2025 Update: Wise’s commitment to improving diversity, equity and inclusion for women in tech

At Wise, our vision is money without borders. In order to build the future of global money, we need a team that’s as diverse as the customers we...

Make sure your bank is respecting your rights.

Today, your rights to transparent cross-border payments are protected under EU law. Pretty cool, right?

The problem is, some banks still aren’t playing by the rules, exploiting the fact that most EU consumers aren’t aware of their rights which came into force last April.

We love transparency. Especially when it’s required by law.

We spent a lot of time a few years ago talking about the Cross Border Payments Regulation 2 (CBPR2). These new rules require providers to show you ‘all currency conversion charges’ (a.k.a. any transaction fees and the exchange rate mark-up) before you make a cross-border payment. The goal is to increase transparency for consumers making cross-border payments between EU countries, for example sending money from Belgium to Hungary.

A short Belgian story.

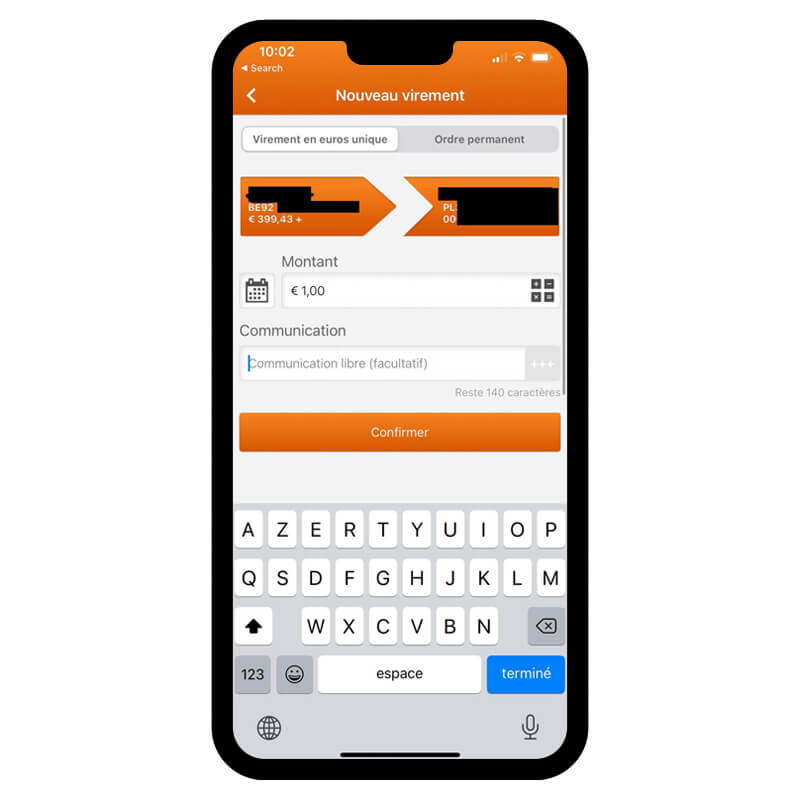

As an expat living in Belgium, I decided to check my Belgian bank, Belfius, to see whether they’ve implemented the new rules. I tried to set up a cross-border transfer from euros to Hungarian forint, but the app defaulted me to only send euros. So it’s unclear what happens to the money on the other side - will the receiving bank convert the money?

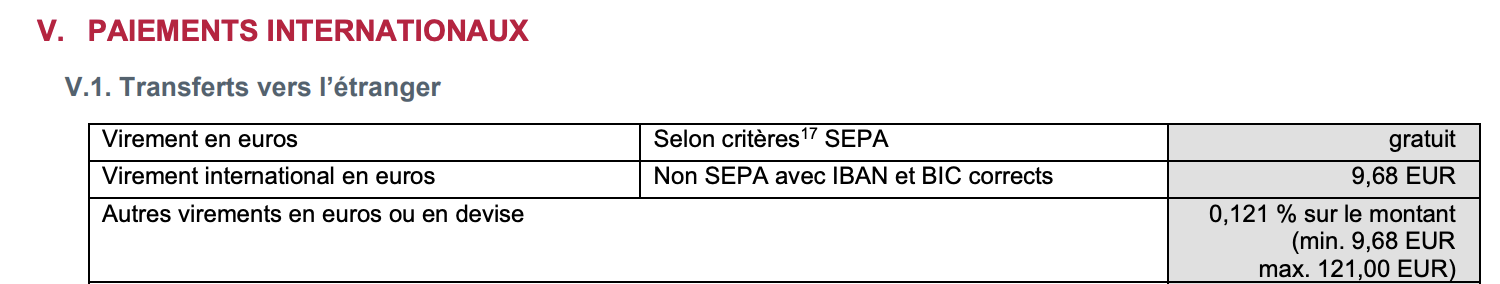

The only information I could find about this type of transfer was in this fees document via their customer service page. So, sending 10 euros to forint would cost: 9.68 euros so 19.68 euros total? I think.

It’s safe to say that understanding how much it costs to make a cross-border payment is not clear or comprehensible - as the law requires.

...And while they’re one of the worst offenders, it looks like they’re not the only ones.

