Q4 2024 Mission Update: Speed

At Wise, we’re committed to giving you the best experience when sending money across borders. That’s why we’re always working to make your transfers instant....

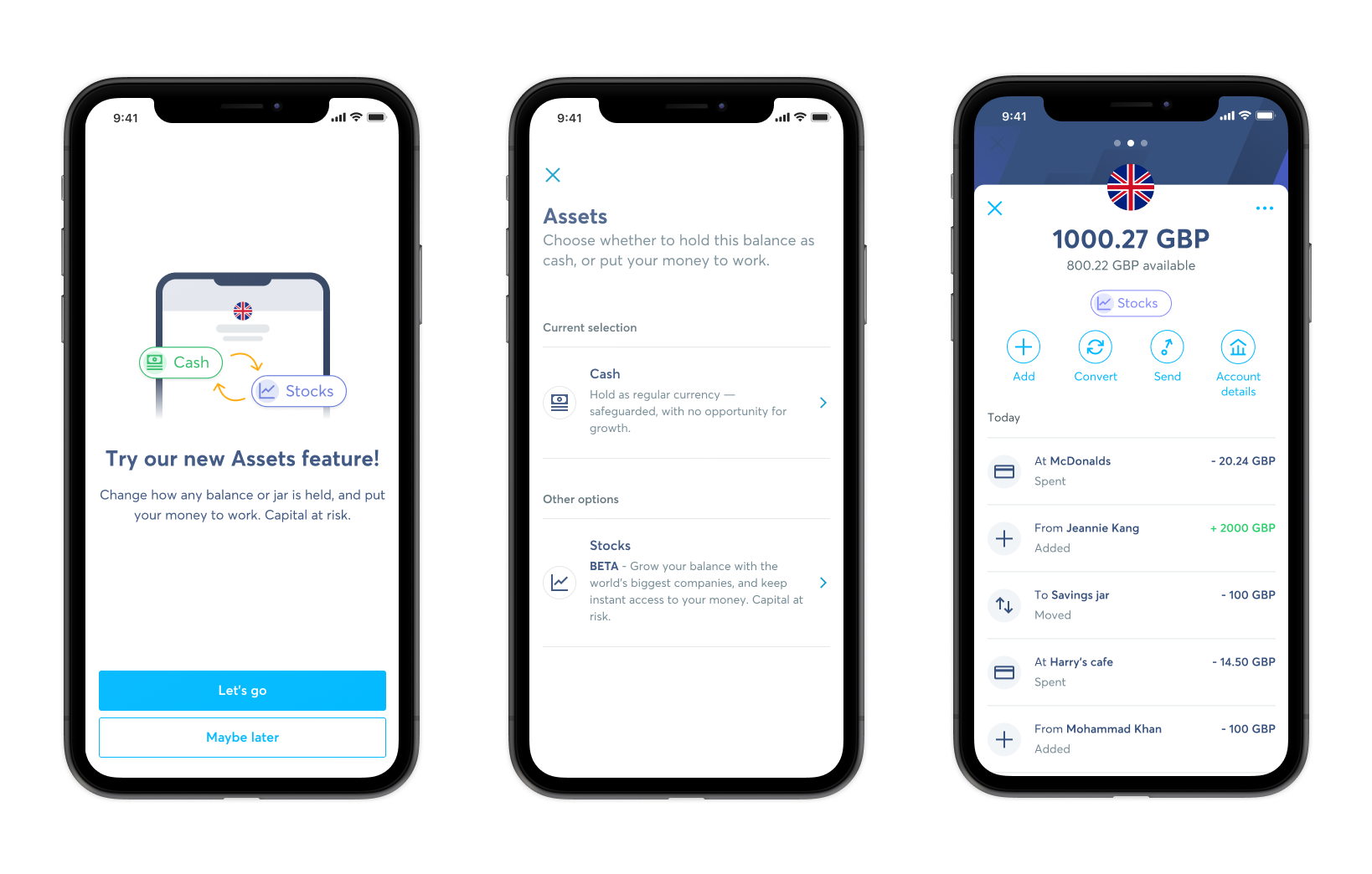

On August 22nd 2021 we silently launched Assets for our UK customers — with many of you spotting it in our app. We’re super excited about this new journey, but we wanted to get things right. Which is why we started with a beta.

Working back from what our customers actually need, we wanted to build something different from a traditional savings account or investments platform. So meet Assets — international money that you can hold in different asset classes, while being able to spend and send as normal.

The first new asset you can choose is called ‘stocks’. It’s not a stock trading platform, but a place to hold your money in the global stock market — all in just a few taps.

More on that later. First, let’s go back to how Assets links to our mission.

(Or get started now and finish reading this another time.)

The money in your bank account is already working, just not for you. Banks invest the money you hold with them to make profit for themselves. They use it to fund mortgages, business loans and credit cards for other customers — you’re supporting their business for free, and we don’t think that’s fair.

So as more and more customers hold money in Wise, it became more and more important to us to build something that allows this money the potential for growth. And we wanted customers to stay in control of how their money is held — with transparency over how it’s being used. On top of this, we wanted customers to have total flexibility to keep using their money like normal.

Our first new asset is called stocks because it’s all about equity. It represents the value of the world’s biggest companies by tracking the MSCI World Index made up of 1,500 global companies including Apple, Google, and Tesla.

We’ve made it possible to integrate the multi-currency account with an MSCI index-tracking fund managed by Blackrock, so all the currencies Wise supports can be held as stocks.

Traditional investing platforms don’t usually allow you easy access to your money. But money that’s held as stocks with Wise can be instantly accessed — so you can spend and send money as normal.

To get really specific, up to 97% of your money will be available instantly 24/7, year-around. We hold back 3% to cover any big market fluctuations, to avoid you having a negative balance.

For now, only UK customers can use Assets.

You can get started with as little as 1 GBP — and there’s no minimum holding period. So you can give Assets a try and if it’s not for you, switch back to cash at any time.

The fund we’ve chosen has an average annual growth rate of 13.07% since 2012, measured in Euros. But like all investments, your capital is at risk, and values do go up and down over time — so growth isn’t guaranteed.

Money held in Assets will be protected by the Financial Services Compensation Scheme (FSCS) up to £85,000.

To get started you can follow this link to log into your account.

Or, open your app or log into your account and tap the ‘cash’ icon on any of your balances or jars. You’ll get the option to switch from cash to stocks.

There will be two charges:

The fund management fee is 0.15% annually, accrued daily on money you hold as stocks (0.00041% daily).

The Wise service fee is 0.40% annually, also accrued daily (0.0015% daily), and will be debited monthly from the balance or jar you hold as stocks.

Mission zero is at the core of our Assets team. So we look forward to bringing you price drops soon.

This is just the beginning for Assets. We’ll be working towards releasing it for business customers, and into other markets. We also hope to add more ways to hold your money — as well as in cash or stocks. So customer feedback is essential, and we look forward to hearing your thoughts

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

At Wise, we’re committed to giving you the best experience when sending money across borders. That’s why we’re always working to make your transfers instant....

This blog post is to update our customers about changes in price and is not a marketing communication. Our mission is to lower the cost of moving money across...

We have some excellent news to share: we’ve received our second licence from the Central Bank of Brazil, this time as a payment institution. Until now, we...

This blog post is to update our customers about changes in price and is not a marketing communication. We regularly review our fees to reflect the real cost...

Our mission is to lower the cost of moving money across borders. We’ve made progress over the last 13 years, bringing our average fee to 0.64% globally. As we...

We have been changing our fees on Wise over the last months. Some of you benefited as a lot of routes got cheaper, but you would have seen an increase in some...