Best CRM for Startups (UK - 2025)

Get insights on the best SRM for startups to optimize customer relationship and drive growth.

QuickBooks (Intuit QuickBooks Online) offers a well liked online and cloud accounting service to sole traders and businesses in the UK. You can get help with your tax and VAT, and manage your income and expenses. Plus you can generate reports and analytics to improve business performance, and manage payroll, with different packages and solutions for different customer niches.

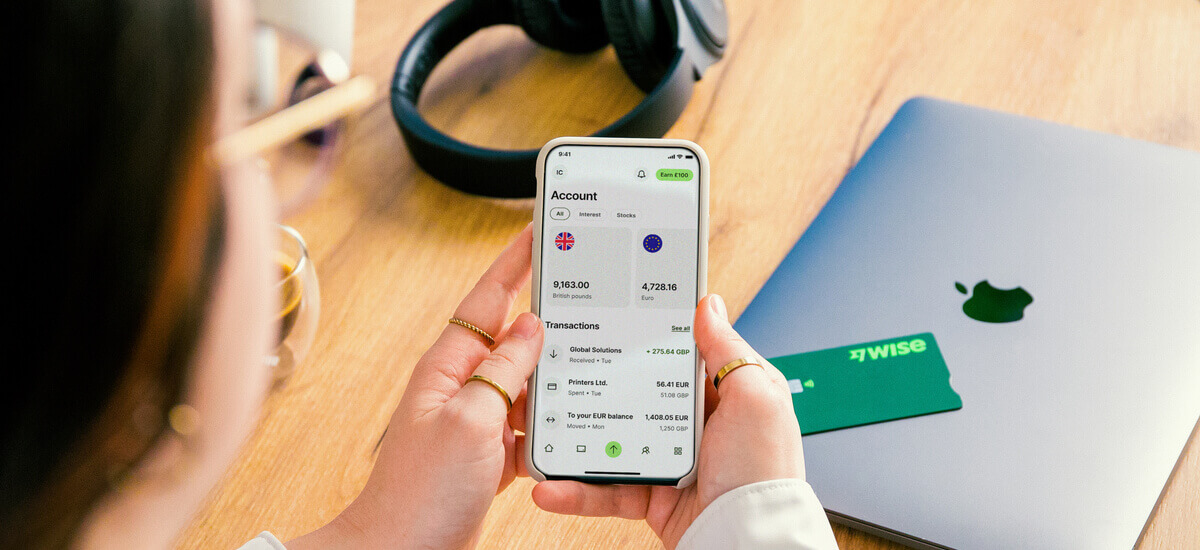

Join us as we cover some QuickBooks essentials for the UK, plus a quick look at Wise Business, as another helpful tool to manage your UK business. Wise offers multi-currency account and card services which have low fees, no monthly costs and integration with services like QuickBooks, to make accounting simple.

💡 Learn more about Wise Business

Let’s start with a quick overview of what QuickBooks is, in case you’re new to the service.

QuickBooks offers services to businesses and sole traders in the UK and many other countries, focused on online accounting packages. The accounting software plans available from QuickBooks online allow you to manage the day to day finances for your business all in one place, and with automated features to save time and reduce the scope for human error.

You can manage income and expenses, track business performance, prepare your taxes and VAT for example. You also have access to accounting tools to manage business functions, you can even add on optional support for payroll if you have employees.

This QuickBooks review walks through what features QuickBooks offers to UK business customers and sole traders, and also what you’ll pay. You can learn more about QuickBooks payroll in this full guide.

So - our key question: is QuickBooks any good?

Read on for an overview of the services, and a quick look at features available, as well as an introduction to the reviews of QuickBooks you can find online.

We’ve focused on features, plans, pricing and customer service as the most important considerations when choosing an accounting package for your business - plus you can also get more information and ideas from other QuickBooks online reviews.

Trustpilot is a great place to find customer reviews and ratings of providers. Over on Trustpilot, QuickBooks gets an Excellent 4.4 star rating from 5, from over 15,000 customer reviews1.

An impressive 83% of people give it the full 5 star review at the time of research, citing great online and phone support and easy onboarding as some of the reasons why they like the service available.

We’ll look at QuickBooks pricing (UK) in a moment, but first let’s take a look at some of the services, features and support you might get when you sign up.

Accounting tools cover a very broad range of services, but what you get will depend on which plan you sign up to, with options suited to everything from sole traders just starting out, to large and complex organisations.

Here’s an overview of the key features supported by QuickBooks across different account plans:

Is QuickBooks worth it? Here’s a rundown of the costs involved in signing up with QuickBooks in the UK.

