Mettle business bank account review UK

Learn about Mettle business bank account, its core features, limitations, eligibility requirements, fees and customer service.

If you’ve started your own business you’ll need smart and simple ways to manage your company finances.

Digital banks and providers in the UK offer business customers some great account options which can be used to hold, send, spend and receive company funds. But which provider is right for you?

This guide looks in detail at the Tide Business Account, compared to the Revolut business account. We’ll also look at an alternative - Wise Business accounts, which come with easy ways to handle foreign currency transactions with lower fees.

Discover how to grow your

business abroad with Wise 🚀

| 📝 Table of contents: |

|---|

Picking the best business account provider for your needs is important - and can help you cut your costs and admin, giving your business a great basis to grow.

Both Revolut¹ and Tide² offer several different account plans, which include different features to suit businesses of all shapes and sizes.

Tide offers a free standard plan which could be handy for a new business - as well as 3 paid account tiers which offer more features, and extras like priority support or cashback. Here’s an overview of your options.

| Tide plans and features | Tide business account fees³ |

|---|---|

Tide Free

| Free |

| Tide Plus All of the above features, plus:

| £9.99 per month + VAT |

| Tide Pro All of the features of the Tide Free and Tide Plus account, and:

| £18.99 per month + VAT |

| Tide Cashback All of the features of the Tide Free and Tide Plus account, and:

| £49.99 per month + VAT |

Revolut also offers different business account types, from a free account through to custom built plans which are aimed at enterprise level customers. Here are the features and fees you can get from each account tier:

| Revolut business plans and features | Revolut business account fees⁴ |

|---|---|

Revolut Free

| Free |

| Revolut Grow All the features of the Revolut Free plan, plus:

| £25 per month |

| Revolut Scale All the features of the Revolut Free plan, plus:

| £100 per month |

| Revolut Enterprise Enterprise packages are tailor made to the organisation’s requirements | Custom |

Before you decide which business account provider and plan works best for you, it’s worth comparing a few options, taking into consideration:

Tide offers business accounts and associated services, such as loans and company registration support, to UK based companies, sole proprietors and freelancers.

Let’s take a look at how Tide shapes up across our key measures:

Speed: Tide offers outbound payments within the UK only. Transfers to other Tide accounts are instant, other Uk transfers should take minutes.⁵

Security: Tide is FCA regulated and protects customer funds wither by safeguarding it, or through the Financial Services Compensation Scheme, depending on account type.

Convenience: Access your Tide account online or in the Tide app.

Customer support: Tide gets a good rating on Trustpilot, with 4.3 stars out of 5.⁶ It also came in the top 5 of business banks and providers in independent reviews in October 2022. Customers who have premium Tide accounts have priority customer service options.

If you pick a basic Tide business account plan you won’t need to pay a monthly charge. However, there are some transaction fees you’ll want to know about. Here are some key costs associated with operating a Tide business account.

| Service | Fees |

|---|---|

| Receive payments | £0.20 Some account plans have free incoming and outgoing payments included |

| Send payments | £0.20 UK transfers only Some account plans have free incoming and outgoing payments included |

| ATM withdrawals | £1 |

| Currency exchange | Mastercard exchange rates apply for foreign transactions |

Best known for: Excellent customer service, with low cost UK payments and cash deposit options.

Tide is known for its strong customer service and support, as well as offering plenty of connected business services which can help smaller companies grow. It is primarily useful for transactions within the UK, with options to deposit cash at Post Offices and other agent locations, as well as local transfers which can be pretty much instant.

While you can use your Tide cards to transact internationally, there’s no option to send payments overseas - which can be a drawback if you’re using suppliers based abroad.

| ✅ Advantages | ⛔️ Disadvantages |

|---|---|

|

|

Revolut bills itself as a financial super app, and offers account services to both individuals and businesses. It’s already got a huge customer base in the UK and in the other countries and regions it trades in, with great customer ratings as a bonus.

Here’s how Revolut looks on the measures we’re using:

Speed: Local UK transfers can be delivered in a couple of hours, international payments may take up to 3 days depending on destination.⁷

Security: Revolut is FCA regulated, and customer funds are protected through safeguarding.

Convenience: Access your Revolut account online or in the Revolut app.

Customer support: Revolut gets an good rating on Trustpilot, with 4.3 stars out of 5, from 123,000+ reviews.⁸

All Revolut business account plans have some fee free transaction options, with higher tier plans coming in with higher fee free allowances and more free transactions. However, in most cases there will be some costs involved in operating your Revolut account - here are the key fees to know about.

| Service | Fees⁹ |

|---|---|

| Receive payments | Free to receive in GBP and EUR |

| Send payments | Local transfers £0.2 International transfers £3 Some account plans include some fee free transfers as part of the package |

| ATM withdrawals | 2% of withdrawal value |

| Currency exchange | Fee free to plan limit - then 0.4% markup added to Google exchange rate, once plan allowance is exhausted Out of hours and exotic currency fees may also apply |

Best for: low cost currency exchange and local receiving accounts in GBP and EUR.

Revolut stands apart from Tide mainly in the range of multi-currency options available. Revolut accounts can be used to hold and exchange 30+ currencies, and all accounts have some fee free exchange which uses the Google rate. However, to unlock more features and get higher fee free allowances, you’ll need to upgrade your account to a monthly paying tier.

