Stop typing, start uploading — your shortcut for adding new recipients

Paying someone new? Don’t waste time typing out their bank details or double-checking their IBAN. Upload a screenshot or invoice instead. Our new AI feature...

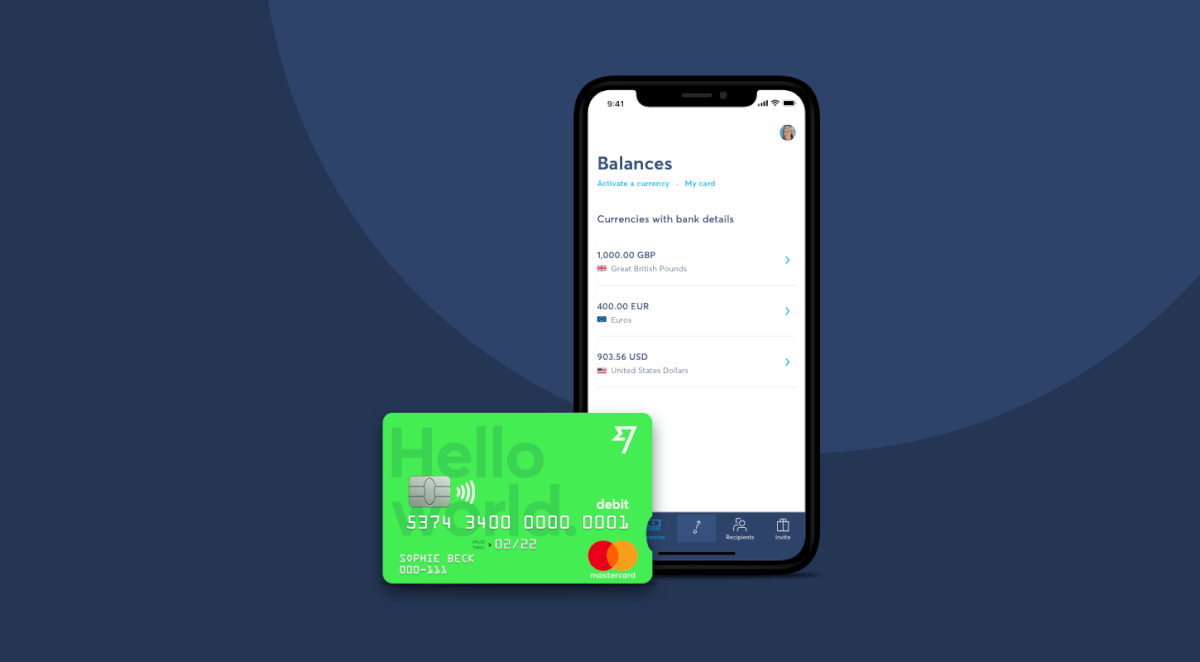

Today we’re excited to announce we’ve kicked off the private launch phase of our borderless account and debit Mastercard. Time to say bye bye to crazy bank fees for good.

We invented TransferWise to fix a big, broken, and greedy part of the banking system. Our mission was to make moving money around the world instant, convenient, fair, and eventually free.

Today, we're taking the next big step towards achieving our mission — we’re launching borderless accounts with debit cards for everyone.

Here are a few FAQs about what’s happening.

It’s a new kind of account, designed for people living international lives. It lets you pay, get paid, and spend on your TransferWise debit card around the world. There are no hidden fees, and you’ll no longer need bank accounts in multiple countries.

We built it because getting a bank account abroad is difficult, time-consuming, and expensive. And that’s a problem for expats, freelancers, and people who live and work in more than one country.

The borderless account is the first truly multi-currency, multi-country account available to everyone.

You set up it up quickly and easily online, and once your account is verified, you get instant bank details for countries around the world.

That means you get:

These are your personal bank details. You can give them to friends, family, companies or customers in the UK, Europe, US and Oz to get paid in the local currency, directly into your borderless account, And best of all, no-one pays any fees.

You can keep up to 28 currencies in your account and convert them in seconds at the real exchange rate — like the one you see on Google. You just pay the low, transparent conversion fees that we’re known for, and you’ll always see these upfront.

Anywhere in the world that accepts Mastercard!

Ready to get going? Get your free borderless account. And if you have any problems getting started, feel free to get in touch — we’re always happy to help.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Paying someone new? Don’t waste time typing out their bank details or double-checking their IBAN. Upload a screenshot or invoice instead. Our new AI feature...

We're thrilled to introduce a powerful new feature designed to save you time and eliminate the frustration of manual data entry when sending money. Now,...

The new Wise Card is here! 🇧🇷

We have great news for our customers in Brazil! You can now set up your own Pix key directly in the Wise app

Welcome to the Wise Partner Program! In this guide, you will find all the information you need to get started, optimize and succeed as a Wise partner. Simply...

From time to time, you might make a purchase with your Wise card and run into an issue — maybe something you bought didn’t arrive, wasn’t as described, or you...