Stop typing, start uploading — your shortcut for adding new recipients

Paying someone new? Don’t waste time typing out their bank details or double-checking their IBAN. Upload a screenshot or invoice instead. Our new AI feature...

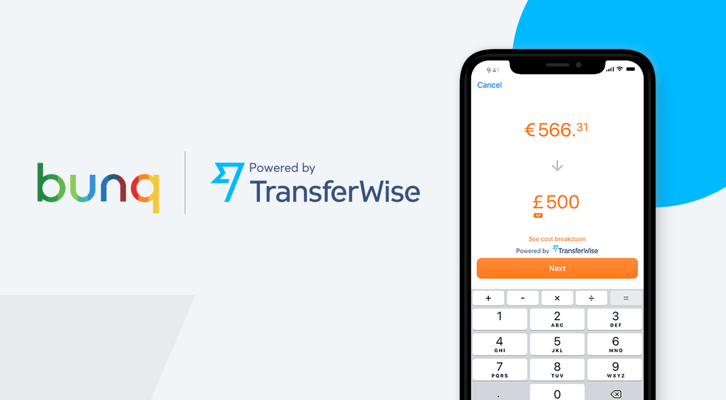

TransferWise are very happy to announce a new partnership with Amsterdam-based challenger bank bunq.

bunq have joined the growing number of banks integrating with TransferWise to offer fast, low-cost international payments to their personal and business users — from within the bunq app.

Like TransferWise, bunq is dedicated to giving people and businesses a transparent, low-cost, and convenient banking experience. And by building on the TransferWise API, bunq were able to launch international transfers in just 7 weeks.

bunq users can now send money around the world at the real exchange rate, and pay only the standard, low-cost TransferWise fees. At launch, bunq users can send money to 15 currencies, with more currencies and one-click business sign-up coming soon.

bunq and TransferWise are both on the new, instant SEPA payment system. So from your bunq app, you’ll be getting our fastest ever Euro bank transfer funding. For instance, a EUR to GBP transfer doesn’t take days — it takes minutes. In the future, it should only take a few seconds.

Most people and businesses have their money in their bank. It’s a natural place to go if you need to make international bank transfers. But unfortunately, sending money through your bank can be slow and expensive.

It starts to get interesting if you can use TransferWise with your bank. You get all the convenience of sending money direct from your banking app, and a seamlessly-created TransferWise account that’s already verified. Plus, payments come straight from your bank balance. On top of that, you get the fast, low-cost international transfers that TransferWise customers love — with transparent pricing and clear delivery estimates.

This doesn’t just make sense to challenger banks. BPCE, the second largest banking group in France, have also already started integrating with TransferWise to replace their current experience. The TransferWise platform is becoming the new standard for how cross-border payments should work. And with our API now open to business and banks, we’re humbled and excited to see how it can reach ever more people.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Paying someone new? Don’t waste time typing out their bank details or double-checking their IBAN. Upload a screenshot or invoice instead. Our new AI feature...

We're thrilled to introduce a powerful new feature designed to save you time and eliminate the frustration of manual data entry when sending money. Now,...

The new Wise Card is here! 🇧🇷

We have great news for our customers in Brazil! You can now set up your own Pix key directly in the Wise app

Welcome to the Wise Partner Program! In this guide, you will find all the information you need to get started, optimize and succeed as a Wise partner. Simply...

From time to time, you might make a purchase with your Wise card and run into an issue — maybe something you bought didn’t arrive, wasn’t as described, or you...