Asia-Pacific players embrace partnership to win customer share in cross-border payments

Many banks are taking the first steps toward delivering exceptional customer experiences by using next-generation correspondent service providers.

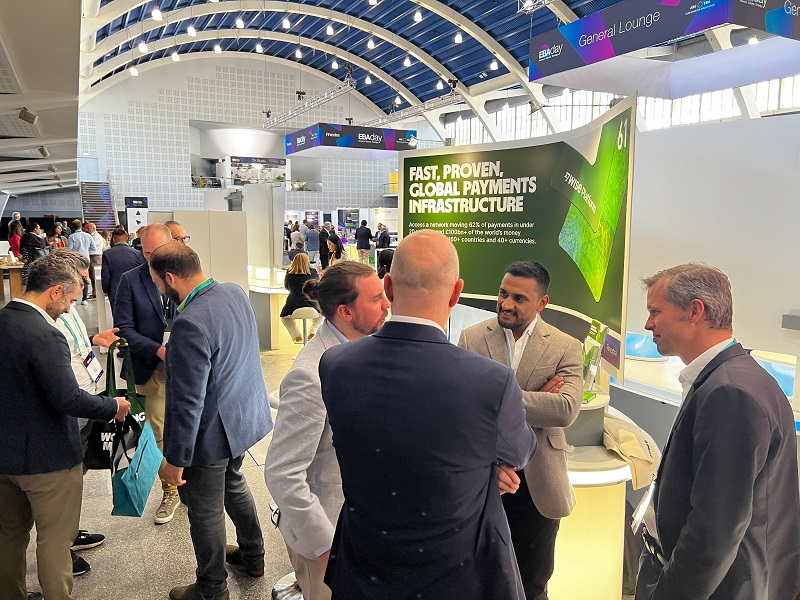

At EBAday 2024, the Wise Platform team had a strong presence and gained invaluable insights on the evolving cross-border payments landscape, including the increasing prevalence of bank-fintech collaborations and the evolving correspondent banking ecosystem.

Two weeks ago, the Wise Platform team arrived in Lisbon for the annual EBAday conference hosted by Finextra and the European Banking Association. Each year, this industry-leading event brings together key banks and financial institutions from Europe and beyond to discuss the critical issues senior banking executives are facing, from cross-border payments to treasury and liquidity management.

Year-on-year the Wise Platform team attend EBAday to meet with, and hear from, senior cross-border payments leaders from around the globe.

Attending the conference provided the Wise Platform team with an opportunity to hear more about the key challenges banks face and to meet with clients and prospects from around the world. Drawing from our experience at the event, here are our two key takeaways around the future of cross-border payments, focussing on bank-fintech collaborations and the correspondent banking ecosystem.

Kicking off the event, Finextra's Head of Research Gary Wright and Wise Platform's Head of UK & Europe Partnerships, Roisin Levine, led a lively roundtable on ‘How financial institutions can offer retail customers the next generation of instant cross-border payments.’

During this session, top-tier bank representatives shared feedback on their efforts to modernise international payments for retail and small-mid sized business (SMB) customers, identifying the lack of centralised governance as a key obstacle to building a cohesive global payments infrastructure. They added that this stemmed from an absence of unity among countries, governments and financial ecosystems.

Find out more about Wise Platform

Participants also acknowledged the growing challenge of balancing operational efficiency, consumer behaviour and cost control. Compounding this, they added that many banks struggle with legacy systems that demand costly upgrades. In response, the discussion highlighted banks' increased focus on fostering trust through collaborative partnerships.

Recognising the evolving needs of their customers, participants concluded that banks are increasingly partnering with fintechs to modernise their cross-border payment services with demonstrably positive results. Wise Platform, for example, has forged partnerships with more than 85 banks and enterprises across the world, offering trusted and reliable global payments infrastructure solutions that can be easily integrated without requiring any costly technical overhauls.

Levine returned to the stage the following day to discuss the current state and evolution of correspondent banking relationships. During this keynote panel, it was revealed that the number of active correspondents dropped by a staggering 34% in Europe between 2011 and 2022, underscoring an ongoing trend among financial institutions to consolidate their routes, cut costs and create efficiencies.

Wise Platform's Roisin Levine discusses how correspondent services can enhance access to global currencies and improve cross-border payments whilst driving financial inclusion.

Levine, joined by industry experts from Deutsche Bank, CaixaBank and Celent, emphasised that by collaborating with the next generation of correspondent service providers, like Wise, banks can enhance customer access to global currencies, improve cross-border payments and promote financial inclusion.

Levine also shared how Wise Platform’s Correspondent Services offering empowers banks to enhance their traditional banking relationships. Today, banks can simply route SWIFT messages through Wise Platform just as they would with any other correspondent banking partner. Our partners gain access to Wise’s powerful infrastructure, connecting directly to local payment systems, and working with 90+ banking and payment partners around the world to enable cross-border payments in 40+ currencies across 160+ countries.

The panel concluded that while correspondent banking partnerships are consolidating, incorporating regulated disruptors can complement existing relationships and help banks distribute risk.

The insightful debates, panels and client meetings at EBADay 2024 in Lisbon provided our team with valuable insights into the challenges banks face in modernising cross-border payments.

The correspondent banking ecosystem is undergoing a significant transformation, and the next generation of tech-driven providers will play a crucial role in shaping its future. We’re looking forward to seeing what’s ahead and EBADay 2025 in Paris!

Find out more about Wise Platform

1.Some currencies may not apply. For a full list, please visit wise.com to find out more.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Many banks are taking the first steps toward delivering exceptional customer experiences by using next-generation correspondent service providers.

Triin Teppo, Wise's Head of Global Products Operations, examines the importance of straight-through processing for improving the customer experience.

Problem Getting paid on time and the right amount has long been the biggest downside of flexible work for freelancers or contractors. Often it is the...

Deel is a leading global HR and payroll company enabling more than 15,000 companies, spanning from SMBs to large enterprises, to scale their teams around the...

Problem Sending money abroad can still be complex, expensive, and slow. For too long, Swiss customers have had few choices about how to send their money...

Discover how leading SME financial service provider Qonto partnered with Wise Platform to double the adoption of its international transfers feature.