Q4 2023 Mission Update: Price

Our average price stayed at 0.67% in Q4 2023. Overall, this quarter we 😞Increased fees on sending USD to countries outside the USA when using the SWIFT...

Welcome to our first mission update of 2021 and our first one as Wise. Our name has changed but not our mission. We have a lot to share with you as we continue to build ‘money without borders’; enabling everyone to move their money across the world - instantly, transparently, conveniently and eventually for free.

There are now 10 million of you trusting us to move over £5bn every month and here are some of the highlights this quarter

Our average price stayed the same in Q1 but we were able to reduce the transfer fees for 840,000 of you.

We always work to reduce fees by reducing costs in three ways: by being more efficient in how we operate Wise, having better technical integrations with bank partners and working more deeply in payment networks, and by taking advantage of our scale as we grow.

As a reminder these fees have two components - a fixed fee per transaction as well as a percentage fee based on the amount you send. Depending on how much you send at a time our fee reductions can impact you differently.

Last quarter, we saw some large drops in some of our fixed fees which will benefit you more if you send smaller amounts. Whether you are sending to or from New Zealand Dollars or Hong Kong Dollars, you will have seen your fees dropping between 10% and 30% depending on the amount and where you send it to. If you send Canadian Dollars you will have seen a 17% drop on a $1000 transfer, and if you are sending money to Euros you’ll see 7c more arriving regardless of how much you send.

This means it now costs less to use the Wise account. For example, payouts from your EUR balance reduced from 35¢ to 28¢, from your HKD balance from HK$6.15 to HK$5.33 and in New Zealand from NZ$0.99 to NZ$0.76.

Our philosophy is that customers should only pay for what they use – and not subsidise services that only some customers use. That's why we have fees for specific parts of our products. This means we have had to start charging customers who are holding large amounts in their Wise accounts, specifically affecting those of you with EUR balances and those of you in Australia. This is because we face negative interest rates in the Eurozone and because Australian regulation requires us to hold extra money in addition to what we hold for you as a precaution.

In the Eurozone we’ve introduced an annual fee of 0.4% for personal users holding amounts above 15,000 EUR. For business customers charges start when you hold more than 70,000 EUR. We only apply the fee if you’re above the threshold for more than three days and we bill on the incremental amount over the threshold at the end of the month. If you live in Australia, we have a 1.6% annual fee if you go over your free thresholds for more than 3 days - details here on those thresholds across currencies.

Finally, up until now we’ve been offering debit card replacements to our customers for free. This quarter we introduced a fee (£5 or €6) if you have either lost or damaged your card, which covers production and delivery of your new debit card. Renewal of an expired card remains free.

We got faster: this quarter, 38% of all transfers happened instantly, i.e. arriving in the other bank account in less than 20 seconds. This is up from 34% last quarter. It's a huge achievement and now we are focused on hitting our next milestone of 50% of all transfers being instant. We also saw 62% of all remaining payments arriving within 1 hour.

How did we do this? Great work done by the teams in South-East Asia during March is already showing positive impact –– the full effect will be seen in the coming months.

In Europe, we were able to launch instant transfers to the 4 largest banks in Romania for transfers below 50,000 RON.

Everyone wants to be confident of when their money is going to arrive. Last quarter 91% of our estimates were accurate (or early), it’s the best we’ve done so far and gives you that reassurance that your money has arrived on time.

One big improvement we made was sending money to India. We noticed payments sent to certain banks in India were bouncing back and causing delays, so we changed our rules to stop this happening. We also improved our transfer predictions over weekends and this all meant 83% of transfers to India got accurate estimates, up from 77% the previous quarter.

Your Wise card got even better: We also have digital cards live for everyone with debit cards in all countries (except the US and Japan, sorry!). These can be easily activated in the app and means you can start using the debit card immediately and for free, with 60,000 digital cards in use already.

We had big news from Japan where you can start on Wise faster than ever before. Last year, it took 2.5 days on average to get your documents verified in Japan, now 78% of our customers are verified in under 24 hours - this means you can get up and running even quicker. We were able to do this by helping you take and submit your photos correctly, adding visual guides for entering your address and removing a local vendor we used for address verification; all of which have sped things up.

If you like inviting friends and family to use Wise now when you get your invite bonus we’ll pay it straight into your Wise Account. It’s far quicker and easy and you can get it paid in just 2 clicks.

