2025 Update: Wise’s commitment to improving diversity, equity and inclusion for women in tech

At Wise, our vision is money without borders. In order to build the future of global money, we need a team that’s as diverse as the customers we...

Welcome to our very first full year results blog post since we became a public company. We are really excited to share our mission and financial highlights for the twelve months ended 31 March 2022.

Kristo Käärmann, our CEO and co-founder, said:

“In 2011, my co-founder Taavet and I set out on a mission to make international banking faster, easier, cheaper and more transparent for everyone, everywhere. We’ve come a long way since then. Fast forward 11 years and we’re now moving 3.5% of personal money that moves across borders. We are really pleased to get this far - but there’s still 96.5% left to go. And the opportunity to support businesses is even greater.”

Money without borders - instant, convenient, transparent and eventually free.

These pillars of price, speed, convenience and transparency drive everything we do at Wise, and considering the success we have seen in recent years, these are working well for us.

The problem of broken international banking exists in a massive market. It is estimated that there are over 280 million immigrants worldwide, and that businesses export US$18 trillion in a year. In 2021 people and businesses transferred £22 trillion globally.

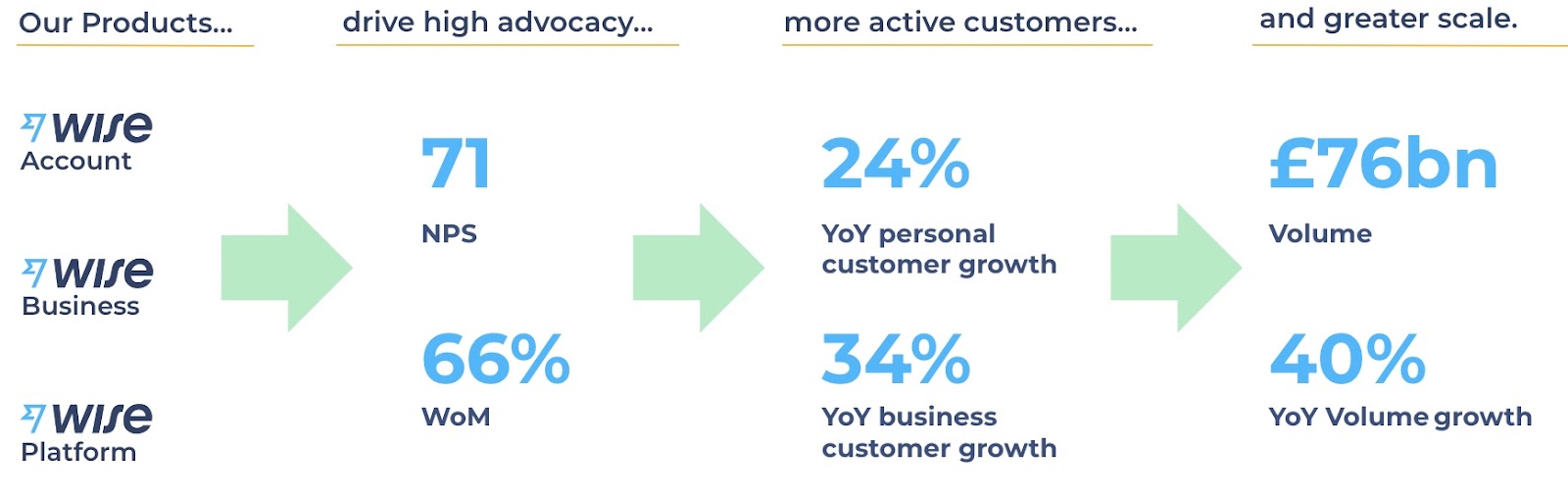

In addition to the basic transfer functionality, we now have 3 core products that serve this massive market.

The Wise Account allows people to send and receive money across a huge number of countries and currencies. Wise Account customers can spend their money anywhere with the Wise debit card. They can also hold money in their Wise Account in over 50 currencies and this year we have introduced Wise Assets in the UK that allows customers to invest their money, whilst retaining instant access to it.

This year we launched the Wise Account into Brazil and Malaysia, and added additional features to make life more convenient for international people, including auto-conversions and scheduled transfers.

