Welcome to our half year results blog post where we are excited to go through our mission and financial highlights for the six months ended 30 September 2022.

Kristo Käärmann, our CEO and co-founder, said: “Our goal today remains the same as 11 years ago when we started 一 to make moving and managing money faster, easier, cheaper and more transparent for people and businesses around the world.

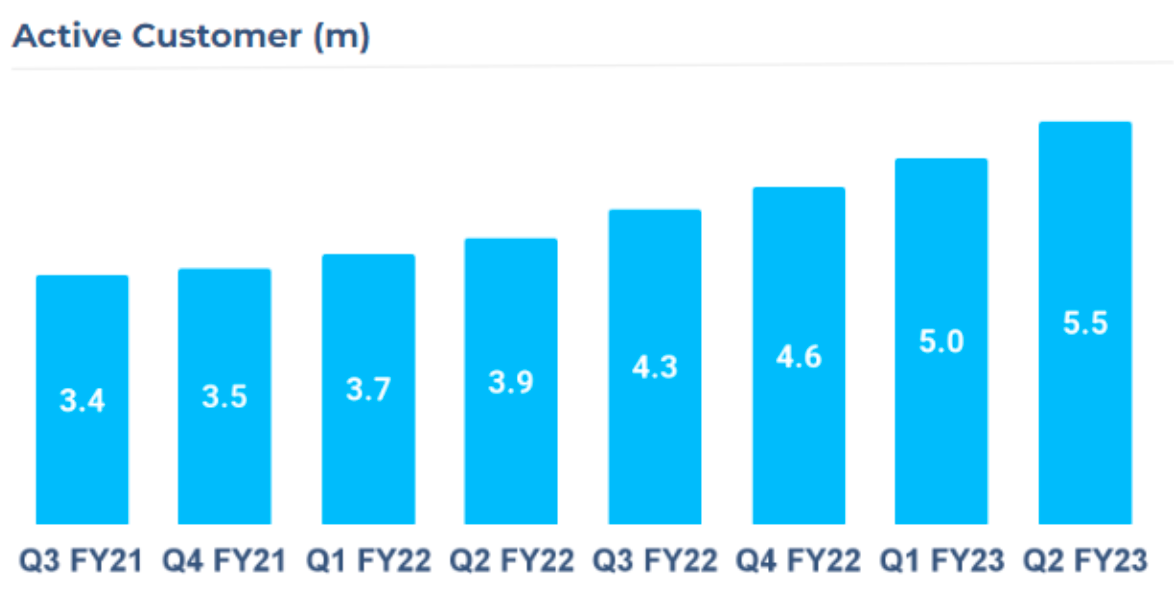

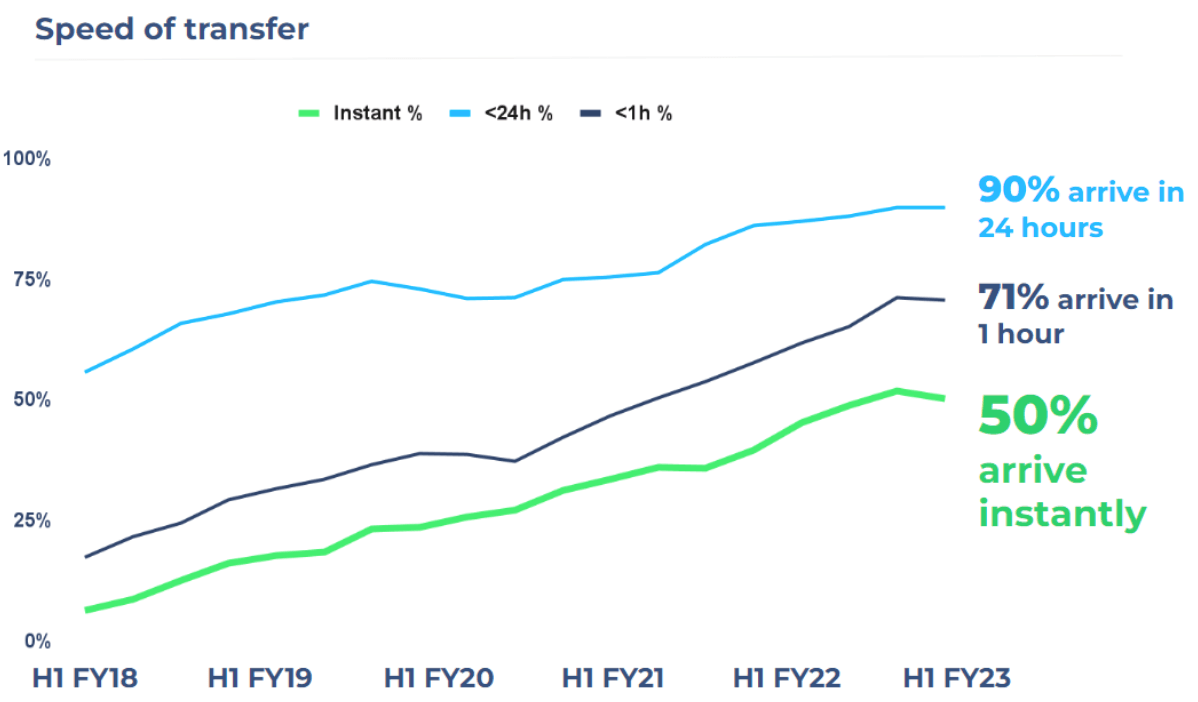

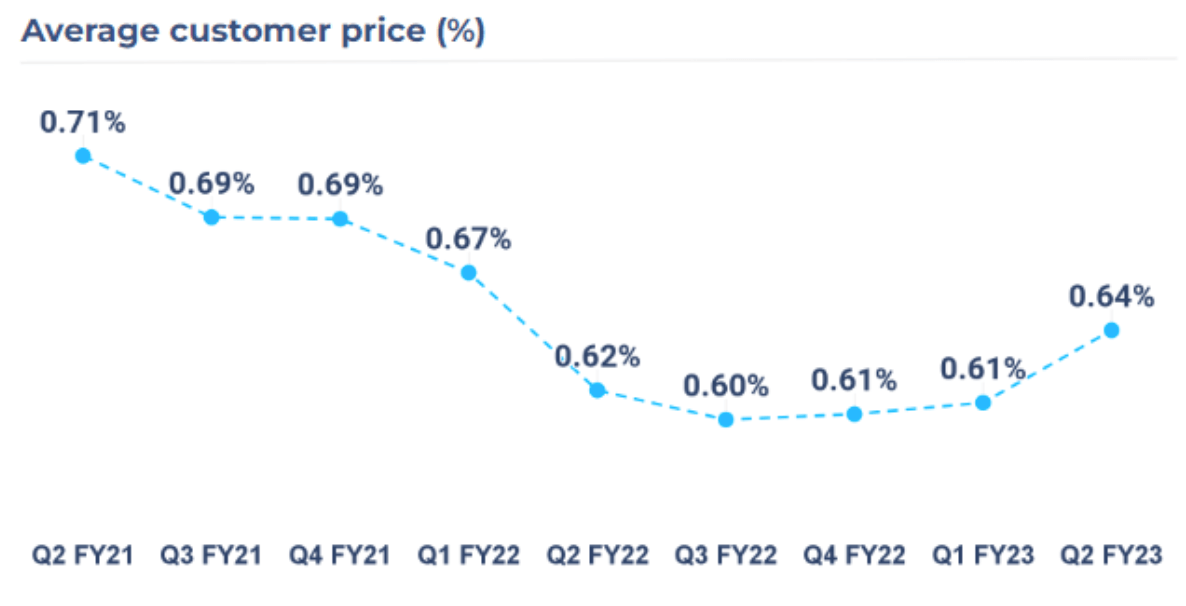

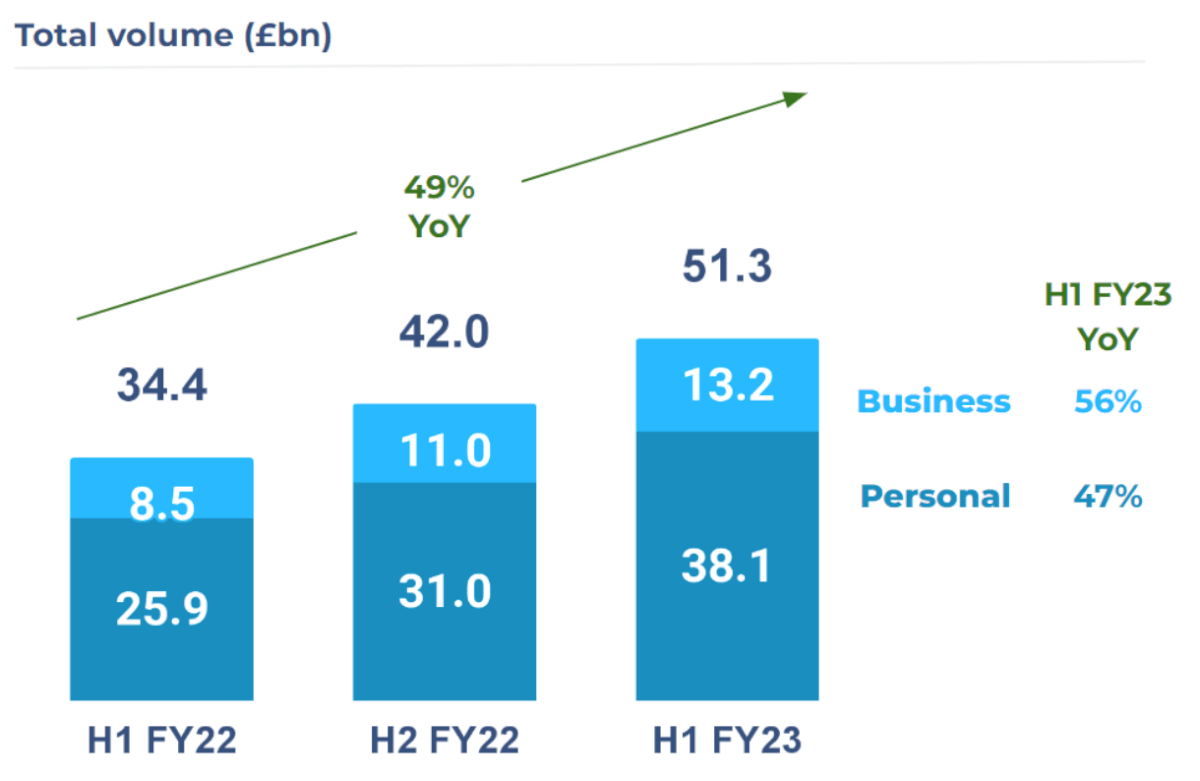

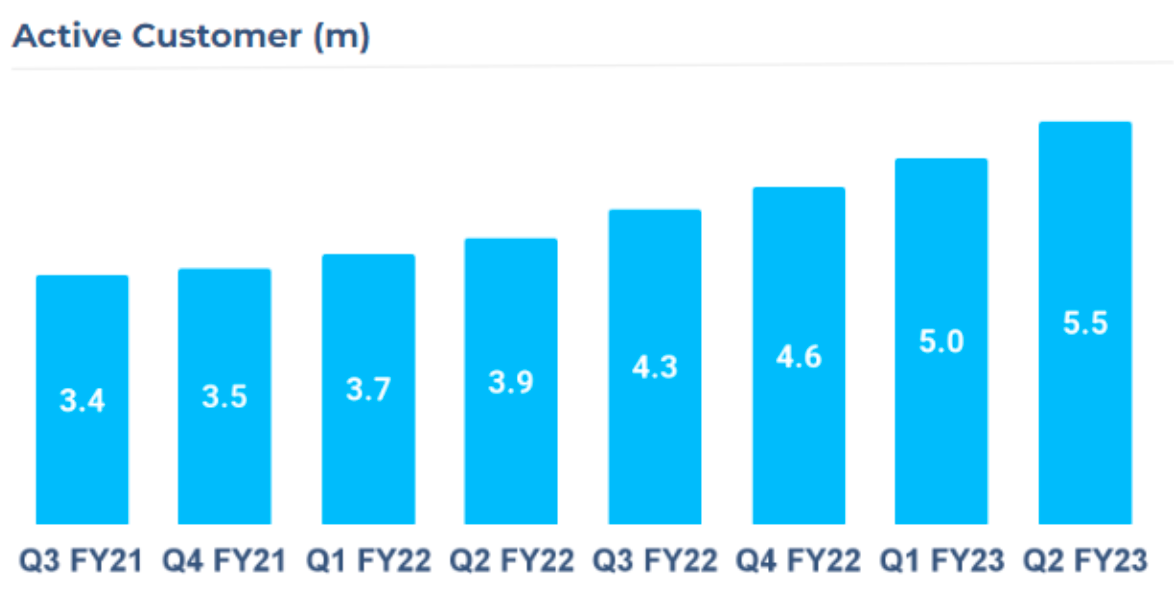

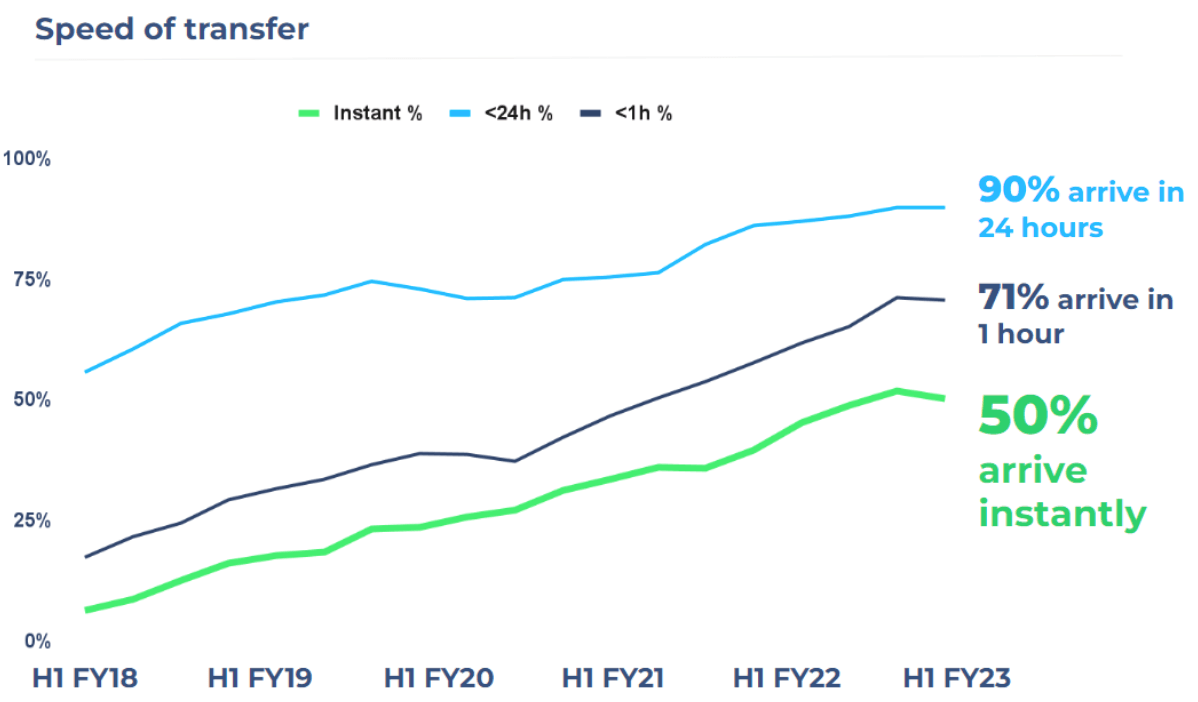

