2025 Update: Wise’s commitment to improving diversity, equity and inclusion for women in tech

At Wise, our vision is money without borders. In order to build the future of global money, we need a team that’s as diverse as the customers we...

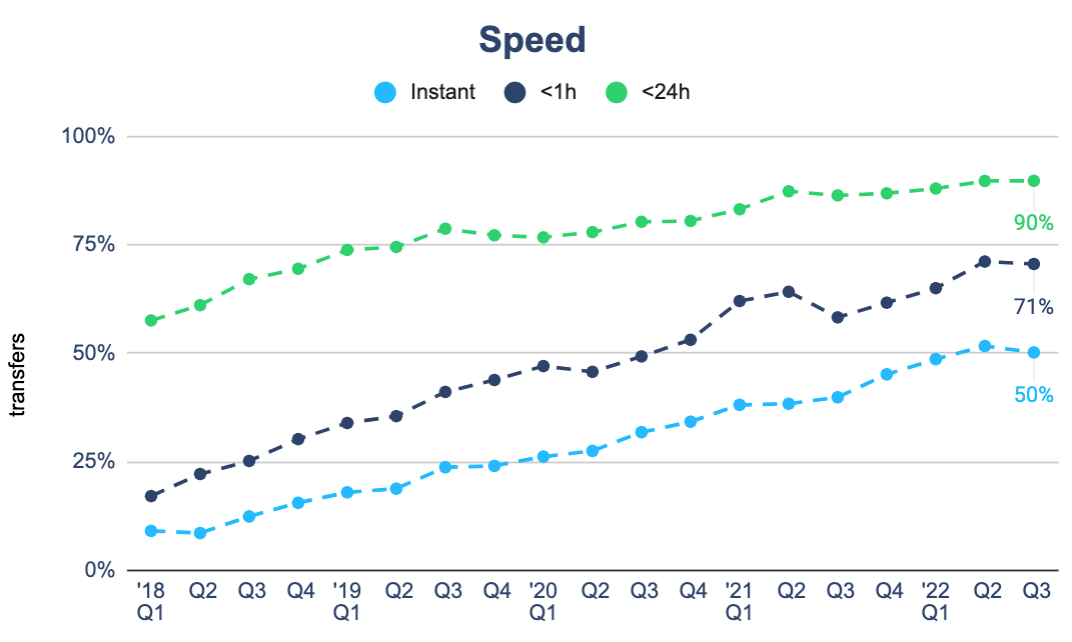

Instant dipped by 1% in Q3, meaning 50% of transfers were completed in under 20 seconds.

This dip was mostly caused by our decision to temporarily reduce the number of transfers we sent instantly to Brazil. We did this because we had challenges in getting funds to our partner account quickly enough to serve the volume of instant transfers we were paying out.

Despite this, we continued to make some improvements to speed:

We can now receive your payments 24/7 in Japan, rather than 9AM-9PM on business days. This means we'll be able to convert your money and pay out your transfers sooner. We did this by integrating with a new partner and connecting to their API to help get us round the clock coverage.

We sped up payouts in Chile. 20% of transfers now reach their recipient in less than 24 hours - previously all transfers would take over a day. We did this by integrating with a new partner, called BCI, who pay out transfers within 24 hours if your recipient has a bank account with them.

We improved the speed of large transfers which require additional due diligence checks, by reducing the number of manual reviews we have to make. This meant that 75% of these transfers were completed in less than 26 hours, compared to 75% of transfers taking 44 hours in Q2.

We improved payout speeds in Hong Kong, making 56% of transfers to Hong Kong instant.

Last quarter, we told you that we were going to kick-off a project to reduce the number of transfers we have to suspend (while we run financial crime checks) without compromising on the quality of our controls. We originally planned to do this by improving the risk model behind our existing checks, but after doing some more analysis we realised we could have even more impact by rebuilding the underlying control. This will eventually help us to speed up transfers by avoiding compliance-related delays. We aim for the bulk of this work will be delivered in Q1 2023.

Unfortunately we didn't manage to deliver instant transfers to and from Poland, or to Israel. This was due to delays integrating with our partner banks. However, both of these are on track to be delivered in Q4, along with launching instant payments from Brazil via the PIX network.

