New year, new steer? Key takeaways from our end-of-year event with SeedLegals

Earlier this month, we hosted a festive end-of-year event with our partners at SeedLegals. The evening brought together an inspiring group of founder and...

Managing expenses efficiently is crucial for companies of all sizes. Business expense cards offer a streamlined solution for your team, simplifying transaction tracking, reducing administrative burdens, and providing valuable insights into spending patterns. Additionally, they facilitate easy monitoring and control your team members' expenses and significantly simplify the reimbursement process, improving efficiency.

Sometimes, ATMs, shops, and online stores offer to charge you in your home currency. Then, they mark up the exchange rate. You and your team members can avoid these hidden fees by always choosing to be charged in the local currency of where you are.

Wise business debit cards are an excellent choice for small business owners needing digital or physical business cards for themselves and their team. With access to 40+ currencies, you can use your Wise Business debit card in more than 160 countries, effectively reducing costs on international transactions. Whether you're making payments online or in-person, our physical and digital cards come with no monthly subscription fees and the flexibility to issue up to three digital debit cards per team member.

| The Wise Business Card offers several advantages: |

|---|

|

Once you've set up your Wise Business account, you can request your physical business debit card. Open a balance in any of the 40+ currencies available, and top your account up to get started and spend like a local.

As the Wise Business account holder, your first physical card is provided to you for free and is included in our one-time account setup fee. We won't charge you for delivery either, unless you require express delivery, which is priced from £12, depending on where you live. However, while your physical card may be on the way, you are able to instantly create your digital cards (up to three per team member).

| First card on the account | Free |

|---|---|

| Cards for team members One time cost per card | 3 GBP |

| Card replacement fee | 3 GBP |

| Standard delivery Included in your fee | Free |

| Optional express delivery Delivery in 1-2 days with DHL | From 12 GBP |

Withdrawing money from an ATM

Make 2 withdrawals of up to 200 GBP each month for free per account. After that, we’ll charge 0.5 GBP per withdrawal. There’s a 1.75% fee on any amount you withdraw above 200 GBP.

Explore more on what the fees are in different countries and currencies.

Digital cards are virtual cards to be used on your phone or smart watch. With the digital Wise business debit card, you can shop online and in-store, at home or overseas - and get the added bonus of currency conversion savings too. Plus, you can add your digital cards to Apple Pay or Google Pay With ease. You can get up to 3 digital cards per team member at any time, separating your business expenses easily with daily and monthly spending limits for each team member.

