Mettle business bank account review UK

Learn about Mettle business bank account, its core features, limitations, eligibility requirements, fees and customer service.

Managing a business’s finances is a major task, and comes with its own particular set of responsibilities and rules. So it’s no surprise that most top banks offer specially tailored types of accounts for businesses, whether you’re a sole trader, a multinational or non-profit. NatWest, one of the UK’s top banks, isn’t an exception.

In this article you can find out what banking services NatWest has to offer to UK businesses and organisations, information on how to apply for a NatWest business account and a rundown of NatWest charges.

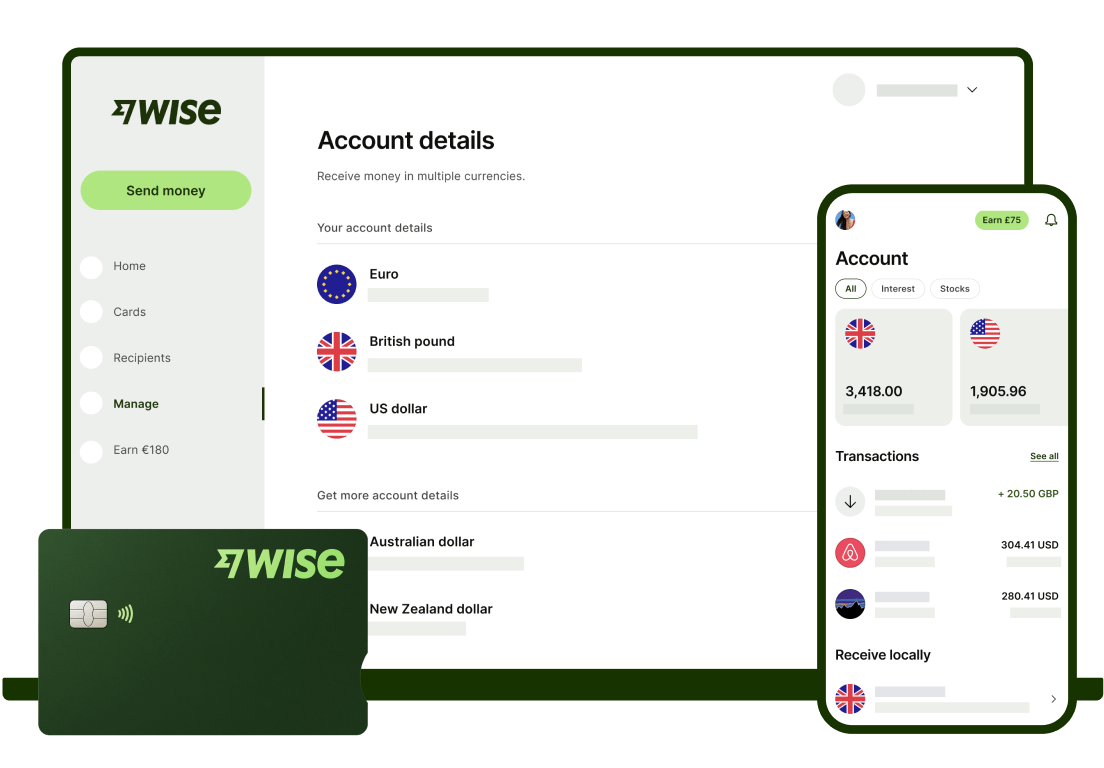

We will also present you with an alternative for NatWest Business accounts, an especially great one if you do business overseas: Wise Business, a multi-currency account that helps you to pay and get paid easily across currencies.

Like a lot of banks, NatWest offers different sorts of business accounts depending on the size and type of your business. So, take a look through the different types below to see which one suits you best.

Of course, NatWest is just one option of many; there are lots of UK banks that offer business accounts, and even some other institutions that you can use. Wise Business, for instance, has a great range of business options, especially if you’re likely to do business with companies abroad.

Now, back to what you came here to read.

This sort of account is designed for companies that have been trading for less than a year, with an annual turnover (existing or predicted) of less than £1 million. If your business meets these requirements you can apply for a NatWest start-up business account online.

You might get 2 years of free service charge with this account, plus a debit card, along with a few other perks like access to FreeAgent accounting software for free. Like with all of these accounts, you get access to mobile banking via NatWest’s app.¹

The next account is for new businesses trading for under a year and with more than £1 million in annual turnover, or for companies with less than £1 million in annual turnover but that trade for more than one year. In other words this account is destined to small to medium-sized businesses.