The Wise Account has now been adopted by 20% of people that send money with us, and this proportion has been increasing steadily over time. Our Wise Account customers are more engaged and typically transfer twice as much as customers that only use Transfer.

Wise Business is targeted at small and medium-sized businesses and freelancers that have international banking needs. They get all the functionality of the Wise Account but with added features specific to the needs of businesses.

This year we have increased the tools available to business owners allowing them to pay international invoices, manage employee spending by using our debit cards and also to synchronise their activity and bills with accounting software like Xero and QuickBooks.

Our business customers use us more frequently than personal customers and transfer larger amounts of money too.

Wise Platform takes the magic of Wise and allows businesses and banks to integrate directly into our infrastructure.

This year we increased the number of partnerships to over 50, which includes the likes of Monzo, N26, Shinhan Bank, GooglePay, Temenos, gotrade and deel.

Improving our infrastructure allows us to lower our unit costs, allowing us to charge substantially less than leading traditional banks. In fact, this year our customers saved over £1bn in fees, compared with the cost with the traditional banks.

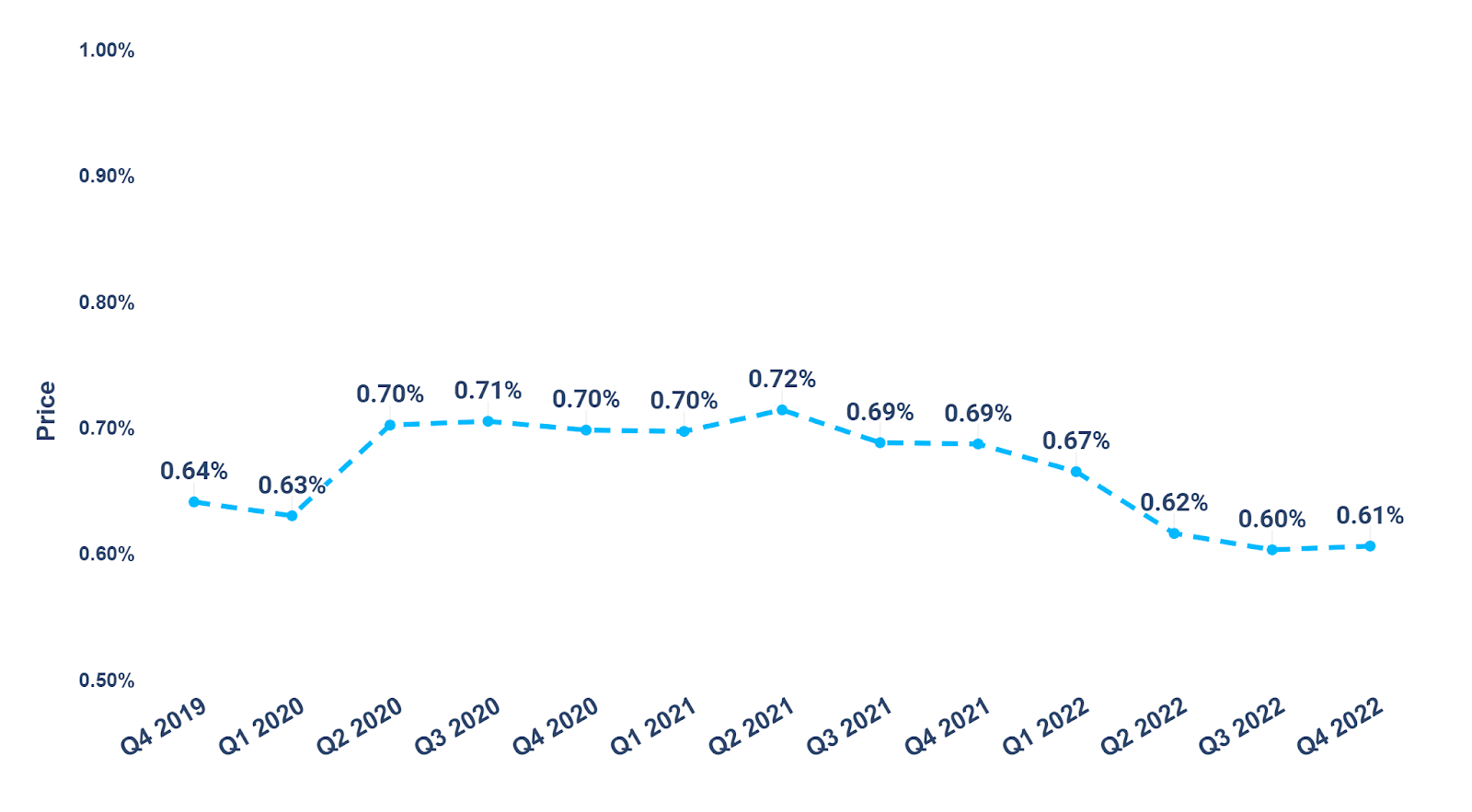

In Q4 FY2022, this average price was just 0.61%, a reduction of 8 basis points as compared to the average price in Q4 FY2021.

We’re continuously increasing the speed of our transfers as we develop our infrastructure, and in the most recent quarter 49% of our transfers were instant, 65% were delivered in under one hour, and 88% arrived in under 24 hours. We’re able to estimate the time of delivery with an accuracy of nearly 80% which our customers value as important information. This compares to up to five business days, on average, it takes a traditional bank to complete an international transfer with a high level of uncertainty on the exact time-frame for delivery.

Our coverage took an important step forward in the year:

We launched in India, allowing residents to send money to 40+ countries. Wise customers can also send money to India instantly.

We’ve been investing in our infrastructure for a long time, and there is still a lot more to build. But it seems to be working. Two-thirds of our customers came to us through “word-of-mouth” and our most recent Net Promoter Score was 71.

