Welcome to our quarterly trading update blog post where we will be going through our mission and financial highlights from the last three months, October to December.

Kristo Käärmann, our CEO and co-founder, said: “I’m delighted that for the first time we’ve supported more than 4 million customers to complete cross-border transfers in a single quarter. We moved over £20bn, 38% growth on last year and 15% growth on the prior quarter.

We did this while continuing to make good progress on our mission to make moving and managing money across borders faster, easier, cheaper and more transparent for everyone, everywhere. We dropped prices, sped up payments, and expanded access to Wise’s products and features in more countries and through more partners.

Most notably, 45% of transfers were instant this quarter, and we launched the Wise card in Canada, Brazil, and Malaysia, with the Wise account also going live in Malaysia.”

Mission Highlights

Money without borders; enabling everyone to move their money across the world - instantly, transparently, conveniently and eventually for free.

We dropped prices for 5 currencies this quarter! 📈

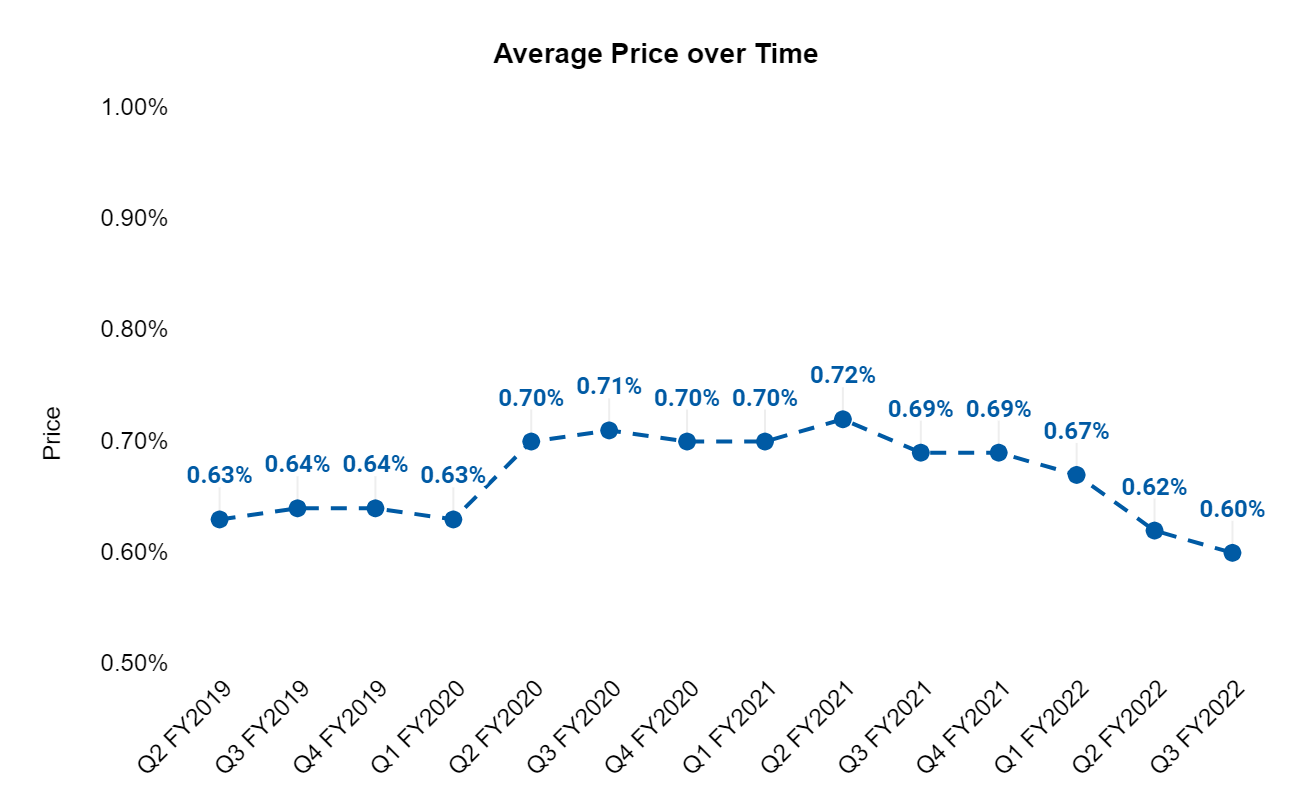

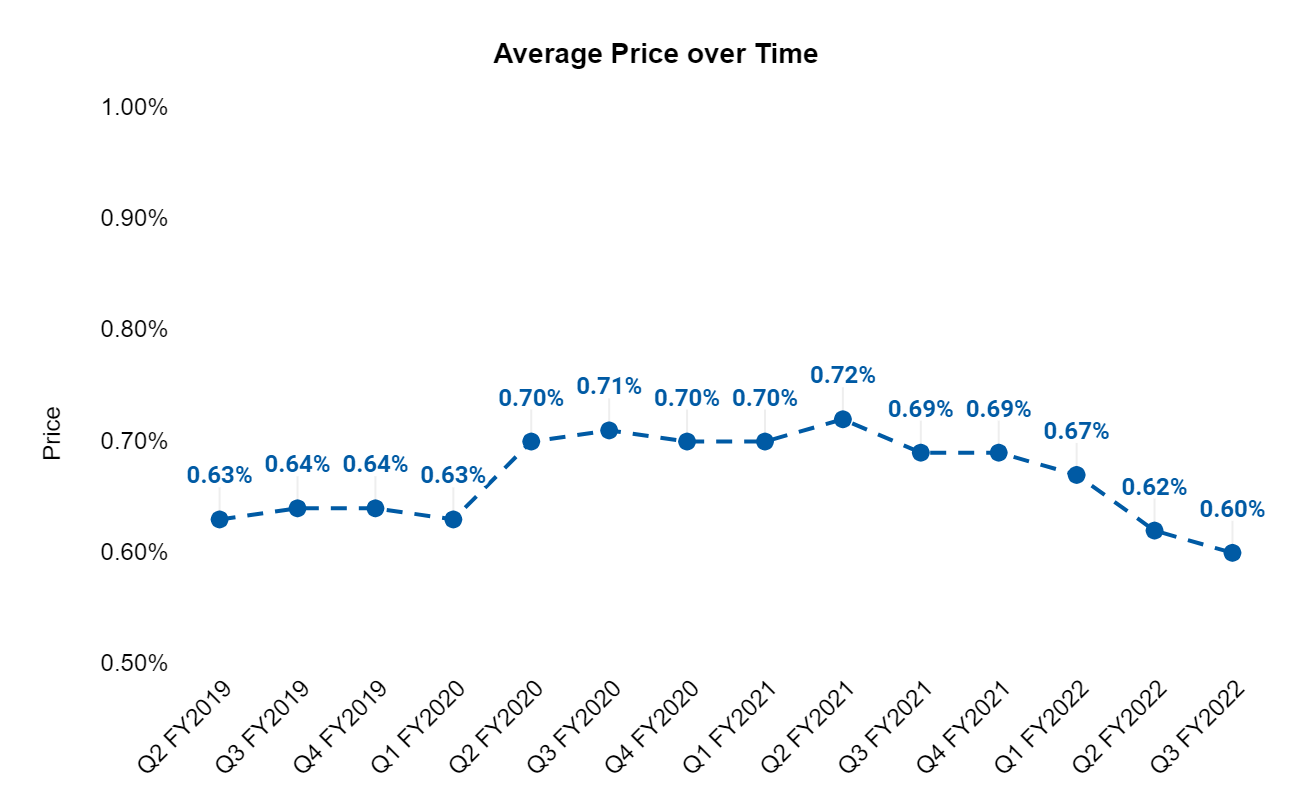

Growing volumes and reducing costs allows us to sustainably reduce prices for our customers whilst generating gross profits for reinvestment. Over the last year we dropped prices across 50 currencies, including 5 currencies in the most recent quarter! Our customer price¹ is now 0.60% on average, 9bps lower than a year ago and 2bps lower than the previous quarter.

