Q4 2023 Mission Update: Price

Our average price stayed at 0.67% in Q4 2023. Overall, this quarter we 😞Increased fees on sending USD to countries outside the USA when using the SWIFT...

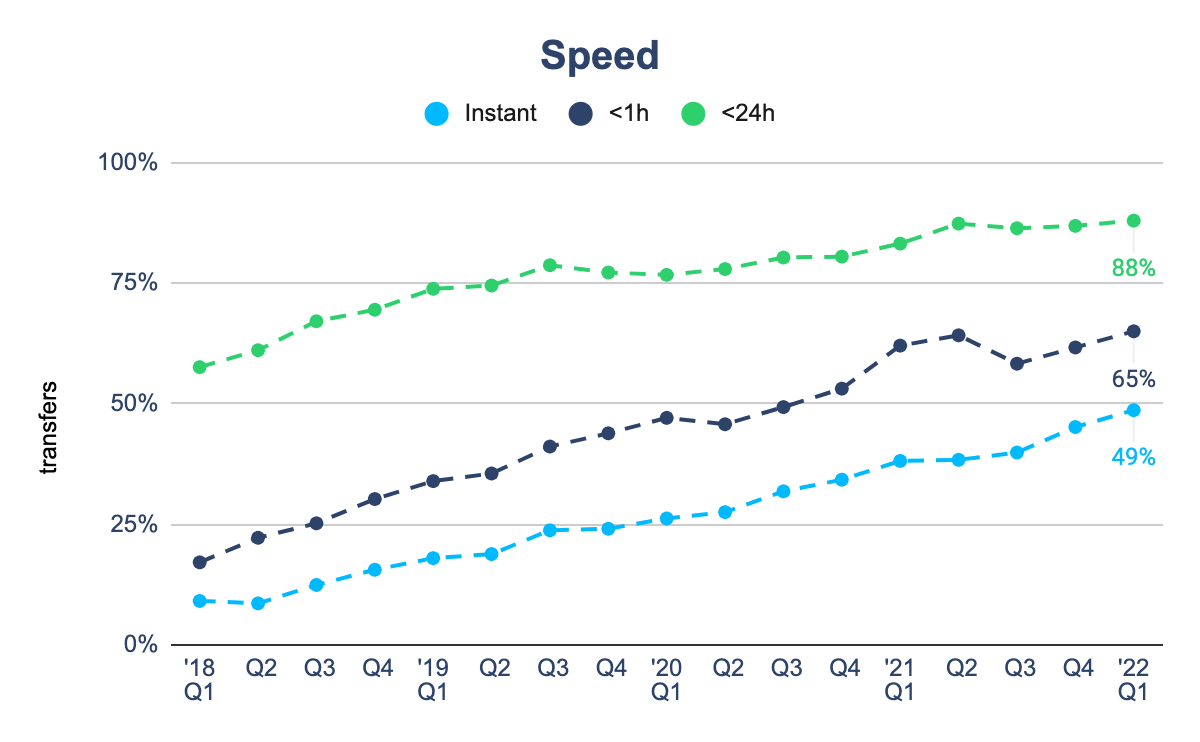

In Q1, 49% of our transfers were instant.

We've sped up some routes this quarter, making transfers from Singaporean dollar, and to Brazilian Real and Malaysian Ringgit instant.

Seeing as we're talking about instant, we thought it might be helpful to have a refresher about what we mean when we say that a transfer is instant.

Each transfer is comprised of three stages:

To make a transfer instant, we need to integrate with payment networks or processors in the currency you're sending money to and from. Those networks need to be able to handle their side of the transfer (either pay in, or pay out) in under twenty seconds.

For example, if you make a transfer from Euros to Pound Sterling and pay for it through Apple Pay, it will be instant because Apple Pay sends us your money in less than twenty seconds. Additionally, British banks are all connected to the local instant payment network so they'll send the converted funds to your recipient in under twenty seconds too.

And of course, if you send from one Wise account to another, the payment will always be instant because we handle both the pay in and pay out side.

In Q1 we made or improved connections to more instant payment networks.

In Brazil we connected to the new instant payment network, PIX. Now, most transfers up to 10,000 BRL can be paid out in less than twenty seconds.

If you're sending money from any currency with an instant pay in connection, it should get to your recipient in Brazil instantly.

This includes sending from the UK, and some banks in the Eurozone. This is a significant improvement from our previous performance, when 12% of transfers were taking over 24 hours to arrive.

We've also fixed an issue with our partner in Singapore, which was preventing customers from paying in instantly. Fixing this has enabled customers to send Singaporean dollar transfers much faster: 80% of transfers made to currencies with an instant payment network are now instant.

For example, 63% of transfers from Singaporean dollar to Malaysian Ringgit are instant, along with 71% of transfers to Indonesian Rupiah.

Finally, our payout partner in Malaysia improved their processing speeds, allowing us to make payouts instant. Half of transfers from Australian dollar to Malaysian Ringgit are now instant, as well as 65% of transfers from British pound.

