We'll lose £215 billion to hidden fees unless we act

We’re set to lose £215 billion to hidden fees this year alone. That's because today, banks and other providers are able to tell you your transfer is free, has...

Just before Christmas you may have been sent a message from your bank saying they won’t be charging you for making euro payments from non-euro countries like the UK. That there’s no longer a fee for making a payment in Europe. (They’re still planning on charging you for non-euro payments outside the EU…)

Some example bank messages

Natwest UK Customer email, 13 December 2019

Metro Bank customer email, 22 November 2019

So that means it’s free, or at least much cheaper, right?

Well, no.

New EU rules require all cross-border payments in euro in non-eurozone EEA countries - Bulgaria, Croatia, Czechia, Denmark, Hungary, Iceland, Liechtenstein, Norway, Poland, Romania, Sweden, United Kingdom* - to be priced the same as domestic payments. This regulation (the extension of the Cross-Border Payments Regulation, CBPR2) means cross-border euro payments will incur very low or even zero fees. The reality is there is still a cost.

The extension of the Cross-Border Payments Regulation (CBPR2) is signed into European law, 19 March 2019. Photo courtesy of European Parliament Rapporteur Eva Maydell MEP

Despite the regulation requiring equal fees with domestic payments, banks and other providers will still be able to charge you for currency conversion. And unlike Wise, which charges you upfront for currency conversion through a clear fee, banks are going to continue to hide it inside their sneaky exchange rate mark-ups.

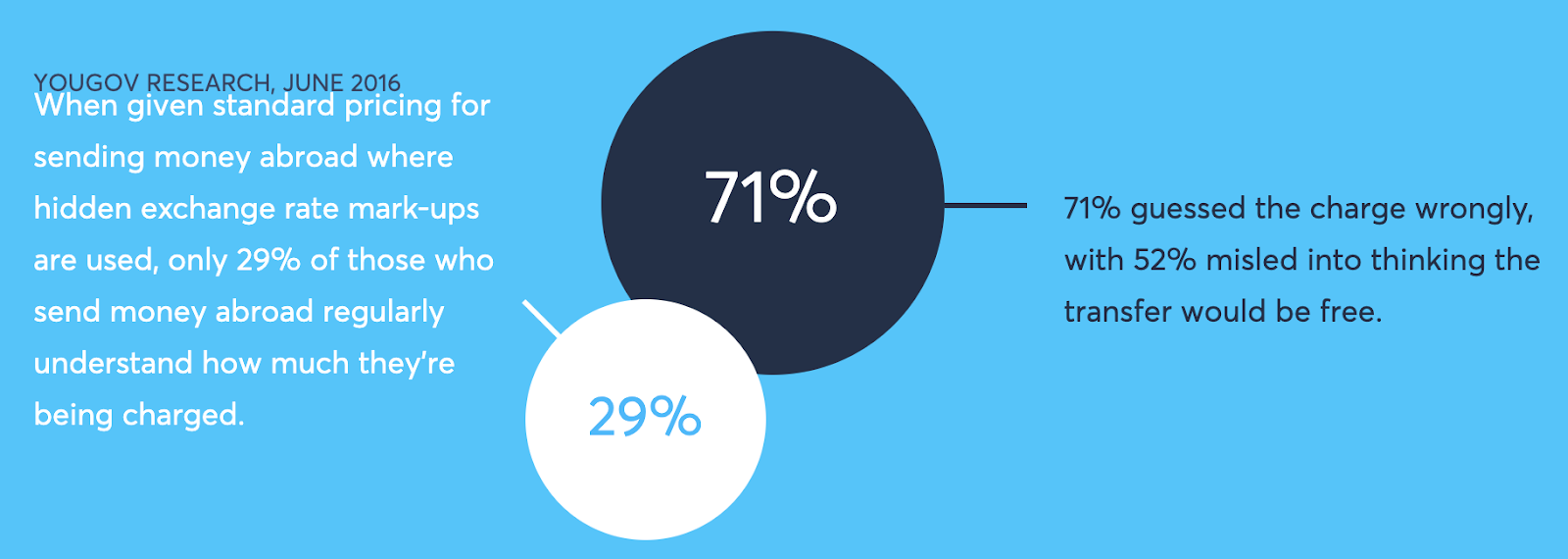

Why are they sneaky? For most of us exchange rate margins are much harder to understand.

Source: Stophiddenfees.co.uk

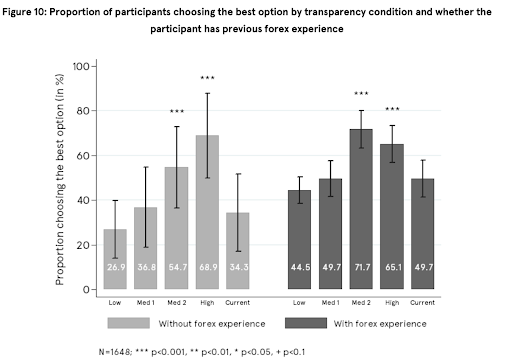

Next April the part of the CBPR2 regulation that will really make a difference, comes into force. From 19 April 2020 banks and brokers will need to show the total cost (any fees plus the exchange rate margin quantified as one single currency amount) of making a cross-border payment from one account to another.

This is the proven measure from UK Government research that will mean many more consumers are able to make better choices about which provider to use.

The impact of improved transparency of foreign money transfers for consumers and SMEs, The Behavioural Insights Team, 21 March 2018.

There will also be an additional measure to make card payments more transparent and comparable.

However, there is an effort from industry to water down these provisions. Some providers may try and calculate from a worse exchange rate, not the real exchange rate on the day. We’re working hard to make sure that it is implemented properly. If you want to join our campaign, please sign up here.

Wise makes it easy to manage your money across borders and across currencies. Whenever you convert your money, we display all of our charges upfront as a fee with nothing hidden in the exchange rate.

However, sometimes our customers are making payments from and to the same currency - this would be “an equivalent domestic payment”. We looked at our payment costs in Europe, and unlike most banks we charge a fair up-front low cost for domestic transactions. A Bulgarian consumer who decides to send euros to their friend in France pays the same fee with Transferwise as for a bank transfer in lev, within Bulgaria. At no point would it be more expensive to make a euro payment in the non-euro zone than an equivalent domestic payment.

If you want to know more about this regulation, our transparency campaign, and how to make sure banks and brokers implement the regulation properly, sign up to our mailing list.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

We’re set to lose £215 billion to hidden fees this year alone. That's because today, banks and other providers are able to tell you your transfer is free, has...

From holidaymakers, students funding their student loans, people sending money to support loved ones back home, to small businesses working with overseas...

Chancellor of the Exchequer HM Treasury 1 Horse Guards Road London SW1A 2HQ Dear Chancellor, We are writing to you to take this opportunity to stop hidden...

£187 billion! That’s how much people and businesses lost to hidden fees in a single year.

Share your story with us. Why is sending money abroad important to you? How are hidden fees impacting you and your family? The International Day of Family...

Help change the law! Last year, when sending money abroad, British consumers and businesses lost £5.6 billion in fees. Is it bonkers? Yes! Is it surprising?...