Sadly we had challenges in Brazil with our local partner bank, which led to closing all transfers from Brazil earlier in the quarter. The good news is we’ve recently got the go-ahead from the Central Bank of Brazil (an ‘authorization to operate’), meaning that we are now serving our customers in Brazil directly as a licensed exchange broker.

When you need to submit documents for verification, sometimes they are rejected later in review due to poorly-taken photos. This is not a great experience for you, and a bit of extra hassle, so now we’ve improved how we review those images, just to make sure more documents are accepted on the first time around, making the onboarding smoother and faster - nearly 22,000 customers each month are now being helped in this way.

For those transfers that require deeper, manual checks and due diligence, we’ve also started to speed things up. Every month 50,000 users who need to go through this process have had their transfers sped up by two days and for a further 50,000 customers we have reduced their processing time from 24 hours to 8 hours. We are aware some other processes are still slow and we are focusing efforts of multiple teams to get processing time across all such checks under 24 hours.

Sometimes we do need to deactivate accounts. For example, if we can’t be sure your Wise account is used legitimately and we need to protect your account; if you already have a pre-existing account and a new one is created; or if your existing account is being used for purposes outside our authorised use policy. This is important to keep all of our services safe.

This quarter, we launched a self-service tool to help you if your account has been deactivated and you want to appeal the decision. 58% of all customers affected are going through this flow, which makes it more transparent about what you need to do and the status of your appeal.

Additionally, when you’re setting up your Wise account numbers for the first time we ask you to take a live photo of your document and also a selfie. It’s naturally easier to do that using the camera on your phone, so now when you start the flow on the web we help you seamlessly transition to your mobile and back.

We also now support Confirmation of Payee in the UK. This means when someone is transferring money to your Wise account, their bank can check if the entered name and account number matches our records before making the payment, preventing impersonation scams. Soon, you’ll see us do it the other way around too – we will be able to validate the recipient’s details before you send a transfer to someone in the UK.

Finally, on safety. You may have seen the introduction of two-factor authentication which is the extra security step to take when you login. It’s something you may have used with other apps and we feel we’ve made it quick and easy to use on Wise. This security step protects you from the risk of your account being accessed or taken over by someone else and has reduced the number of such incidents by 6,000 already. It’s now mandatory to set up when becoming a new customer or returning to Wise and now over 75% of you are using it.

Businesses registered in Europe, the UK, Australia, New Zealand, Singapore and Japan can now have multiple cards for their employees to use. If you’re an admin for the Business account, you can order additional Wise Business cards for £3. We’ve issued nearly 2,000 of these so far to help your team use your Wise account even more effectively.

Businesses in Japan can now get verified completely online just like individuals. You no longer have to get a physical mail sent to your address which drops the time it takes to verify you from 7 days to 2 days.

Some of you have told us about a bank or a business that refused to accept your Wise EUR account number. For example, the Greek tax authority might only accept an IBAN with a Greek country code in it. This ‘IBAN Discrimination’ is actually against the law in the EU and we’ve heard from thousands of you that this had happened to you. Enforcing this has been hard for regulators and consumers didn’t have access to an easy way to complain.

On World Consumer Rights Day (March 15), we launched AcceptMyIBAN.org with a few friends from the fintech world, including N26, Revolut, Klarna and SumUp. So now, whether you bank with HSBC, have a Wise account or pay with Revolut, there’s an easy way for you to report whenever your IBAN is not accepted. So far, more cases have been reported in just 2 weeks than the German authorities have seen in 3 years.

With our name change, not that much should change for you right now. You can access your exact same account via wise.com, using your current email and password. You won't need a new account. We recently started redirecting transferwise.com to wise.com. If you’re having a specific problem since the change, check our handy FAQ.

