Welcome to our quarterly trading update blog post where we will be going through our mission and financial highlights from the last three months, April to June.

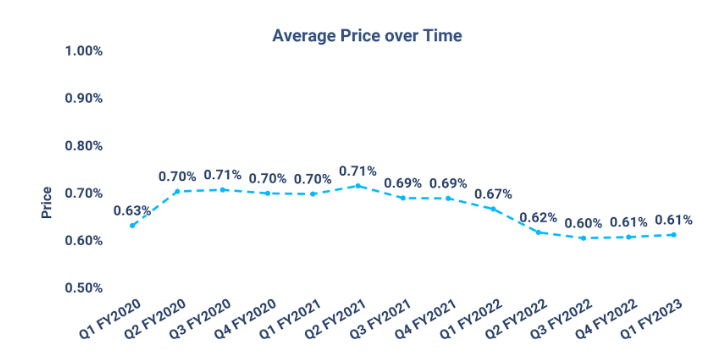

In the first quarter of the financial year we continued to disrupt a massive and underserved market, with 5 million active customers moving more than £24 billion across borders; a 49% increase on the same period last year. We continued to save our customers money by providing cross-border transfers at a highly competitive average price of 0.61% in FY23.

We do this through our superior products: Wise Account, Wise Business and Wise Platform. Our team has rolled out further product enhancements designed to make the product more convenient to use and to enhance security features for businesses.

These products are powered by our infrastructure. In Q1 we saw more than half of our payments delivered instantly. We see this as truly game changing versus the alternatives that customers have today. And our customers love it.

So we continue to invest heavily in products and infrastructure, and take the lead in driving down the cost of cross-border transfers whilst at the same time maintaining a profitable business model.

Kristo Käärmann, our CEO and co-founder, said: *“In the three months to 30 June 2022 we helped 5 million active customers move more than £24 billion across borders, a 49% increase on last year. We also reached a key milestone in our mission, more than 50% of all cross-border transfers are now completed instantly.

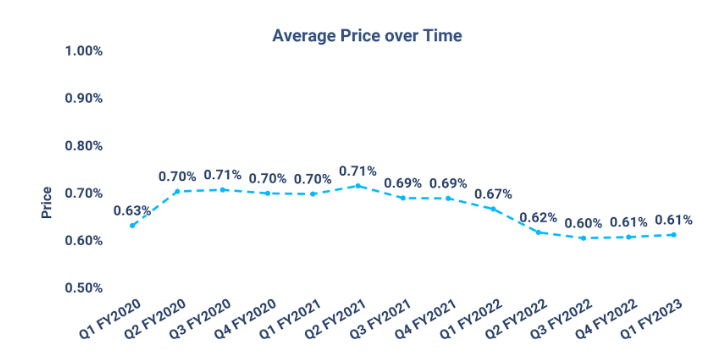

Our Wise Account and Wise Business products got even better as we launched 2-step payment approvals and employee spending controls on mobile for our business customers. The average price that our customers paid for cross-border transactions reduced from 0.67% to 0.61% in Q1 FY23 compared with the same period last year and was unchanged compared with Q4 FY22.”*

Mission Highlights

Money without borders: enabling everyone to move their money across the world - instantly, transparently, conveniently and eventually for free.

Average customer price remained flat compared with last quarter 📈

Growing volumes and reducing costs allows us to sustainably reduce prices for our customers while generating significant capacity for reinvestment. In Q1 FY23 the average price was 0.61%, compared with 0.67% in Q1 FY22 and flat compared with Q4 FY22. While we were able to reduce fees for customers sending money to Mexico, Singapore, UAE and Kenya, this was offset by additional servicing costs and costs of managing risks and uncertainty associated with the current macroeconomic environment.

Over 50% of all transfers are instant — huge milestone. 💥

We continue to focus on improving how we operate and in Q1 FY23 our payments got faster - now the majority of our transfers arrive in under 20 seconds (up from 36% in Q1 FY22). This is a result of the work that our team continues to deliver to offer superior speeds to our customers including the roll-out of instant transfers to Brazil, where we also launched the Wise Account in February 2022. Currently, 90% of all transfers are completed within 24 hours, up from 88% last quarter. Instant transfers are important for the overall customer experience and are a key driver of our high net promoter score.

