Welcome to our first quarterly trading update blog post where we will be going through our mission and financials highlights from the last three months, April to June.

Kristo Käärmann, our CEO and co-founder, said: “Wise’s mission is to make moving and managing money across borders faster, easier, cheaper and more transparent for everyone, everywhere. In the first quarter of this financial year we continued to take important steps forwards towards this goal while also successfully listing Wise on the London Stock Exchange.

*“We were pleased that in the first quarter of this financial year we were able to reduce pricing by 2bps to 0.67%, dropping prices for 19 currencies while also delivering 38% of all transfers instantly. Our financials in that period were in line with our expectations with revenues of £123.5m, representing a growth of 43% YoY compared to Q1 FY2021.

“As we enter the next phase of our growth to tackle the problem of the £150 billion the world continues to pay in hidden fees each year, we’re focused on doing so reliably and sustainably, so our customers know they can count on us for the long term.”

Mission Highlights

Money without borders; enabling everyone to move their money across the world - instantly, transparently, conveniently and eventually for free.

We continue to be driven by our mission and were pleased that in the first quarter of this year we were able to reduce our average fees by 2bps to 0.67% after dropping prices for customers on 19 currencies, while also delivering 38% of all transfers instantly.

Our coverage took an important step forward as we launched in India, allowing Indian residents to send money to 40+ countries at the real exchange rate, with lower and more transparent fees.

We also made it more convenient for Wise customers to receive money: over 1 million customers have opted to receive money with just their email address.

It is still early in the development of our platform proposition but we are delighted to have recently announced partnerships with Google Pay, Shinhan Bank, Temenos and Thought Machine, allowing many more people and businesses to conveniently access Wise’s cheap, fast and transparent international money transfers.

See here for access to the full blog post with our Mission Update.

