Cost of Starting a Business in Vietnam: Complete Guide for UK Residents

Find out the cost of starting a business in Vietnam as a UK resident. Our guide covers capital rules, legal fees, visa fees, and more.

SWIFT, which stands for Society of Worldwide Interbank Financial Telecommunication, is a global messaging network that allows banks and financial institutions worldwide to reliably and quickly execute payments between each other across borders. SWIFT has been the pillar for cross-border payments since 1973; as of May 2022, SWIFT recorded 46.1 million financial information (FIN) messages every day. This figure only continues to grow year on year.

More than 200 countries and territories around the world use SWIFT.

While the SWIFT network is reliable it is undoubtedly a legacy system. Until recently, there has been little available to challenge SWIFT or spur innovation, but with the emergence of open banking, payments API, and money transfer service alternatives, there are now a plethora of opportunities to make the system easier, faster, safer, and more flexible.

Power global payment collection - find out how Wise Platform can help your business receive multiple currencies with low fees.

SWIFT is a centralised system connecting banks around the world using a specific message-type language. Unlike the predecessor system Telex, which asked banks to transcribe lengthy sentences to describe transactions, SWIFT cannot be misinterpreted and is therefore faster and more secure.

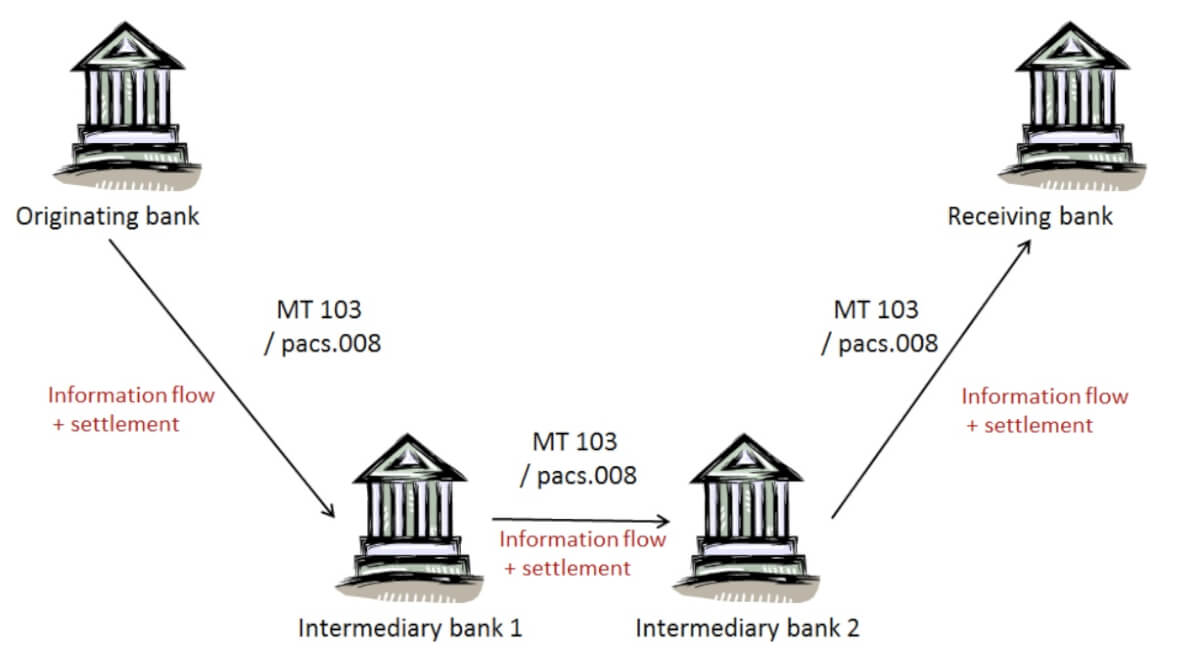

The following diagram from SWIFT’s website shows exactly how it works when the bank initiating the payment and the bank receiving the payment are both in the SWIFT network.

Source: Fintech Ruminations

The first step in a SWIFT payment is to collect the recipient’s banking information including the bank account details and the SWIFT code in full form.

Next, the SWIFT network opens up communication between both banks and authenticates the payment. Both banks receive a message from SWIFT asking them to process the payment. Once they receive the message, they put the details of the transaction into special ledgers called Nostro and Vostro accounts which are the same across the network. In case you’re not familiar with these Latin words, Nostro means “ours” and Vostro means “yours”.

That’s how the first 2 steps work when both banks are connected to the SWIFT network, but what happens if they aren’t? The process works the same except an intermediary bank would serve as the go-between for banks that can’t access the system.

In the third and final step, the receiving bank receives the funds in its local currency, and the money goes directly into the recipient’s account.

