Should Expenses be Paid Through Payroll?

Discover if expenses should be paid through payroll, with pros, cons and directions from HRMC.

If you’re looking to buy commercial property for the first time, you probably have tons of questions. Are there specific things to think about before beginning your search? How do you go about putting in an offer? We’ll cover it all right here in our handy guide.

| Want to save money when you buy properties abroad? Find out how |

|---|

The first thing to do is to spend some time building a clear idea of what you need from a property and how much you can invest. Make yourself a list of requirements, by considering the following:

1. Type of property you require. This is often industry and business-needs dependent, but broadly falls into the following categories: retail, offices, leisure or industrial.

2. Freehold or leasehold. As the owner of the freehold, you own the property outright and can do as you see fit. But if you buy the leasehold, you’re renting the property from a landlord for an agreed length of time. There are pros and cons for each, so weigh these up carefully.

3. Property size. Ask yourself about the storage you need, what customer footfall and staff numbers you expect, and how much space you can manage on your budget. Does your business require outdoor areas and if so, how large should they be? This should give you an idea of your minimum space requirements.

4. Location. There are several key things to think about here depending on your business, e.g. how busy is the area and will it attract customers? Is it conveniently located for staff and customers?

5. Cost. Look at the sold prices in the local area for the type of property you’re looking for. If you need a loan for your property purchase, you’ll likely want to compare commercial mortgages as these tend to offer better interest rates than regular business loans.

Commercial mortgages usually last from 3-25 years¹. Consulting a mortgage broker can help you to find the best loan to value (LTV) ratio. You’ll usually find a maximum LTV of 70-80% for an owner-occupied mortgage or 75% for commercial investment. So, expect to need a deposit somewhere in the region of 20% and 40%².

6. Additional costs. For example, UK stamp duty land tax, conveyancing fees, mortgage broker fees, insurance, refurbishment, and costs of fixtures/fittings.

Now you’ve thought about your options and drawn up a list of your requirements, you’re ready to start looking for a new home for your business. To keep things simple, begin by using one of the popular online property listings websites, such as Zoopla or Rightmove. The commercial pages on these websites let you filter by property type, price range and location, just like when house hunting. You can also check property listings in newspapers.

If you’re interested in buying overseas, then Rightmove and Zoopla also have listings for commercial property in different countries.

As well as carrying out your own searches, it’s useful to speak to estate agents with experience in the commercial property market, who may be able to point you towards suitable premises. You’re also bound to have lots of questions, so seek out their expertise to help you.

Once you’ve found a property, don’t be tempted to put the offer in too soon. Instead, visit it several times to make sure you give it a thorough evaluation.

You’ll need to make it in writing to the agency with which the property is listed. If your initial offer isn’t acceptable to the vendor, it’s worth negotiating to try and agree on a price. Once your offer is accepted, you can request the vendor take the property off the market.

At this stage you’ll need legal assistance to carry out the conveyancing process. Enlist a commercial conveyancing solicitor who will commission searches and draw up the contract.

It’s highly recommended you get surveys done at this point. This is to reduce the risk of potentially expensive or disruptive problems further down the line. A Buildings Survey³ looks at the structure of the property, while a Local Authority Search¹ checks any planning applications or other potential impacts from the wider area.

You’ll need comprehensive business buildings insurance in place when you exchange contracts. To get the best cover at the best price, compare quotes from a range of insurance companies.

When you have your finances in place, and all surveys have come back, your solicitor will send you the contract to sign. Once contracts have been exchanged, a completion date will be agreed between all parties. On the completion date, your solicitor will transfer the funds for the property purchase, and you’ll get the keys to your brand new premises.

Buying a commercial property means high value transactions and if your funds will be coming from overseas, you could lose over 4% on international fees using traditional methods like banks.