The features are much the same as with the startup account: you still get a debit card, the right to use FreeAgent accounting software free of charge, dedicated relationship manager (eligibility criteria apply) and a few other benefits as well. There is no minimum money fee so you only have to pay for the services that you’ll use.²

An account dedicated to self-employed people in the UK. Offered by Mettle, part of NatWest Group, this is a free mobile business account.³

There are no monthly fees or transaction fees, and you can apply online from the Mettle app. Eligibility criteria applies though and we'll run through the requirements for this account in a moment.

Other relevant information about this account are its limitations:

If you are a sole trader and need to receive or send money abroad, Wise Business may be a better option. You can open a multi-currency account to get paid in GBP, EUR, USD and other major currencies, and manage your business money in over 40 currencies.

Learn more about Wise Business

multi-currency account 🌎

If you’re a non-profit organisation like a charity, club or society, a Community account might be the best way forward.

You might be able to get free banking with this account if your turnover is below £100,000 and if you are a NatWest personal or business customer already.⁴

This account comes with a Visa debit card, just like the other accounts, and you can also get a chequebook and book for paying in - handy if you receive a lot of cash or cheques.

When you have to make international business payments it might seem logical to do this with your bank. You already have an account there, they have all your information, so it just seems easier. Although these are valid reasons, easier certainly doesn’t mean cheaper.

Most banks won’t convert your money at the mid-market exchange rate when you make an international payment. Instead they add a mark-up and charge you a hidden fee that way. Wise Business is different. Its smart technology skips hefty international transfer fees by connecting local bank accounts all around the world. Which means you can save time and money when you send money abroad.

Wise also has a lot of additional features for business users:

Get started with

Wise Business 🚀

For the Start-up¹ or Business account², you’ll need to meet the following criteria:

And the information you’ll need to provide to start your NatWest business account application is as follows:

Personal details. Your name, date of birth, contact details, and address. You’ll need to provide this information for not just the business owner, but all directors, partners, members, and other signatories.

Business details. You also need to provide information about your business, including addresses, contact details, information about what the business does and how many people it employs, and if there are any other names your business goes by. Be ready with basic details about your end-of-year accounts as well, even if they’re only forecasts.

Registration details. And you’ll also need to provide information about your registration: your registered company number if you’re a limited company, and details of any country that either you or your business is registered in.

The small business Mettle mobile account has different eligibility requirements:³

Things are also different for the Community account, where NatWest will need different information depending on which sort of organisation you are - a registered charity or a church, for instance. They could need to see a few extra documents, so it helps to have ready:

You can apply online with NatWest for a business account. The process will depend a little bit on exactly which sort of account you’re opening, but the following should be a good guide to how to get set up in most cases.

You might find you’re eligible for a free business account with NatWest, at least for a while. But otherwise, these are the fees you’ll face. But it is important to notice that this is not a complete list: there are other specialist fees like BACS payment fees, that are too numerous to list here. Be sure you have the full picture from NatWest before signing up.

| Services | Fee |

|---|---|

| Automate payments (in or out) | £0.35 per item |

| Cash payments (in or out) | £0.70 per £100 |

| Manual payments (in or out) | £0.70 per item |

| BACS payments | £0.18 per item |

Non-Sterling Transaction Fee is 2.75% of the transaction value. This includes:

| Services via online banking | Fee |

|---|---|

| International transfer (out) | £15 |

| Euro SEPA credit payments | Free |

| International payment (in) below £101 | £1 or free for EUR |

| International payment (in) £101 or over | £7 of free for EUR |

We’ve included International payments as this is often an area where bank fees can get surprisingly high - not just with NatWest. If you do business internationally, the fees for foreign transfers can make a big difference to your balance sheet, especially when you’re just starting out.

💡Learn more about Wise Business

Finding the banking option that works for you is essential, so that you can concentrate on making sure your business is successful. When deciding on the right account for your business, research is key - as features, benefits, and costs can vary widely.

Natwest offers a range of account options and benefits that may fulfil your business needs, but if you expect to send and receive international payments frequently, it’s worth comparing the products available against a specialist business account from Wise, to see which will work best for you.

Sources used:

Sources last checked July 26, 2023.

Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn about Mettle business bank account, its core features, limitations, eligibility requirements, fees and customer service.

Wondering what are the fees related to Revolut's Business Account? Read our complete review of plans and service fees.

A guide to the Starling sole trader account vs. business account, comparing the two on features, fees and eligibility.

Can you use Airwallex in Singapore? Find out here in our essential guide for UK businesses, covering everything you need to know.

Find the best business bank accounts in Canada with our easy guide. We compare top banks and digital providers so you can choose what fits your business best.

AIB offers three types of business current accounts. Each of these accounts is specifically tailored to a segment of the market.