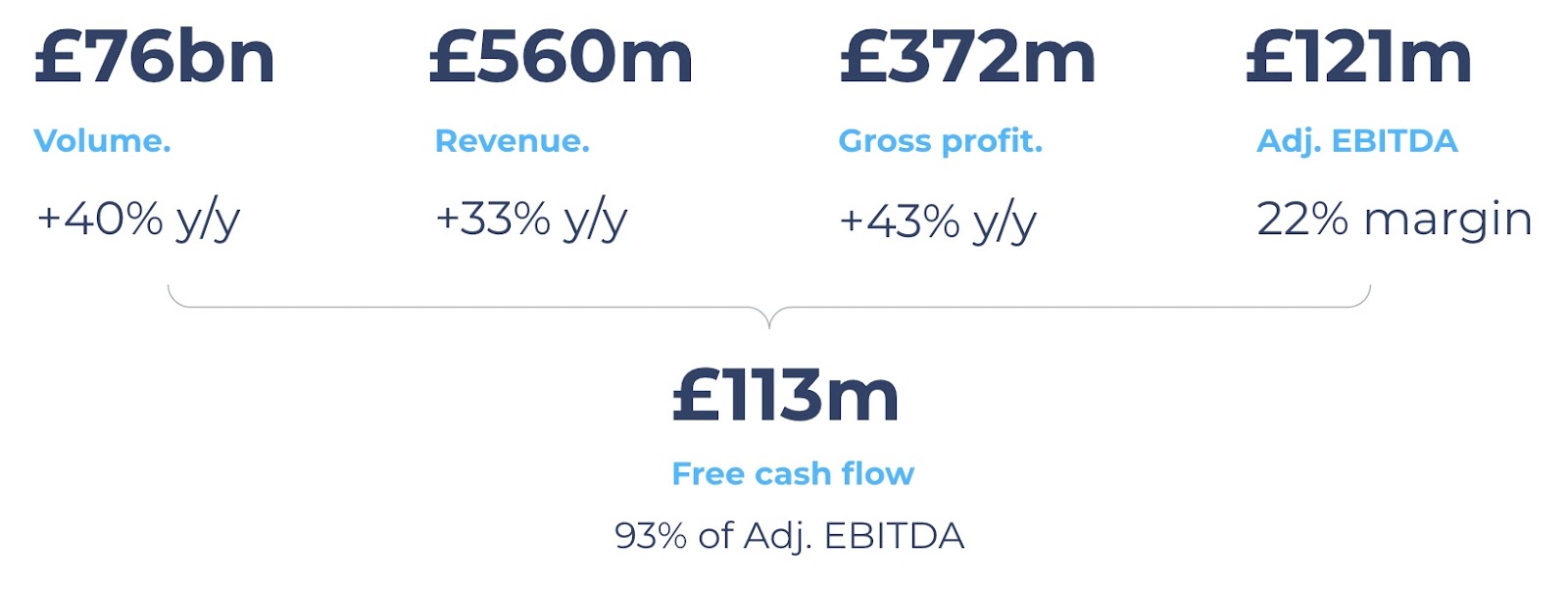

This year we moved £76 billion of customers’ money, an increase of 40% compared with last year.

But there is still a long way to go. We will continue to invest in infrastructure, build features for a smooth and delightful banking experience, and expand globally to bring Wise to more people and businesses. Onwards.

In FY2022, we had 7 million active personal customers and c. 410,000 active business customers. Both segments are growing rapidly with personal customers growing at 24% and business customers growing at 34% over FY2021.

We processed £76.4 billion in cross-border payments in FY2022, which was a 40% increase over the prior year. We saw volume from personal customers grow by 35% YoY whilst Business customer volume grew by 59% YoY.

The volume growth was faster than the growth seen in the number of customers, driven by the average volume per customer, which we have seen increasing vs FY2021, which was in part impacted by the Pandemic. Businesses typically send larger volumes compared to personal customers and we also see businesses sending more volume as they grow with us. And since businesses represent a growing proportion of the total number of customers, the average volume per customer for the Group is gradually increasing, reaching £10,300 in FY2022, a 13% increase over the prior year.

Thanks to the adoption of the Wise Account, we do see customers using more products, and sending or converting more volume on Wise. This growth is evident from the fact our customers’ deposit balances grew 83% to £6.8 billion vs £3.7 billion in FY2021.

