5 Ways to Stand Out and Boost Black Friday Sales

Black Friday is the day after Thanksgiving, falling on Friday 29th November in 2024. It’s known for being a perfect time for snagging a bargain, opening the...

International trade is a crucial part of commerce and trade. However, there are several things that you need to keep in mind when it comes to importing into the UK.

In this article, we’ll look at the things you need to keep in mind when importing into the UK from within the EU and outside the EU. We’ll also take a look at how to save money when making international payments to suppliers with Wise Business.

When importing from the EU into the UK, there are several things to keep in mind. You should also note that Brexit is changing the way and procedures of importing goods into the UK from the EU.¹

Here are the major things that you need to be aware of:

Importing Businesses have to get an EORI Number: The Economic Operator Registration and Identification (EORI) Number is a must-have for businesses that want to continue importing goods into the UK after 1 January 2021. This 12-digit EORI will start with GB and will allow easy movement of goods into the UK from within the EU. You find out the documents needed to apply for an EORI Number here.

You must make import declarations: To import any goods into the UK, import declaration of the goods must be made. You can make import declarations by yourself or use a third-party agent. Freight forwarders, brokers/custom agents, and fast parcel operators are some agents that handle import declarations for you.

Check the tax and duty rates to be paid: For every goods imported, you’ll have to pay VAT and custom duties. In the event of a no-deal exit by the UK, the custom duty tariffs for imports from the EU, and the rest of the world will be changed. According to reports, temporary rates will be applicable for about 12 months before a more permanent regime is introduced by the government. Use our import duty calculator to calculate the expected duty that might accure when bringing goods into the UK.

Get the appropriate license for the goods to be imported: Depending on the kinds of goods that are being moved into the UK, a special certificate or license might be required. You might even need to pay an inspection fee. You can check if you’ll need a license for your goods here.

If you are importing goods into the UK from outside the EU, here are a few things that you need to keep in mind.²

Register your business for importing: To start importing goods from outside the EU, your business needs to be registered. You’ll need to get an EORI number and also register for VAT.

Decide how you’ll make customs declarations and transport the goods: To import goods from outside the EU to the UK, you need to make customs declarations and set up a system of transportation. You can do that by yourself, or hire a third party to take care of that for you. Customs agents, freight forwarders, and brokers can help with declaring your goods at customs.

Find out which class your goods fall under: The class that your goods fall under will tell the rate of duty that you need to pay, and if you need an import license. Your courier or customs broker can easily help with this. You can find out the right commodity code for your goods here

If you want to start importing into the UK, these are the list of things that you need.

For restricted goods, you might need to get an import license.

It might look overwhelming, but to import into the UK, you just need to pay attention to the things that we've listed above.

Another thing that you should pay attention to is paying for the goods themselves. If you use a regular bank transfer to pay your overseas suppliers, you'll incur some extra fees. In addition, your bank might not give you the best exchange rate.

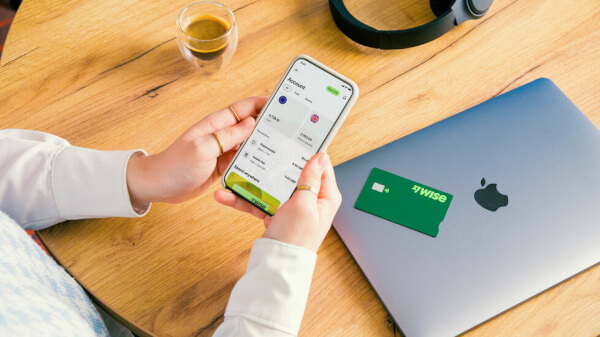

These extra fees are frustrating – but can be avoided with a little research. Other service providers, especially Wise Business , turn out to be cheaper than UK high street banks.

When you make an international payment via Wise, you will get the real, mid-market exchange rate; the one shown on Google – and you will only pay a small upfront fee for the transfer.

Wise is tightly regulated, and with over 3 million customers and growing, you can be sure that their service is excellent.

Additional benefits are:

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Black Friday is the day after Thanksgiving, falling on Friday 29th November in 2024. It’s known for being a perfect time for snagging a bargain, opening the...

December kicks off the end of year shopping period, with huge uplifts in on and offline sales as people grab a bargain and get ready for the holiday season....

The term "turnover" is used often in the world of business, but its implications vary significantly depending on the context. At its core, turnover is a...

Wise is a financial technology company focused on global money transfers that offers two different types of accounts: a personal account and a business...

In today's fast-evolving digital landscape, e-commerce is quickly transforming the ways consumers shop and how businesses operate worldwide. DHL’s E-Commerce...

In an increasingly interconnected global economy, small businesses in the United Kingdom (UK) have more opportunities than ever to expand through import and...