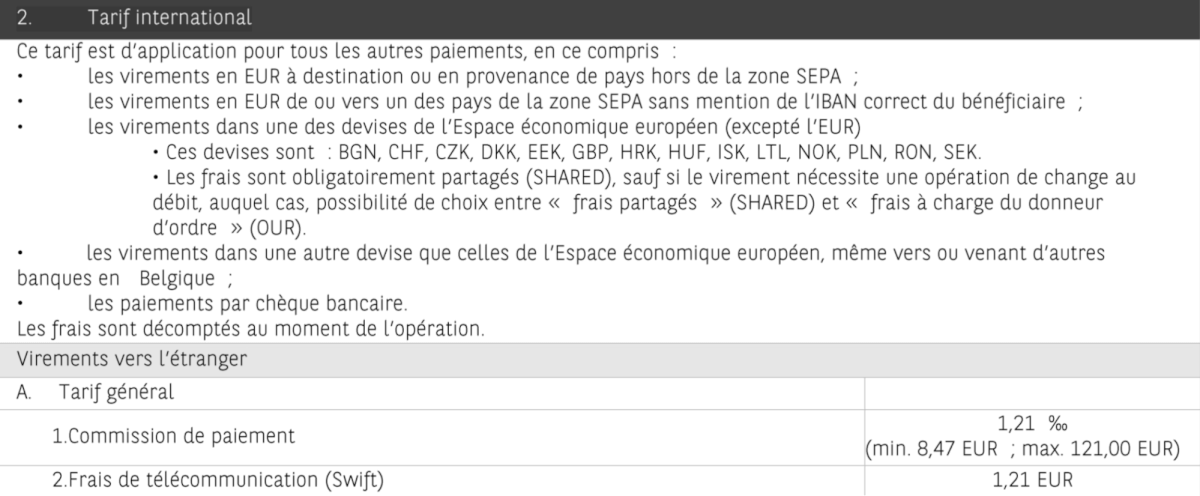

BNP Paribas Fortis

While BNP does show transaction fees (a good first step), at no point do they give you a confirmed exchange rate, even after the payment. If you want to know the fees you’ll pay, you have to use the details within their list of fees and - once again - do the math yourself… huh?

Navigating a 25-page document instead of just showing their fees transparently, up front, is not providing consumers the transparency they deserve.

ING

Similar to BNP, ING shows you some fees before making the payment. But again, they only give you an estimated exchange rate - meaning you’ll only see how much you paid after the payment. This means consumers still won’t understand how much it will cost them before making the payment, required by the law.

And if you’re a small business, forget transparency. With an ING business account, you won’t see any fee information prior to making a cross-border payment. This isn’t right. Both consumers AND businesses deserve to understand the fees they’re paying - especially during an economic crisis.

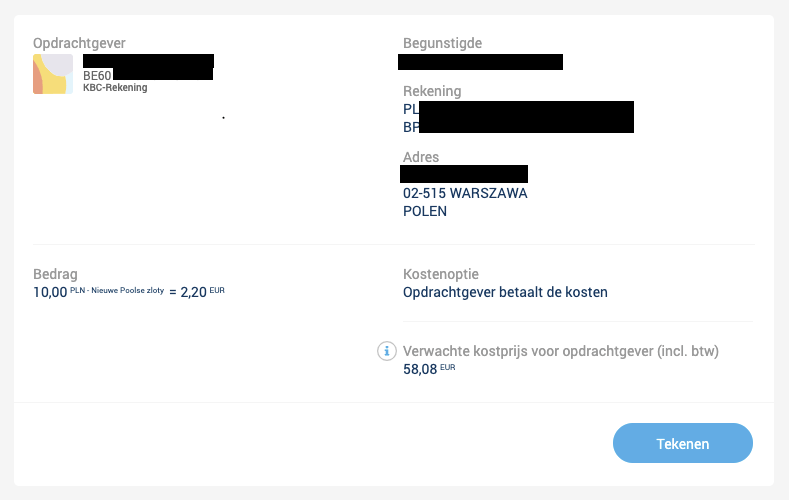

KBC

On a brighter note, KBC does show you their fees - well done! Their fully transparent approach fulfils the spirit of the law, and ensures consumers understand the total cost of what they’re paying, before making the payment.

We’re excited to see KBC leading the way in Belgium when it comes to transparency. Now we just need all Belgian banks to get on board!

And thanks to this transparency, you can now clearly see their fees are exorbitant: you’ll pay a whopping 58 euros to send a 10 zloty transfer to Poland. Ouch.

So, it shouldn’t come at a surprise that other banks are bending the rules - or not following them at all. Their fees are high - really high. So if they can continue being sneaky, they will.

Europeans lose €12.5 billion annually when sending or spending money abroad. Increased transparency should lower this amount, but if banks aren’t being held accountable, nothing will change.

What can I do about it?

If you live in Belgium or have a Belgian bank account, check your bank to see if they’re following the rules and telling you how much you’ll pay for your cross-border payment. If they’re not following the rules, submit a complaint to the Meldpunt. Here’s how.

Join our cause to spread the word and make sure we hold banks accountable and get EU rules enforced across the continent.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

At Wise, our vision is money without borders. In order to build the future of global money, we need a team that’s as diverse as the customers we...

Paying someone new? Don’t waste time typing out their bank details or double-checking their IBAN. Upload a screenshot or invoice instead. Our new AI feature...

We're thrilled to introduce a powerful new feature designed to save you time and eliminate the frustration of manual data entry when sending money. Now,...

The new Wise Card is here! 🇧🇷

We have great news for our customers in Brazil! You can now set up your own Pix key directly in the Wise app

Welcome to the Wise Partner Program! In this guide, you will find all the information you need to get started, optimize and succeed as a Wise partner. Simply...