This volume growth has been partially hindered by changing FX rates causing a headwind. On a fixed FX basis, we saw VPCs grow 18% (vs 13% using floating rates) and therefore overall volume grow at 46% on a fixed FX basis (vs 40% using floating rates).

The volume growth has driven our revenue growth, which is a function of the volume our customers move and also of the prices we charge our customers. In FY2022 we generated £559.9 million of revenue, a 33% increase versus £421.0 million in FY2021. Revenue from personal customers grew 27% YoY and revenue from business customers grew 59% YoY.

Importantly, however, we saw revenue growth across all of our operating regions. This includes 30% in the United Kingdom, our most mature market. This follows from the 32% growth in the United Kingdom in FY2021. This is a strong demonstration of the runway we have ahead of us, particularly in newer regions.

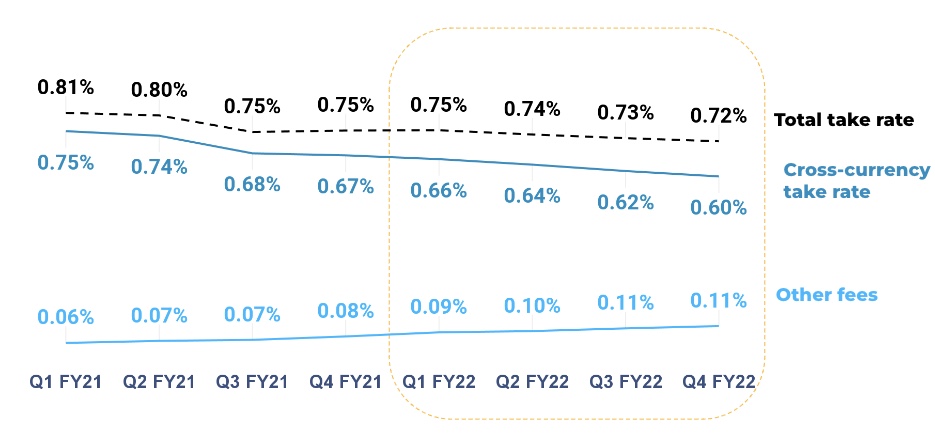

As some of you will have read in our Mission Updates throughout the year, we managed to reduce our cross-currency take rate by 7bps to 0.60% in Q4 FY22 compared to .67% in Q4 of FY21. This was primarily driven by reductions in price that were enabled by reduced unit costs that we passed on to our customers. Specifically, this is enabled by lower foreign exchange losses and reduced spread costs thanks to better risk management and more favourable terms with our banking partners. With price reductions being funded in this way we are able to grow the business and strengthen our market position while generating a healthy level of gross profit to reinvest into our future.