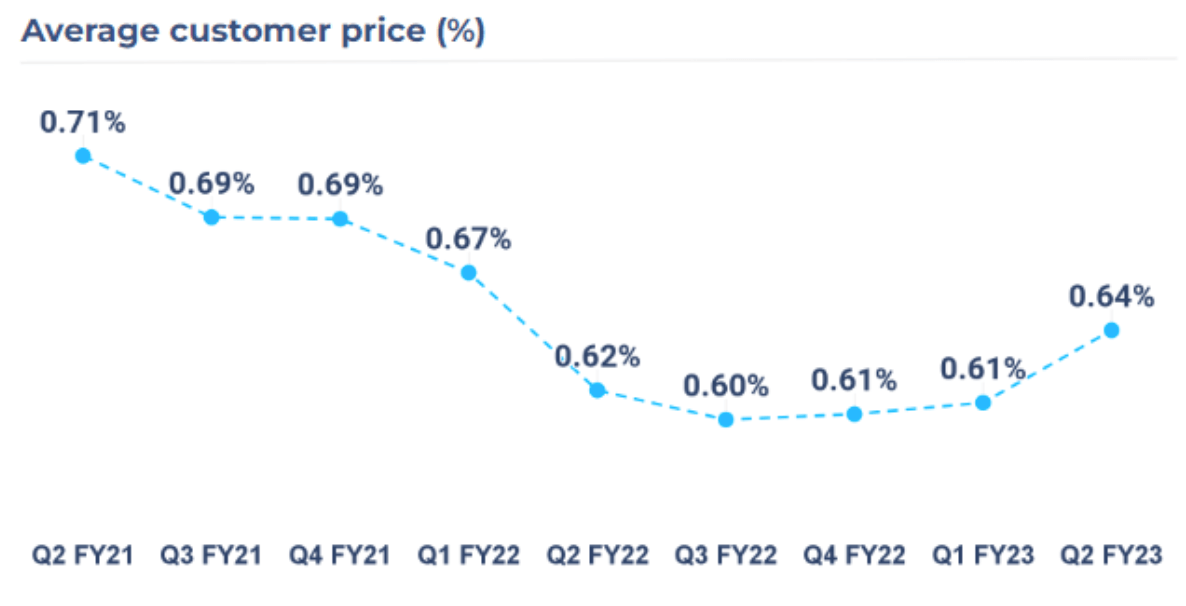

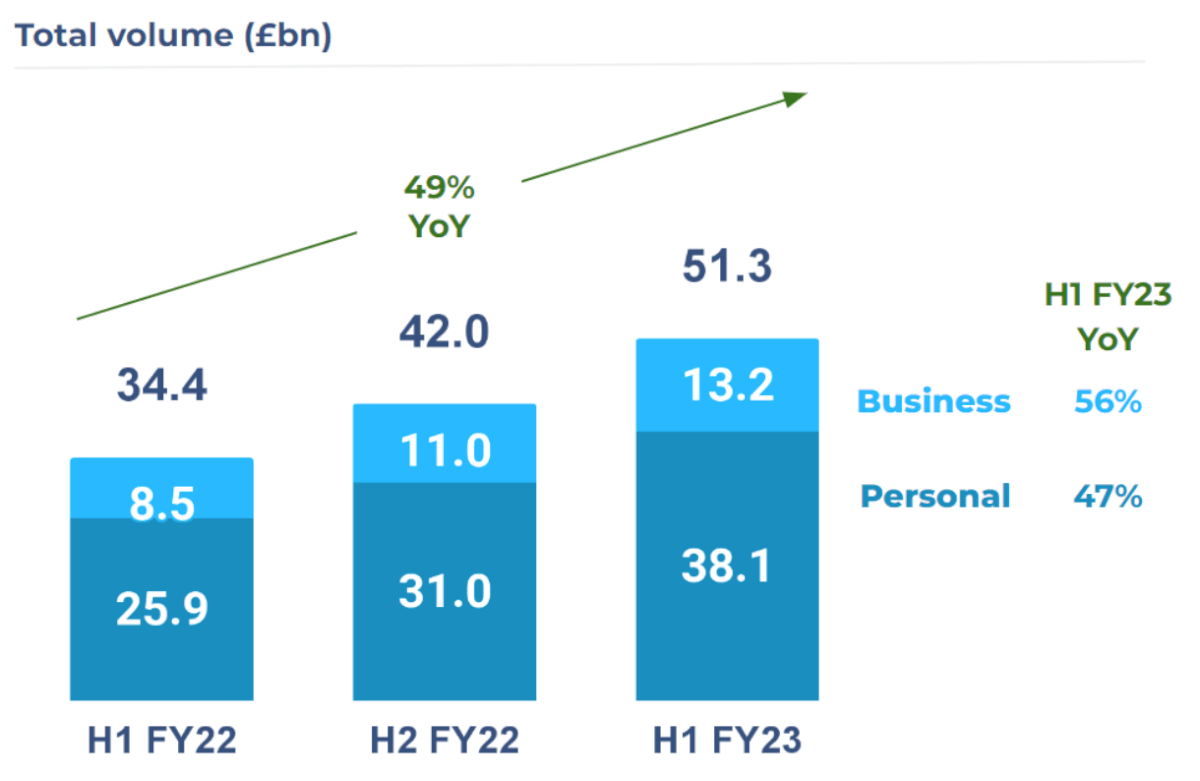

In the first half of this financial year, we got faster, hitting a key milestone with 50 percent of all transfers now instant; completed within 20 seconds. During the period we had to raise prices on some routes but we were also able to decrease fees on others. As a result, our global average fee today is 0.64% and as such we consistently remain one of the cheapest and fastest options for moving money around the world. Our customers agree: 5.5 million customers trusted us with their money in Q2 alone, up 40% from last year. In total, we have helped