5 Ways to Stand Out and Boost Black Friday Sales

Black Friday is the day after Thanksgiving, falling on Friday 29th November in 2024. It’s known for being a perfect time for snagging a bargain, opening the...

In France, e-invoicing is becoming mandatory for businesses on a phased roll out plan through 2024 and beyond. Aside from the legal requirement, businesses tend to find e-invoicing an efficient, fast and easy way to bill business customers, with less paperwork to worry about. If you are a UK business owner or director and you're new to e-invoicing in France, we’ve got all you need to know right here.

This guide covers e-invoicing in France, including the France e-invoicing mandate and roll out dates, so you can prepare your business.

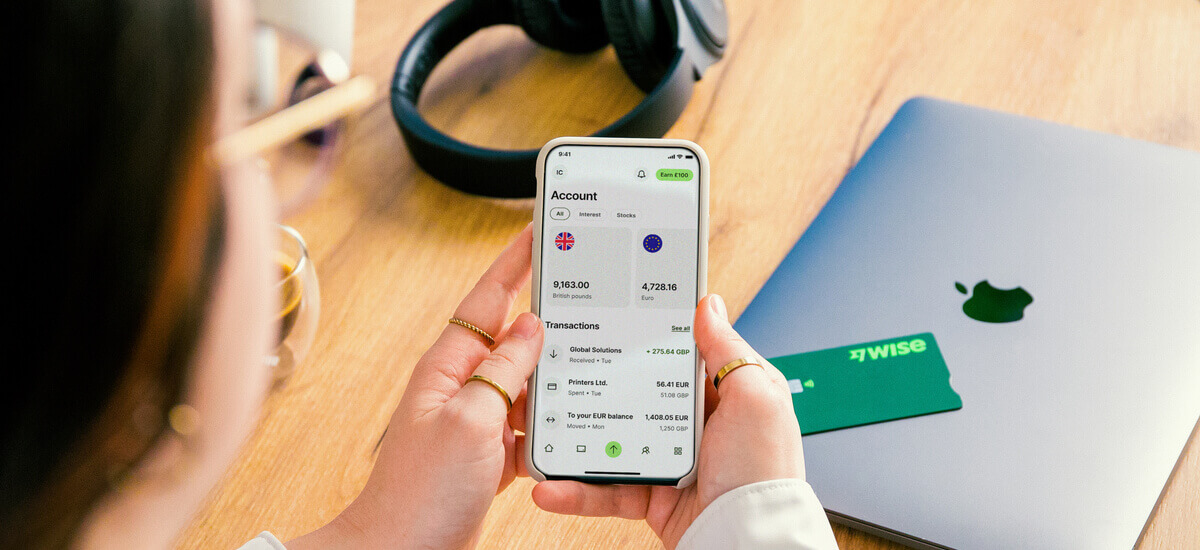

If you are invoicing overseas, a Wise Business multi-currency account can be a helpful tool to receive payments on your customer's local currency, like Euros.

💡 Learn more about Wise Business

Using e-invoices is often easier for businesses, and also helps minimise VAT fraud and tax evasion - making it a logical step for governments around the world.

In France, the roll out of mandatory e-invoicing is in progress, with all businesses required to be able to accept e-invoices from July 2024. Further to this, it was announced in December 2023 that it would be mandatory for large businesses to issue e-invoices from July 2024, with the roll out for intermediate businesses and SMEs following in 2025 and 2026 respectively.

It’s already a requirement for businesses dealing with public bodies to issue e-invoices, and many French businesses have adopted this system already ahead of the roll out¹.

The French e-invoicing system is flexible and offers several different ways to add or upload the required information. It’s been in use by public bodies for several years already, processing a huge 68 million invoices annually by 2021¹.

The Public Finances Directorate General (DGFiP) and the Agency for State Financial Information (AIFE) work together to oversee the French e-invoicing system Chorus Pro.

It’s free to use Chorus Pro, and the system can accept invoices in several different ways and formats. This means you can add invoices yourself or through a third party service provider, manually or by downloading a PDF or XML file, or use EDI to submit your invoice instead.

If you have a UK business and export to France you can expect your customer to ask for an e-invoice. You’ll also need to know about French mandatory e-invoicing if you have a French subsidiary or entity.

The good news is that there is lots of help out there for people learning to use Chorus Pro, including support built into the system itself, and a user community which can help by answering questions and giving advice. If you’re struggling with the system at all you can also choose to submit your e-invoices through a third party service provider.

You’ll use a standard format when e-invoicing French companies, but you do have several different input and file type options depending on your personal preferences and needs.

You’ll be able to download PDF or XML e-invoices or use EDI data exchange directly in Chorus pro or through a service provider, for example. Formats include structured OASIS UBL 2.1 and minimal OASIS UBL 2.1 options, as well as others.

Let’s round up a few common questions about e-invoicing in France and how it works.

Mandatory e-invoicing in France is being rolled out gradually, based on the size of business and the type of sales involved. It’s already mandatory to use e-invoices when dealing with many public bodies for example, and e-invoicing processes are set to become mandatory for large companies from the middle of 2024.

Slightly smaller businesses will need to use e-invoicing from 2025, with SMEs set for mandatory roll out in 2026. It’s going to be mandatory for businesses in France to be able to receive e-invoices from July 2024, even if the business is not yet required to issue e-invoices itself.

The EU e-invoicing directive was published in 2014², and has led to the roll out of e-invoicing systems and services throughout Europe, at locally agreed timescales. The rollout of this directive is ongoing, with different EU member states implementing the rules at their own pace. Although e-invoicing isn’t yet mandatory in all situations in Europe, e-invoicing has become much better known and much more popular as the roll out continues.

An e-invoice is a standardised electronic invoice in a structured format which can be submitted and processed through an e-invoicing system such as Chorus Pro. Different countries may have their own e-invoicing systems, but within the EU the aim is for all e-invoicing systems to be compatible and work together to reduce friction in cross border trade.

Wise Business can help UK businesses, freelancers and sole traders get paid by customers in multiple currencies, with low fees and the mid-market exchange rate.

Your Wise Business account comes with local account details to get paid in major foreign currencies like Euros and US Dollars just as easily as you do in Pounds.

All you need to do is pass these account details to your customer, or add them to invoices, and your customer can make a local payment in their preferred currency. You can also use the Wise request payment feature to make it even easier and quicker for customers to pay you.

Get started with Wise Business 🚀

If you’re a UK business selling to businesses in France, e-invoicing is going to be important to you. Use this guide to learn more - and check out Wise Business as a smart way to manage your business finances across borders, with easy, low cost ways to hold, send, receive, spend and exchange euros, pounds and more.

Sources used in this article:

Sources last checked March 27, 2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Black Friday is the day after Thanksgiving, falling on Friday 29th November in 2024. It’s known for being a perfect time for snagging a bargain, opening the...

Black Friday - Friday 29th November in 2024 - kicks off the end of year shopping period, with huge uplifts in on and offline sales as people grab a bargain...

The term "turnover" is used often in the world of business, but its implications vary significantly depending on the context. At its core, turnover is a...

Wise is a financial technology company focused on global money transfers that offers two different types of accounts: a personal account and a business...

In today's fast-evolving digital landscape, e-commerce is quickly transforming the ways consumers shop and how businesses operate worldwide. DHL’s E-Commerce...

In an increasingly interconnected global economy, small businesses in the United Kingdom (UK) have more opportunities than ever to expand through import and...