Cross-border payments and conversions make up the majority of our revenue. But as we serve customers more broadly, we’ve seen that our revenue from other products has been growing faster. We earn fees when customers move money in their local currencies, spend on their Wise debit card, and hold their money in our Assets product. Because of this the total take rate decreased by only 4bps to 0.73% in FY2022 compared to 0.77% in the prior year, as the contribution to take rate from other revenues grew from 0.07% in FY2021 to 0.10% in FY2022.

We’ve worked hard to scale our costs of sales.

Whilst we dropped prices, we still generated £371.9 million of gross profit, a 43% increase on £260.5 million last year and equivalent to a 66% gross margin (FY2021: 62%), thanks to the savings in our marginal unit costs mentioned above. This growth in gross profit, which is in line with our growth in volume, demonstrates that reductions in price can be made whilst sustaining our ability to invest.

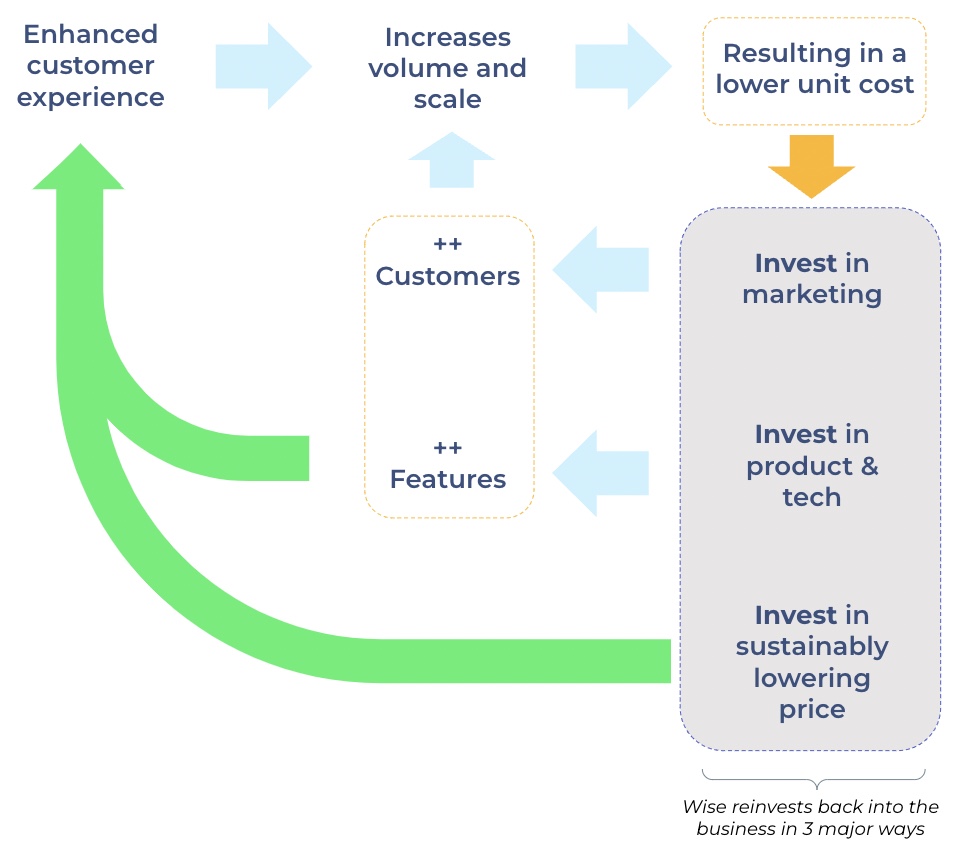

We invest in three ways to build better customer experiences that in turn drive more customers, more volume and more scale. This means we can lower our unit costs even more and still grow our capacity to reinvest.

