We'll lose £215 billion to hidden fees unless we act

We’re set to lose £215 billion to hidden fees this year alone. That's because today, banks and other providers are able to tell you your transfer is free, has...

From holidaymakers, students funding their student loans, people sending money to support loved ones back home, to small businesses working with overseas suppliers, international payments are part of Europeans' lives.

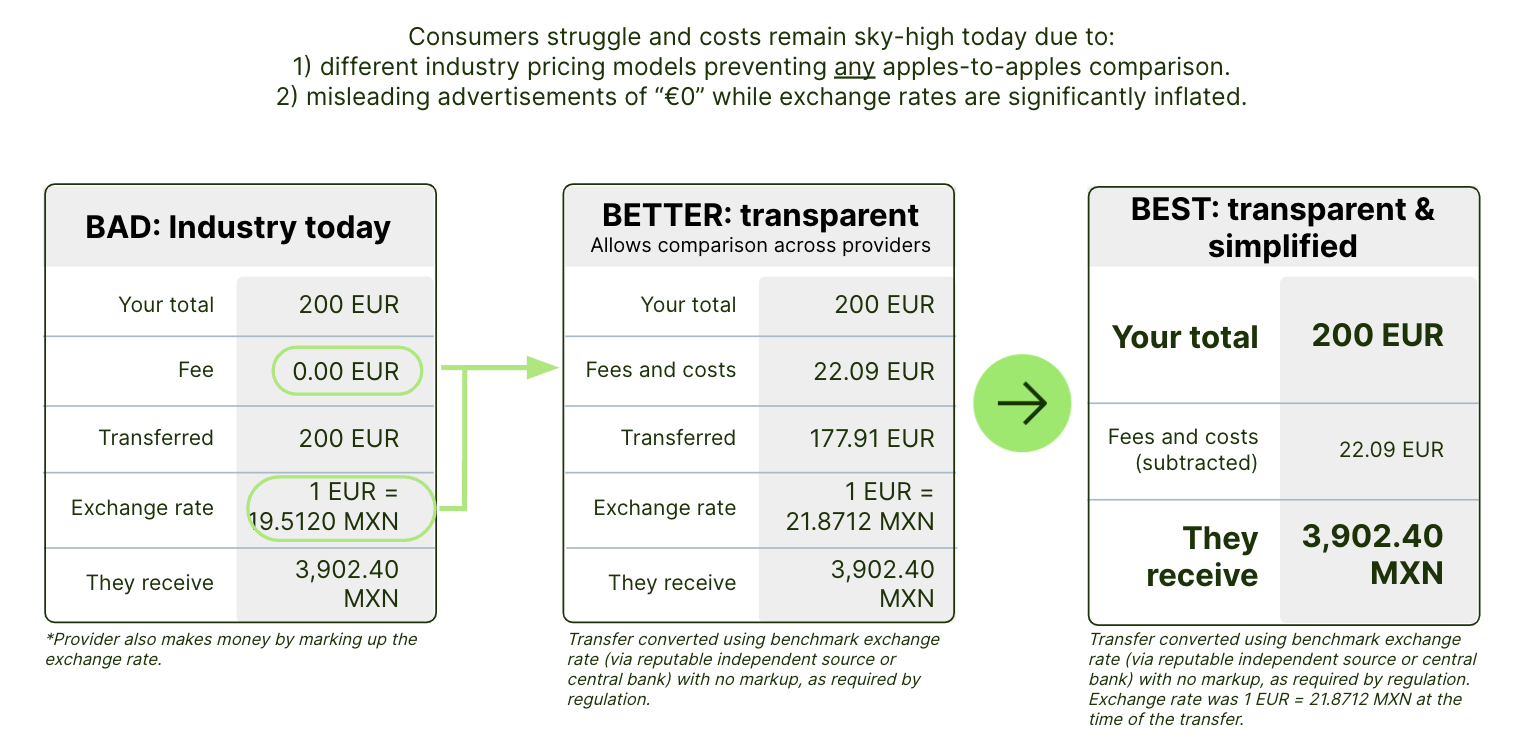

But most people and businesses are unaware of what they actually pay to send, spend or receive money internationally. That’s because financial providers can advertise “low fees” or “no fees”, but hide the bulk of the cost in an inflated exchange rate. For example, a provider can say transferring €1000 to Sweden costs €5, but they fail to disclose that there’s a 3% mark-up over the mid-market exchange rate, which means the cost is actually closer to €35 than to €5.

In 2020, the EU passed a law to stop these hidden fees for all payments within the EU, but unfortunately, this practice is still widespread.

