Sprinting ahead: 5 cross-border payment trends set to mature in 2026

Explore the 5 cross-border payment trends defining 2026. From G20 targets to retail customers, discover how global payments are moving from sprint to standard.

Working Capital or Net Working Capital is a measure of how efficient a business is in its day-to-day operations.

Essentially, it shows how much money or liquid assets your business has readily available to cover any current or immediate financial needs, like expenses or debts. It's an important indicator for how financially stable your business is in the short term.

In this article, we’ll cover the basics of Net Working Capital, why it's a critical metric and how to calculate it. We'll then explore some tips on how to improve it if your business is global and depends on working with several different currencies.

| 💸🌎 Operating in multiple currencies? Manage your working capital better and save money with Wise! Find out how! | |

| :-----------------------------------------------------------------------------------------------------------------------------------------------: | - |

At the most basic level, net working capital (NWC for short) is defined as total current assets less total current liabilities.

The NWC figure with a good idea of their company’s ability to meet immediate short-term financial obligations.

Positive net working capital usually implies that the company can meet its impending debts and payments while negative net working capital implies that the company may struggle to pay back creditors. In extreme downside scenarios, the company may even go bankrupt.

Different users may choose to calculate NWC differently. This is because current assets can be made up of several items, including, but not limited to: inventory, accounts receivable, prepaid expenses, etc.

Depending on their profile, these current assets can be converted to cash with varying levels of ease. Meanwhile, short-term obligations usually have to be paid in cash. As such, users may opt to exclude certain items from current assets that may not be easily converted to cash in order to provide a clearer picture of the business’s ability to pay back creditors in the near term.

Learn More: The Best Working Capital Loans for Small Businesses

As discussed above, net working capital is a reasonably sound indication of the company’s ability to pay off short-term obligations from a range of creditors. The current liabilities section of the balance sheet is a list of all the upcoming payments that the business has to make within the year.

Therefore, assuming that the net working capital is positive (i.e. current assets are greater than current liabilities), the business is likely to be able to generate enough cash to pay these current liabilities. In case the net working capital is negative, the business may have to tap other sources of funding to pay back near-term obligations.

However, net working capital can be more than just a simple measure of liquidity. It is also an indicator of growth. If a company consistently has large cash balances, it may imply that the company is generating enough positive cash flow to reinvest in itself for growth. On the other hand, a business with lower cash balances may just be making enough to sustain itself, but not enough to grow exponentially.

To calculate NWC, let’s break it down into its fundamental components: current assets and current liabilities.

Current assets are defined as assets that provide benefits or will be used within a 12-month period. Similarly, current liabilities are debts and obligations that have to be paid to the creditors within a 12-month period.

Examples of current assets include:

Examples of current liabilities include:

Most companies will report current assets and current liabilities separately from long-term assets and long-term liabilities, respectively. Therefore, once you have identified current assets and liabilities, the calculation is simply:

To illustrate, let’s take an example of a business that has £100 of cash, £40 of inventory and £60 of accounts receivable. Current liabilities include £40 of accounts payable, £30 of taxes payable, and £25 of revenue that has been recorded for services not yet provided (i.e. unearned revenue).

Current assets would therefore be: £100 + £40 + £60 = £200

Current liabilities would be: £40 + £30 + £25 = £95

Net working capital = £200 - £95 = £105

While each company and industry has different standards on what constitutes a good net working capital ratio, there are some common practices that businesses can adopt to improve net working capital, and consequently, their ability to meet short-term obligations:

While working capital is a simple calculation, it is rarely as simple to manage. These complexities are further heightened when operating an international business. Different tax jurisdictions, currencies, and supplier terms across different countries can all impact how much working capital you can access if needed:

| 💡🌎 Tip! To reduce FX costs when converting between different currencies, use a cheaper solution like Wise for Business to get access to conversions at the mid-market rate with no mark-up or better yet, get a Multi-currency account to easily manage payables and receivables in different currencies. This can help you get paid faster and settle any outstanding overseas payments or bills on time. |

|---|

These differences can add to overall overhead expenses and/or current liabilities, thereby reducing net working capital. To this end, working capital management is a key priority for managers when leading expansion efforts to ensure that fiscal discipline is maintained even when operating under different circumstances across different environments.

