Mettle business bank account review UK

Learn about Mettle business bank account, its core features, limitations, eligibility requirements, fees and customer service.

Thinking of switching your business bank account? If you originally opened an account with Lloyds Bank but it no longer meets your needs, it could be time for a change.

In this guide, we’ll show you how to close a Lloyds business account in the UK. This includes the steps to follow, forms to fill in and whether you can do the whole thing online. But the good news is that it’s usually pretty straightforward to close a business bank account in the UK.

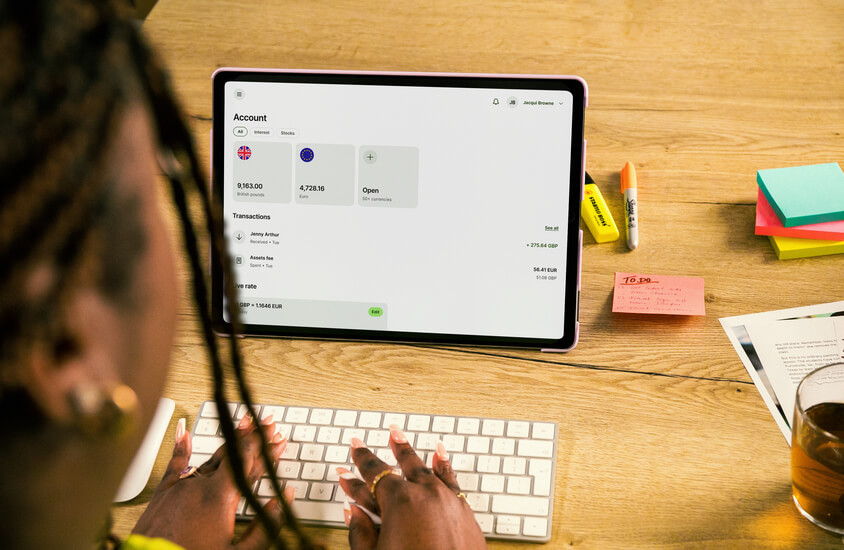

We’ll also give you the lowdown on a convenient and cost-effective alternative to a traditional business bank account. Open a Wise Business account and you can hold money in over 50 currencies, and make easy international transfers for low fees.

If your business has any dealings overseas, Wise could save you a bundle on international payments.

💡Learn more about Wise Business

But first, let’s get that Lloyds business account closed down for you.

As a business owner, your time is precious. So, it’d be ideal if you could close your business account online in just a few clicks.

Unfortunately though, Lloyds Bank doesn’t offer the option of closing a business account online. You can at least start the process though, by downloading the Account Closure form here.

The process of closing a business account with Lloyds Bank is reasonably straightforward. It all starts with completing the Account Closure form, and submitting it to the bank for processing.

Here are the steps you’ll need to follow:¹

- Go to the ‘Close an Account’ page of the Lloyds Bank website, and answer the quick questions to be directed to the correct form to use. You may also be able to get a copy of the form by visiting your local branch in person.

- Download, print and complete the form with all the required information. You’ll also need to ensure the form is signed by an authorised person responsible for the business.

- Email the completed Account Closure form to businessbankingservicing@lloydsbanking.com. This is the fastest way to submit it, but you can also post it to Lloyds Bank, Business Banking, BX1 1LT.

- If you’re signed up to the text and email service (there’s an option to sign up in the Account Closure form), you’ll receive notifications when your form has been received.

- You’ll also get a notification when your account has been closed, along with a closing statement in the post.

Before you start this process, it’s important that you make sure you’ve repaid any outstanding balances linked to the account, including your credit and charge cards.

To complete the Account Closure form, you’ll need to provide the following information:²

When closing a business bank account, it’s crucial that you download a full transaction history for accounting and record-keeping purposes.

The good news is that Lloyds Bank automatically provides you with your transaction history for the previous 5 years. This happens at the point of closing your account, unless you choose not to receive it.³

If you need to, you can also request copy statements for up to 5 years after you’ve closed your account.³

Looking for a new business account provider? It doesn’t necessarily have to be a traditional bank, as there are other solutions out there.

If your business trades internationally, the Wise Business account is the perfect choice. It’s easy to open online, and gives you a powerful platform for sending, receiving and managing your business finances in over 50 currencies.

You can pay overseas workers or suppliers all over the world, for low fees and the mid-market exchange rate. And getting paid for your services is easier too, as you can accept payments in 10 major currencies using your own local account details.

Team expenses are sorted, thanks to the Wise Business expense cards. It works in 174 countries, charges no foreign currency transaction fees and even offers 0.5% cashback on spending.

And to make it easier to manage company finances all in one place, you can link your Wise Business account to your favourite accounting tools such as Xero or Quickbooks.

Get started with Wise Business 🚀

Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information.

And that’s pretty much it - all you need to know about how to close a Lloyds business account.

You should find it straightforward, as there’s just one form to fill in. As long as you provide all the required information (and get the signatures you need), the closure of your account should run smoothly.

Sources used:

Sources last checked on date: 11-Apr-2023

Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn about Mettle business bank account, its core features, limitations, eligibility requirements, fees and customer service.

Wondering what are the fees related to Revolut's Business Account? Read our complete review of plans and service fees.

A guide to the Starling sole trader account vs. business account, comparing the two on features, fees and eligibility.

Can you use Airwallex in Singapore? Find out here in our essential guide for UK businesses, covering everything you need to know.

Find the best business bank accounts in Canada with our easy guide. We compare top banks and digital providers so you can choose what fits your business best.

AIB offers three types of business current accounts. Each of these accounts is specifically tailored to a segment of the market.