Summary of fee changes

This blog post is to update our customers about changes in price and is not a marketing communication. Our mission is to lower the cost of moving money across...

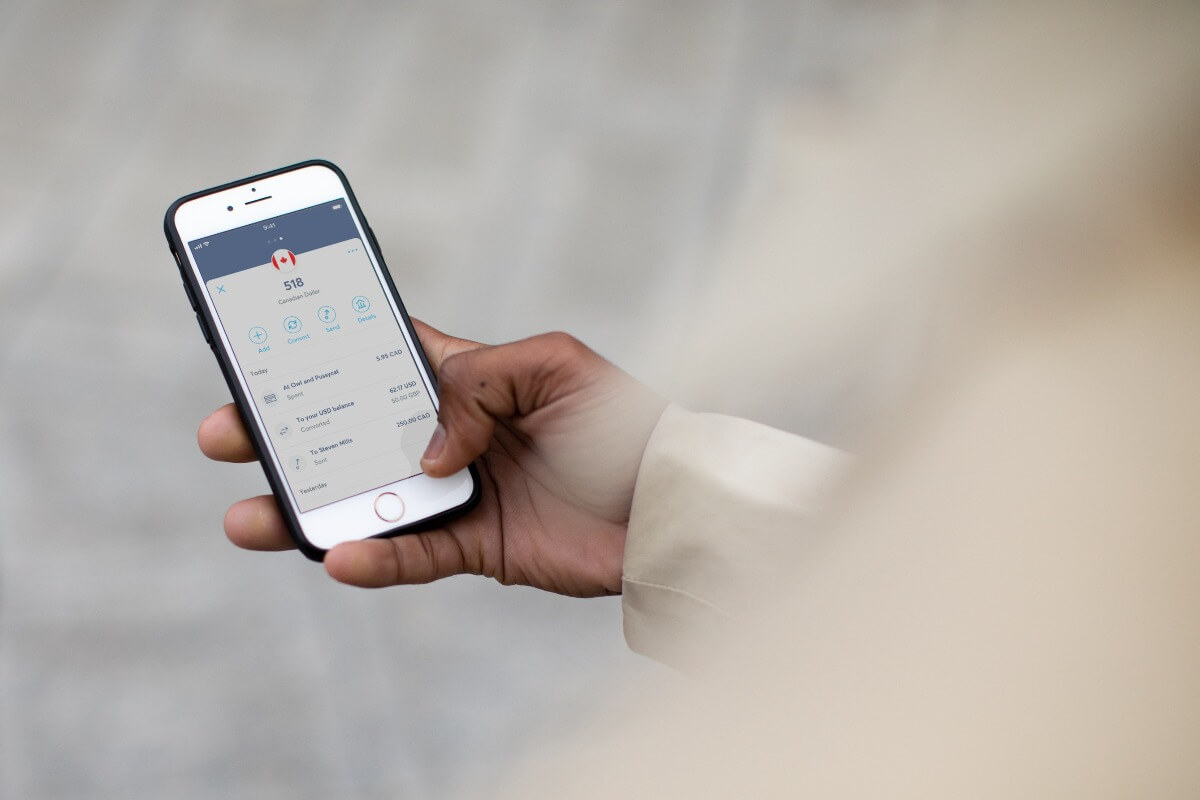

Whether you’re in Toronto or Vancouver, Paris or Sydney, you can now receive Canadian dollars straight into your Wise account — like a local would — thanks to your very own Canadian account details. Which is great if you’ve just arrived in Canada, live abroad but receive a Canadian salary, or are an international freelancer with Canadian customers.

These account details will be unique to you, and are free to get if you have a personal account. More money — ou de l'argent — for you.

Doing business across borders?

You can use these account details to get paid by Canadian businesses or platforms like Shopify, Amazon, or Paypal straight into your account, just like a local business.

If you have a business account, account details come with a one-time fee of around £16/C$42/€21/US$31 (depending on your country). You can see if it’s worth signing up for a business account here.

No long fussy forms and no need for a local address. Just a few minutes of setup.

That’s it — they’re ready to share at the click of a button.

To get paid like a local, simply provide your account, transit number, and institution number to the person who wants to pay you. They can pay using EFT credits (also known as direct deposits or bank-to-bank transfers). These payments are common for Canadian businesses making domestic payments or paying an employee’s salary.

If your employer asks for a voided cheque, you can provide them with your Canadian account details, which is all the information needed to pay your salary.

Please note that they won’t be able to pay using Interac, domestic wire, or SWIFT transfers. Most Canadians making domestic personal transfers use Interac, so sending EFT credits may not be familiar to them, and they may need to contact their bank. If they do send any of these payment types to your account, they’ll be automatically returned with 15 CAD less to cover return processing fees.

It usually takes 1 to 2 days to receive CAD into your account. Sometimes it can take up to 3 days.

Once you have some CAD in your account, you can supercharge your savings by setting up direct debits in other currencies, like USD, GBP, or EUR. If your account is debited but you don’t have money in that specific balance, we automatically convert your CAD at the real exchange rate to save you on cross-currency fees. This way you can pay your phone bills in the UK and add money into stock brokerages in the US all from the same account.

But there’s no rush to spend your dollars. You can hold them in your account, convert them to a different currency, or send them to another account whenever you like. Whatever you do with your dollars, “Yukon” trust us — it’s safe with Wise.

We don’t support Canadian e-transfers through Interac just yet. We know it’s a very popular way to send and receive local payments from friends and family in Canada, so we’re working to add this feature in the near future. We’ll keep you posted. Money without borders, we’re coming for you.

New to Wise but want to receive Canadian dollars without any fees? It’s free to create an account, and you don’t even have to leave your sofa — sign up here.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

This blog post is to update our customers about changes in price and is not a marketing communication. Our mission is to lower the cost of moving money across...

We have some excellent news to share: we’ve received our second licence from the Central Bank of Brazil, this time as a payment institution. Until now, we...

This blog post is to update our customers about changes in price and is not a marketing communication. We regularly review our fees to reflect the real cost...

Our mission is to lower the cost of moving money across borders. We’ve made progress over the last 13 years, bringing our average fee to 0.64% globally. As we...

We have been changing our fees on Wise over the last months. Some of you benefited as a lot of routes got cheaper, but you would have seen an increase in some...

This blog post is to update our customers about changes in price and is not a marketing communication. We regularly review our fees to reflect the real cost...