Account-to-account (A2A) payments: how to move money between your accounts

Read our helpful guide to account-to-account (A2A) payments, including how they work, how long they take and the benefits.

Most of us will need to send money overseas at some point. But what’s the best and cheapest way to send money abroad?

Banks aren’t always the best choice when it comes to international transfers - as it can become very expensive, very fast. Luckily, there’s a fantastic selection of handy apps to choose from instead. Here, we’ll guide you through some of the most popular apps, with some handy pointers on what to look out for and what to avoid.

Wise make international money transfers cheap, fair, and simple. Their multi-currency app allows you to conveniently manage over 40 currencies, all in the one place.

Use the Wise app and you’ll be able to send money to people in over 50 countries. Download for free on Android and iOS - find it in Google Play and the App Store.

|

|---|

All fees are transparent and super low - take sending 1000 GBP to EUR. You could save up-to £52.14 compared to other leading UK banks, with just a £3.95 transfer fee and the real exchange rate. Check fees for all currencies using their online Price Checker.

With the Wise app and their price comparison tool you can keep-updated on the progress of your transfer, and compare the speed against other leading UK providers.

Your recipient doesn’t need a Wise account to receive money - as it can be sent direct to their local bank account. Don’t know their account details - no problem! You can also send money using just their email address.

Over 3 million people use Monzo to spend and send within the UK - choosing the app-based bank as an innovative alternative to traditional UK banking. You can also send money overseas, as Monzo has partnered with Wise to offer international money transfer services. This means the same low fees, the ‘real’ exchange rate and quick, reliable payments – all without leaving the Monzo app.

|

|---|

Monzo offers a great, convenient way to integrate international payments with your everyday banking. It’s all done through the one app, available to download for iOS and Android. Best of all, you’ll also win on cost. It’ll cost you just the same as using Wise directly, and there’s no hidden mark-up, like you may find with other providers.

Download the Monzo app on Android and iOS - find it in Google Play and the App Store.

Source: https://apps.apple.com/gb/app/monzo-bank/id1052238659

Everyone’s heard of PayPal, and a lot of us may use it frequently. It’s everywhere, and used for many online payments across the web. PayPal money transfer is relatively quick and easy.

You can use it to quickly and easily complete online money transfers overseas, through the PayPal app, or simply by logging into your PayPal account. Currency conversion is done at the exchange rate that PayPal set, so you’re probably not getting the mid-market exchange rate.¹ You can also send money with just your recipient’s email address - as long as they have a PayPal account.² You and your recipient will need to have a PayPal account in order to send and receive money. The app is free to download from the App Store and Google Play.

Source: https://apps.apple.com/gb/app/paypal/id283646709

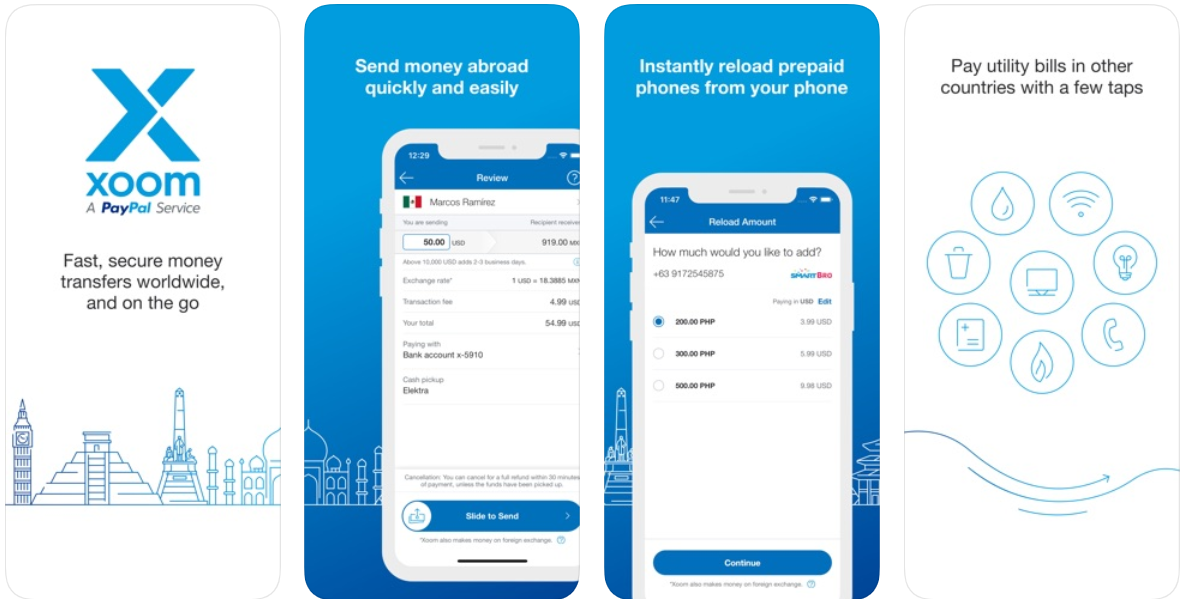

Xoom is an international money transfer provider, enabling you to send money to more than 130 countries.