Ongoing product evolution 💙

This quarter we onboarded a million new customers, supported by continued strong progress in the US and excellent product-market fit in Brazil. In the last three months we also made our products more convenient to use. Our personal customers can now link their Wise account to over 6,000 finance apps like Venmo, Truebill and Chime. In Brazil, personal customers are now verified much more quickly, with 97% of verifications completed within 24 hours. We have also enhanced transparency of our customers’ transaction history by introducing category icons and making the name of the shop or business clearer.

Our business customers now have the ability to manage employee spending controls through the mobile app and we have enabled 2-step payment approvals, providing additional security to business owners. In the U.S. we have widened the roll-out of digital cards, so now more business customers can offer digital cards to their employees, removing the need for plastic cards.

Wise Platform continues to innovate and remove frictions for adopters. As such we've built a new SWIFT Receive feature for our Platform partners. This allows financial institutions not connected to the SWIFT network to now receive payments from all over the world via SWIFT using their existing customer account details. The feature also enables financial institutions with an existing SWIFT setup to process these incoming SWIFT transfers more quickly, cheaply and conveniently. We also went live with new platform partners including Monzo Business, Firstbase and Onfolk.

Finally, our mission roadmap, which is available on the Wise website, sets out the future improvements we have planned for each of our products. Incremental improvements, although may seem small on their own, are at the heart of our strategy as they allow us to reduce cost and in turn price, as well as increase speed, convenience and transparency.