45% of all transfers were instant, faster than ever. 💥

We are continuing to focus on improving how we operate and in Q3 our payments got faster - we hit record highs for the number of transfers arriving in under 20 seconds (up from 40% in Q2 2021). We did this by reaping the rewards from our work in Q2, like speeding up security checks and resolving technical issues that were causing delays on payments sent to India.

We are more global than ever before! 💙

In Q3 we took Wise even more global - convenience is about provisioning access to Wise wherever it best suits our customers. We launched the Wise Account and Card in Malaysia and the Wise Card in Canada and Brazil meaning Wise is now available across 5 continents and 40+ countries!

We have also made further progress in serving more customers through platform partners with new partners including music royalty manager Eddy, armed forces credit union Andrews Federal, and invoice platforms Bilingo and Libeo.

Business customers are now able to make payments to China from 8 currencies while Alipay users will now be able to send money to China from any supported Wise currency to an Alipay recipient.

Growth and Financial highlights

Customers

4.1m

26% YoY, 11% QoQ

0.25m

39% YoY, 10% QoQ

Q3 FY2022 was a strong quarter with over 4 million customers transacting on Wise. The number of active personal customers grew by 26% YoY to 4.1 million while the number of active business customers grew by 39% to 250k compared to the prior year.

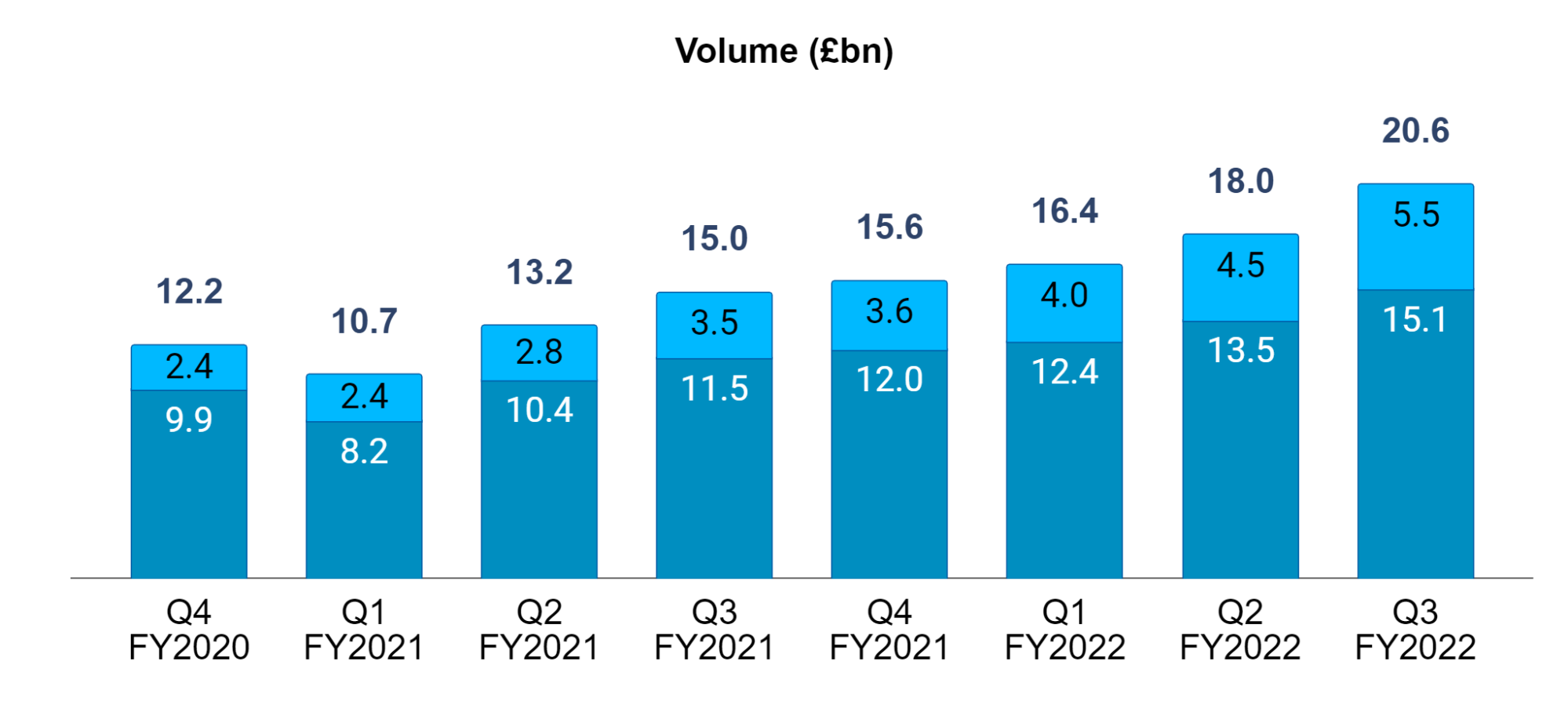

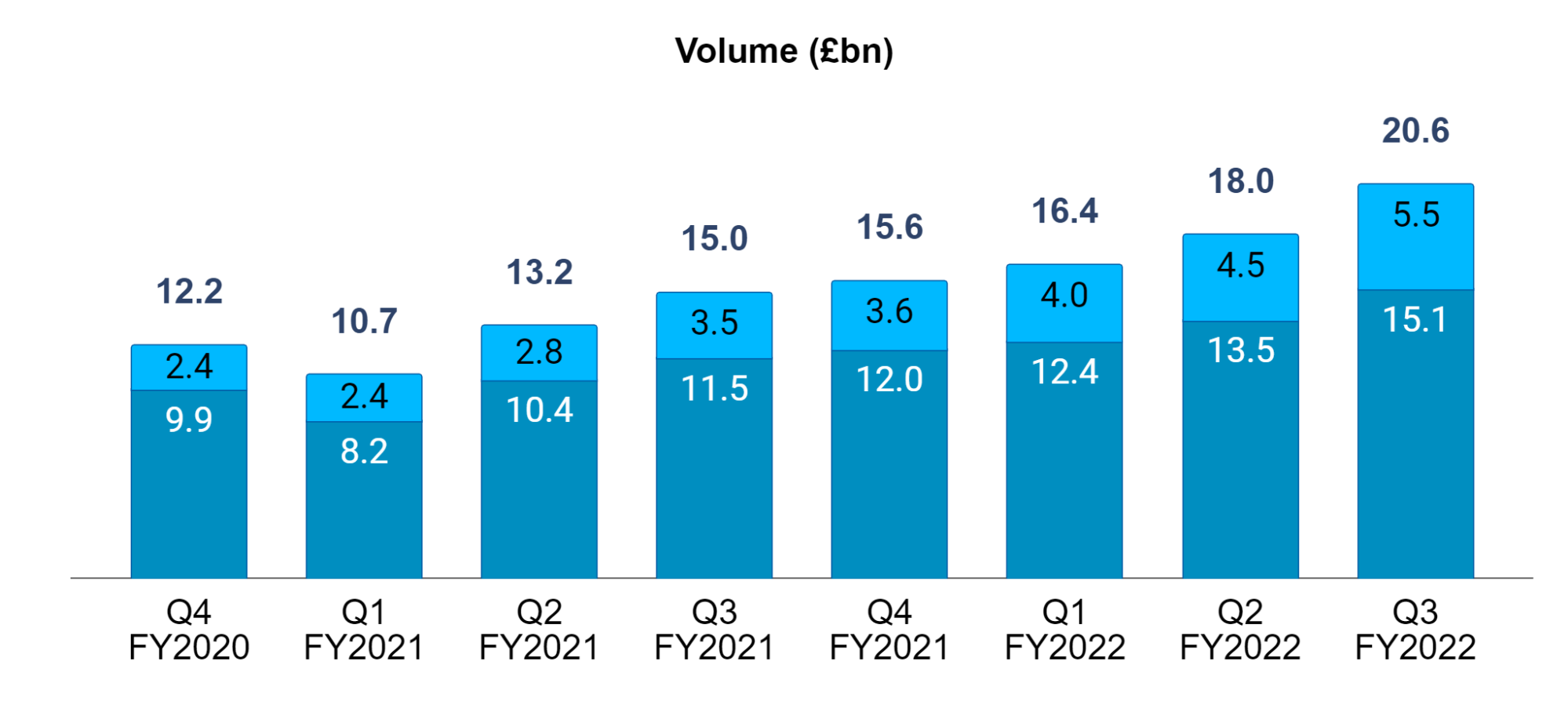

Volume

20.6bn

38% YoY, 15% QoQ

Volume grew by 38% YoY and 15% QoQ to £20.6 billion, driven by growth in the number of active personal and business customers and a higher average volume per customer (VPC). Our business customers’ VPCs are seasonally strong in Q3 but have nonetheless grown 13% YoY. This reflects that as our customers grow, so do their VPCs, as well as reflecting the increased adoption of the Wise Account and card.

