Stop typing, start uploading — your shortcut for adding new recipients

Paying someone new? Don’t waste time typing out their bank details or double-checking their IBAN. Upload a screenshot or invoice instead. Our new AI feature...

In September, we’re taking another step closer to Mission Zero.

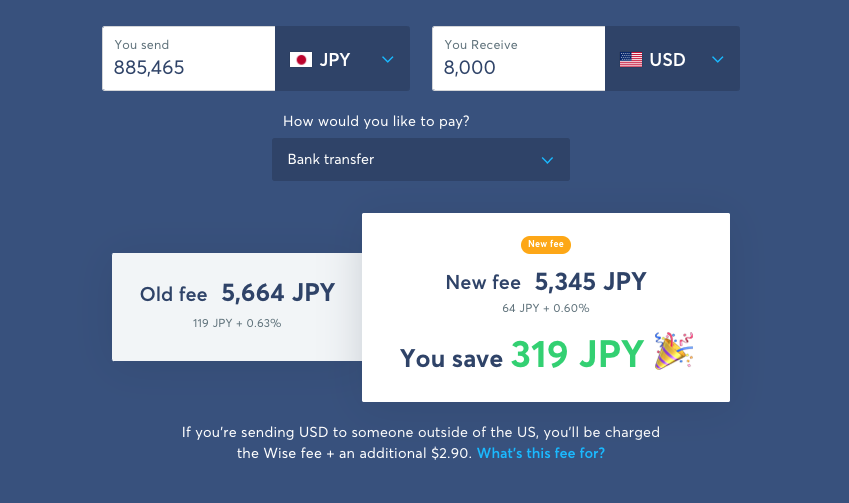

That's because, we've been able to drop price on many of our routes — when and where we managed to reduce some of our running costs — and pass those savings on to you.

So, depending on your currency route, sending the equivalent of £1,000 could be cheaper by -6% — or even -50%, in some cases. Overall, 1 in every 4 pounds sent with Wise (26% to be exact) will cost customers less than it used to.

You can check our pricing page to see exactly how the changes will benefit your next transfer… but here's an example of what this price drop means:

When improvements make our product run more efficiently and reduce some of our operational costs, we’re able to pass on savings back to our customers via cheaper transfers.

But what exactly helped us make transfers cheaper?

We're managing our foreign exchange risk better.

At Wise, we offer our customers a guaranteed fixed, mid-market rate.

We do this because we believe it’s the best experience for our customers, i.e. they pay and get the same amounts as they saw when they first started their transfer with us.

However, that also means we’re exposed to the risk of exchange rate fluctuations - from when you send money, until the moment the funds arrive in our accounts. This period may take from a few seconds up to multiple days (e.g. a transfer set up over a bank holiday). And sometimes, the value of the funds is smaller than we’d initially expected by the time we get them.

While banks and other providers tend to add markups to the exchange rate to protect themselves from this risk (and to make a bit of profit), we believe in transparency — and offering the mid-market rate is the most transparent way to operate.