Even when sending from and to instant currencies, not all transfers will be instant. There are a few possible reasons for this.

How much money you send: sometimes if a transfer is over a certain limit, we have to slow it down to help us manage our flow of funds, or due to partner restrictions.

If you're a new customer: we might also run additional checks at the processing stage which means we have to slow down your transfer.

Our partner connection: sometimes, our payout partners have processing issues, meaning transfers are delayed - although we're always working on reducing the frequency of this!

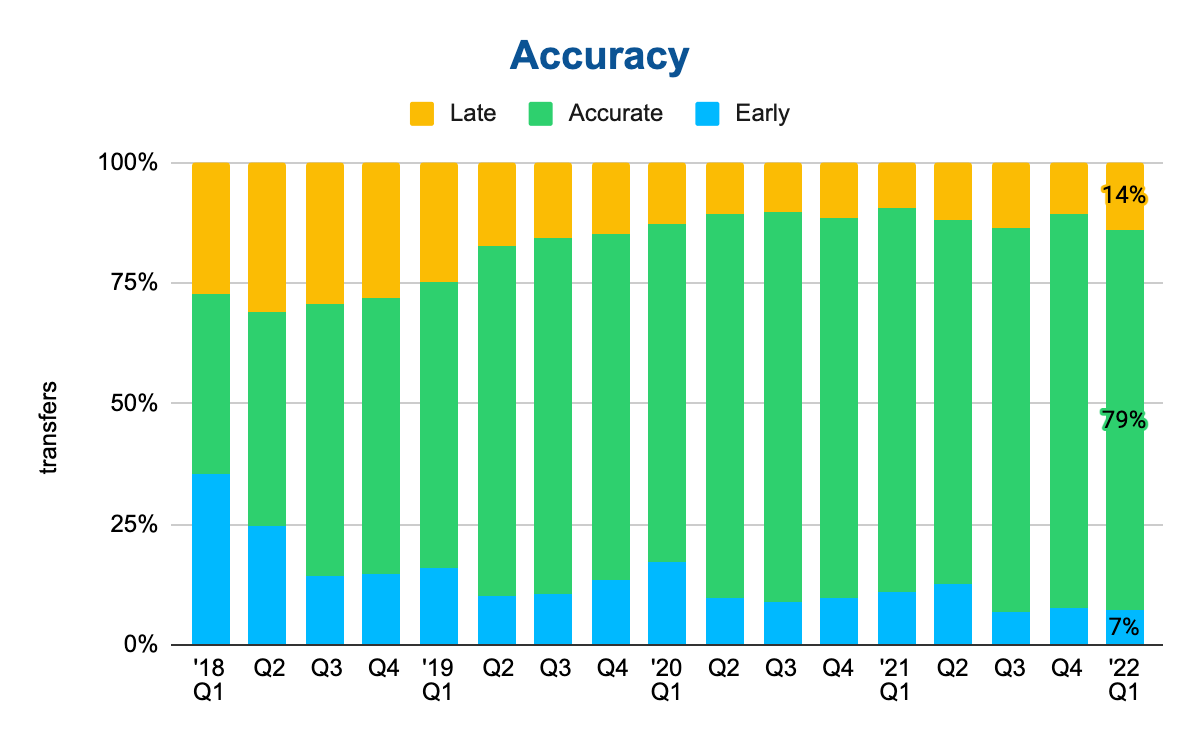

Unfortunately 2% more transfers were delayed this quarter compared to last quarter.

There were two reasons for this. Firstly, we had to run some additional compliance checks for our European customers, which meant transfers were slowed down for a lot of people. While this doesn't have a lasting impact on delays, it has shown us that we need to improve our estimates while customers are undergoing compliance checks.

Secondly, we continue to struggle with payout delays in Asia, particularly when sending money to India.This is an ongoing challenge we're having with our payout partner, which we're working on fixing in Q2.

Happily, we did make some transfers more accurate. We connected with a partner's API to give us more accurate estimates for when transfers sent via the SWIFT network would arrive. This has improved the accuracy of around 30,000 SWIFT transfers each month.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Our average price stayed at 0.67% in Q4 2023. Overall, this quarter we 😞Increased fees on sending USD to countries outside the USA when using the SWIFT...

Speed In Q4, 61% of our transfers were instant, meaning they were completed in under 20 seconds. That’s an increase of 1% from Q3. What's changed? We’ve been...

We believe that the world’s a richer place when money moves fast and flows free. That’s why we work hard to ensure our product is as convenient as can be,...

Maximum Speed: Moving at the Speed of Light At Wise, we are committed to providing our consumers with the best possible experience when it comes to...

The key indicator that we’re offering a truly convenient product is your ability to use Wise without any hiccups. That’s why we’re measuring convenience (or...

We aim to make sure that using Wise is as convenient as possible – so you can manage your money hiccup-free. And we measure that convenience (or lack of it)...