ATMs in Pakistan: locations, fees, and tips

Read our essential guide to ATMs in Pakistan, including how to find them, fees, exchange rates, withdrawal limits and more.

Travelling to Pakistan any time soon? Perhaps you’re visiting friends or family, or spending time there as a tourist. You might even be working or studying there.

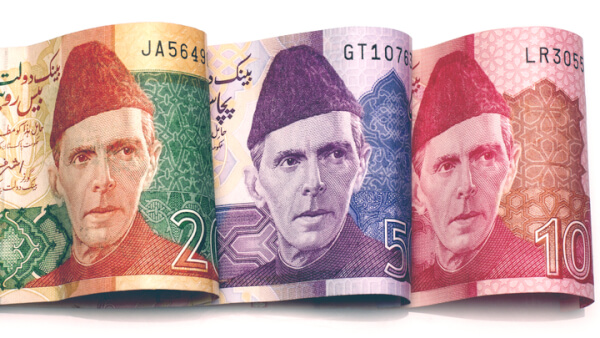

Whatever the reason for your trip, you’ll need to find a convenient and low cost way to spend in the local currency - Pakistani rupee (PKR).

The Wise card could be the ideal solution, as it lets you spend like a local in 160+ countries. But does it work in Pakistan? Find out everything you need to know here in this handy guide.

Please see the Terms of Use for your region.

Yes, the Wise card works in Pakistan* and in 160+ countries worldwide. You can use it wherever Visa and Mastercard payments are accepted. This includes shops, restaurants, transport hubs and online too.

*If your card was issued in the US and you're a personal or business customer, it won’t work in Pakistan

It’s another yes, as the Wise card does support spending in Pakistani rupees. What’s more, you can also hold a balance in PKR in your Wise account. This gives you a couple of different options for spending.

You can either spend as you go, and Wise will automatically convert the currency from PKR into your home currency balance (e.g. GBP) using the mid-market exchange rate.

Alternatively, you can convert the currency in advance. Choose how much you want to spend and convert between GBP and PKR in your online Wise account. You’ll get the same great exchange rate. Then you can spend in Pakistan and the funds will come from this currency balance.

This might be a good option if you want to keep a close eye on your spending during your trip.

So, how much will it cost to use your Wise card in Pakistan? There’s a one-time fee of just £7 to get the Wise card, available to order once you’ve opened your free Wise account. There are no monthly fees after that.

And as for spending, Wise charges no foreign transaction fees when you use the card abroad. There’s just a small fee to convert the currency, and you can always check this at any time on the Wise website or in the app.

What’s more, you can withdraw up to £200 (or the currency equivalent) a month from ATMs in Pakistan with no fee from Wise. There’s a maximum of 2 withdrawals. After you’ve reached this limit, a fee of 1.75% + £0.50 will apply. But that should keep you in travel cash when you need it.

One of the main benefits of using the Wise card for travel spending is the exchange rate. Wise uses the mid-market exchange rate, which is free of the extra mark-ups and hidden costs that banks and other providers tend to use. It means that you get more Pakistani rupees for your pounds.

Please see the Terms of Use for your region or visit Wise fees & pricing for the most up-to-date information on pricing and fees.

So, is the Wise card good for spending in Pakistan? Absolutely, as you can hold a balance in Pakistani rupees and spend in the currency just like a local (unless your card was issued in the US). Wise charges no foreign transaction fees, and only a low, transparent fee for currency conversion.

But the real game-changer is that exchange rate, as Wise only ever uses the mid-market exchange rate with no margin, mark-up or hidden fees. It makes your hard-earned travel budget go much further.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Read our essential guide to ATMs in Pakistan, including how to find them, fees, exchange rates, withdrawal limits and more.

Check out our in-depth guide on everything you need to know about buying a prepaid Pakistan SIM card, including different providers, pricing, and features.

While Pakistan is often avoided because of political instability, a trip to this South Asian jewel will offer a different insight to that shown in the media....