|

|---|

Xoom is a fast, secure, PayPal-backed way to do international transfers. It means you’ll benefit from PayPal-level security features, and can use a PayPal linked bank account or card, but unfortunately not your PayPal balance. They’ll charge a transaction fee for all payments, but the amount is only disclosed just before you make a transaction. Xoom sometimes charges a mark-up on the mid-market ‘real’ exchange rate – dependent on where you’re sending the money from and to.⁴ The Xoom app is available from the App Store and Google Play, for iOS and Android devices.

Source: https://apps.apple.com/gb/app/xoom-money-transfer/id529615515

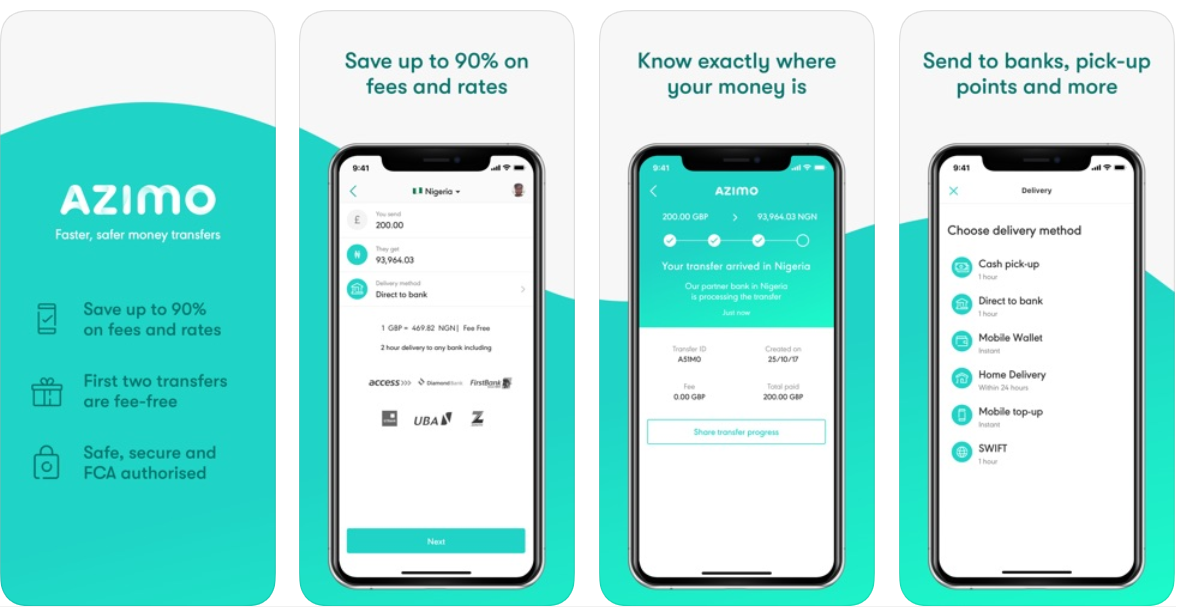

Azimo is an international money transfer service allowing you to send money to over 60 currencies. The Azimo app is secure and easy to use, and money is transferred quickly.

|

|---|

Azimo offers pretty low fees, a great introductory offer and is popular with customers, with over 1 million users. However, you may not get the the mid-market exchange rate with Azimo - but they’ll provide you with an indication of the rate before they process your transfer.⁶ Azimo’s app, free to download from the App Store or Google Play.