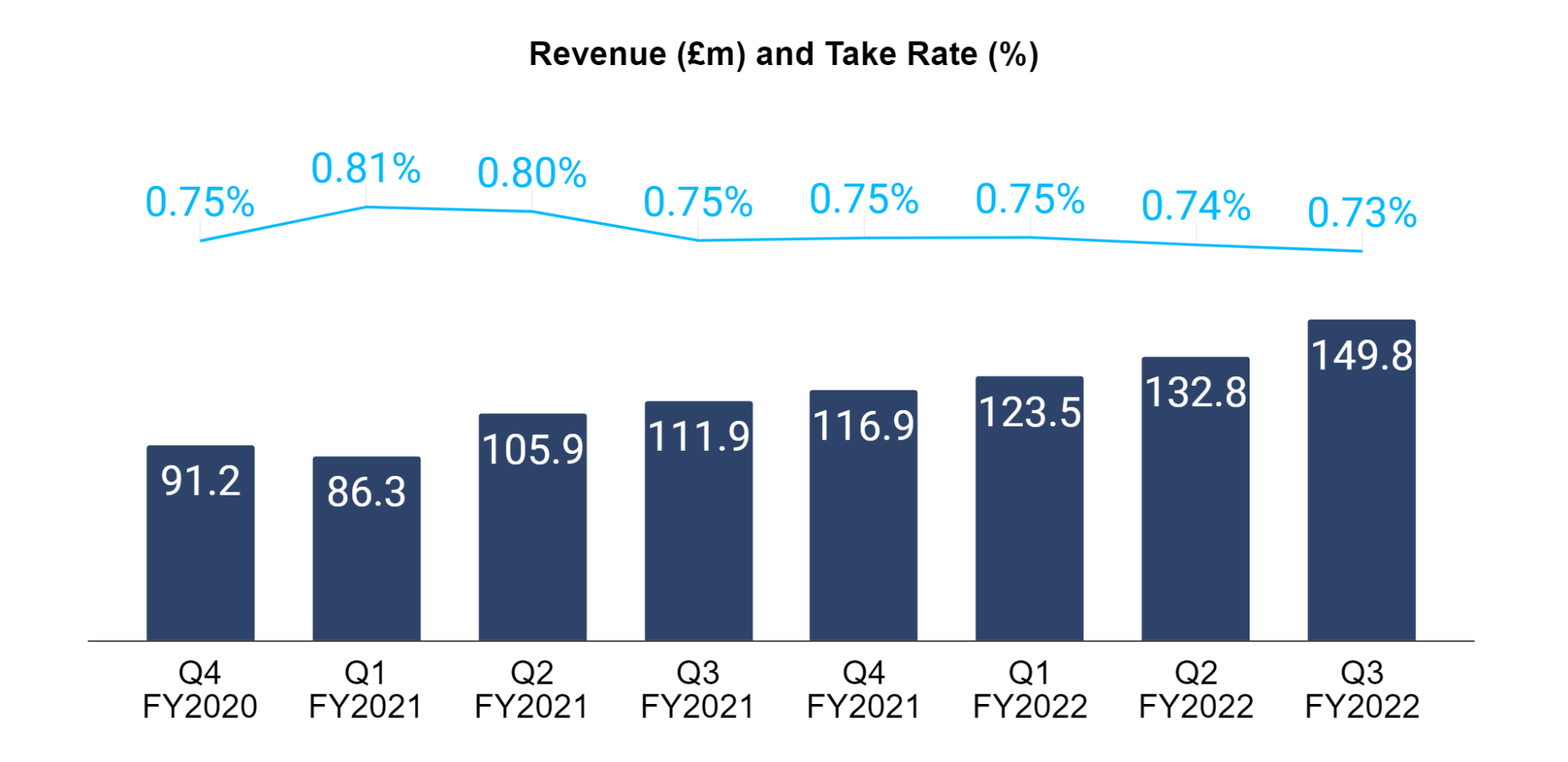

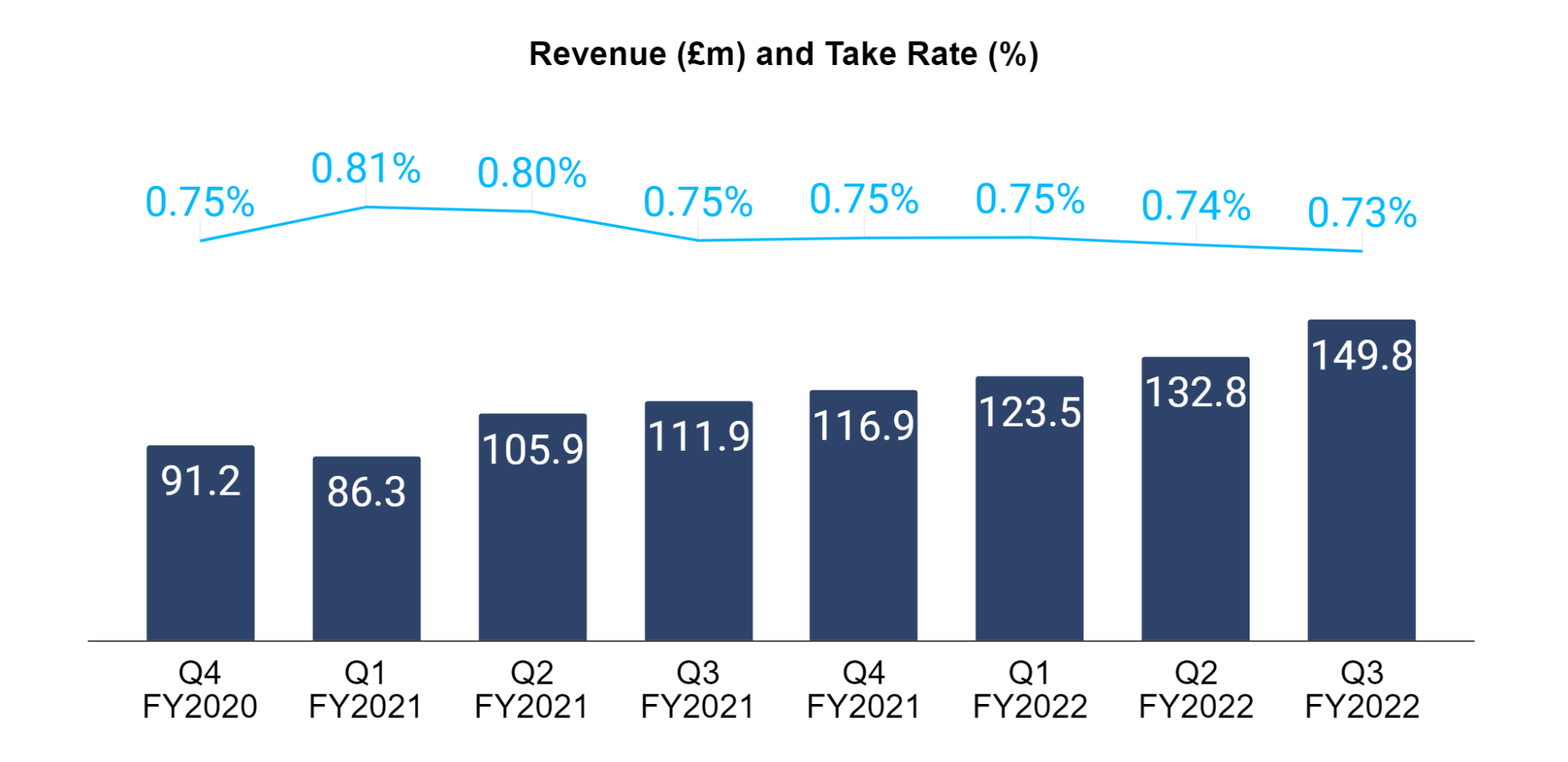

Revenue

149.8m

34% YoY, 12% QoQ

Revenue grew by 34% YoY and 13% QoQ to £149.8 million, broadly in line with the rate of growth in volume. Our continuing efforts to engineer and optimise away costs to support sustainably lower prices for customers resulted in a lower take rate as expected, reducing to 0.73%, down 2bps YoY and 1bp QoQ. This reflects the price drops which are partially offset by incremental revenue from other sources beyond cross-border transactions.

Looking ahead, we continue to expect the take rate to be slightly lower in the second half of FY2022 compared to the first half as a result of price reductions. This is expected to be more than offset by higher volumes as we now anticipate revenue growth of c. 30% for FY2022 over FY2021. We continue to expect gross margin for FY2022 to be c.65-67%, subject to foreign exchange related costs continuing to remain broadly stable.

Enquiries

Martin Adams - Head of Owner Relations