Growth and Financials Highlights

Customers

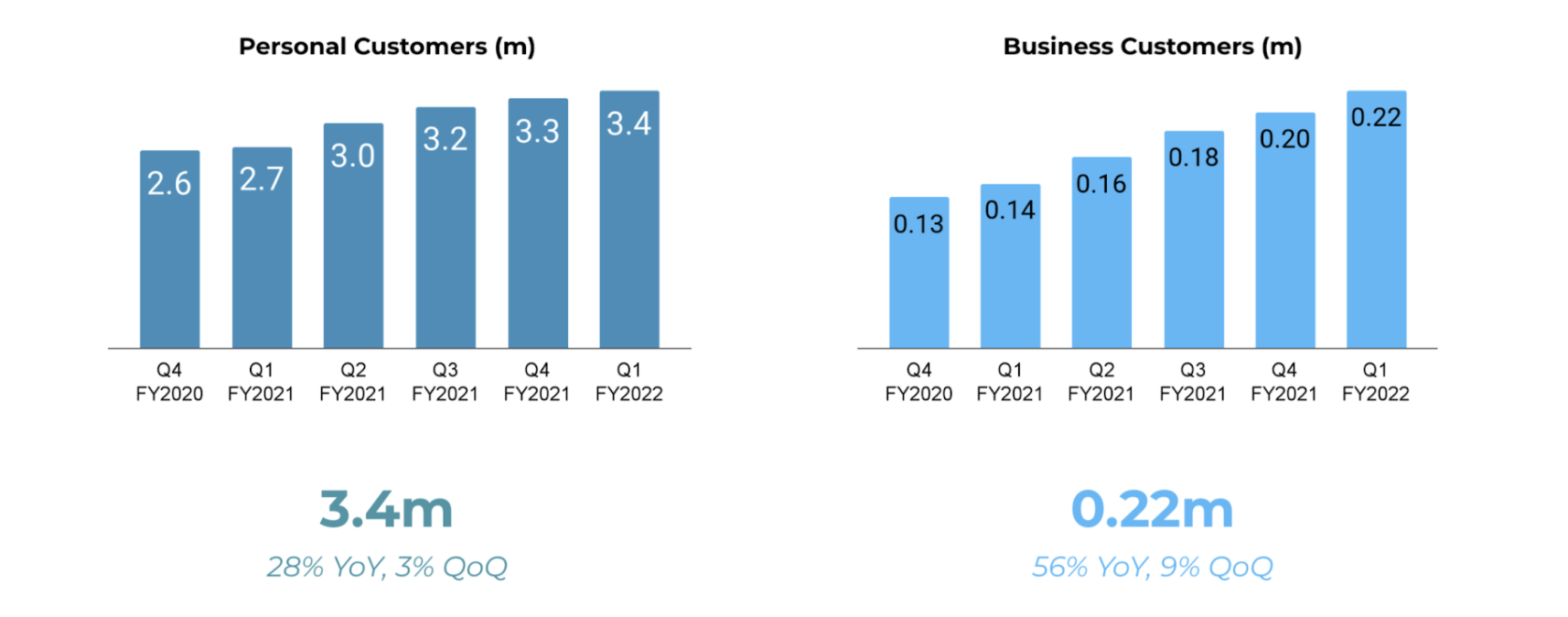

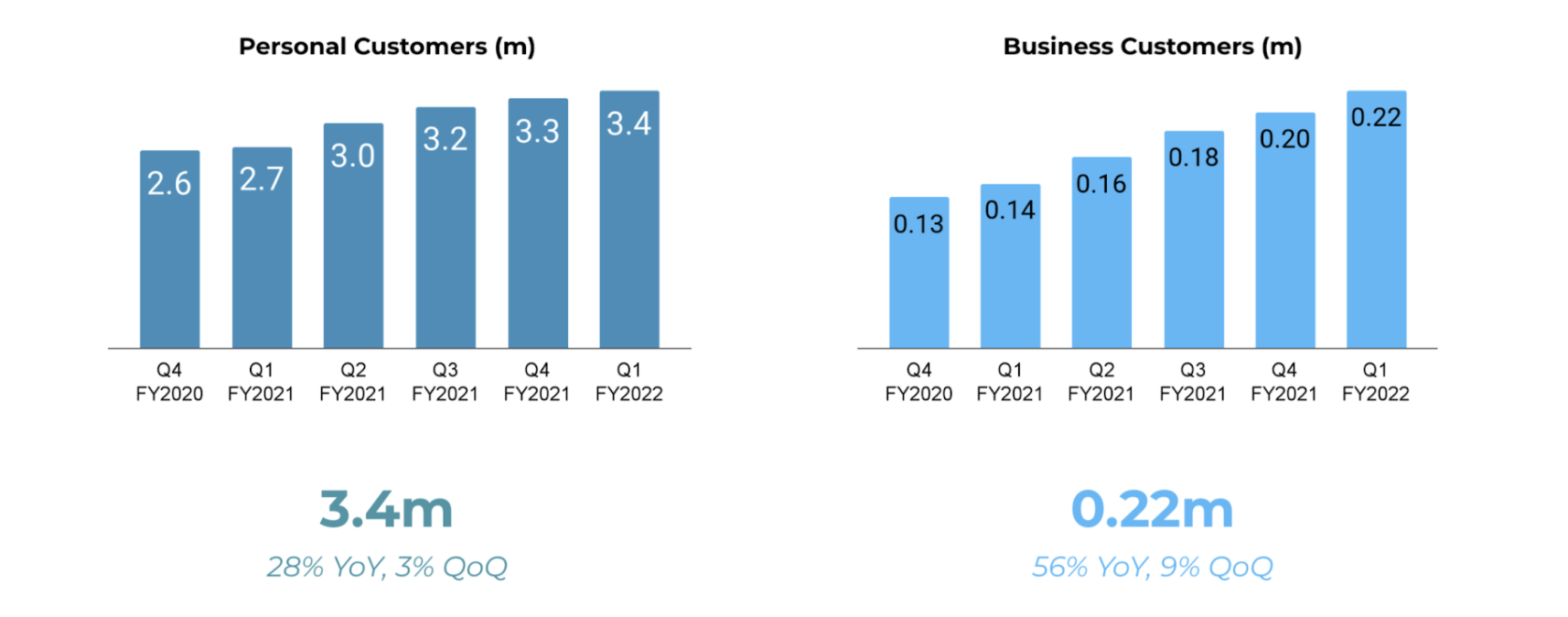

A total of 3.7m customers transacted on Wise in Q1 FY2022. Despite ongoing lockdowns across many countries worldwide, the number of personal customers grew by 28% YoY to reach 3.4m. Business customers, who typically use Wise for a broader range of needs such as paying and receiving funds from suppliers, vendors and customers, grew by 56% compared to the prior year.

Volume

A year ago, in Q1 FY2021, the volume per customer sent by both personal and business customers saw a marked, temporary reduction due to the impact of the COVID-19 pandemic on customer demand for international payments. Volume per customer recovered over the following quarter and has been broadly stable since.

As a result, volume grew faster than active customers, reaching £16.4bn in Q1 FY2022, an increase of 54% YoY. Compared to the prior quarter, volume grew by 5%. The number of active personal customers using Wise grew by 3% QoQ, while the growth in business customers maintained its strong momentum, increasing 9% QoQ. With a greater proportion of business customers sending larger and more frequent payments, the overall volume per customer for Wise increased by 2% QoQ.

Revenue

Revenue grew at 43% YoY and 6% QoQ to reach £123.5m in Q1 FY2022, in line with our expectations. This growth in revenue was outpaced by YoY volume growth as certain higher-priced routes returned to longer-term average levels of activity and a lower proportion of overall volumes. This is reflected in the 6bps reduction in the take rate. The take rate was stable compared to the prior quarter as a 2bps reduction in conversion fees was offset by additional fees from the adoption of our Wise account.

We are pleased to have started FY2022 in line with our expectations and expect to continue in line with our forward-looking guidance, including for revenue growth of low to mid 20s on a percentage basis in FY2022.

Enquiries

Martin Adams - Head of Owner Relations

martin.adams@wise.com

Abigail Daniels - Global Head of Public Relations

press@wise.com

Brunswick Group

Charles Pretzlik / Sarah West / Samantha Chiene

Wise@brunswickgroup.com

+44 (0) 20 7404 5959

FORWARD LOOKING DISCLOSURE DISCLAIMER

This report may include forward-looking statements, which are based on current expectations and projections about future events. These statements may include, without limitation, any statements preceded by, followed by or including words such as “target”, “believe”, “expect”, “aim”, “intend”, “may”, “anticipate”, “estimate”, “plan”, “project”, “will”, “can have”, “likely”, “should”, “would”, “could” and any other words and terms of similar meaning or the negative thereof. These forward-looking statements are subject to risks, uncertainties and assumptions about Wise and its subsidiaries. In light of these risks, uncertainties and assumptions, the events in the forward-looking statements may not occur. Past performance cannot be relied upon as a guide to future performance and should not be taken as a representation that trends or activities underlying past performance will continue in the future. No representation or warranty is made or will be made that any forward-looking statement will come to pass. The forward-looking statements in this report speak only as at the date of this report.

Wise expressly disclaims any obligation or undertaking to update, review or revise any forward-looking statements contained in this report and disclaims any obligation to update its view of any risks or uncertainties described herein or to publicly announce the results of any revisions to the forward-looking statements made in this report, whether as a result of new information, future developments or otherwise, except as required by law.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.