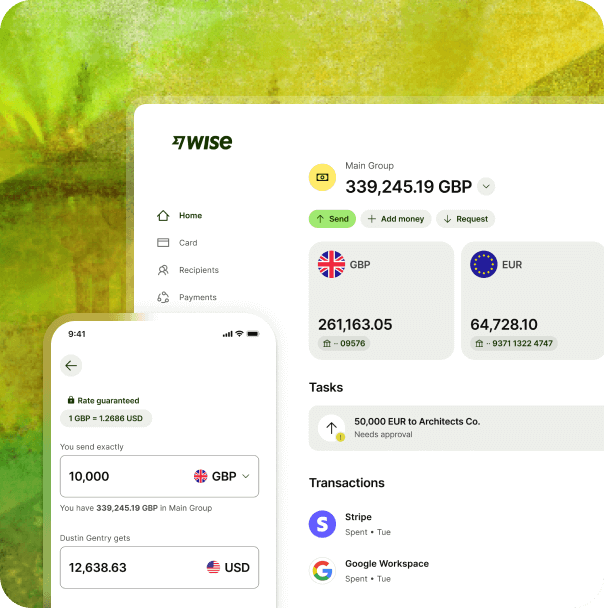

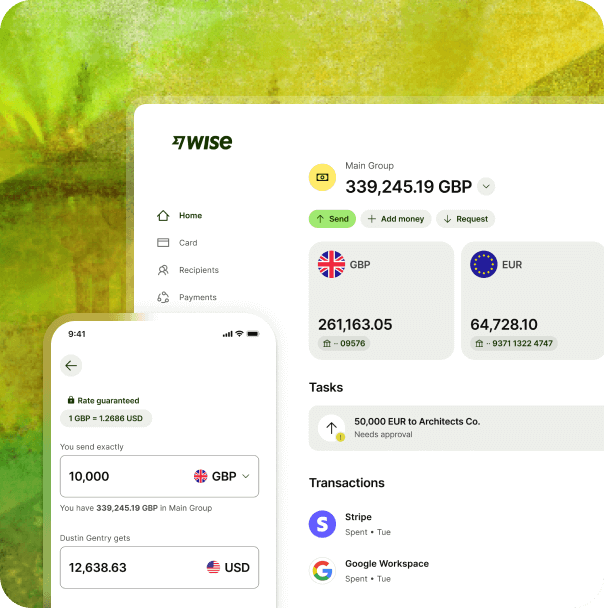

Save on international transfers

Forget hidden FX fees — the more you send, the more you save. Pay suppliers, employees and invoices in bulk.

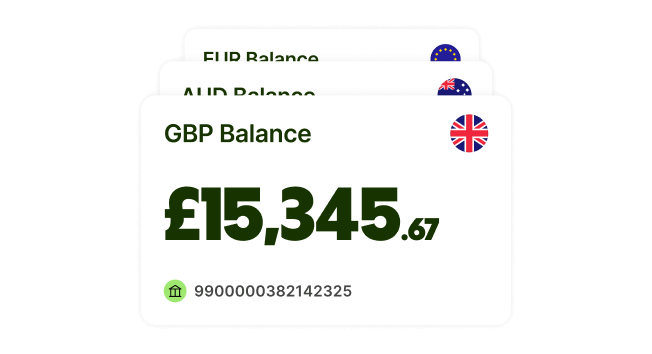

Get paid fast like a local business

Receive money with local account details like IBANs, sort codes and routing numbers, just like your business is based there.