move £51.3 billion for people and businesses in the past six months, an increase of 49% year over year.

But we are still solving only a fraction of the problem, and the fight for transparency and fairness must continue. In the past months we also joined the European Commission in calling on all providers to commit to full disclosure on all fees, including exchange rate markups, on all transfers to Ukraine - a significant step forward in the right direction for transparency in the industry”

Mission Highlights

Money without borders; enabling everyone to move their money across the world - instantly, transparently, conveniently and eventually for free.

We now have 5.5 million active customers.

5.5m

40% YoY, 10% QoQ

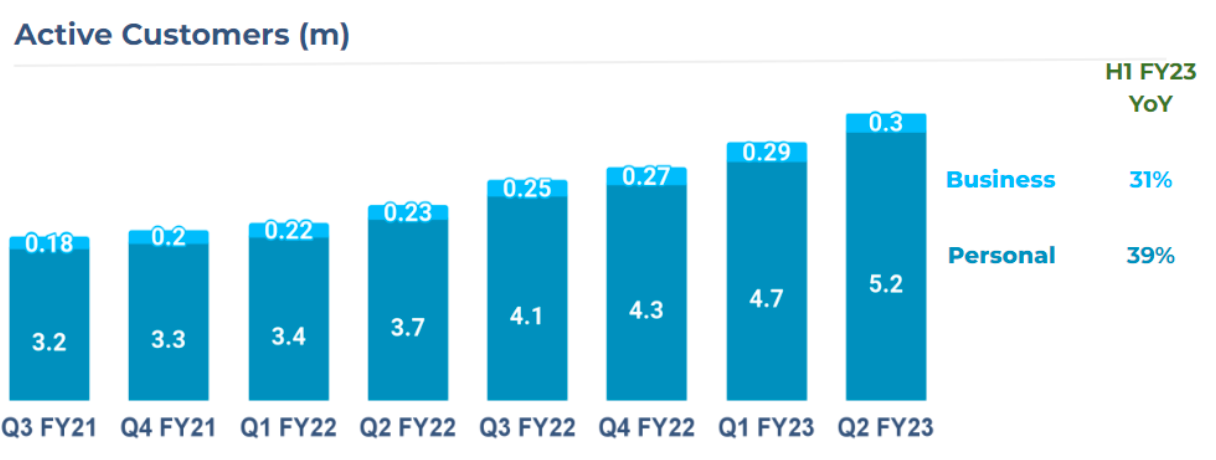

We’re helping more people than ever move and manage their money. We now have 5.5 million active customers and our customers moved more than £51 billion with us in the first six months of FY2023. The growth in active customers and volumes was driven by growth in new customers, two-thirds of which are recommended to us by existing Wise users, and increased adoption of the Wise Account across both new and existing customers. It’s great to know that more people than ever are getting transparent and low prices with us.

