Zervant is a company that offers freelancers and small businesses free invoicing software to help them get paid faster, and more securely – regardless of which currency they operate in. Its founders are especially attuned to the needs of its customers, because they themselves are entrepreneurs.

We spoke with co-founder Tuukka Koskinen about what inspired Zervant, and why its customers should use Wise when invoicing international clients.

Solving #EntrepreneurProblems

Seven years ago, Tuukka was a newly promoted CEO at another company, and his co-founders were working in different places, too. Despite their full-time careers, they set about finding a way to fix a universal problem all entrepreneurs face.

“We all have been running our small businesses on the side of our careers. The key thing for us was to make sure all entrepreneurs get paid for their work,” he says. “Obviously one of the crucial elements is to make sure their invoices are cleared. As easy as possible. And securely.”

They started developing an invoicing software that would achieve these goals. Tuukka, like a true entrepreneur, quickly made the decision to leave his new role and pursue Zervant full-time. He’s worked there as COO ever since.

A growing market for foreign currency invoicing

Currently close to 20,000 freelancers and small businesses sign up with Zervant every month. Customers send an average of six invoices a month, and around 10% go to currencies outside of the Euro. With operations in seven markets, and plans to enter four more, Zervant has a need to help customers make better international payments. This is where Wise comes in.

**“**When you are getting paid for the invoice you are sending in a different currency than your [client’s], the charges get complicated. And that’s what Wise is concentrating on – making it more simple and cost-effective.”

Wise and Zervant teamed up to share tips on how to use the two together.

“We do understand we are not alone in this ecosystem of different financial services,” Tuukka says. “The main thing for us is helping the entrepreneurs get paid. Not only the invoice, but organizing the finances for them.”

Zervant customers can get a great exchange rate and pay no receiving fees when they use their Wise account to invoice clients in foreign currencies. An account comes with UK, Eurozone, US, and Australian bank details that can be added right to foreign invoices. Once an invoice is paid, it’s easy and cheap to convert money into the currency they need. Money can also be held in up to 28 currencies – all within the one account.

###“When the invoice isn't in your local currency, it makes most sense to utilize Wise.”

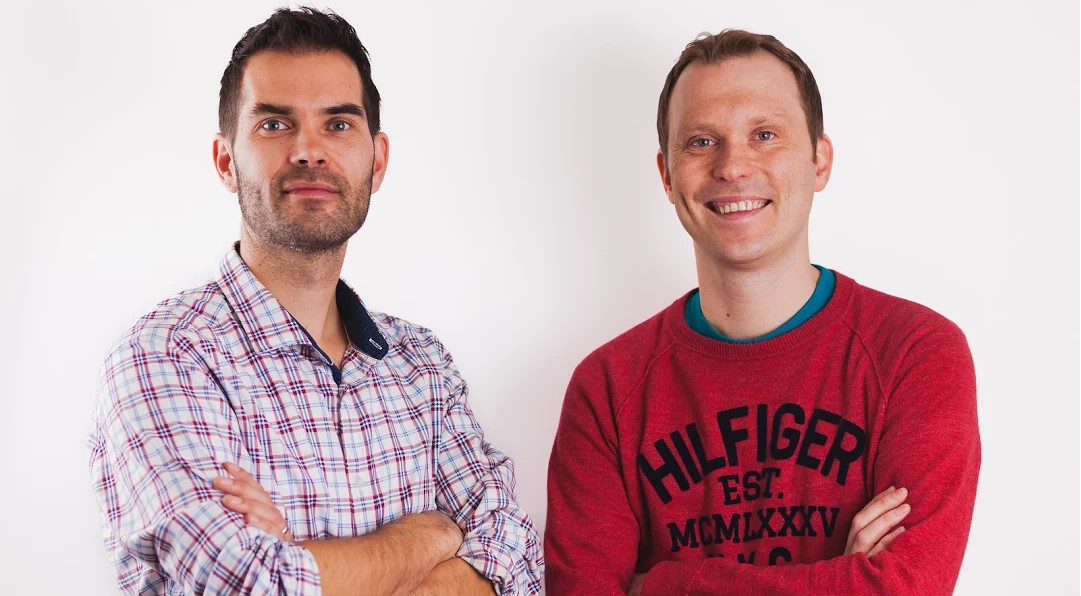

Cofounders Tuukka Koskinen (right) and Mattias Hansson

Helping more entrepreneurs succeed

Tuukka mentions how proud he is that Zervant works with all types entrepreneurs – from designers and builders, to hypnotherapists, breweries, and musicians. Tuukka highlights one example of a customer that shows just how broad entrepreneurship can be – a business helping refugees become entrepreneurs.

“We will always have lots of people that unfortunately have to move from their countries. And of course those people that have the opportunity to move to different countries. There are lots of different stories,” he explains.

Zervant makes us proud to be part of the financial tech community. We’re excited to see what’s next for them.

Learn more about Zervant.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.