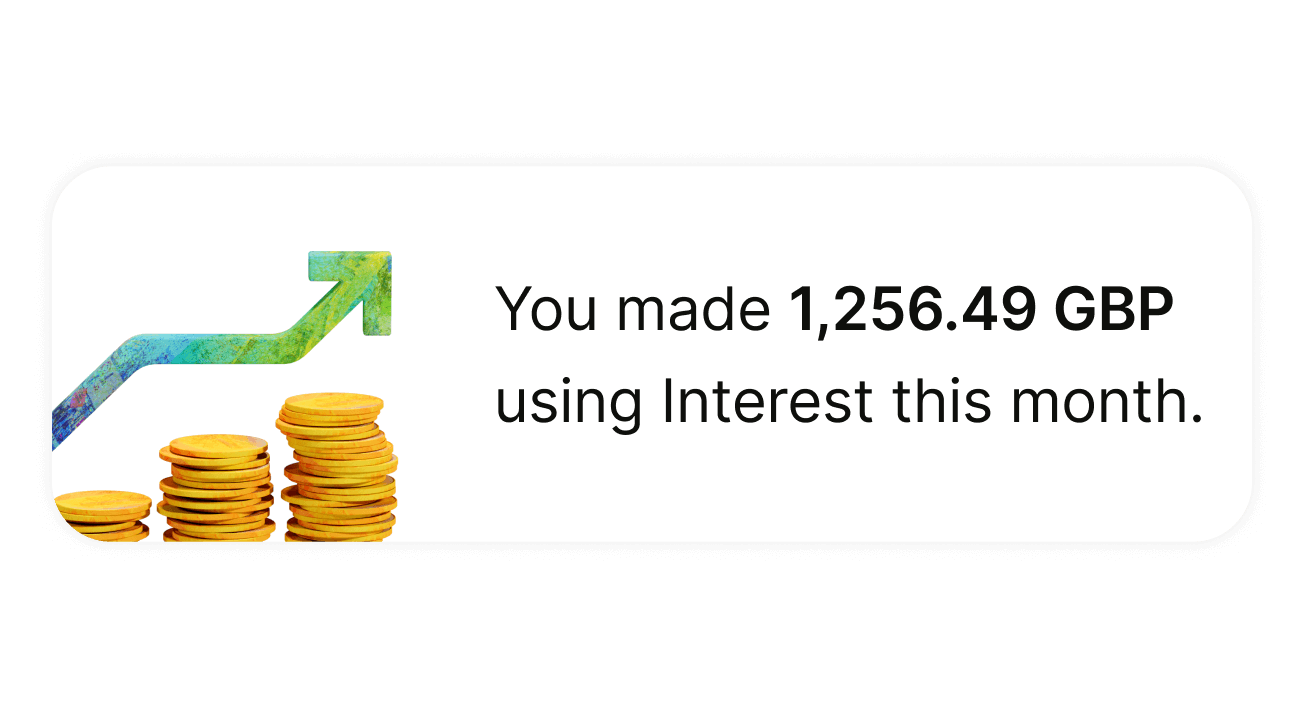

Earn returns up to 4.26%

Get returns every working day without locking your money away. Run your business as your balances work harder. Capital at risk.1

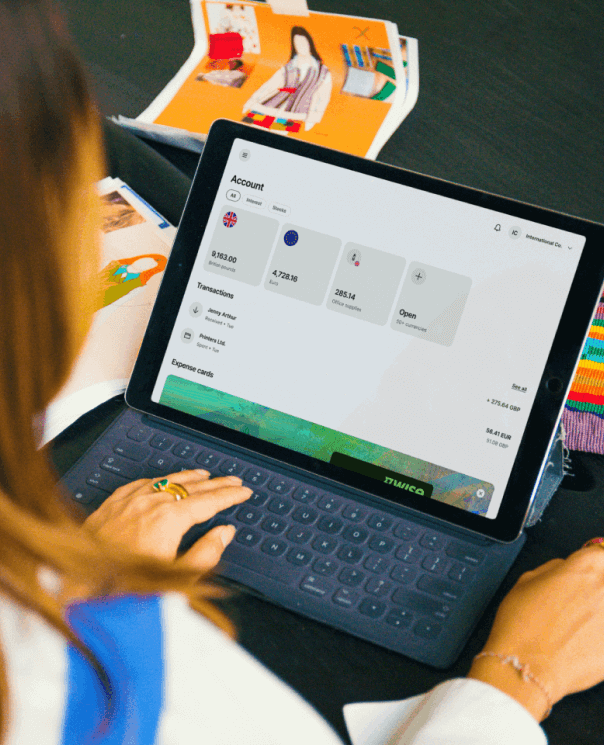

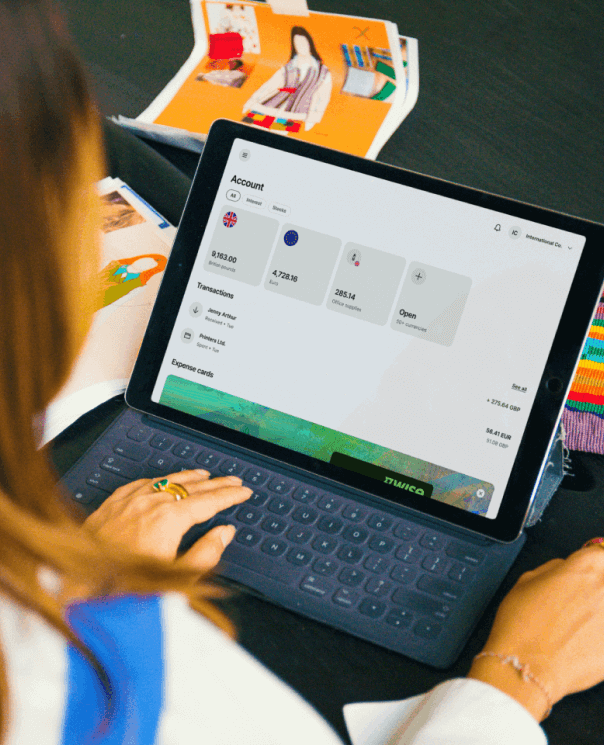

Manage team expenses without monthly fees

Get physical and digital cards, separate your money and control spending, and get 0.5% cashback without any foreign transaction fees.