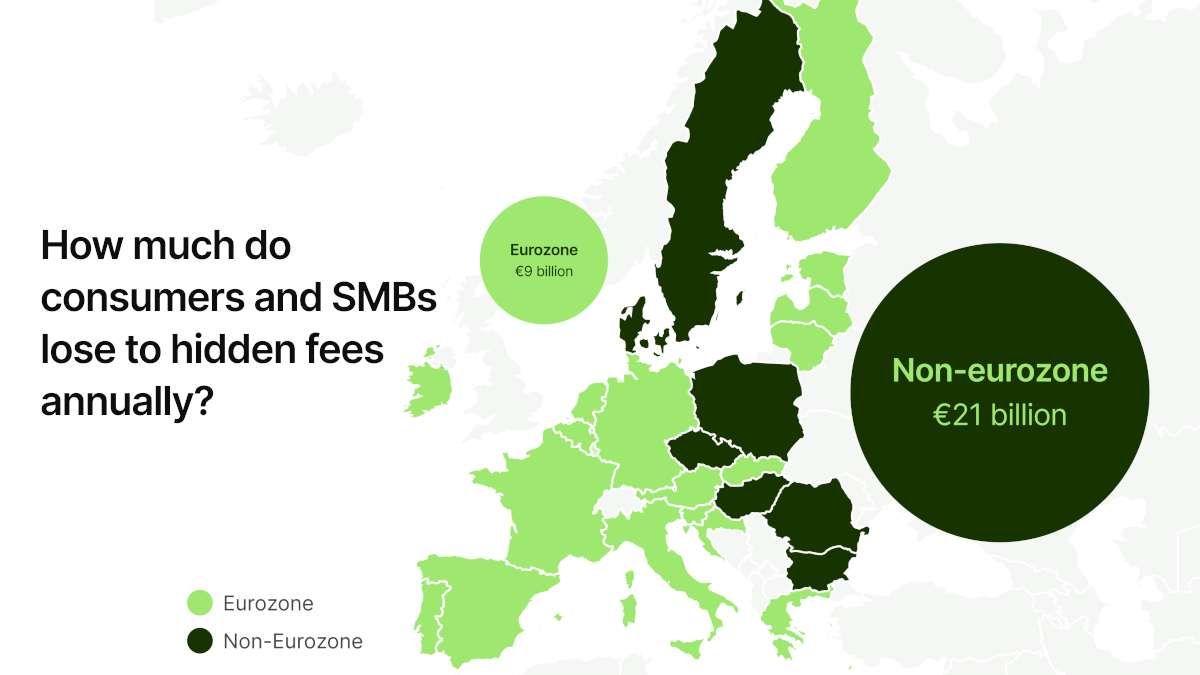

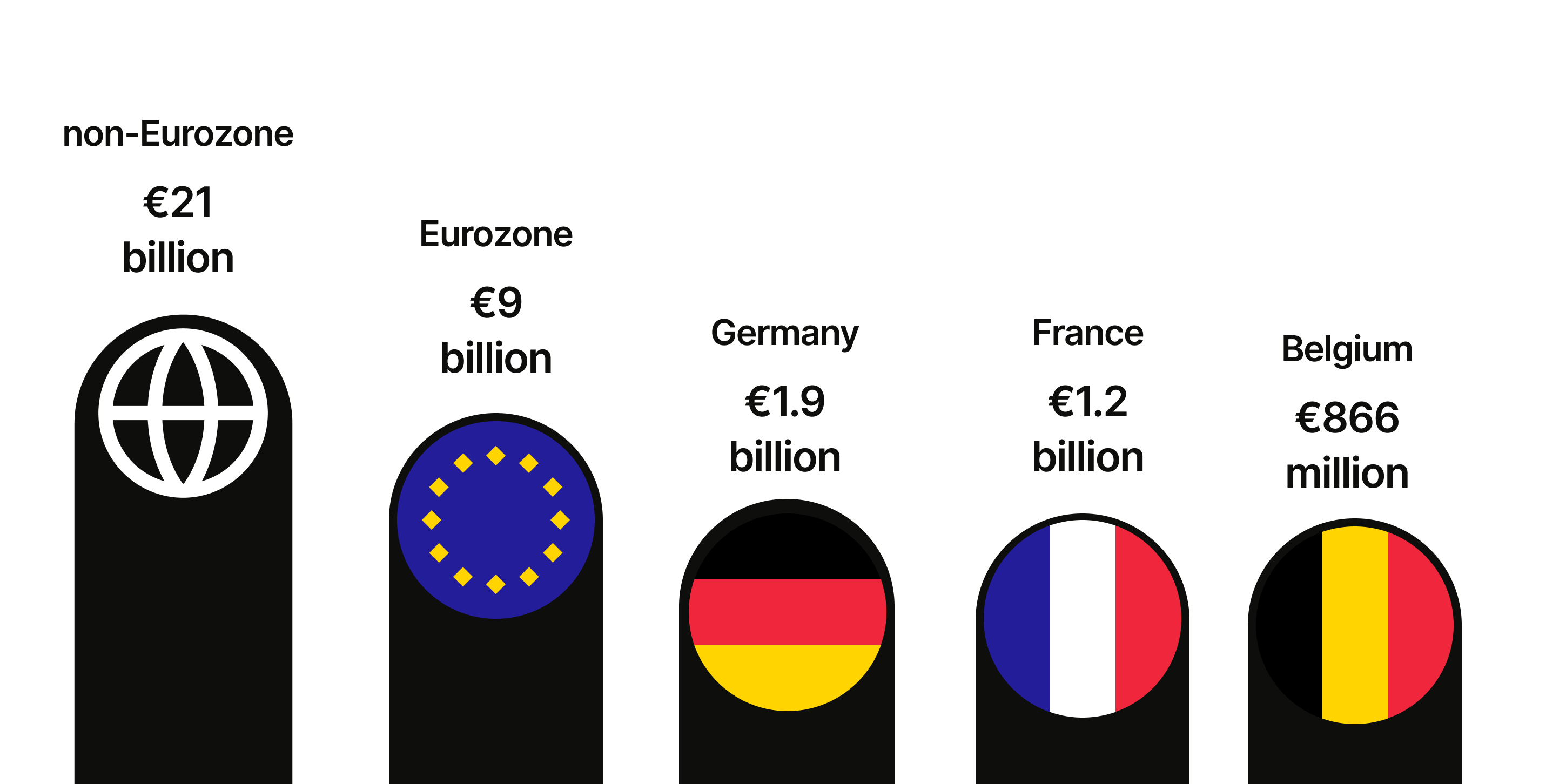

New independent research reveals that, in 2023 alone, consumers and SMBs in the European Union lost €30 billion to hidden fees in international payments.

€30 billion is a lot of money.

For European consumers, that’s money they could have spent on basic needs, savings or investment, especially in a high inflation environment.

Europe’s small and medium-sized businesses are hit the hardest by hidden fees. That money could have gone to hiring, product investment, marketing or rainy day savings.

European consumers and businesses deserve transparency. They have the right to know exactly how much they pay, compare providers and make an informed choice.

Hidden fees affect everyone in Europe.

The graph shows how much money do consumers and SMBs lose to hidden fees annually. Average prices in EUR. Checked in March, 2024. Source: Research conducted by Capital Economics. The Eurozone data includes Germany, France and Belgium.

The graph shows how much money do consumers and SMBs lose to hidden fees annually. Average prices in EUR. Checked in March, 2024. Source: Research conducted by Capital Economics. The Eurozone data includes Germany, France and Belgium.

Hidden fees are not a new topic.

The Revised Cross-Border Payments Regulation (CBPR2) was introduced in 2020 to give full price transparency to consumers sending cross-border payments within the EU. But loopholes in the text allowed providers to continue their unfair practices.

In 2023, the European Commission revealed new proposals for a Payment Services Regulation (PSR) to put an end to this issue. The PSR is going through the negotiating process right now.

To achieve true price transparency and comparability across providers, the regulation should require:

