Should Expenses be Paid Through Payroll?

Discover if expenses should be paid through payroll, with pros, cons and directions from HRMC.

If your business is looking into renting a commercial property, or you’re a landlord with property available to let, it can be useful to know about commercial property licence agreements.

Below, we’ll cover the essentials you need to know about this kind of licence agreement. This includes the difference between a licence and a lease for business premises, tenants rights and some of the pros and cons to consider.

And if your business is based overseas, but you’re looking for UK commercial properties to rent, read on. At the end of this guide, we’ll show you how you can save money on cross-border rent payments using a secure Wise for Business account.

But first, let’s explore what commercial property licence agreements are, and how they differ from lease agreements

But where a lease differs from a licence is in the rights, obligations and protections it gives to the tenant. Both parties need to adhere to the terms of the lease agreement, which includes things like rent payments and rent control, the eviction process, the right to remain and exclusive use of the premises.

Leases can also be bought and sold, while licences don’t give tenants any proprietorial rights. If the owner of the freehold changes, a new licence would need to be drawn up.

Mixing up the two can be disastrous. For example, a tenant may find their licence terminated with minimal notice, or through a misunderstanding end up tied into a long lease contract when they’re keen to vacate the premises.

Before signing on the dotted line, it can be useful for both landlords and tenants to understand some of the pros and cons of commercial property licence agreements.

Let’s start with the advantages:

A licence typically lasts for a short period, up to two years¹. This can make them ideal for temporary arrangements.

For example, imagine your business is looking for a commercial shop to rent in London for a pop-up venture. You don’t want a long lease agreement, as you’re planning to move on within a few months. A licence agreement could give you permission to use the space for your pop-up, and vacate when you’re ready.

A licence can be a good way to help landlords fill hard-to-let properties temporarily, while they find more permanent tenants. It’s also a good option for larger properties, where landlords are planning to share spaces with other businesses and organisations.

You don’t necessarily need a lease agreement as a landlord to attract rent for commercial premises. You can charge monthly rent to a tenant with just a licence.

But if you’re a tenant looking into how to calculate commercial rent for UK premises, make sure you take into account licence costs, service charges and other fees. These will all still apply, even if you don’t have a lease.

Now, here are a few potential drawbacks to consider:

Security of tenure is one of the problems with licences compared to leases, as you’ll have no right to remain at the property once the licence period ends. Plus, either party can terminate the licence after a notice period (usually around a month¹), so your landlord could decide to evict you at any point. Similarly, landlords could lose a great tenant at short notice with only a licence, rather than a lease, in place.

If you’re considering a licence to occupy a business premises, tenants rights is absolutely a topic to look into. A licence doesn’t give you much in the way of rights, beyond permission to legally occupy a premises. A full lease agreement can give tenants much more protection.

Renting commercial property in the UK can sometimes be complicated, not to mention expensive. In fact, the average rent per square foot for commercial property in the UK reached a whopping £2,175 on London’s Bond Street in 2020².

With rental prices for business premises so high in many major UK cities, you’re going to want to find every possible way to save money where you can. If you’re based overseas and looking into renting business premises in the UK, open a Wise account first.

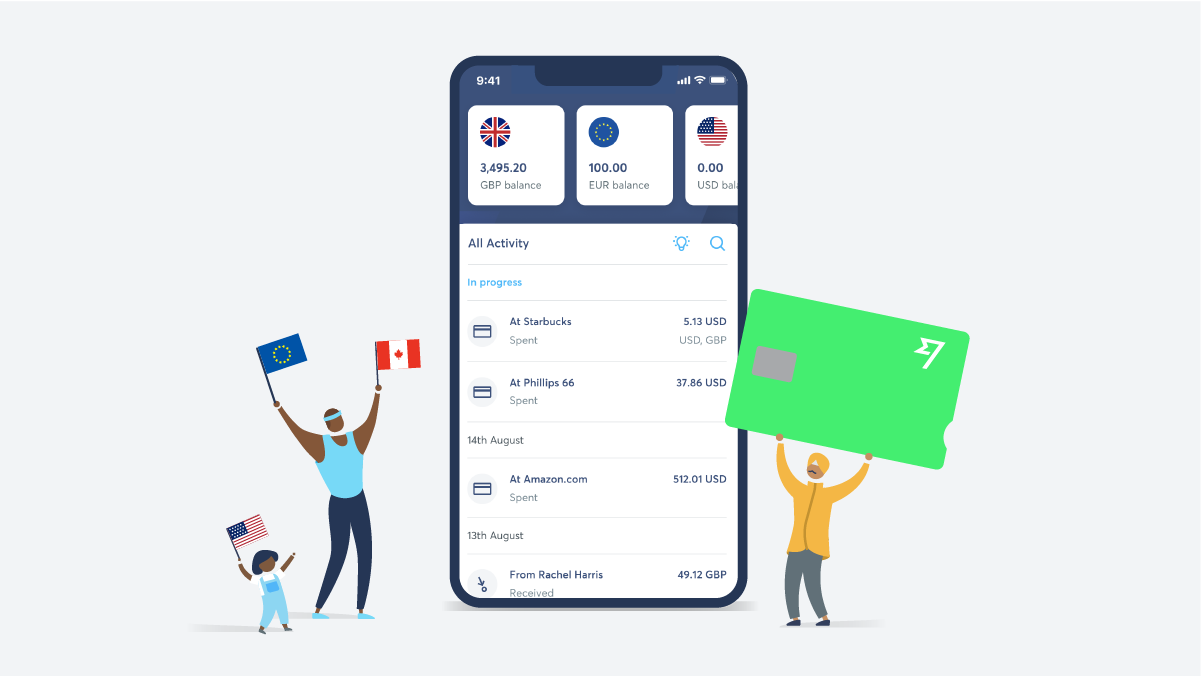

With Wise for Business, you can cover international rent payments for low fees and the real, mid-market exchange rate. It’s secure, convenient and quick, plus it could save you a bundle whether you opt for a short-term licence or a long-term lease.

Wise can also help to streamline your business finances in other ways. For example, you can use a Wise multi-currency account to manage and pay invoices in 70+ countries, pay up to 1,000 suppliers, vendors or employees at once and move money between accounts in seconds. It even integrates seamlessly with accounting software such as Xero and Quickbooks.

So, that’s pretty much it - all the essentials you need to know about commercial property licence agreements in the UK. It’s really important to understand the differences between these and lease agreements, whether you’re a tenant, landlord or freeholder.

If in doubt, seek professional advice to help you find the best solution for the needs of your business. Good luck!

Sources used for this article:

Sources checked on 17th May-2021.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Discover if expenses should be paid through payroll, with pros, cons and directions from HRMC.

Discover the best practices when setting up per diem expenses, how to set up rate, proceed with payment and more.

We’re excited to announce that Morgan Stanley, a leading global financial services firm, has teamed up with Wise Platform, Wise’s global payments...

Discover how to automate expense reporting with our complete guide that covers step-by-step process, tools and best practices.

Travel and expense (T&E) processes are necessary in any business in which employees may spend on allowable business expenses, which need to be recorded,...

Discover the 6 best reconciliation tools available for businesses in the UK.