We first invest in our product and infrastructure platform. We invest heavily in our Engineering teams, and in launching new features and products. This drives a better customer experience, more referrals, and also lowers our unit costs. FY2022 saw us acquire a company for the first time. We successfully completed the acquisition of Vaho Forex Private Ltd in India, which helps us obtain an Authorised Dealer II licence and should significantly speed up our growth in the market.

We then also invest in marketing. Although two-thirds of our customers join us through recommendations, we invest in marketing to reach new customers, but only if we can achieve a sustainable payback period. And we invested 30% more in marketing in FY2022 vs FY2021. This drives more customers to our platform, which in turn drives more volume and scale, and again lowers our unit costs.

And of course, we re-invest in sustainably lowering prices for our customers. This is a long-term investment on the belief that driving down the cost of international banking, and in turn having the lowest unit cost, will position us the strongest for the future.

Administrative costs increased 48% to £321.4 million, primarily due to an increase in employee costs, outsourced services, marketing and other administrative expenses.

Employee costs increased 31% to £184.8 million as we continued to build our teams to support growth. We increased the number of Wisers by c.950 to almost 3,400.

Consultancy and outsourced services increased by 55% to £42.3 million and other administrative expenses were almost four times higher at £22.9 million. This increase includes the one-off listing costs plus an increase in consultancy services related to stricter compliance standards. The return of travel and office-based working has also driven an increase in related expenses.

Marketing costs increased 30% to £28.2 million as we have used additional targeted ways to drive customer growth, beyond our primary ‘word-of-mouth’ approach. We continue to operate a disciplined approach to return on investment for marketing.

Capitalisation of intangible assets in FY2022 reduced versus the prior year by 76% to £4.7 million (vs £19.5 million in FY2021). This previously announced change does not impact our cash flows and we continue to expand and invest in our Engineering team.