- All payment service providers to disclose their exchange rate mark-ups against a live, aggregated, neutral benchmark rate.

- The mark-ups and all fees to be clearly disclosed upfront.

Check if your bank is transparent in hidden fee reports for France, Germany, Belgium here

When in doubt, always make sure your provider is using the mid-market rate, the real rate set by the market. To see the current mid-market rate, and how it’s changed over the last 30 days, check out our rate tracker.

Here are the traps to look out for when converting your money:

Misleading pricing — You'll see an offer for a '0% fee', 'zero commission' or 'our best rates'*.

A set 'day rate' — Most providers take the mid-market rate, and apply a margin on top, without being transparent. So you have no idea how much they're over charging you.

An unfair deal on your currency — By hiding the real charge in the exchange rate offered, most providers make huge profits at your expense, and you're none the wiser.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

We’re set to lose £215 billion to hidden fees this year alone. That's because today, banks and other providers are able to tell you your transfer is free, has...

Chancellor of the Exchequer HM Treasury 1 Horse Guards Road London SW1A 2HQ Dear Chancellor, We are writing to you to take this opportunity to stop hidden...

£187 billion! That’s how much people and businesses lost to hidden fees in a single year.

Share your story with us. Why is sending money abroad important to you? How are hidden fees impacting you and your family? The International Day of Family...

Help change the law! Last year, when sending money abroad, British consumers and businesses lost £5.6 billion in fees. Is it bonkers? Yes! Is it surprising?...

There should be nothing to hide Sending money abroad is a big deal for people living international lives. You might be supporting your family, planning your...