We’re excited about the courage policymakers around the world have shown to help make transparent pricing the norm. For example, the European Commission introduced a “mark-up rule” for all transfers to Ukraine, urging providers to disclose all fees, including the exchange rate mark-up. While participation is voluntary for now, this means more providers will price transparently, as we do at Wise, and expensive providers will have their high fees exposed.

We are offering our customers a superior product

Getting verified and set up with a Wise Account is now quicker and easier for more of our personal customers, and we’ve made it easier for them to move money as well. For example, in the US, customers can link their account to over 6,000 finance apps such as Venmo, Truebill and Chime, making pay-ins and pay-outs simpler, whilst having more methods for sending USD. We've also made sending money to China via Alipay easier. And when our customers spend with Wise, they now have a more transparent and detailed transaction history to help track and stay on top of their spending. Customers want security when they use Wise, and we've introduced new features, including unique communication codes and improved scam prevention and scam reporting tools.

We’ve made life more convenient for our business customers too. We’ve re-designed the Business dashboard, making it much easier to find the features that matter most to businesses. In the U.S. we’ve widened the roll-out of digital cards, so now more businesses can offer digital cards to their employees, and with greater in-app employee spending controls and 2-step payment approvals, our business customers can feel more in control of their money. It’s also now easier for businesses to get paid - by sharing new ‘payment request’ links, they can have their customers pay them directly into their Wise account.

Looking forward, we remain focused on rolling out more features to more people around the world. This means not only adding new features and improving convenience, but taking some of the features currently only available in our more established markets and making them available more broadly across the other countries we operate in across the world.

Our products are powered by our infrastructure

We reached a milestone achievement this year, with more than half of all transfers completed instantly; in less than 20 seconds and in Q2 FY23 90% of all transfers were completed within 24 hours. This compares to Q2 FY22 where 39% of all transfers were completed instantly and 86% were completed within 24 hours.

We made a number of improvements in the last six months, and ongoing improvements will continue to help speed up more payments. New partnerships have led to noticeably faster payments in Hong Kong and Chile, and also for payments from Japan where customers can now receive 24/7, instead of just between 9am and 9pm on business days.

The price our customers pay reflects the cost for us to deliver the service, plus a margin that allows us to do this sustainably. When we find ways to lower costs, we pass this through as a price reduction, and conversely when costs increase prices will also increase. In the second quarter, the average price our customers paid was 0.64%, 2 bps higher than the same period last year. This is largely a result of higher FX volatility and servicing costs. We’re pleased that we were able to limit price increases and as a team we are working hard to keep bringing prices down over time. In fact, as we share the benefit of higher interest rates (on the balances that customers hold with us), this should support pricing.

We’re growing at scale whilst remaining profitable and highly cash generative

With a disciplined financial model, we continue to invest and grow at scale whilst remaining profitable and cash generative. As of Q2 FY23, active customers grew by 1.6m to 5.5m from 3.9m in Q2 FY22, resulting in a 50% increase in volumes from £18bn in Q2 FY22 to £27bn in Q2 FY23. At the same time we continue to make significant reinvestment back into Wise including adding 1,418 Wisers to help us on our mission. Our adjusted EBITDA for the six months was ~£92m, a 52% increase on last year. This is equivalent to a 22% margin, consistent with our medium-term guidance. We generated ~£78m of free cash flow in the period, up from £59m last year. You can read more about our financial performance for the six months below.

These results demonstrate that the investments we’ve been making for the longer-term are paying off and also that whilst we’ve come a long way, there is still more to do. We will continue to invest and focus on our four mission pillars: price, speed, convenience and transparency to build the best way for people and businesses to move and manage their money internationally.

Growth and financial highlights

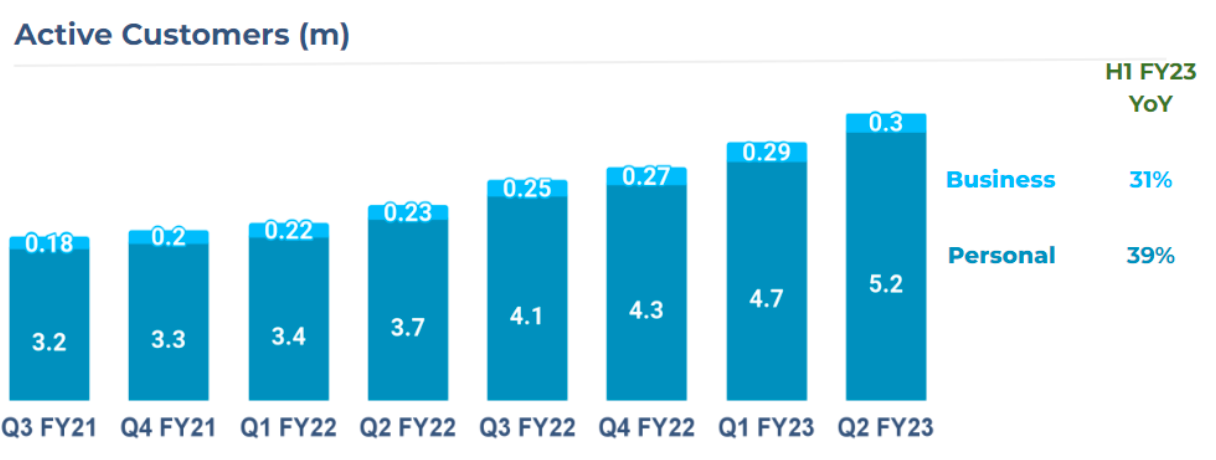

The number of Personal and Business customers continues to drive growth.

