Summary of fee changes

This blog post is to update our customers about changes in price and is not a marketing communication. Our mission is to lower the cost of moving money across...

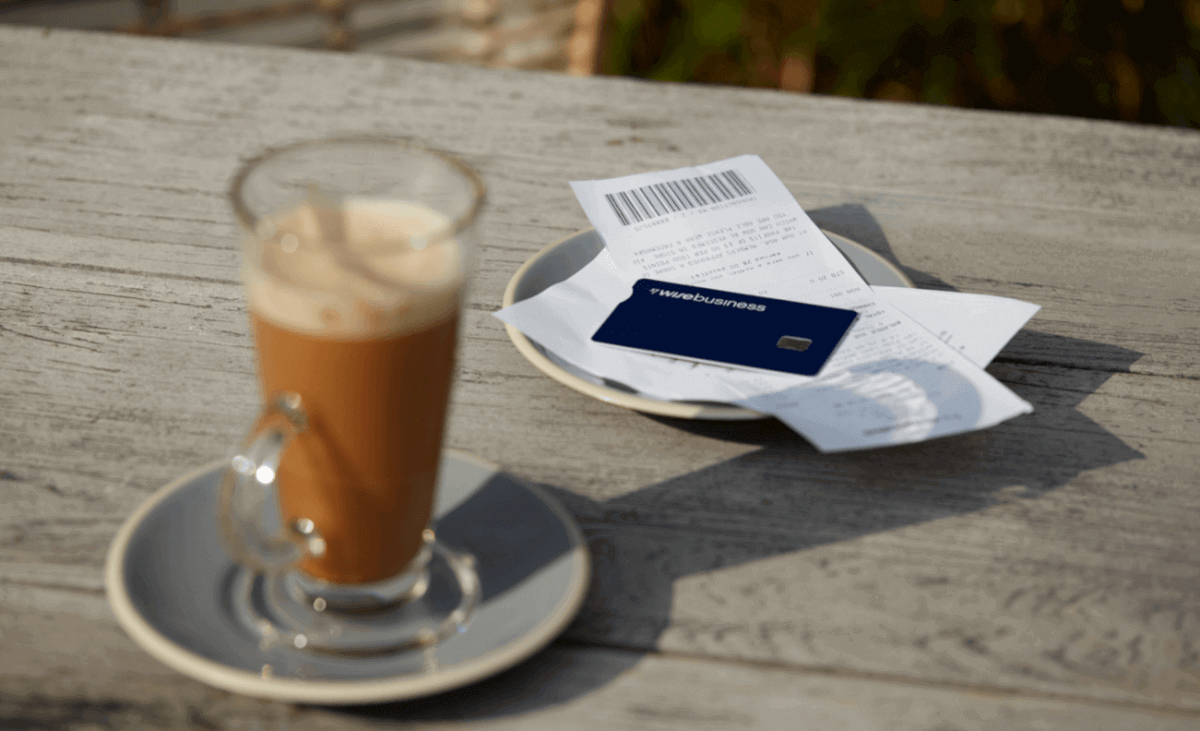

It’s now possible to get extra cards for your team. This means employees who buy things for your business — from social media ads to the Monday coffee round — can do it directly from your Wise Business account.

Learn more about Wise Business 🏢

Wise Business debit cards are the best way to avoid fees

Spending directly with extra physical or digital cards is the easiest way to avoid hidden fees. Because just like the Wise Business debit card you might already have as a business owner, these extra cards also use the real exchange rate.

...and make employee expenses easier

Whether it’s employees, freelancers, interns or business partners, using a personal card for business expenses can be a faff — and often means a long wait for reimbursement.

Not to mention the hidden fees and hiked up exchange rates. But as always, with Wise, your team can spend in any currency without a second thought, as we auto-convert using the best available rate.

Plus, to help with your accounting, everyone can add a receipt and note to any transaction (on web — with mobile coming soon).

You’ll still be in control

To give you peace of mind, we’ve created a new role on business accounts called ‘Employee’ with limited access. When ‘Employees’ log in, they can see their own activity but have no visibility of any sensitive info or business spending.

And to keep their spending in check, you can set and manage individual limits. You can also freeze cards if they go walkies, and remove team members from your account when they stop working with you (this automatically disables their cards).

It costs 3 GBP to get a card

Instead of a monthly subscription per user, we charge an upfront fee of 3 GBP (or equivalent). And that’s it.

They’ll receive 1 physical debit card, and can generate digital cards (up to 3 at any one time).

How it works

Once signed up, Employees can order their own Wise Business debit card, and generate digital cards. And can get spending — even before their physical card arrives!

Invite your team members now 💳

P.S. We’re expanding as fast as we can and Wise Business debit cards are currently available in these regions.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

This blog post is to update our customers about changes in price and is not a marketing communication. Our mission is to lower the cost of moving money across...

We have some excellent news to share: we’ve received our second licence from the Central Bank of Brazil, this time as a payment institution. Until now, we...

This blog post is to update our customers about changes in price and is not a marketing communication. We regularly review our fees to reflect the real cost...

Our mission is to lower the cost of moving money across borders. We’ve made progress over the last 13 years, bringing our average fee to 0.64% globally. As we...

We have been changing our fees on Wise over the last months. Some of you benefited as a lot of routes got cheaper, but you would have seen an increase in some...

This blog post is to update our customers about changes in price and is not a marketing communication. We regularly review our fees to reflect the real cost...