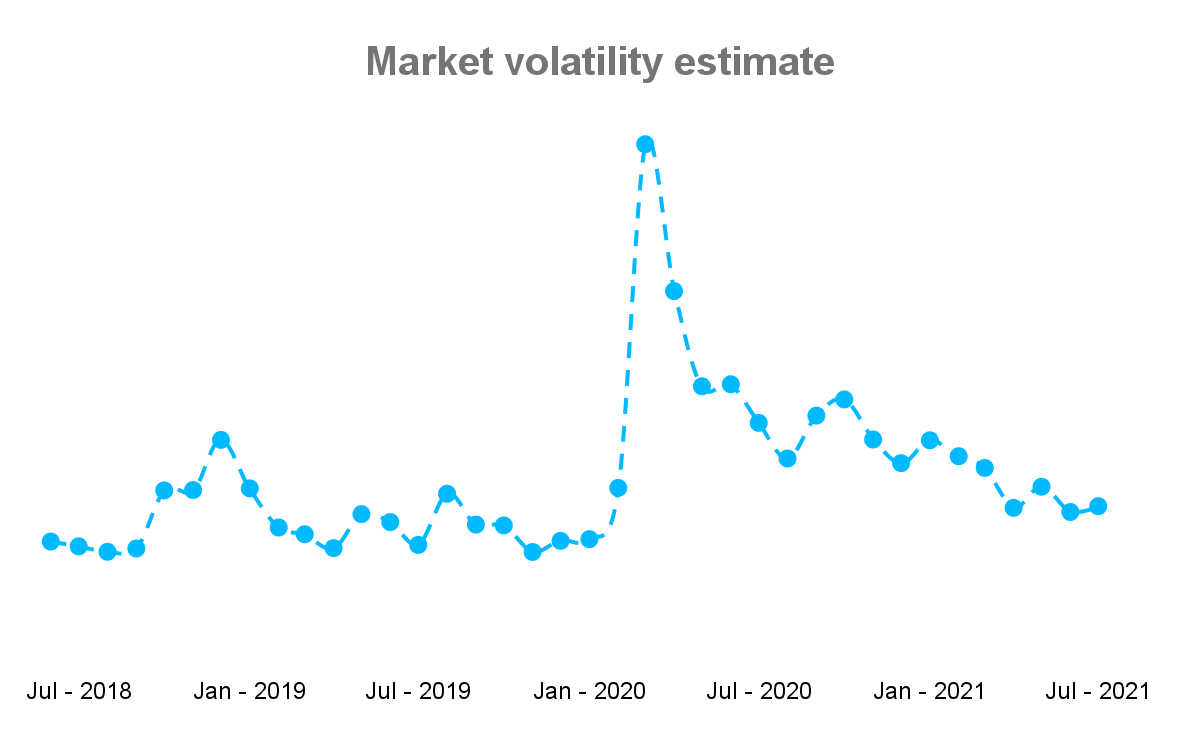

Since the beginning of the Covid pandemic, there’s been extreme volatility in foreign exchange markets, peaking in March and April 2020 and gradually returning to pre-covid levels in May 2021.

Unsurprisingly, during this period - we saw banks increase their fees; to help cover the cost of the risk. Through this period we saw banks increase their fees (known as spreads) by up to 5 times more.

In the last 4 months, we saw markets stabilising in comparison to the peak of the pandemic and our risk related costs have gone down respectively. Additionally, these costs are now 15% lower than before the volatility began thanks to improvements in our risk management systems. On top of that, we’re serving more customers and more payments, which also helped us scale costs.

As is often the case, there is never one single change behind prices dropping. Rather those savings are a result of incremental progress from many different areas and result of efforts from different teams.

Speedier transfers also made things cheaper

Surprisingly, making transfer payments faster also makes them cheaper.

As some of you may have noticed, we’ve shortened fixed rate guarantees for some currencies. We set this period based on how long it takes 95% of our customers to fund their transfers. For example in the UK with faster payments this is a matter of hours, in the US this could take days.

This change has meant that we’ll no longer bear the disproportionate costs of very slow transfers — which was bringing the price of other transfers up.

So, in a nutshell, funding your transfers directly from your Wise account balance makes the payment of your transfer not only faster but also cheaper. Not just for you, but for everybody as it helps us to manage our FX risks even better. That’s because when your money is already on your balance, with us, we can fund your transfer instantly. And, down the line, this is what will enable us to continue lowering our fees for more and more people.

More customers help us scale costs

Lastly, as more of you send money with Wise, our volumes have grown. Meaning, we now have greater volume to spread our risks over.

Smaller concentration also leads to savings from risk management trades and while not immediately noticeable, they are steadily adding up month after month.

We’ve reduced our bank fees

Wherever we’re not connected to the Central Bank, we use local partnerships to help us deliver your transfers in the fastest and safest way possible. A while back, our Banking team worked behind the scenes to build and improve local partnerships.

This helped us reduce some of our own operational costs, resulting in cheaper transfers for you, too.

But, really, why do we drop prices?

Simply because it’s the right thing to do. We operate under the principle that customers should only pay for what they use and how much their use of our product costs.

At Wise, we’re on a mission to make it cheaper to use your money across borders – and on the path of making it eventually free. And these price drops are fundamental in getting us closer to that mission.

But we couldn't do it without you. The more people who use us, the more of an opportunity this gives us to continue lowering our fees and making sure you get the most out of your money. So, what are you waiting for? Get your friends to join the revolution.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Paying someone new? Don’t waste time typing out their bank details or double-checking their IBAN. Upload a screenshot or invoice instead. Our new AI feature...

We're thrilled to introduce a powerful new feature designed to save you time and eliminate the frustration of manual data entry when sending money. Now,...

The new Wise Card is here! 🇧🇷

We have great news for our customers in Brazil! You can now set up your own Pix key directly in the Wise app

Welcome to the Wise Partner Program! In this guide, you will find all the information you need to get started, optimize and succeed as a Wise partner. Simply...

From time to time, you might make a purchase with your Wise card and run into an issue — maybe something you bought didn’t arrive, wasn’t as described, or you...