In the second quarter of FY23, 5.2m personal customers and 300 thousand business customers used Wise Transfer and Wise Account to move and manage money across borders. This was an increase of 40% in the number of personal customers and 31% in the number of business customers as compared to the same period last year which were 3.7m and 230 thousand respectively.

During the first six months of the year, we processed £51.3bn in cross-border payments (£34.4bn in H1 FY23), a 49% increase as compared to the same period last year. Our personal customer and business customer volumes grew by 47% and 56% to £38.1bn and £13.2bn respectively.

Furthermore, businesses typically send larger volumes compared to personal customers, and, as they represent a growing proportion of the total number of customers. The average volume per customer (personal and business) is gradually increasing and in the second quarter it stood at its highest point to date at £4.9k.

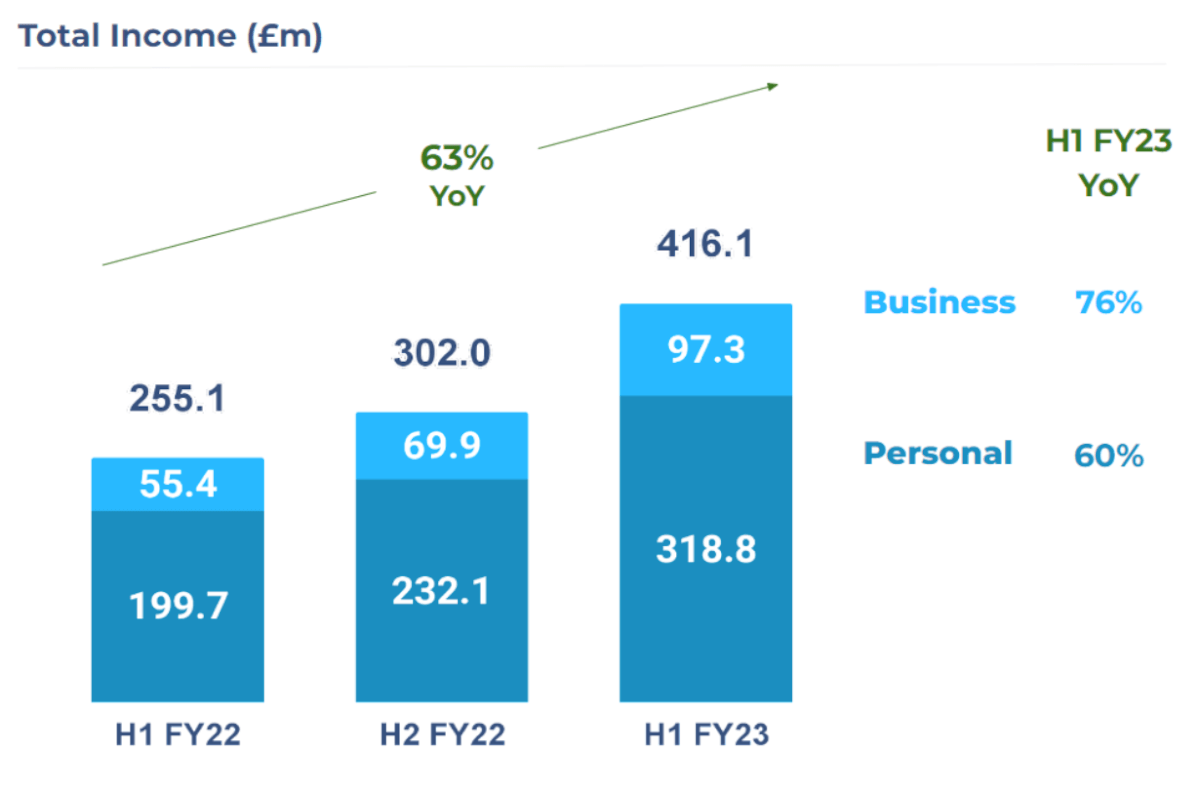

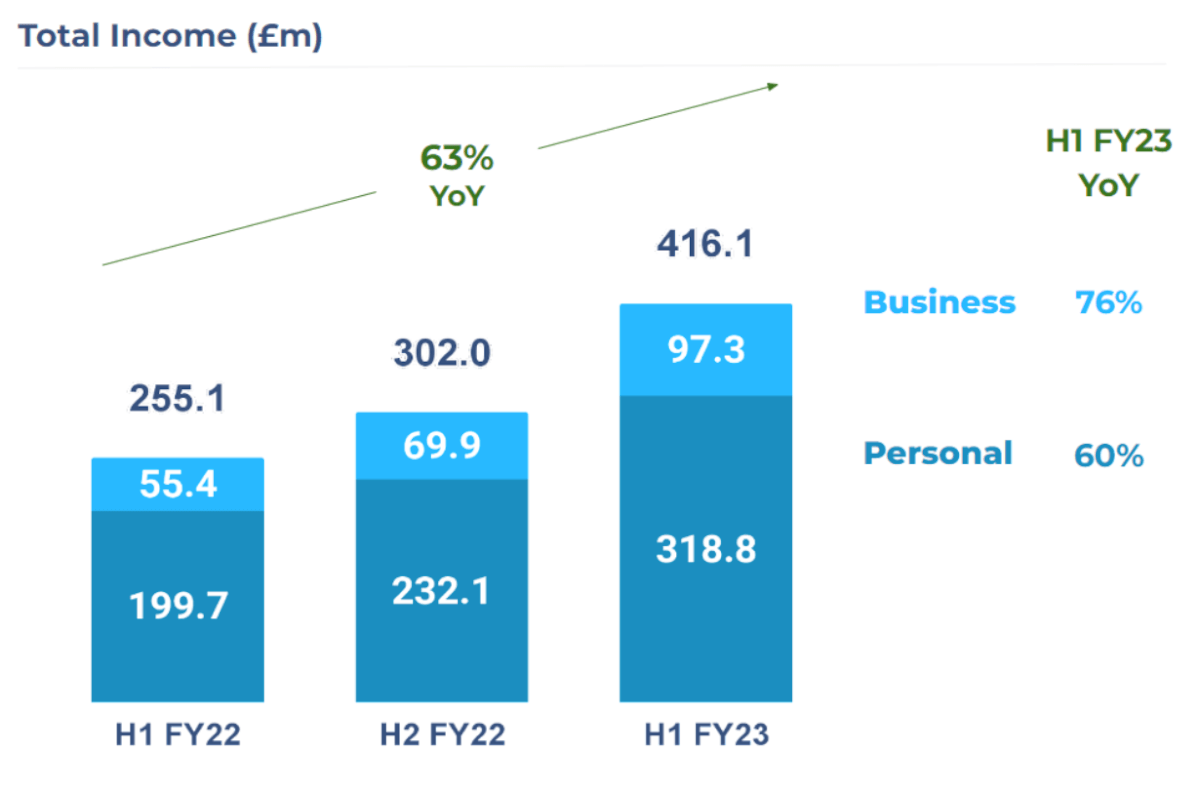

Total Income grew 63% year-over-year to £416 million.