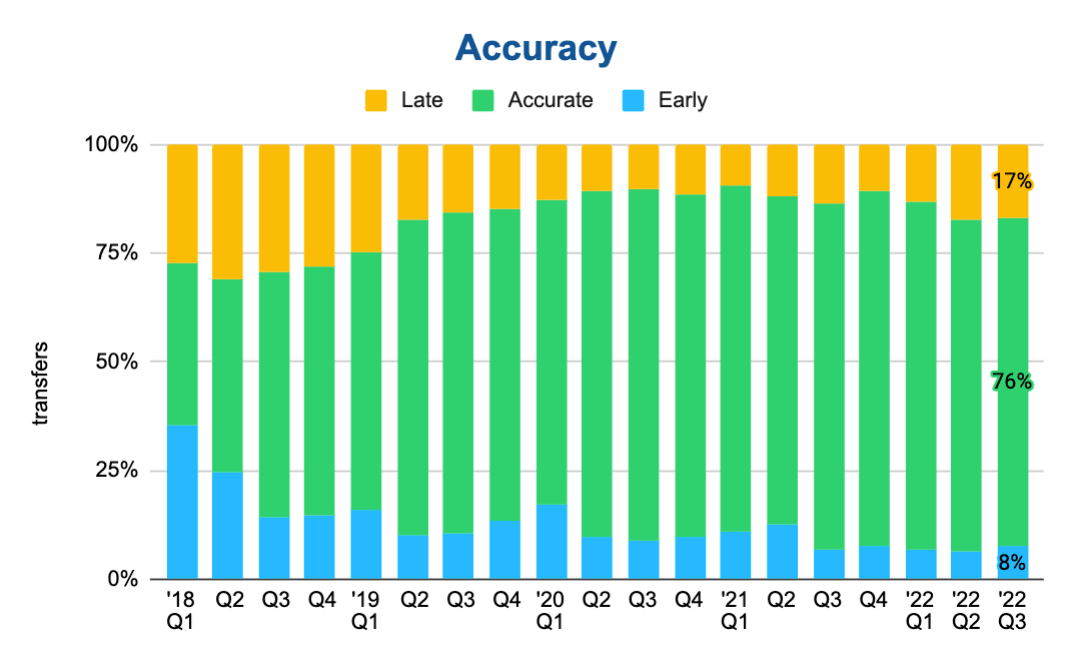

Our accuracy performance has remained stable in Q3, with 76% of transfers on time and 17% being late. This is still down on our peak performance in Q4 last year, where 82% of transfers were on time.

Most of our delays are the result of ongoing issues reported in our Q2 mission update. These are:

These three issues contributed to 34% of our total delayed transfers.

However, when we look at how long our delays last, we can see that our performance is improving. 60% of delays last less than an hour, compared to Q4 of last year when over 60% of delays lasted more than an hour.

We know that all delays are frustrating but we think that delays of hours, or days, are much more painful than a couple of minutes. Reporting on the length of the delay helps to give a better picture about whether our performance is trending in the right direction and where we might need to focus more of our attention.

For example, the payout delays in India and screening delays tend to be resolved in a couple of minutes, whereas transfers to Brazil could get delayed for the whole weekend, so it makes sense to prioritise fixing this issue in Q4.

We'll do this in two ways: firstly, by delivering instant pay ins from Brazil, which will increase the funds we have coming into our account overnight and at weekends. Secondly, we'll connect to our partner bank's API which will also help us deposit funds faster when needed.

We will also spend some time in Q4 digging into the delays which are over an hour long, and understand what's driving these and how we can resolve them. We'll report back on this next quarter, so watch this space!

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

At Wise, our vision is money without borders. In order to build the future of global money, we need a team that’s as diverse as the customers we...

Paying someone new? Don’t waste time typing out their bank details or double-checking their IBAN. Upload a screenshot or invoice instead. Our new AI feature...

Welcome to the Wise Partner Program! In this guide, you will find all the information you need to get started, optimize and succeed as a Wise partner. Simply...

We're thrilled to introduce a powerful new feature designed to save you time and eliminate the frustration of manual data entry when sending money. Now,...

The new Wise Card is here! 🇧🇷

We have great news for our customers in Brazil! You can now set up your own Pix key directly in the Wise app