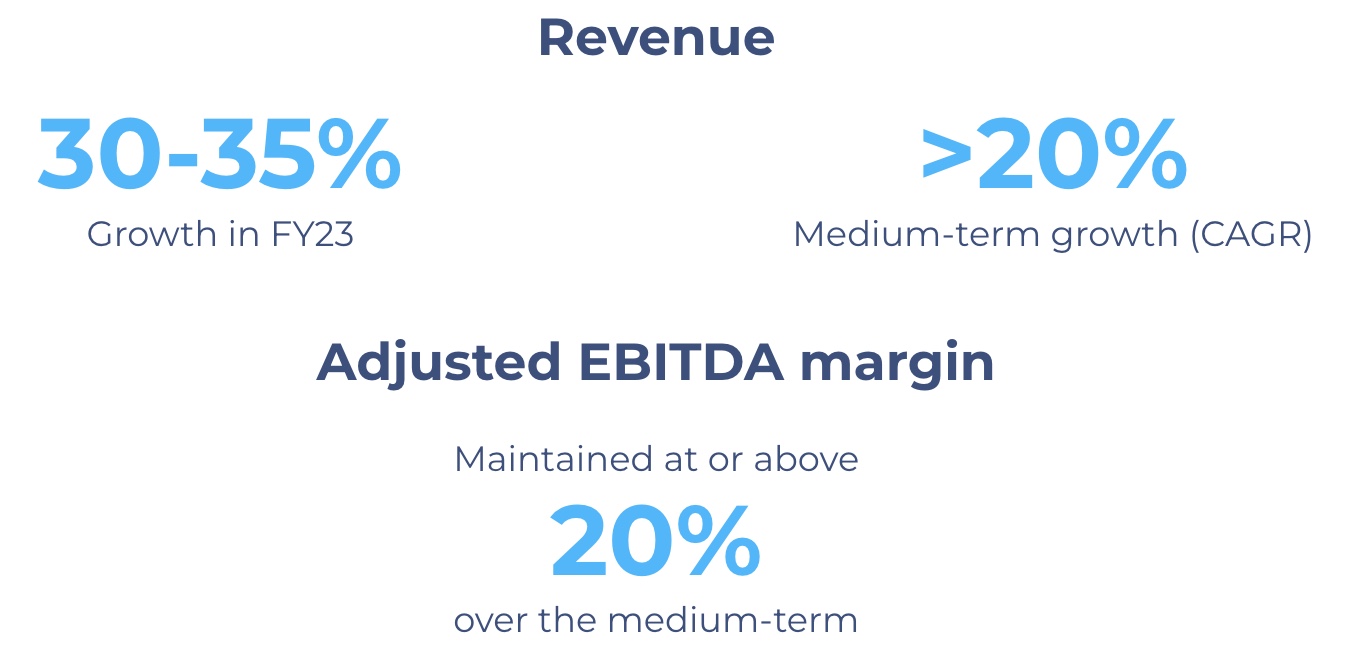

Our Adjusted EBITDA margin was 22% for the year (FY2021: 26%) which corresponds to £121.4 million of Adjusted EBITDA (FY2021: £108.7 million) and an 11% increase over the prior year, reflecting our commitment to investment in future growth whilst maintaining sustainability.

Profit before tax was £43.9 million compared to £41.1 million last year, a growth of 7%. This reflects the higher growth in operating expenses and the investment in our future, but also was in part driven by the costs of the listing, and includes a £4.8 million loss on the sale of government bonds in early 2022. Stock based compensation expense increased 11% YoY, a total cost of £42.2 million for FY2022.

As at 31 March 2022, we held £7.2 billion of cash and highly liquid investment grade assets, up 77% from £4.1 billion held at the end of FY2021. Specifically, this includes £6.8 billion of customer deposits (£3.7 billion at the end of FY2021), which we keep safeguarded and readily available for our customers.

This amount also includes £357.8 million of our “own cash” (£286.1 million at the end of FY2021). We are seeing this cash balance increasing thanks to the cash-generating qualities of the business we’ve built. Our FCF conversion remains high at 93.3% (95.6% for FY2021) of Adjusted EBITDA for the year.

We are well capitalised for the future and as at 31 March 2022, our Group eligible capital of £242.5 million was significantly above our minimum capital requirements, set by our regulators around the world.

We continue to invest and build for the future. In the medium term, we continue to expect to deliver revenue growth above 20% (CAGR) and an adjusted EBITDA margin at or above 20% as we continue to invest sustainably.

With some positive trends from FY2022 carrying through to provide a strong start to the next financial year, we expect revenue to grow by between 30% to 35% in FY2023.

We’re growing fast at scale, and profitable. And our growth continues to be fuelled today and tomorrow by the products we’ve been investing in over the past years, supported by the ability to grow our investments in marketing and underpinned by building products and features that everyone loves and continues to recommend. We’re seeing faster growth from customers adopting more features, which helps to drive their activity, engagement and volumes they trust us with.

Last year was notable for our listing, but the work we do to continue to build our business cannot and will not stop. We have, as to be expected, work to do to continue to develop our controls, processes and operations so that we can move money around the world instantly, for everyone.

Our focus on our mission will not change as we continue to grow and scale, and neither will our focus on building a strong, sustainable and cash-generating business that is best placed to address the evolving needs of our customers.

I’m therefore happy to keep saying that we’ve just got started, and that we have a long way to go. But it is working.

Onwards!

Enquiries

Martyn Adlam - Head of Owner Relations

martyn.adlam@wise.com

Sana Rahman - Global Head of Public Relations

press@wise.com

Brunswick Group

Charles Pretzlik / Sarah West / Samantha Chiene

Wise@brunswickgroup.com

+44 (0) 20 7404 5959

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

At Wise, our vision is money without borders. In order to build the future of global money, we need a team that’s as diverse as the customers we...

Paying someone new? Don’t waste time typing out their bank details or double-checking their IBAN. Upload a screenshot or invoice instead. Our new AI feature...

Welcome to the Wise Partner Program! In this guide, you will find all the information you need to get started, optimize and succeed as a Wise partner. Simply...

We're thrilled to introduce a powerful new feature designed to save you time and eliminate the frustration of manual data entry when sending money. Now,...

The new Wise Card is here! 🇧🇷

We have great news for our customers in Brazil! You can now set up your own Pix key directly in the Wise app