Sync to your accounting software

Connect with bank feeds for fast, accurate reporting in every currency. Integrate with the tools you use every day.

Personalise your team's set up

Set spending limits, configure your teams and tailor permissions according to people's jobs.

Grow your business faster with Wise

Wise is the cheap and easy way to run your business in multiple currencies or enter new markets. Just 60 GBP to set up, with no monthly account fees.

Low, transparent FX fees

Unlike banks, we don’t hide any fees in markups and only use the mid-market exchange rate.

Instant international payments

Cross-border transfers you can count on: over half arrive in under 20 seconds.*

Easy and convenient

Get set up and get paid from different countries in minutes, all from your laptop or phone.

*Accurate as of Q2, 2024. Transaction speed claimed depends on individual circumstances and may not be available for all transactions.

Grow your business faster with Wise

Wise is the cheap and easy way to run your business in multiple currencies or enter new markets. Just 60 GBP to set up, with no monthly account fees.

Low, transparent FX fees

Unlike banks, we don’t hide any fees in markups and only use the mid-market exchange rate.

Instant international payments

Cross-border transfers you can count on: over half arrive in under 20 seconds.*

Easy and convenient

Get set up and get paid from different countries in minutes, all from your laptop or phone.

*Accurate as of Q2, 2024. Transaction speed claimed depends on individual circumstances and may not be available for all transactions.

Bank transfer fee

0 GBP

Our fee

3.88 GBP

Total included fees (0.39%)

3.88 GBP

- You could save up to 41.91 GBP

Should arrive in 5 hours

Minimum fees, and getting lower

We’ll never disguise fees in the exchange rate to charge your business more. Wise Business shows the real amounts you’ll pay or receive, and you’ll get instant transaction notifications to track your payments in real-time.

Your money, protected

Wise customers move £30bn every quarter. Our security systems are built to keep every penny safe and available any time.

- 24/7 support24/7 support

Our business, security and fraud specialists are here by phone or online, wherever you’re calling from.

- SecuritySecurity

Encryption, biometrics and real-time payment approvals keep your money away from thieves.

- SafeguardedSafeguarded

Your money is diversified and held with an established group of financial institutions.

Hear from businesses scaling with Wise

"Holding Euro account details allows us to get paid directly from our customers, without the need for exchange fees."

Stela & Momchil

Founders, BeeHype

Read their story

“I know if I’ve got a Wise account, and my customer has got a Wise account, it feels safe”.

Suzanne Noble

Co-founder, Startup School for Seniors

Watch Suzanne’s story

"Wise is a game-changer. It's easy to use, helps us save money, and is perfect for paying our remote team."

Simon Treulle

Founder, Pangolia

Read Simon’s story

"Sending payments to all our clients used to take me close to a week, and with Wise's batch payments feature, I can accomplish this in just a few minutes.”

Chris Kennedy

Rident Royalties

Read Chris’ story

“Wise offers payments to local wallet schemes for certain currencies/countries such as Gcash in The Philippines or Mpesa in Kenya etc, this in turn gives our contractors and clients more choice.”

Xenios Thrasyvoulou

Founder, TalentDesk

Read Xenios’ story

“We have integrated payments with Wise from day one. It’s been an integral part of how we’ve been able to payout royalties and run our business."

Andy Irvine

CEO, GYROstream

Read Andy’s story- Investments can fluctuate, and your capital is at risk. The Variable rate is based on the performance of the Fund over a 7-day period ending on 14/11/2024. The Fund has achieved an average annual return of 0.93% over a 5-year rolling period exclusive of fees. Interest is offered by Wise Assets UK Ltd, a subsidiary of Wise Payments Ltd. Wise Assets UK Ltd is authorised and regulated by the Financial Conduct Authority with registration number 839689. When facilitating access to Wise investment products, Wise Payments Ltd acts as an Introducer Appointed Representative of Wise Assets UK Ltd. Please be aware that we do not offer investment advice, and you may be liable for taxes on any earnings. If you’re uncertain, we urge you to seek professional advice. To find out more about the Funds, visit our website.