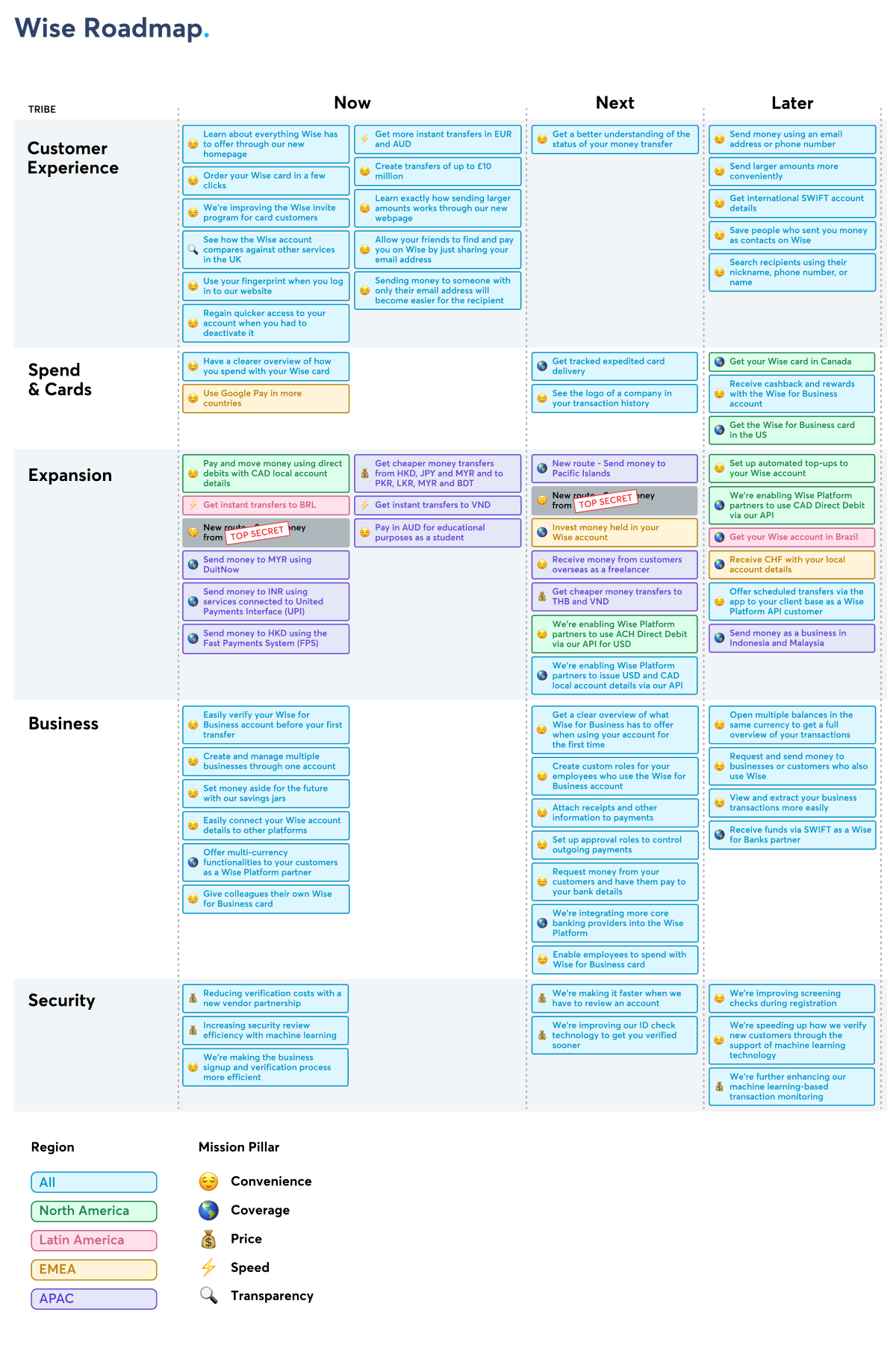

While we are always proud to share what we've done each quarter, it’s good to give everyone a sense of where we are going and what’s up next; so we have introduced our open product roadmap. It showcases what our teams are working on next, whether it’s focused on speed, price or convenience and you’ll be able to see in which markets and across which products. We’ll also let you know when we expect these things to launch, so you can see how we are making progress in the coming months. We are really excited to share this with you all as we move onwards. Check it out here.

We had over 300 Wisers start new roles in the last quarter and we have 244 open roles right now. We’re looking for a VP People, VP Design, Director of Brand & Creative & Treasury Product Director as well as many roles in engineering and product. Come join us.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Our average price stayed at 0.67% in Q4 2023. Overall, this quarter we 😞Increased fees on sending USD to countries outside the USA when using the SWIFT...

We believe that the world’s a richer place when money moves fast and flows free. That’s why we work hard to ensure our product is as convenient as can be,...

Speed In Q4, 61% of our transfers were instant, meaning they were completed in under 20 seconds. That’s an increase of 1% from Q3. What's changed? We’ve been...

The key indicator that we’re offering a truly convenient product is your ability to use Wise without any hiccups. That’s why we’re measuring convenience (or...

Maximum Speed: Moving at the Speed of Light At Wise, we are committed to providing our consumers with the best possible experience when it comes to...

It was another busy quarter for Wise Platform; from exciting partnership announcements, to podcast deep dives and a whole European tour of conferences,...