Currency fluctuations are one of the key risk factors of international businesses that make purchases and sales in various currencies. One of the ways that this risk can be mitigated is through a multi-currency account. However, opening a multi-currency with traditional banks is usually lengthy, expensive, subject to approval, and not open to all businesses.

Luckily, there is a solution!

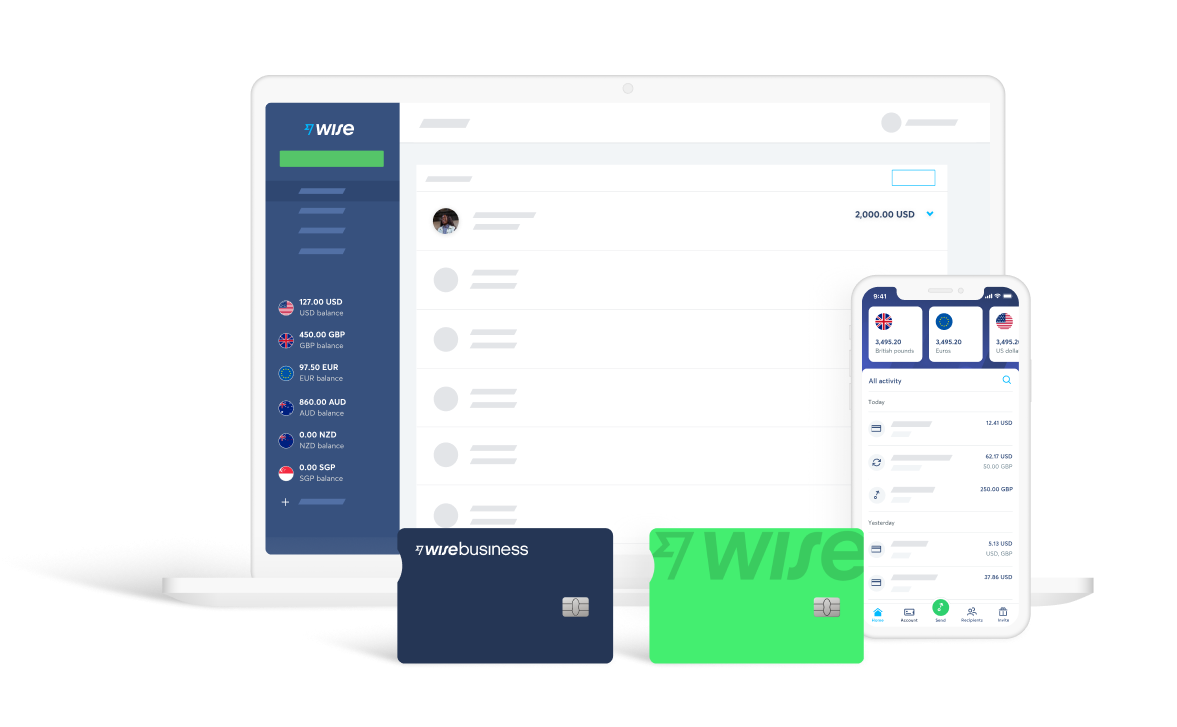

With Wise, you can open an account in minutes and pay little to no monthly fees. You can also manage subscriptions, international payments to your team, contractors or freelancers all over the world, all from one place. Saving you time and money.

Easily move money between currencies and have more control over your cash flow

With Wise you have better visibility of all your global transactions, reduce overhead costs from currency management, and streamline financial reporting to help improve funds and cash reserves to help your international business run efficiently.

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Explore the 5 cross-border payment trends defining 2026. From G20 targets to retail customers, discover how global payments are moving from sprint to standard.

Learn about the corporate tax system in Mozambique, its current rates, how to pay your dues and stay compliant, and best practices.

Learn about the corporate tax system in Uganda, its current rates, how to pay your dues and stay compliant, and best practices.

Learn about the corporate tax system in Lithuania, its current rates, how to pay your dues and stay compliant, and best practices.

Learn about the corporate tax system in Kuwait, its current rates, how to pay your dues and stay compliant, and best practices.

Learn about the corporate tax system in Jordan, its current rates, how to pay your dues and stay compliant, and best practices.