QuickBooks pricing offers several different plan options which have their own monthly fees, and which have a specific customer niche in mind. Of course, you could sign up to any of the products available, but QuickBooks guides different customers to a specific plan or plans, to help them pick the best pick for their needs.

At the time of writing, all QuickBooks plans are offered with an initial discount of 75% of the fees, which can be for 6 or 12 months. This gives you the opportunity to test the service and plan you’ve picked before you need to pay the full fee. This offer may change, but is a handy way to try out the options with lower financial risk.

Here’s a summary of the plans available from QuickBooks UK2:

| Plan | Target customer | QuickBooks UK monthly fee |

|---|---|---|

| Self employed | Sole Traders not registered for VAT who need to prepare Self Assessment | £10 - fees reduced for first 6 months |

| Simple start | Sole Traders or small businesses managing VAT, Income Tax and preparing Self Assessment | £16 - fees reduced for first 6 months |

| Essentials | Small businesses working with suppliers, who need to manage VAT and Income Tax | £33 - fees reduced for first 6 months |

| Plus | Small and medium businesses managing projects, stock, VAT and Income Tax | £47 - fees reduced for first 6 months |

| Advanced | Larger businesses needing automatic data backup, custom permissions, bespoke reporting and insights | £115 - fees reduced for first 6 months |

QuickBooks also has an optional add on for most plans, to support running payroll. This starts from £1 a month.

QuickBooks offers a very comprehensive online self help support service, including tutorials, blogs, ways to talk to other QuickBooks customers and community resources3.

If you can’t solve your problems using this self service model, QuickBooks customers in the UK can reach customer service using an online contact form4 which will direct your query to the appropriate team or individual to get the help you need.

It’s also reassuring to know that Trustpilot reviews of QuickBooks frequently note the great service the customer has received, including naming individual team members who have helped them with online and phone queries. Check out the latest QuickBooks reviews on Trustpilot to learn more about what previous customers think of their service levels.

QuickBooks UK offers several different accounting plans which have their own features and fees. Whether the options available are worth it for you will depend on your specific business needs, but at the time of writing all packages offer new customer discounts which can be an attractive way to test whether a plan might suit your specific needs.

QuickBooks establishes a secure connection if you choose to link it to a bank or other business account from a non-bank provider like Wise Business. This means it’s safe to use. Plus, if you add your bank or other business account you can automatically reconcile your finances to make it much easier to manage your money.

Link a bank or business account to QuickBooks to manage your income and expenses with instant updates and reconciliation options. If you use a service like Wise Business to manage your money you can also keep on top of your finances in 40+ currencies, with ways to get paid with local and SWIFT account details in 8+ currencies. This can mean connecting with suppliers, contractors and customers around the world is easier and cheaper than ever.

Since the launch of the HMRC Making Tax Digital (MTD) program, HMRC have been migrating some of their services to online and digital options only. It’s helpful to know that QuickBooks is MTD compliant and recognised by HMRC for VAT submissions3. As the MTD program rolls out to cover other tax functions like income tax, keep an eye out on the additional features and support QuickBooks will launch.

QuickBooks offers a broad range of accounting and bookkeeping solutions which are designed to suit different business needs and sizes. Whether or not it’s all you need for your business depends on the nature of your work and the package you select. QuickBooks UK offers phone support to talk through package options and get advice on onboarding which can help you decide if it’s right for you.

Some sole traders and small business owners may use QuickBooks without an accountant, but you can also use it with an accountant to check over your final tax return and ensure everything is complete and compliant. This is the recommended solution for more complex businesses, or if you're unsure about the tax rules for your specific business type.

QuickBooks has a reputation for being easy to use, and suitable even for beginners. The interface is attractive and simple, and there’s a lot of support on hand if you need it including tutorials, FAQs and community guidance.

Wise Business can help UK businesses, freelancers and sole traders to manage finances across multiple currencies, with low fees and the mid-market exchange rate.

When you open a Wise Business account, you’ll benefit from all of these useful features:

Get started with Wise Business 🚀

This guide covers all the key details, including QuickBooks pricing in the UK and reviews of QuickBooks available online, to help you decide if it’s the right fit for you. Use this to start your research and consider linking QuickBooks and Wise Business to manage your company finances across multiple currencies with ease.

Sources used in this article:

Sources last checked February 18, 2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Get insights on the best SRM for startups to optimize customer relationship and drive growth.

Discover the best 0 interest business credit card you can get in the UK to help you manage cash flow and business spending.

Can you use Airwallex in the US? Find out here in our essential guide for UK businesses, covering everything you need to know.

A business that needs access to working capital should consider debt factoring advantages and disadvantages before making a decision.

Discover the best startup business credit cards to improve cash flow and streamline financial management.

Can you use Airwallex in the UAE? Find out here in our essential guide for UK businesses, covering everything you need to know.