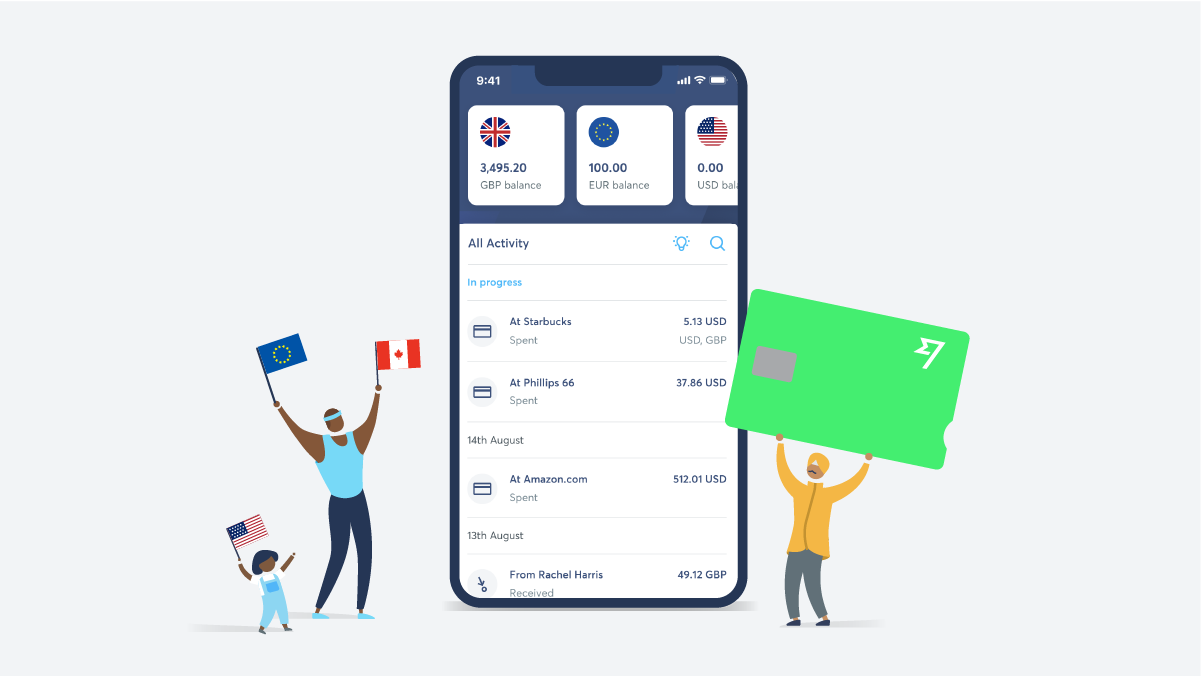

To reduce the cost, transfer money through Wise account and you can securely purchase across international borders for low, transparent fees.

Better still, you’ll get the mid-market exchange rate, without the mark-up banks usually add on top. This could save you a small fortune on currency conversion costs, especially for high value property purchases.

You can also take advantage of all the money saving features of Wise for Business like the multi-currency account and debit card as well direct debit for recurring payments. With this powerful payment technology, you could pay your vendors, suppliers and employees abroad cheaper and faster than traditional banks.

So, those are all the essentials covered for buying a commercial property in the UK. Remember, take your time figuring out what you really want and seek expert advice if you need it. It’s easy to get carried away, but this will help you avoid regrets and get the best out of your property purchase. Best of luck finding your new premises!

Sources used for this article:

Sources checked on 17-May-2021.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Discover if expenses should be paid through payroll, with pros, cons and directions from HRMC.

Discover the best practices when setting up per diem expenses, how to set up rate, proceed with payment and more.

We’re excited to announce that Morgan Stanley, a leading global financial services firm, has teamed up with Wise Platform, Wise’s global payments...

Discover how to automate expense reporting with our complete guide that covers step-by-step process, tools and best practices.

Travel and expense (T&E) processes are necessary in any business in which employees may spend on allowable business expenses, which need to be recorded,...

Discover the 6 best reconciliation tools available for businesses in the UK.