Complete guide to doing business in Spain in 2026, for growing startups and entrepreneurs

Thinking of expanding or starting a business in Germany? Our complete guide covers potential opportunities, barriers and cultural considerations.

UK businesses can get paid conveniently using the Bacs direct debit service1. Direct debits are extremely common - and used by 9 out of 10 UK consumers. But while customers are often familiar with direct debit as a way of sending the same amount every month there’s also the option to arrange a variable direct debit for payments which can change in amount or frequency.

This guide covers all you need to know, including the variable direct debit advantages and disadvantages you may want to consider. And as a bonus we’ll introduce Wise Business to help you set up your own variable business direct debit payments in 5 major currencies conveniently.

💡 Learn more about Wise Business

As the name suggests, a variable direct debit is a direct debit payment where the amount, date or frequency of payment may change.

Businesses may use a variable direct debit when the billable amount changes, either month on month, or relatively frequently. For example, if you’re billing a client by usage, or for a changeable number of hours of work every month, a variable direct debit gives you control of the amount you’re paid. A variable direct debit can also help where you may not need to bill the client every single month, or where your prices may be subject to relatively frequent change.

Variable direct debits are covered under the direct debit guarantee, which offers reassurance for both the customer and the business, and ensures the security and reliability of the scheme.

So what’s the difference between a fixed direct debit in which the customer is charged the same amount monthly, and a variable direct debit? Here’s a summary on some key features:

| Variable recurring payments | Fixed direct debits |

|---|---|

| Customer must authorise the payment with a direct debit mandate | Customer must authorise the payment with a direct debit mandate |

| Customer will expect the billed amount to change | Customer will expect the billed amount to be the same |

| Customer must be notified of the amount and date of an upcoming payment using an Advance Notice of Direct Debit | If any changes are required to the payment, they must be notified to the customer with an Advance Notice of Direct Debit |

| Customer must be told of every upcoming payment with 10 working days notice | Customer must be told of any changes to their payment with 10 working days notice |

| Customer is covered by the direct debit guarantee | Customer is covered by the direct debit guarantee |

Using direct debit payments is good for the customer and also for the business being paid.

From the perspective of the customer, the payment is automated and can not be forgotten. This is simple and avoids any late payment fees which may otherwise apply. For the business, direct debit payments can build brand loyalty and make it far easier to ensure payments arrive on time - particularly as direct debits are billed from a bank account which doesn’t change its number like a card with an expiry date.

Of course, there are a few drawbacks. For businesses, there will be a fee to pay to collect direct debits, which varies depending on the third party sponsor you use. Plus, there’s still the risk of payment failure if the customer doesn’t have enough in their account when the payment is due. This isn’t a great outcome for either the customer or the business - and makes it crucial that you issue advance warning of a variable payment in compliance with the direct debit guarantee.

To collect a variable direct debit as a small business in the UK, you’ll need what’s known as a sponsor. This is a third party provider which is authorised by Bacs to support direct debit transactions. You may choose your business bank account provider if they offer this service, or set up a standalone arrangement with a direct debit provider instead.

In either case, the outline of the process you need to follow to collect variable direct debits is the same:

Sign up with a direct debit sponsor

You’ll need to research and select a direct debit sponsor which will support you with collecting direct debits. Different third party providers charge their own fees, so comparing a few options makes business sense.

Create and issue a direct debit mandate

Your sponsor will help you create a direct debit mandate according to an agreed template2, which you can add your own branding to. You will then issue this to your customers. This form is the basis of your agreement with the customer and what authorises you to be paid.

Your customer will return the mandate to their bank

Your customer will complete this mandate either in hard copy or online, including giving authorisation for you to debit from their account as per your agreement. They then need to pass this back to the bank to allow the transfers to begin.

You must notify the customer of the amount and date of each direct debit payment

Under the terms of the direct debit guarantee3 customers must be told with 10 days notice of the amount that will be deducted and when. If you’re using a variable direct debit this means issuing this notice every time you take a payment.

The customer’s bank will process the payment according to the agreement

Assuming there’s enough in the customer’s account, the payment is processed and the funds are delivered to your nominated business account without further action needed.

