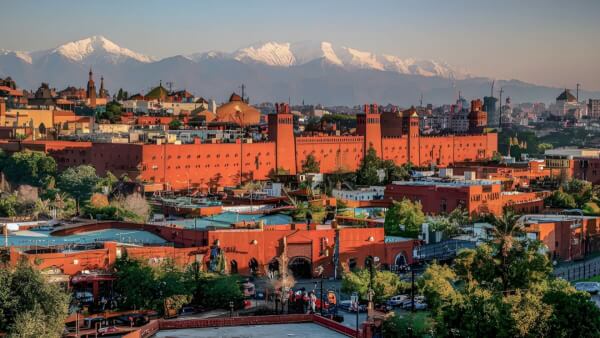

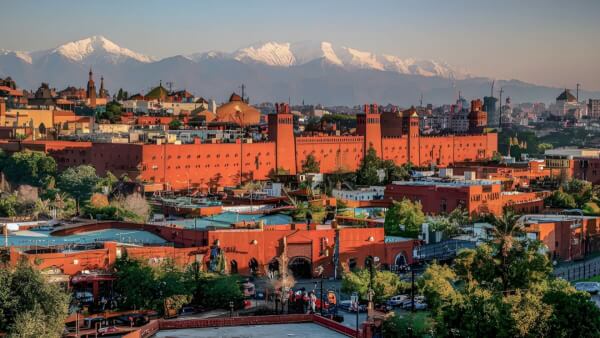

Morocco tourist tax: What you need to know in 2025

Travelling to Morocco soon? Find out everything about the tourist tax in Morocco and essential travel tips.

Holidaying in Morocco this year? Before you jet off from the UK, you might want to do some research into the best and cheapest way to spend in Moroccan dirham (MAD).

Revolut is one option for spending internationally, particularly in Europe. But the big question is - does it work in Morocco?

Read on for a handy guide on using Revolut in Morocco, including whether spending in MAD is supported by the money app. We’ll also give you the lowdown on fees for using your Revolut card in Morocco.

And while you’re comparing travel spending solutions, make sure to check out the Wise card from the money services provider Wise.

You can use it for purchases and ATM withdrawals in 150+ destinations worldwide, including Morocco. It automatically converts your money to the local currency at the mid-market exchange rate whenever you spend*.

Yes, you can use both your Revolut account and card in Morocco.

You can convert and hold Moroccan dirham in your Revolut balance, managed through the Revolut app.¹ This means you can convert some GBP to MAD before your trip, if you want to.

And you should be able to use your Revolut card anywhere in Morocco where Visa and Mastercard are accepted. This includes shops, cafes, restaurants, bars rail stations, airports, hotels and ATMs.

Revolut does support the Moroccan dirham (MAD).² This means you can spend in MAD using your Revolut card, just like a Moroccan local.

You can also withdraw cash in the currency from ATMs all over the country. Whether spending or withdrawing money, the card will automatically convert the currency for you.

Revolut cards don’t charge foreign transaction fees for spending and cash withdrawals overseas, unlike some banks.

But there are some situations in which you may be charged a fee. Key examples include carrying out transactions in a different currency (requiring a currency conversion) on weekends, and withdrawing more than £200 from an overseas ATM within a month.

Below are the Revolut card fees you need to know about, based on the free Standard plan:

| Transaction | Revolut fee |

|---|---|

| Additional merchant surcharge fees (for paying by card) | Set by the merchant (if applicable) |

| Currency exchange transactions above £1,000 a month | 1%³ |

| Currency exchanges on weekends | 1%³ |

| ATM withdrawals over £200 (or more than 5 withdrawals) | 2% (min. £1)⁴ |

As well as looking at the fees, it’s also useful to know about Revolut’s exchange rates. This can affect the total cost of spending abroad just as much as the fee, if not more.

Revolut offers competitive exchange rates for currency conversions. Many are often at the mid-market exchange rate or close to it.

However, there are some occasions when the money app will add some extra fees to this rate.

For example, if you pay for something in a different currency to your Revolut balance at a weekend, you’ll be charged a 1% fee.³ You can get round this though by converting GBP or another currency to MAD in advance, making sure it’s on a weekday when this fee doesn’t apply.

There’s also a 1% fee if you convert more than the fair usage limit for your Revolut plan. This is £1,000 within a 30-day period for the Standard plan.³

Planning on staying in Morocco for a while? Perhaps you’re working, studying or visiting family. In any of these circumstances, it could make sense to open a local account there.

Unfortunately though, you won’t be able to open a Revolut account in Morocco. It doesn’t currently offer accounts and cards to customers living in the country.⁵

You can still use your UK-issued Revolut card there, and you can use Revolut to send money from the UK to Morocco.

Want a great exchange rate all the time, not just on weekdays?

Get yourself a Wise card and you can spend at the mid-market rate in 150+ countries, whenever you want.

Open a Wise account online and you can get a Wise card for a one-time cost of just £7. Your card automatically converts currency whenever you spend, so you don’t need to worry about preloading your account or converting cash. There’s only a small conversion fee* to pay.

And if you need cash, your Wise card has you covered. You can withdraw up to £200 a month (max 2 withdrawals) from ATMs in Morocco for free (although double-check that the ATM operator doesn’t charge its own fee).

Sources used:

Sources last checked on date: 29-Jul-2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Travelling to Morocco soon? Find out everything about the tourist tax in Morocco and essential travel tips.

How much money can you take to Morocco? Read this handy guide for info on the rules for taking cash in and out of Morocco.

Should you pay with cash or card in Morocco? A handy guide including cash etiquette, Moroccan ATMs and using your UK card.

What is the best currency to take to Morocco? Read our guide on currency in Morocco, accepted payment methods and more.

Check out our in-depth guide on everything you need to know about buying a prepaid Morocco SIM card, including different providers, pricing, and features.

Check out our handy guide to using PayPal in Morocco, including what fees you can expect.