Some additional costs can also creep in with Revolut, including fair usage fees if you exceed your plan allowances, and extra charges for currency conversion out of hours and at weekends.

| ✅ Advantages | ⛔️ Disadvantages |

|---|---|

|

|

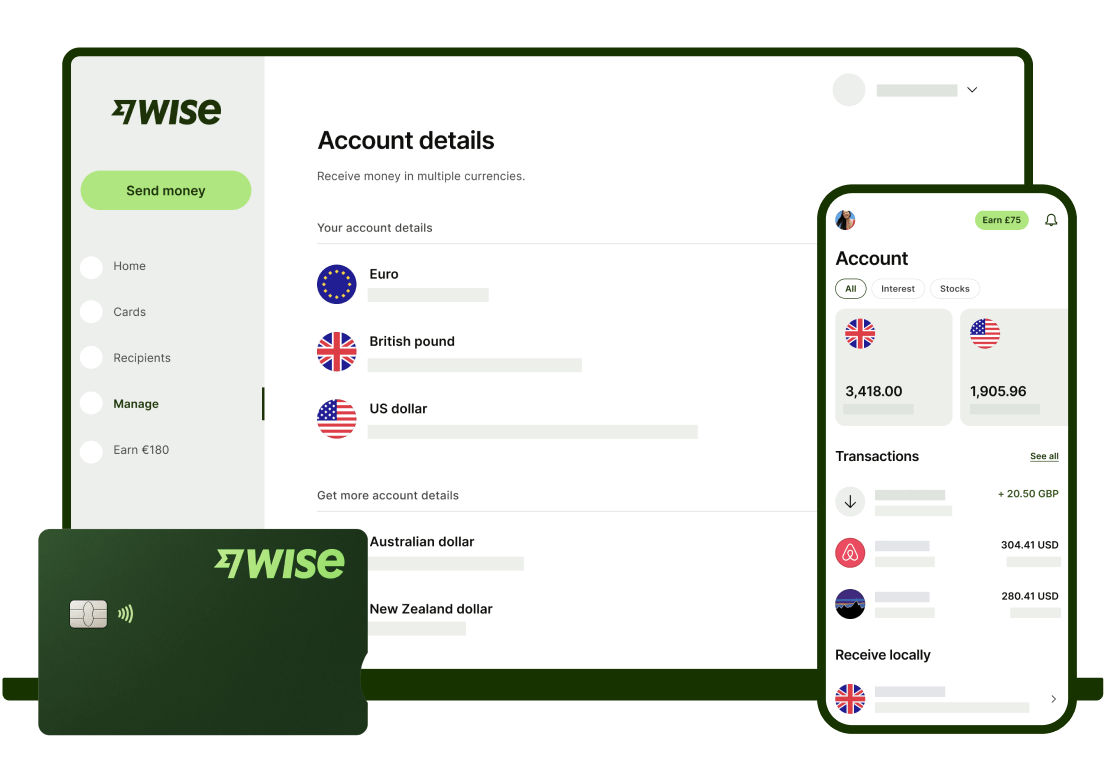

Wise Business can be a great alternative for companies looking for a straightforward and simple multi-currency account. Open a Wise account online or in-app for a low one-time fee, and get access to debit and expense cards, plus the option to hold and exchange 50+ currencies, and open receiving accounts in up to 10 currencies.

Let’s look at how Wise compares:

Speed: 50% of Wise international payments are instant, 90% arrive in 24 hours.

Security: FCA regulated, all customer funds are safeguarded. As a global business, Wise is also overseen by a selection of other regulatory bodies around the world.

Convenience: Access your account online and in the Wise app.

Customer support: Wise has an Excellent 4.5 out of 5 stars on Trustpilot, from an enormous 184,000+ customer reviews.¹⁰

Wise business accounts have low, transparent fees with no ongoing charges. That means you simply pay for the services you need, as and when you need them.

| Service | Fees |

|---|---|

| Receive payments | Get paid for free with local receiving accounts in up to 10 currencies |

| Send payments | From 0.41% |

| ATM withdrawals | 2 withdrawals, up to £200 per month fee free £0.5 + 1.75% after that |

| Currency exchange | All currency exchange uses the Google exchange rate |

Pricing/fees: Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information

UK business owners, sole proprietors and freelancers can open a Wise Business account online or in the Wise app, with a low one time fee of £50 (Advanced plan) or for free (Essentials plan), and no ongoing charges. Once you have an account you can order linked debit and expense cards for just £3 each - with no monthly subscription to worry about.

Wise accounts can hold and exchange 40+ currencies, and send payments to 140+ countries. That makes them perfect for dealing with employees, contractors and suppliers based overseas. You’ll also get local account details to get paid fee free from 8+ currencies, giving you even more ways to connect with customers and clients around the world.

Check out the Wise Business account today, for better ways to do business across borders.

Get started with Wise Business

Sources:

Sources last checked January 27, 2023

Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn about Mettle business bank account, its core features, limitations, eligibility requirements, fees and customer service.

Wondering what are the fees related to Revolut's Business Account? Read our complete review of plans and service fees.

A guide to the Starling sole trader account vs. business account, comparing the two on features, fees and eligibility.

Can you use Airwallex in Singapore? Find out here in our essential guide for UK businesses, covering everything you need to know.

Find the best business bank accounts in Canada with our easy guide. We compare top banks and digital providers so you can choose what fits your business best.

AIB offers three types of business current accounts. Each of these accounts is specifically tailored to a segment of the market.