Growth and Financial highlights

Customers

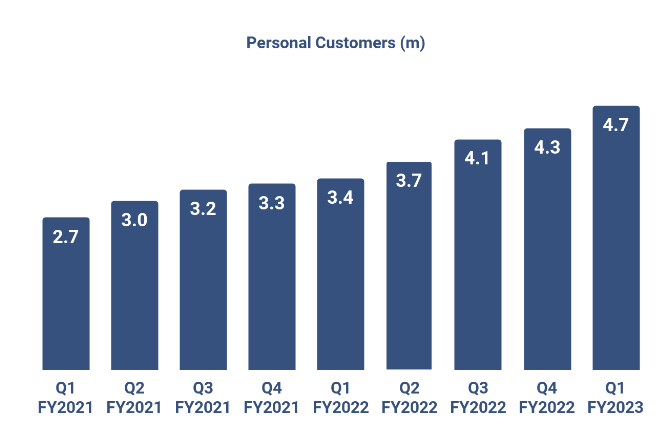

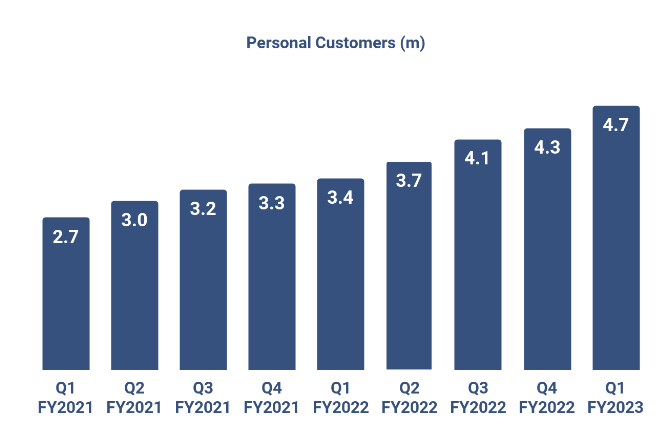

4.7m

37% YoY, 9% QoQ

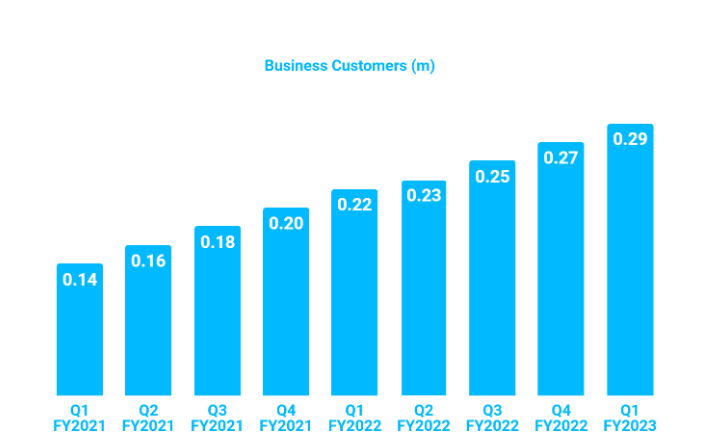

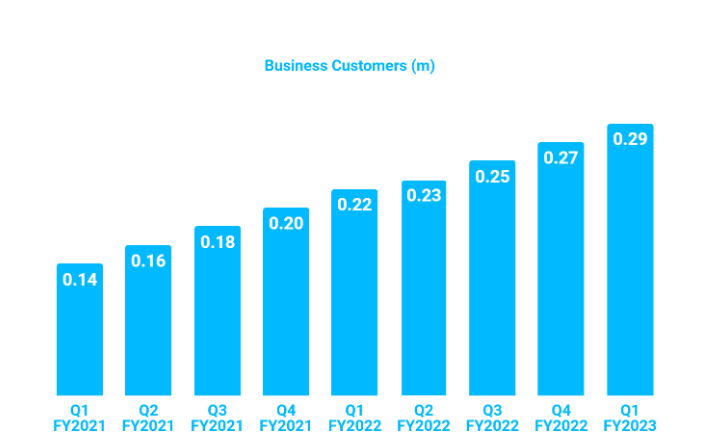

0.29m

33% YoY, 6% QoQ

Q1 FY23 was a strong quarter with 5 million active customers transacting on Wise. The number of active personal customers grew by 37% YoY to 4.7 million. The number of active business customers grew by 33% to 290k compared to the prior year.

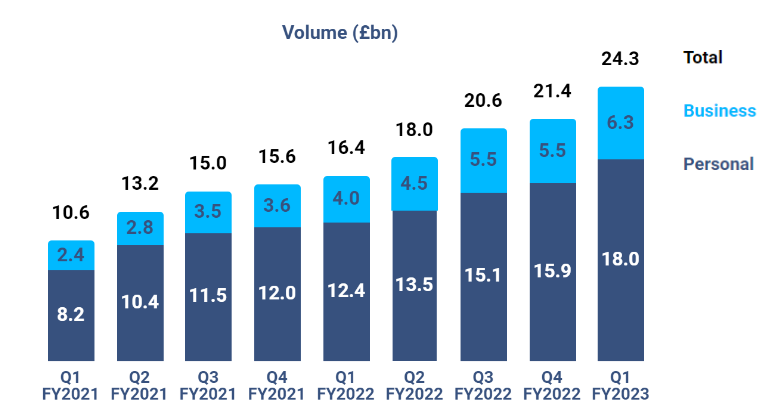

Volume

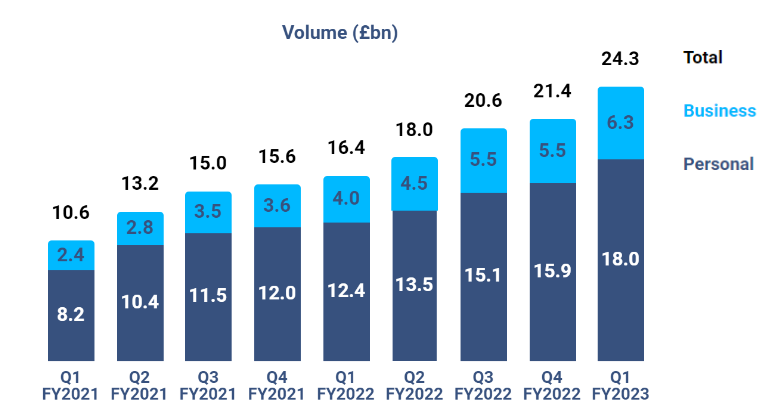

24.3bn

49% YoY, 14% QoQ

Total volume grew by 49% YoY and 14% QoQ to £24.4 billion. Volume growth was predominantly driven by a higher number of active customers that are increasingly using the Wise Account and Wise Business products, leading to higher average volume per customer (VPC). The growth in volume was also driven to a lesser extent, other more variable drivers such as people and businesses responding to increased levels of FX volatility and the translation impact from FX movements which was a tailwind in the quarter, compared with a headwind in FY2022.