In the first six months of FY23 we generated £416.1m in total income, a 63% increase versus £255.1m in the same period last year. Total Income is largely a function of the volume our customers move, the prices we charge them, and the interest income generated from customer balances.

Our revenue take rate for H1 FY23 was 0.77%, 2 bps higher than the same period last year. Other revenues, which are driven by spending on the Wise card, same currency transactions and the Assets product, were higher compared to the same period last year, reflecting the increased adoption of the Wise Account and Wise Business products. The increase in other revenues more than offsets the reduction in the cross-border take rate, which was 3 bps lower at 0.62% for H1 FY23. This reduction in the cross-currency take rate reflects reductions we have made to certain currencies, and a route mix effect, partly offset by some price increases across a number of other currencies.

We’ve worked hard to scale our costs of sales.

We produced £262.4m of gross profit, a 52% increase compared to £172.6m in the same period last year; equivalent to a 63% gross margin (H1 FY22: 68%). The increase in gross profit reflects the increase in total income, partly offset by higher cost of sales. The reduction in gross profit margin largely reflects higher FX costs associated with the increased levels of currency volatility that we’ve experienced.

We invested our margin for the long term.

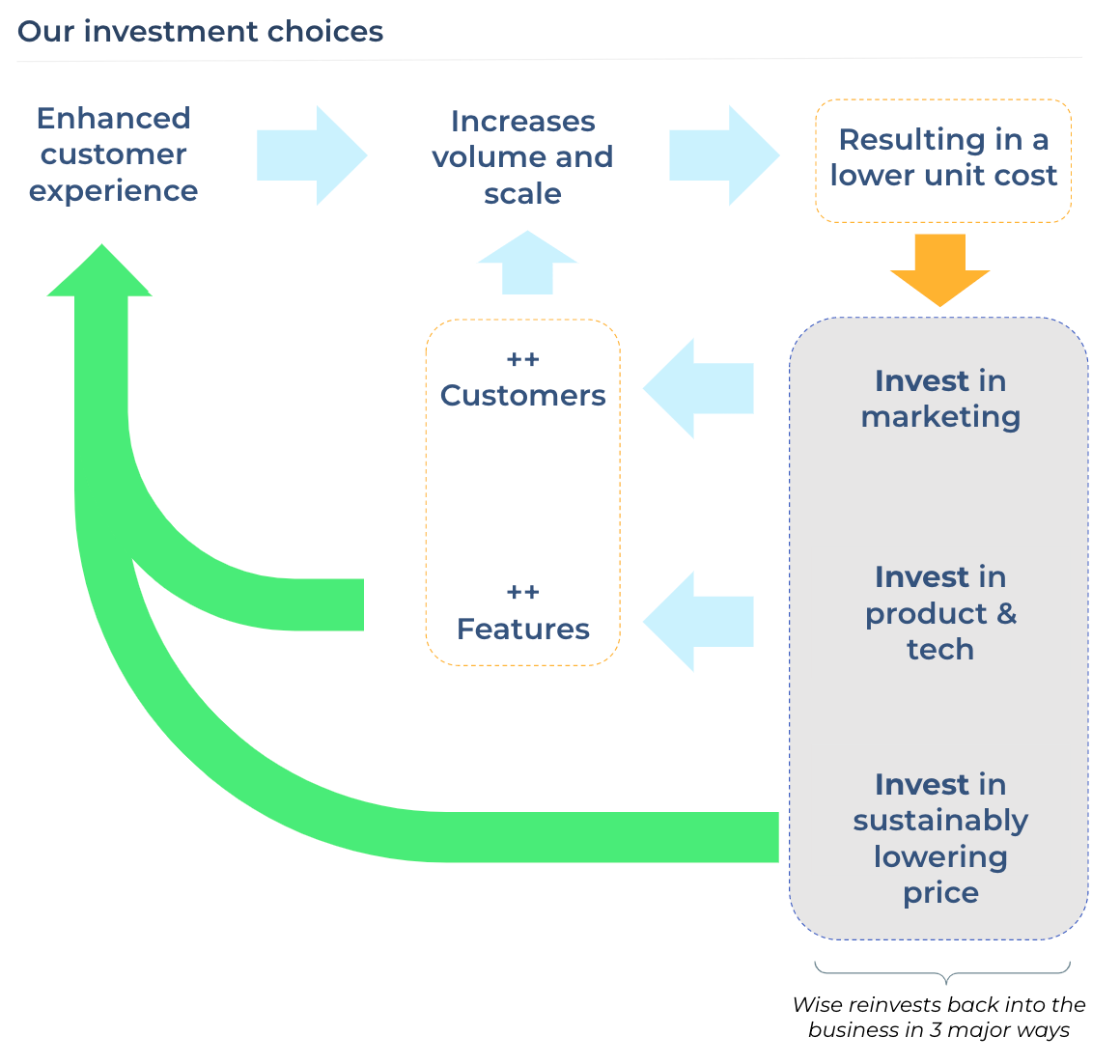

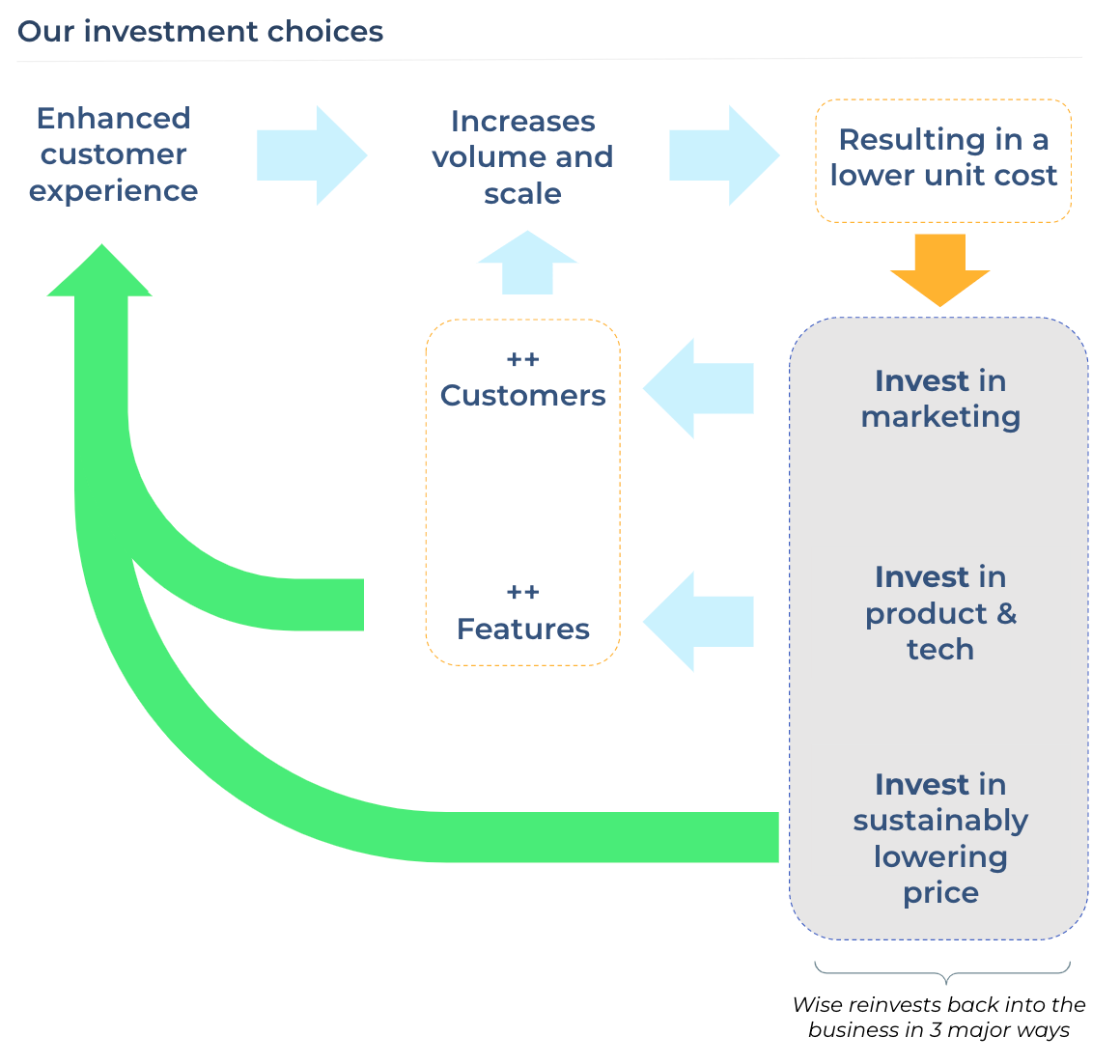

We have three primary areas of investment focus: marketing, product and sustainably lowering prices; all of which we believe in the long-term drive more volume and more scale. This means we get to a lower unit cost and even more capacity to invest. This is how we create sustainable shareholder value.

Administrative expenses increased 41% to £214.9m in the first six months of FY23 (H1 FY22: £152.2m) which is primarily due to an increase in employee benefit expenses and technology and development expenses.

Employee benefit costs increased to £126.5m in the first six months of FY23 as we continue to invest in our team to support further growth. We have expanded the size of the team by 1,418 people or 62% over the last year, with 4,301 Wisers working to deliver our mission at the end of H1 FY23.