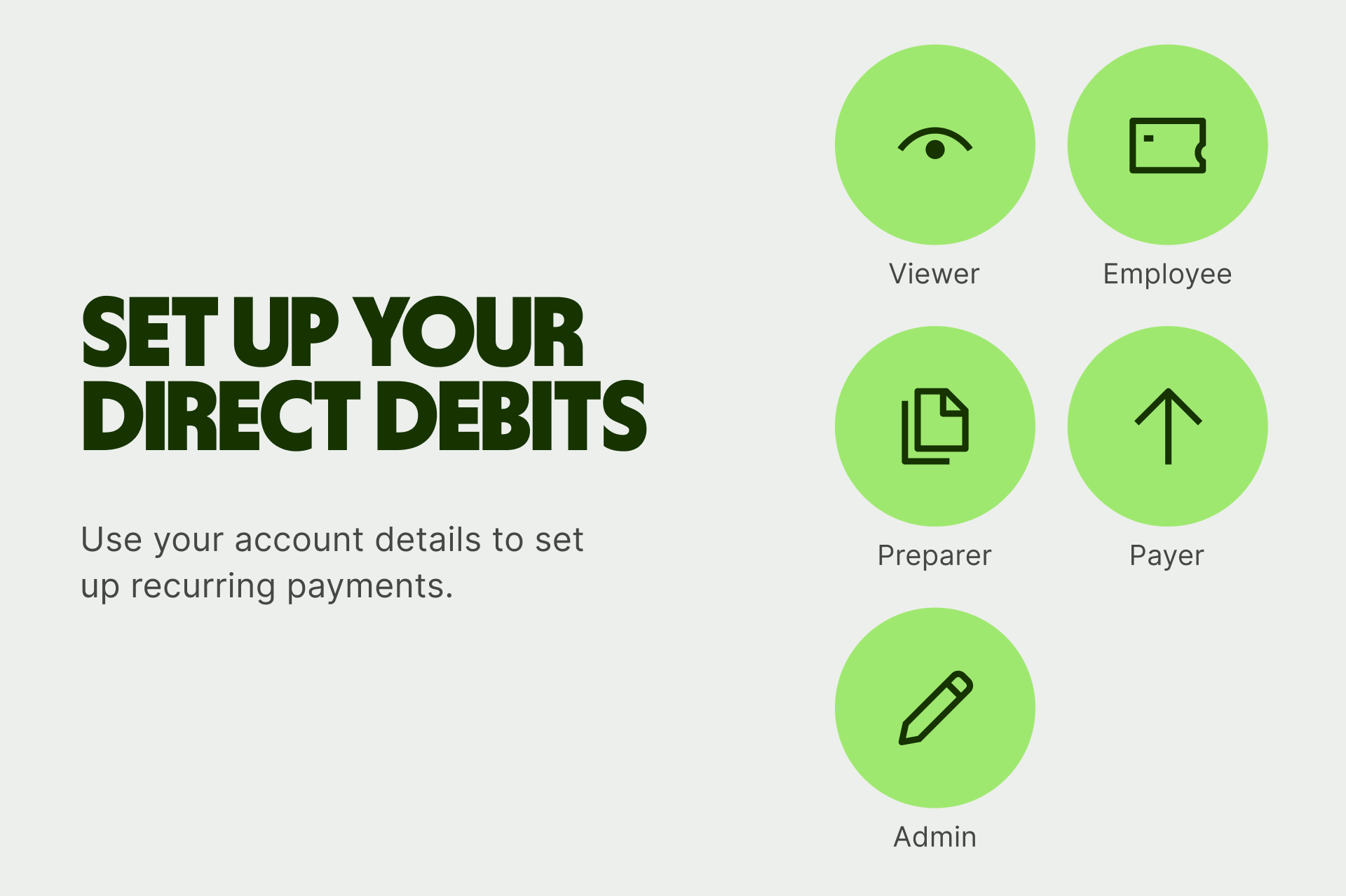

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

A fixed direct debit allows a business to collect the same amount from a customer on an agreed interval - monthly, on a given date, for example. A variable direct debit is more flexible, allowing a company to collect different amounts, or to vary the date of collection.

Both types of direct debit are operated by Bacs in the UK and both require the customer to be given advance notice of payments before they come out. If you’re billing a fixed amount you may only need to let the customer know if the payment details are changing from the original agreement - but with a variable payment you need to tell them every time a payment is due, with 10 working days notice.

A variable recurring payment may be used in any situation in which the payment amount isn’t always going to be the same amount, or payable on the same dates or intervals. You might use a variable payment if you bill customers by their usage of a service, for example. Or, as a business owner, you may use a variable direct debit yourself to pay for your business utilities if you have an office or store.

Different third party providers - known as sponsors - facilitate the processing of direct debits. Each provider has their own fees, which may be higher for variable payment compared to collecting fixed amounts. You’ll need to look at different sponsors, including your own bank and third party operators to see which has the best service for your specific needs.

If you have suppliers in other countries, or would love to trade internationally in the future, it’s super handy to have a Wise Business account.

With this powerful multi-currency account, you can send payments to and [set up direct debits for your international bills](https://wise.com/gb/blog/get-local-account-details-in-9-currencies). You can hold currencies in your account at once and switch between them when you need to, always with the mid-market exchange rate.

Get started with Wise Business 🚀

Variable direct debits are especially useful for any business collecting recurring, but changeable, payments from customers. If you have a customer who you need to charge based on billable hours worked, or if you may not need to charge the customer every month, for example, variable direct debits allow you to control the amount you’re paid conveniently. Variable direct debits are also covered by the direct debit guarantee which means the customer knows what will be taken from their account and when - offering reassurance and building trust.

Sources used in the article:

Sources last checked December 20, 2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Thinking of expanding or starting a business in Germany? Our complete guide covers potential opportunities, barriers and cultural considerations.

Learn how to apply for the Canada self-employed persons program from the UK and how it could lead to permanent residence in our guide.

How to run a global freelancer business from anywhere in the world. This blog includes insights from a webinar with established freelancers.

Discover which UAE business visas you can apply for from the UK, what to keep in mind and how the process works for each visa type in our guide.

Last month, the United States (US) Supreme Court ruled that many of the government’s tariffs were unconstitutional. The 6-3 decision found that the...

Having trouble deciding which Wise Business account is best for your business? We’re breaking down the differences between the ‘Essential’ and ‘Advanced’...