Buying art as an investment from overseas (UK buyers guide)

Learn about the risks and the long-term rewards of buying art as an investment and how to use Wise for high value purchases abroad.

Scammers are getting more and more sophisticated in how they access your information, and fake websites are just one of the ways they can get into your account.

So how can you spot a fake website? Sometimes it’s fairly easy, wonky logos and mismatched fonts can all scream ‘not the real deal’. But sometimes the warning signs only appear once you’ve tried to log in. By then, it can be too late.

So what should we be looking out for?

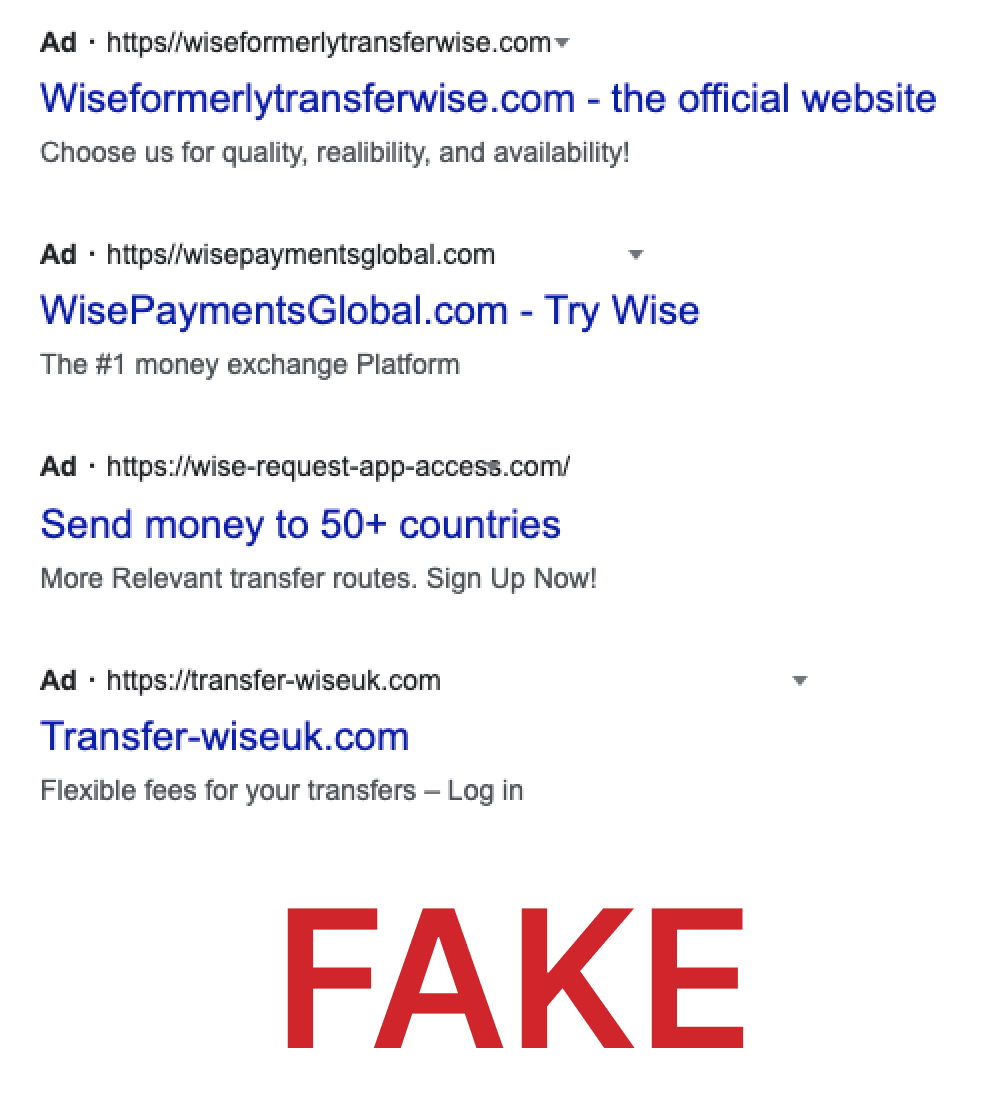

This is especially important if you have used a search engine, received a link through an email, a text message (SMS), or from an unexpected call. For us, this should always be Wise.com. We’ve seen a number of variations crop up over the years, but those simply aren’t us.

You should also be wary of sites that are listed as ‘Ads’ by search engines. These are easy to create for scammers and are more likely to be fake. Clicking the top links that aren’t listed as ‘Ads’ can help make sure you stay on the real site.

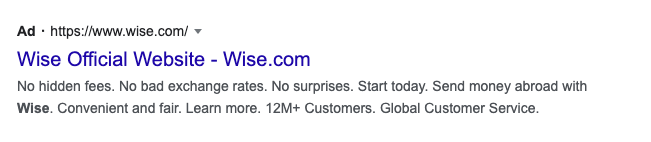

For clarity, here’s our real ad in a search engine.

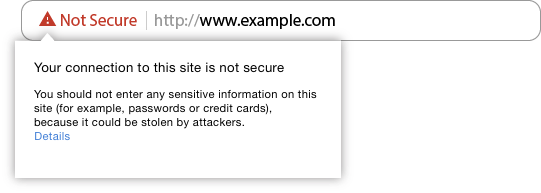

For websites that ask for you to share your personal details, make sure you are using an https:// or secure server internet connection (this should be the first few letters of the URL). If you visit a website that asks you for personal information or login details without taking you to a https:// connection, leave immediately!

Fake websites can make a very convincing page, but often it won’t behave like a proper website. Take a couple of minutes to double-check the site. It doesn’t have to be more than a few clicks, but looking at more than just the homepage, or the log in portal, could save you from falling into the trap. Spelling and grammar mistakes or dead end links, could be a sign that the website isn’t legitimate.

If you think your Wise account has been compromised or you've been scammed, sign out of all devices (you can do this automatically by clicking here), and change your password. Once you’ve done that, contact us immediately – our specialist team is here to help.

If you haven’t already, for better security we strongly recommend that you set up app-based 2-step login on your account.

There are many different methods scammers use to get you to ‘log in’ via these links. Whether it’s calls from fake customer service agents pretending to move money to a safe account or fake texts asking you to validate a payment you didn’t make, scammers are creative when it comes to finding ways to get you to follow links and share your information.

Phishing can be hard to spot, so make sure you know the signs to watch out for here.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn about the risks and the long-term rewards of buying art as an investment and how to use Wise for high value purchases abroad.

Got a speeding ticket in the post after your trip abroad? Learn how to pay a Spanish speeding fine from the UK and why Wise is a great solution.

Need to change your payment method on DAZN or fix failed charges? Find out how and to explore how paying with Wise can help you reduce costs.

Need to to manage your Amazon Prime subscription? Learn how change the payment method and save on conversion fees by paying your bills with Wise

Need to change your Spotify payment method? Learn how to update payments, fix failed charges and save on currency conversion fees with Wise.

Read our helpful guide to SIPPs for non-UK residents, covering everything you need to know about Self-Invested Personal Pensions for UK expats.