Technology and development costs increased by 68% to £19.3m as we invested in improving the security and authentication of our products and systems. We have also increased our usage of cloud computing, which allows us to be as flexible as possible whilst we scale.

We are profitable, highly cash generative and well capitalised.

Adjusted EBITDA of £91.9m for the first six months of FY23 increased 52% compared with the same period last year (£60.6m). This represents an adjusted EBITDA margin as a percentage of total income of 22.1%. The higher adjusted EBITDA was largely driven by higher revenue for the period, which increased by 55%, creating significant capacity for us to invest whilst maintaining a margin consistent with our medium-term guidance.

Profit before tax of £51.3m for the period increased from £18.8m in the same period last year. Earnings per share increased to 3.78 pence per share, compared with 1.33 pence per share last year.

We generated £78.3m of free cash flow in the period, a 33% increase compared to £59.0m last year. Our rate of free cash flow generated, as a percentage of adjusted EBITDA, was 85% (H1 FY22: 98%). The reduction in this rate mostly reflects the effect of changes in working capital, which can vary over time. Excluding the impacts of working capital, our free cash flow generation as a percentage of adjusted EBITDA was 92%, compared with 86% last year.

We remain well capitalised, with Group eligible capital of £281.2m comfortably in excess of our regulatory requirements. The capital we retain over and above our regulatory minimum supports our prudent internal capital buffer and an amount that is available for potential strategic purposes.

Financial Guidance

- Total income growth of between 55-60% in FY23 and greater than 20% (CAGR) over the medium-term

- Adjusted EBITDA margin at or above 20% over the medium-term

To summarise, our strong growth is driven by the quality of the products and features that we’ve built to help our customers move and manage money. Our discipline ensures that we are well positioned to achieve our mission whilst maintaining a sustainable, profitable and cash generative financial model.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.