Source: https://apps.apple.com/gb/app/azimo-money-transfer/id543921619

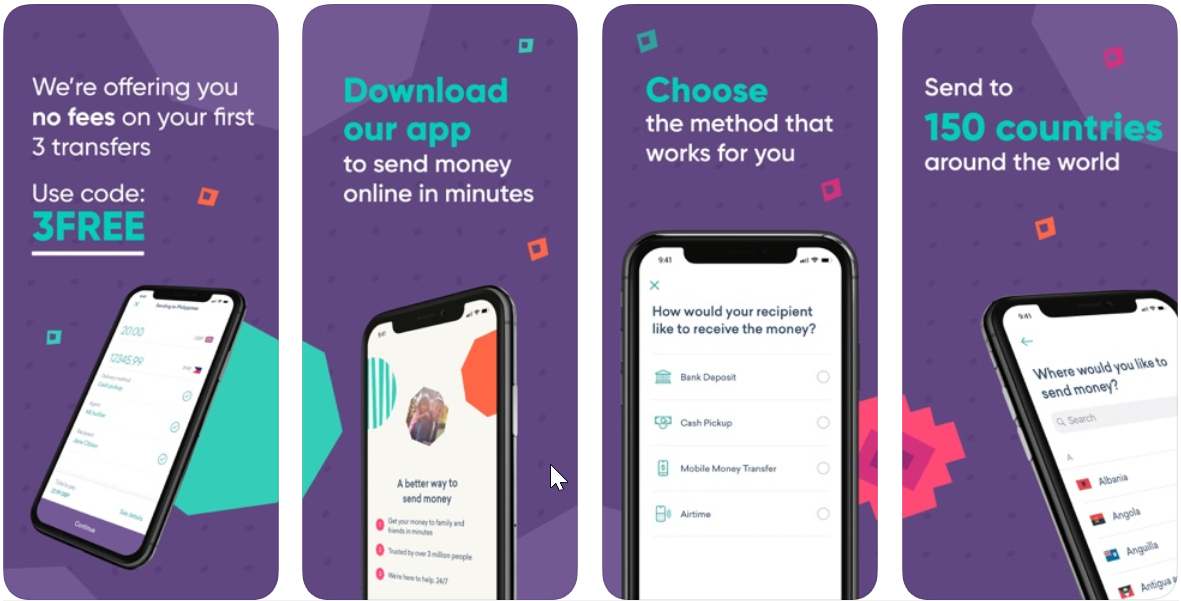

WorldRemit offers a fast, simple and secure way to transfer money overseas. You can send to 150 countries worldwide, tracking your transfer at every stage.

|

|---|

It’s great for sending small amounts to friends and family, with no transfer minimums and lots of ways to receive the money – from airtime top-ups to mobile wallets. WorldRemit add a mark-up to the exchange rate, so you likely won’t get the mid-market rate.⁷ Their app uses industry-leading technology to protect your money, so you can expect very high standards of security and service.⁸ The app is available to download at the App Store and Google Play.

Source: https://apps.apple.com/gb/app/worldremit-money-transfer/id875855935

Skrill is a low-cost money transfer specialist that has specialised in digital payments since 2001. It offers fast, cheap and secure payments through the Skrill app to 45 countries.

|

|---|

While Skrill is undoubtedly a cheap, fast way to send money, the app may be limited by the relatively small number of countries you can send to. For example, you can’t use it to send money to a US bank account, which may be a disappointment for some potential users. You can still send to Skrill Wallets, but this requires both users to have an account with Skrill. Skrill uses leading risk and anti-fraud technology, so your money is protected.⁹ You can download the app from Google Play or the App Store.

Source: https://apps.apple.com/gb/app/skrill-transfer-money/id718248239

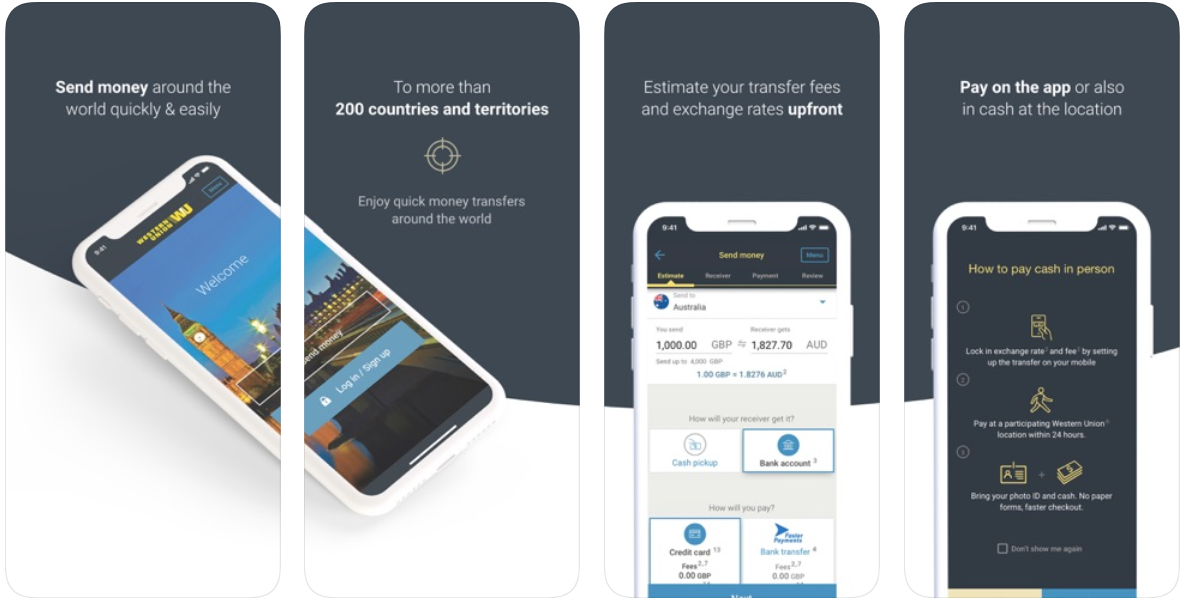

Western Union is a specialist in money transfers, and they now have a handy app you can use to send money overseas. You can send money to over 200 countries and territories worldwide as part of a straightforward, user-friendly transfer process. You can check dedicated websites to help you find a Western Union branch in UK.