martin.adams@wise.com

Sana Rahman - Public Relations Lead

press@wise.com

Brunswick Group

Charles Pretzlik / Sarah West / Samantha Chiene

Wise@brunswickgroup.com

+44 (0) 20 7404 5959

1. Customer price is based on a fixed basket of representative currencies which reduces the effect from route mix and other factors, making it a more accurate representation of our progress in reducing the cost of international transfers over time.

FORWARD LOOKING DISCLOSURE DISCLAIMER

This report may include forward-looking statements, which are based on current expectations and projections about future events. These statements may include, without limitation, any statements preceded by, followed by or including words such as “target”, “believe”, “expect”, “aim”, “intend”, “may”, “anticipate”, “estimate”, “plan”, “project”, “will”, “can have”, “likely”, “should”, “would”, “could” and any other words and terms of similar meaning or the negative thereof. These forward-looking statements are subject to risks, uncertainties and assumptions about Wise and its subsidiaries. In light of these risks, uncertainties and assumptions, the events in the forward-looking statements may not occur. Past performance cannot be relied upon as a guide to future performance and should not be taken as a representation that trends or activities underlying past performance will continue in the future. No representation or warranty is made or will be made that any forward-looking statement will come to pass. The forward-looking statements in this report speak only as at the date of this report.

Wise expressly disclaims any obligation or undertaking to update, review or revise any forward-looking statements contained in this report and disclaims any obligation to update its view of any risks or uncertainties described herein or to publicly announce the results of any revisions to the forward-looking statements made in this report, whether as a result of new information, future developments or otherwise, except as required by law.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.