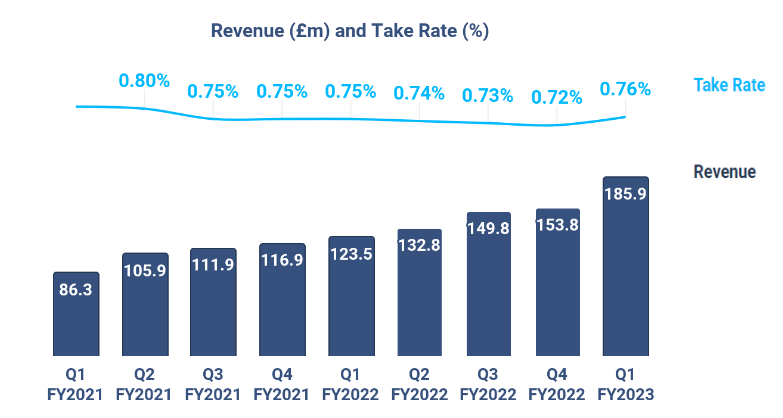

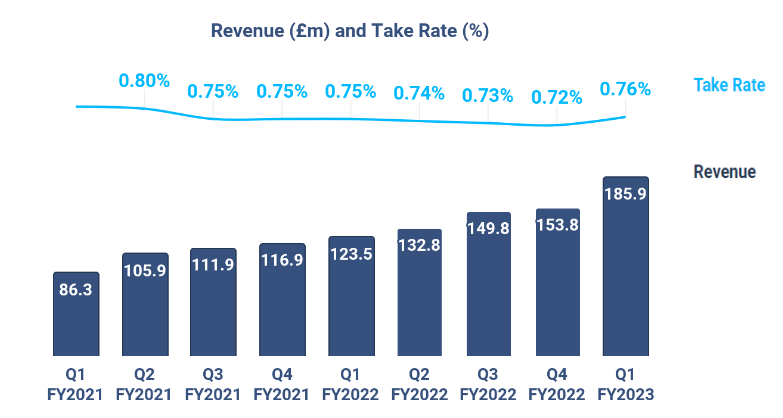

Revenue

185.9m

51% YoY, 21% QoQ

Revenue grew by 51% YoY and 21% QoQ to £185.9 million, in line with the rate of growth in volume. Our total take rate increased 4bps QoQ to 0.76%, reflecting the price rises announced in March 2022 and other revenues picking up. Other revenues benefited from higher debit card spend and interchange fees as customers use the Wise Account.

Looking ahead, for the remainder of FY23 and in the medium-term our guidance remains unchanged. We anticipate revenue growth of between 30-35% in FY23 and greater than 20% (CAGR) over the medium-term. We continue to expect adjusted EBITDA margin at or above 20% over the medium-term.

Enquiries

Martyn Adlam - Head of Owner Relations

martyn.adlam@wise.com

Sana Rahman - Global Head of Communications

press@wise.com

Brunswick Group

Charles Pretzlik / Sarah West / Samantha Chiene

Wise@brunswickgroup.com

+44 (0) 20 7404 5959

About Wise

Wise is a global technology company, building the best way to move money around the world. With the Wise account people and businesses can hold over 50 currencies, move money between countries and spend money abroad. Large companies and banks use Wise technology too; an entirely new cross-border payments network that will one day power money without borders for everyone, everywhere. However you use the platform, Wise is on a mission to make your life easier and save you money.

Co-founded by Kristo Käärmann and Taavet Hinrikus, Wise launched in 2011 under its original name Wise. It is one of the world’s fastest growing tech companies and is listed on the London Stock Exchange under the ticker WISE.

Over 13 million people and businesses use Wise. Today we process on average over £8 billion in cross-border transactions every month, saving customers over £1 billion a year.

FORWARD LOOKING DISCLOSURE DISCLAIMER

This report may include forward-looking statements, which are based on current expectations and projections about future events. These statements may include, without limitation, any statements preceded by, followed by or including words such as “target”, “believe”, “expect”, “aim”, “intend”, “may”, “anticipate”, “estimate”, “plan”, “project”, “will”, “can have”, “likely”, “should”, “would”, “could” and any other words and terms of similar meaning or the negative thereof. These forward-looking statements are subject to risks, uncertainties and assumptions about Wise and its subsidiaries. In light of these risks, uncertainties and assumptions, the events in the forward-looking statements may not occur. Past performance cannot be relied upon as a guide to future performance and should not be taken as a representation that trends or activities underlying past performance will continue in the future. No representation or warranty is made or will be made that any forward-looking statement will come to pass. The forward-looking statements in this report speak only as at the date of this report.

Wise expressly disclaims any obligation or undertaking to update, review or revise any forward-looking statements contained in this report and disclaims any obligation to update its view of any risks or uncertainties described herein or to publicly announce the results of any revisions to the forward-looking statements made in this report, whether as a result of new information, future developments or otherwise, except as required by law.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.