As with any financial transaction, there are also fees involved. With SWIFT, each bank or institution determines its own fee structure. Outgoing transactions are typically higher than incoming transactions. As you may know, banks also charge fees for exchanging currency, and the foreign exchange rates apply. More fees = no surprise.

Good points aside, SWIFT also has its fair share of challenges. One such challenge is that fee structures are inconsistent because intermediary banks determine their own fees. One of the biggest pain points for businesses that send huge volumes of money across borders in different currencies is not knowing upfront (and maybe not even until the process is complete) what the final costs will be.

Without a doubt, the SWIFT network serves its intended purpose. It allows multiple countries to communicate better around cross-border payments. As a bonus, SWIFT prevents any institution from rising to the top as a monopoly.

That said, the news about SWIFT isn’t all good when you consider the public still doesn’t trust financial institutions. According to a GlobeScan survey, global trust in banks and financial institutions disappointingly ranks at -13% and 75% of consumers globally have adopted at least one fintech for money transfer and/or payment services. Many customers are therefore turning away from those banks connected to the system and towards alternative providers who have more streamlined cross-border payment solutions to offer.

| 💡 Read more: Wise launches International Receive. |

|---|

While SWIFT got off to a groundbreaking start, advancements have been glacially slow since then, leaving the door open for competition.

Here is a look at some of the challenges that are making SWIFT ripe for disruption.

Potential for chain reactions. The swiftness of the process relies in part on the individual institutions and their countries. A glitch in one or more parts of the process creates a lag all the way down the line.

Alongside these points, the urgency to improve existing cross-border options for consumers is only increasing. The popularity of cross border payments is growing quickly, especially for SMBs. Cross border sales helped fuel the global economy during the pandemic, and worldwide sales continue to be hot. As for the fees, a Flywire survey showed that 55% of businesses lose from 4%-5% of their monthly revenue due to inefficient payment processing. Around 23% of businesses lose 6%-10% which cuts heavily into their bottom lines and means money is less available for their core services.

Elsewhere, innovation is taking place rapidly. Open banking has been a game-changer in the banking industry. Unique and useful apps are being developed all the time. And APIs let apps talk to each other seamlessly.

All this innovation has paved the way for new payment solutions to enter the field. Some of the leaders are:

New cross-border payment solutions like these offer in some cases a payout network close to the 200 countries SWIFT is offering, but are able to do so a lot faster, in many cases even offering instant cross-border transfers. Secondly, they are often a lower cost alternative because there are less correspondent banks involved than over the SWIFT network.

With competitors hot on its heels, there are signs that SWIFT is listening and responding to the market. SWIFT introduced SWIFT gpi, which makes cross-border payments faster, safer and more reliable. This system delivers cross border payments in real-time almost instantly and traces the transfer along the way, enabling payments to go through even when banks are closed.

Innovations like this are clearly popular - SWIFT gpi is gaining traction and now transfers $110 trillion USD and counting through the network, with over 4,000 financial institutions using SWIFT gpi.

Despite providing a solid and robust infrastructure, SWIFT has its fair share of cons, including:

However, that’s not to say it’s irrelevant or obsolete either. Hybrid solutions like Wise Platform’s International Receive offer an innovative way to improve upon the current SWIFT setup without reinventing the wheel. International Receive is not an integration, but a simple configuration change.

International Receive makes it easier for neobanks and banks to connect to the SWIFT network by using Wise as a correspondent bank, enabling their customers to efficiently and safely receive international payments using their existing account details.

The feature also enables financial institutions with an existing SWIFT setup to switch to Wise’s service, and receive these incoming SWIFT payments more quickly, cheaply and conveniently. Using Wise may seem like adding an extra step; however, because the payout side is handled outside of SWIFT, partners can leverage the speed, convenience, and lower transaction costs of Wise while simultaneously using a system that connects thousands of banks worldwide. The recipient amount is guaranteed and it can still be tracked with up to 95% accuracy.

With Wise Platform, you can offer your customers the most competitive prices for their cross-border transaction needs. As international payments only become more vital for customers worldwide, Wise Platform opens the doors for you to deliver unmatched value for your customers, driving customer satisfaction and growth, and benefitting your business.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Find out the cost of starting a business in Vietnam as a UK resident. Our guide covers capital rules, legal fees, visa fees, and more.

Learn how to apply for and obtain a residence permit for self-employment in Sweden. Our guide explains application steps, requirements and more.

Ready to launch your Canadian business? Read our guide to find out the full cost of getting set up, from registration fees to inventory and more.

Thinking of expanding or starting a business in Germany? Our complete guide covers potential opportunities, barriers and cultural considerations.

Learn how to apply for the Canada self-employed persons program from the UK and how it could lead to permanent residence in our guide.

How to run a global freelancer business from anywhere in the world. This blog includes insights from a webinar with established freelancers.