We'll lose £215 billion to hidden fees unless we act

We’re set to lose £215 billion to hidden fees this year alone. That's because today, banks and other providers are able to tell you your transfer is free, has...

In January, we highlighted a new European regulation, CBPR2, because it was meant to lower fees for some payments in the EU. Since 15 December 2019, firms are required to charge the same for a payment in euros as for a domestic payment in a non-eurozone currency, but we found out that they were still charging more. That’s because of the exchange rate mark-up. This is where firms use a worse exchange rate than the mid-market rate you see on Google, and charge you, their customers, additional fees.

Right now COVID-19 is stretching budgets and putting more financial pressure on people, including those living away from home. Transparency is vital to help those budgets go further, as the World Bank has highlighted that a lack of transparency is the single biggest factor leading to high remittance prices. That sentiment is echoed elsewhere. In Europe, the European Banking Federation (EBA) said “financial institutions should ensure full disclosure and act in the interest of customers, with no hidden charges”. How richer nations respond to the current crisis will have significant economic ramifications for the global economy, and particularly people dependent on international payments.

As of 19 April 2020, banks and brokers will need to show the total cost (any fees plus the currency conversion charge in the sender’s currency) of making a cross-border payment from one account to another, before you make the payment. You also need to be shown an estimate of the total amount that will be received on the other end in the currency of the recipient.

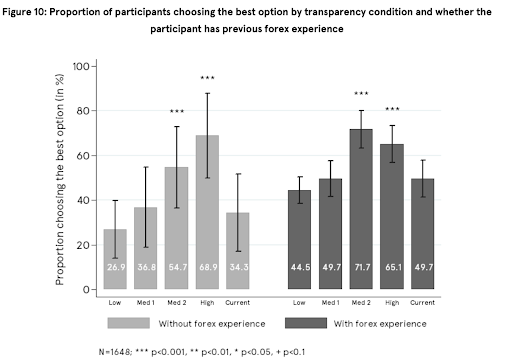

This is the proven measure from UK Government research that will mean many more consumers are able to make better choices about which provider to use.

The impact of improved transparency of foreign money transfers for consumers and SMEs, The Behavioural Insights Team, 21 March 2018.

There is an additional measure to make card payments more transparent and comparable. You can find out about what we’ve done to apply this part of the regulation here. In short, customers in Europe can now see how much more their providers charge compared to the European Central Bank’s exchange rates. This means that banks have to use a neutral benchmark to tell you the percentage they’re charging on top of that.

Simply put, there has been an effort from industry to water down these provisions.

Still hiding costs: Because the law doesn’t say which rate to use when calculating the exchange rate mark-up, some firms are using their own (inferior) rate and not the real exchange rate. That’s like buying something online only to find out afterwards when you look at your bank statement that the shop didn’t include the delivery cost in their quote.

What about cash: In addition, the new law only requires this additional information when you are making a payment online. If you go into a branch of a bank they are under no obligation to tell you the real cost when you ask to make a payment. Even worse, because of a quirk in the regulation, it doesn’t even include bureaux de change aka money service businesses. So pure cash firms won’t be applying the new regulations at all.

Still confusing: Many banks and payments firms put in a last minute plea to ask for a delay in the regulation because of the COVID-19 crisis. Though providers have known about this regulation since it was approved in December 2018, they still asked for more time. And with one week to go before implementation date, the European Commission reiterated the date and the importance of the regulation, but allowed regulators to delay enforcement. Sadly, this means that the implementation of the regulation will be unclear across the EU, with no end date in sight.

Please tell us when you see your bank or payment provider made any changes to international payments or when you see they haven’t. You can hold your bank to account. We will congratulate those who’ve fulfilled the spirit of the regulation by being fully transparent. And we will be in touch with those that haven’t improved their service. It’s only fair.

Join the fight: https://www.nothingtohidefoundation.org/#signup

Ask us any questions: contact@nothingtohidefoundation.org

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

We’re set to lose £215 billion to hidden fees this year alone. That's because today, banks and other providers are able to tell you your transfer is free, has...

From holidaymakers, students funding their student loans, people sending money to support loved ones back home, to small businesses working with overseas...

Chancellor of the Exchequer HM Treasury 1 Horse Guards Road London SW1A 2HQ Dear Chancellor, We are writing to you to take this opportunity to stop hidden...

£187 billion! That’s how much people and businesses lost to hidden fees in a single year.

Share your story with us. Why is sending money abroad important to you? How are hidden fees impacting you and your family? The International Day of Family...

Help change the law! Last year, when sending money abroad, British consumers and businesses lost £5.6 billion in fees. Is it bonkers? Yes! Is it surprising?...