|

|---|

You can send up-to £799.99 from the UK - if you want to send more than this then you’ll need to verify your identity with an ID. Once verified you can send up-to £50,000 per transfer, depending on the destination country. (bank-to-bank transfer only).¹⁰ Western Union may not offer the mid-market exchange rate when money is converted - which can increase the cost of a transfer.¹¹ However, the Western Union network of countries is vast, and you can rely on the quality of service. The app is available to download for free from Google Play and the App Store.

Source: https://apps.apple.com/gb/app/western-union-money-transfer/id1045347175

Send money direct to your recipient’s bank account with MoneyGram, with over 400 banking partners around the world.

|

|---|

MoneyGram offers convenient ways to send and receive money to over 200 countries. All of their products are designed with the customer in mind, to provide reliable and fast ways to transfer money to ‘family, friends and loved ones around the world’. You can send up to £7,600.00 per online transfer to most countries, and up to £7,600.00¹² every 30 calendar days.¹³ You can download the app for both iOS and Android.

Source: https://apps.apple.com/gb/app/moneygram-international/id1085720801

Starling Bank is an app-based bank that provides an alternative to traditional banking options. They offer a wide range of products for personal and business customers.

|

|---|

It's easy to transfer money abroad - as it can all be completed within the app in minutes. They also offer competitive fees, but it's always best to research the exact fees for your payment as they can differ depending on the target currency. However, when sending money internationally they'll charge you around 0.4% transaction fee. You can also send money via the SWIFT network for a £5.50 flat fee.¹⁴

Source: https://apps.apple.com/gb/app/starling-bank-mobile-banking/id956806430

For most people, cost will always be the big deciding factor when choosing international money transfer services. There are two key things to look at – the transfer fee and the exchange rate.

Remember that the mark-up on the mid-market exchange rate may bump up the cost just as much as a transfer fee or even more. For comparisons, you can always find the real exchange rate on sources such as Google, XE and Yahoo Finance.

Speed can sometimes be just as important as price, and you should always know exactly where your money is and when it will arrive. Sometimes, you just need to send money as quickly as possible. If it’s urgent, look for a provider which offers same-day or next-day delivery.

The beauty of money transfer apps is that they’re so blissfully convenient. You can use them on the move, sending money across the world in just a few taps. And unlike old-fashioned international money orders which can take weeks or even months, your recipient will have their money in just a couple of days.

When shopping around for the best money transfer apps, look for how easy they are to sign up for and use. Some providers make it simple to send money with money-to-email options, allowing you to send money direct to recipient's bank accounts, without them having to sign-up to the transfer service.

What happens if something goes wrong with your transfer? You need a support team you can contact right away. Look for providers that are known and well-reviewed for their fast, helpful customer support team.

Sending money overseas is easier and cheaper than ever, especially with a handy app installed on your phone. Money transfer apps offer convenience – the ability to whizz money across to another country at a single tap. However, when choosing an app, you also need to consider cost, plus other important factors such as speed. Take the time to research which provider is best for you, and remember to always double check fees and costs before tapping ‘send’.

*This is the fee for sending a cross border personal payment. Fees apply for users with registered address in the UK, Jersey, Guernsey, Isle of Man, or Gibraltar. For full fees, see the PayPal website.

**Wise is not affiliated with providers listed. This article is intended as an overview, not a comparison. Order of providers listed does not denote importance or ranking. Article does not state which provider is best.

Sources used:

Sources checked: 28-October 2019.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Read our helpful guide to account-to-account (A2A) payments, including how they work, how long they take and the benefits.

Want to transfer a balance between credit cards? Read our guide on Aqua balance transfers, including fees and how long it takes.

Read our guide to learn how to withdraw money from a FairFX card and understand the related fees.

How long does an international transfer with Revolut take? Find out average Revolut transfer times for sending money outside the UK here in our handy guide.

Is Revolut safe to use in the UK? Find out in this helpful guide, covering Revolut security measures, regulation and more.

Check out our helpful guide to Starling Bank large payments, including transfer times, limits and how to set up your first payment.