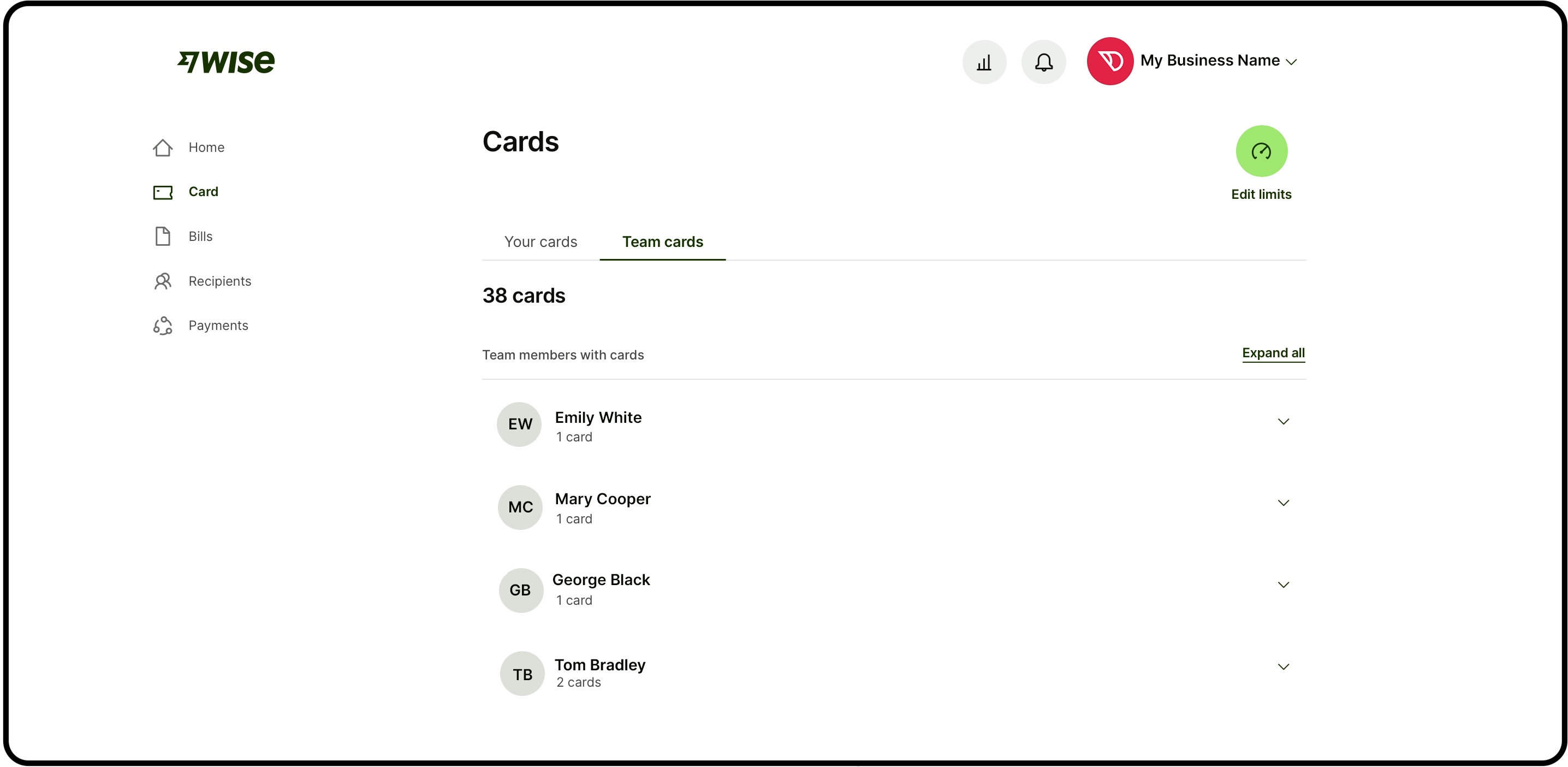

Once the Wise Business account owner has ordered their first physical card, they and their team members (who have the perimision to 'Order a business debit card') can create up to 3 digital cards per user. Head to the Wise App or the website, log-in to your Wise account, click Cards from the menu, and then Order a new card. On the new screen that appears, click on 'Get it Instantly'. When a new team member is added to your account, you can set their spending limits right away. You can also make any changes in the Cards or Team section.

Once you’ve requested your new digital card — it’s ready to be used. To find out more about the uses and benefits of a virtual card, read the following guide.

How does cashback work? We’ll reward you with 0.5% cashback on transactions you make with your business card, usually on the first business day of each month. You’ll receive the cashback in your Wise account, and we’ll categorise it as a Reward. We’ll give you your cashback in the currency you spend it in. Transactions that are cleared by merchants by the 25th of each month will be included in the payout in the following month. This guide discusses the cashback for businesses in detail, just in case you're wondering what transactions may be excluded and how it actually works.

To freeze card(s) you go to either the app or the website, tap on card or select cards, and select freeze card.

You can keep up to date with card spending from your account via real time notifications. If you'd like to see less of these, you can review and modify your notifications on both the website and app. We must inform you of changes to our Terms & Conditions, or your transfers, so important updates will still come through.

What kind of notifications can I expect?

You will be notified about transactions, transfers and balance, so you can keep track of where your money's going 24/7. We might update you about new currencies available or invite you to test new products. Sometimes you may receive notifications about news and tips on using a Wise Business account.

Currently, there is a limit on how much your team can spend with Wise Business cards, however, we can tailor these to your specific business needs. So if you need to increase these, you can do so in the product - just let us know the higher limit and we'll take care of the rest. We'll notify you once approved.

How to set limits for a team member:

Any team member assigned the permission to 'Order their business debit card' can order up to 3 digital cards and one physical card. You can then choose your team member and change their spending limits (either daily or monthly), and grant them permissions to withdraw from an ATM. You can also decide whether or not they can order digital cards. You can now also assign them to Group-only spending, meaning they will only be able to spend from the Group they're assigned to.

To view and edit limits for your individual team members, select 'Team' from the right hand side menu and choose the team member you'd like to change card limits for.

As an admin, by selecting Team on the right menu, you can view all your cards as well as your team's.You can click on each member and change their role and permissions, and set up payment approvals. As an Admin, you're also able to see what Group they're using their card in.

With Groups, companies can segregate their digital business card expenses and send international payments by team or purpose in multiple currencies. For example, the marketing department could have its own Group for online advertising expenses in British pounds, while the sales team could manage a separate Group for client entertainment expenses in Euros. All team members can also send from Groups. Learn more about multi-user access.

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Earlier this month, we hosted a festive end-of-year event with our partners at SeedLegals. The evening brought together an inspiring group of founder and...

Learn what business process automation is and how it can transform your operations. Discover key benefits and how to get started with BPA.

Read our comprehensive Sokin multi-currency account review for UK business customers, including pros, cons and features.

Looking for the best business accounts in Northern Ireland? Compare fees, features and benefits to find the account that supports your business best.

Find the best team collaboration tools to boost productivity and streamline communication. Compare features, pricing, and user reviews to choose wisely.

Looking for the best business bank account for landlords in the UK? Read this to compare accounts, providers, features, fees and more.