Austria corporate tax - guide for international expansion

Learn about the corporate tax system in Austria, its current rates, how to pay your dues and stay compliant, and best practices.

If you’re the director of a limited company, one of the most important things to know is how to pay yourself. There are a few different ways you can withdraw money from a private limited company, and we’ll run through each of them here.

Unfortunately, no option is completely paperwork-free, but hopefully our guide will make it easier to choose the best option for your business and your personal circumstances. So, let’s get started.

There are four main ways you can take money out of a limited company. These are:

Let’s take a look at each in turn:

| 🌎💸 Easily move and manage your money in up to 54 currencies - Find out how with Wise for Business! |

|---|

This is one of the most straightforward ways to pay yourself - or someone else - from a limited company. It’s a simple bank transfer from the company account to a personal one, just like paying an employee.

One of the main advantages of this for smaller companies is that you can potentially draw a salary up to the personal allowance threshold, which means you won’t need to pay income tax.

| 💡 However, before you can pay yourself a salary, you’ll need to make sure the business is first registered as an employer with HM Revenue & Customs (HMRC)². National Insurance and Income Tax contributions (for both the employer and the employee) must also be taken from salary payments and paid to HMRC. And you’ll need to make monthly submissions to HMRC, just like running a payroll. |

|---|

If you incur a cost for something that is exclusively and legitimately for company use, you may be able to claim it as a business expense. For example, equipment, business mileage or insurance.

When you claim for a business expense, you will be personally reimbursed for the cost by the company. The business can also receive tax relief for the expense.

Dividends are considered to be a more tax-efficient way of withdrawing money from a private limited company.

Here’s how they work. The company must pay a percentage of profits in corporation tax, but whatever is left can potentially be paid to company directors and shareholders as dividends. These payments are calculated based on the proportion of shares in the company owned by the director or shareholder.

Your company can only pay dividends when it has made a profit, and it can’t pay out more in dividends than available profits.

Dividends can be issued by a limited company at the end of the financial year, or at various points throughout the year. More frequent dividend payments can be useful when directors are depending on dividends for their income.

Dividends and payment dates must be officially agreed and ‘declared’ at company board meetings. Paperwork in the form of dividend vouchers must be completed, with each recipient receiving a copy².

It's also important to keep in mind the tax implications of dividends especially of those issued from a foreign country.

It’s possible for a director to borrow money from their limited company, as part of what is known as a director’s loan.

You must keep records of any director’s loans³, and the money must be paid back to the business in full within nine months of the end of the financial year¹. If you miss this deadline, you may have to pay an additional tax charge.You may also have extra tax responsibilities if the loan is for over £10,000³.

Here are just a few of the things to remember before withdrawing money from your limited company using one of the methods above:

Limited companies are legal entities in their own right, and all assets belong to the company¹ - not to the director. This means you’ll need to carefully account for all money belonging to the business, making sure to follow the required processes, complete all the necessary paperwork and meet your tax responsibilities.

It could be worth consulting a specialist accountant to find out which is the most tax efficient way to pay yourself from a limited company.

If your company is international or you have directors living or working in other countries, you’ll need to find the best way to pay them across international borders - whether it’s a salary, dividends or directors' loans. , there’s the risk of losing money to poor currency conversion fees and unfavourable exchange rates using traditional methods like banks.

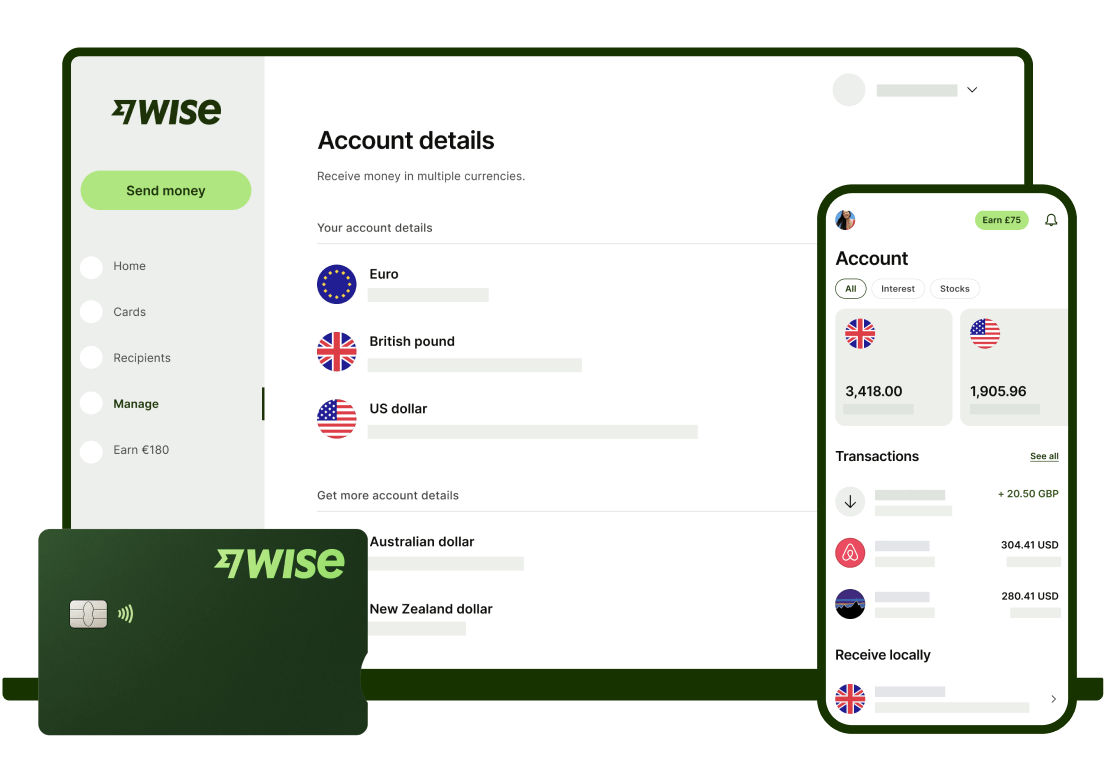

Luckily, there’s a more cost-effective solution out there. Wise for Business can save you money on international transactions. With Wise you can receive cross currency payments like a local and make conversion at the mid-market rate at all times.

Wise is known for low and transparent fees. This means you and your fellow directors will receive exactly what you convert, with no expensive mark-up added on top.

Final thoughts

So, there you have it - the four ways you can withdraw money from a private limited company as a director (or shareholder).

We’ve covered each method and any essential details you need to know, but remember that it can often pay to consult an accountant or financial advisor specialising in limited companies.

There are often tax or other implications to consider when withdrawing money from a limited company. So, it’s a good idea to do your homework and get all the information before going ahead.

Sources used for this article:

Sources checked on 29-Sep-2021.

Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn about the corporate tax system in Austria, its current rates, how to pay your dues and stay compliant, and best practices.

Learn about the corporate tax system in Botswana, its current rates, how to pay your dues and stay compliant, and best practices.

Learn about the corporate tax system in Chile, its current rates, how to pay your dues and stay compliant, and best practices.

Understand the essentials of terms sheets in business. Learn the key components to help you negotiate your next deal.

Learn about the corporate tax system in Montenegro, its current rates, how to pay your dues and stay compliant, and best practices.

Learn about the corporate tax system in Monaco, its current rates, how to pay your dues and stay compliant, and best practices