Austria corporate tax - guide for international expansion

Learn about the corporate tax system in Austria, its current rates, how to pay your dues and stay compliant, and best practices.

Despite steady sales, a business may still face cash flow issues if it lacks effective management of accounts receivable. Poor cash flow can slow or even halt a company's growth and lead to greater challenges over time. For example, a business may struggle to pay vendors, employees, or meet loan obligations. In some cases, it may even be forced to turn down growth opportunities due to a lack of available cash.

In contrast, a strong accounts receivable collection process allows steady revenue and strong customer relationships. There's more scope for the business to expand or upgrade its technology and equipment. Businesses that efficiently manage their accounts receivable (AR) have clear processes in place for collecting payments. They also watch for potential cash flow problems and address them early, before they can harm the business.

Intuit QuickBooks reports that small and medium-sized businesses (SMBs) in the UK are currently owed an average of £27,214 in late payments1. Figures like this make it essential for UK entrepreneurs to be more vigilant. A large sum of outstanding payment can be financially crippling.

This guide covers the best practices for accounts receivable collections so that you can make better decisions for your UK business. It also touches on Wise Business, a cost-effective way to send business payments and receive money from abroad in multiple currencies, with conversions using the mid-market exchange rate.

Accounts receivable collections are the steps a business takes to recover money that customers owe for goods or services they have received. This includes following up on overdue invoices, missed payments, or any credit agreements made with customers.

This process is often referred to as accounts receivable follow-up or accounts receivable recovery. It involves sending payment reminders, staying in touch with customers, tracking outstanding balances, and sometimes taking more drastic actions if payments remain unpaid.

Here is a precise breakdown of the steps involved when collecting accounts receivable:

It's highly essential for a business, regardless of its size, to keep a close watch on its finances. Collecting accounts receivable is one way to keep finances firm.

It's quite clear that managing accounts receivable is key to keeping your business financially strong. Here's more on why a solid process to collect accounts receivable matters:

In the UK, the importance of efficient AR collection is underscored by the fact that 73% of businesses experience negative consequences due to late invoices2. Implementing effective accounts receivable management can support growth, no matter the industry.

A smooth accounts receivable process helps keep your cash flow healthy and ensures customers pay on time. An effective AR process usually involves:

Using automation makes it easier to get paid faster by automatically sending invoice reminders, recurring invoices, and matching payments quickly. This helps speed up cash posting and keeps your cash flow strong.

Setting clear expectations from the start is also key. Ensure that customers know exactly when payments are due, how much they owe, and the payment method. Having this conversation early helps shorten your accounts receivable collection period and avoids confusion later.

Typically, you should have this discussion when a new customer signs on, if you update your collection process, or if a customer regularly misses payment deadlines.

One of the best ways to improve accounts receivable collections is by making invoice payments simple and hassle-free for your clients. Start by ensuring that your invoices are clear, complete, and free of any missing details that could cause payment delays.

You can also speed up collections by offering electronic payment options, such as ACH transfers, so customers can pay directly and boost your cash flow without delays. Another option is setting up a lockbox service through your bank. This is where checks are sent to a special address and deposited quickly, reducing waiting time.

It's a good idea to speak with your bank or industry peers to find the right cash management tools for your business.

Even the best strategies won't work if they aren't being followed properly. As part of accounts receivable collections best practices, it's important to regularly review key performance indicators to spot what's working and what's not.

The main KPIs to track:

If you plan to offer credit to clients, make sure you have clear rules in place. This helps you avoid giving too much credit and makes it easy for your team to decide when to approve or deny credit requests.

The same goes for your accounts receivable collections process. A good collection policy focuses on being proactive, not reactive. Instead of only chasing late payments, send friendly payment reminders before the due date to keep customers on track.

If a customer already has overdue invoices, use your next invoice as an opportunity to list all outstanding amounts. This keeps things clear for the customer and speeds up the collection process.

A survey found that 90% of respondents believe sales teams should not be involved in cash collection3. This misconception overlooks the fact that sales teams play a crucial role in converting deals into cash and generating working capital. They directly interact with customers at key collection points. This ensures that payments are on time.

Not only this, but involving all client-facing teams helps avoid errors, reduce redundancy, and improve communication, leading to faster payments. However, if payments are delayed, the issue may go beyond technical problems. Sales and customer success teams can help identify the root cause and offer solutions.

This proves that collecting accounts receivable isn't only a finance team's responsibility. It's a collective task that requires input from multiple departments.

At the end of the day, if all collection attempts fail, consider collaborating with a collection agency. Although it may not be the perfect solution, it can help you recover some of your overdue payments and keep your cash flow steady.

Managing all these processes, metrics, and reports takes a lot of effort. Traditional businesses rely on manual staff work to handle invoicing and collections. Meanwhile, modern businesses use automated AR software to reduce human involvement and streamline the process.

The perks they experience with automating the systems are:

| How Automated AR Tools Help | Benefits of Collection Strategies |

|---|---|

| Automation of Invoice Creation | Reduces manual errors and ensures timely invoicing, improving cash flow. |

| Automated Payment Reminders | Sends reminders to customers automatically, ensuring consistent follow-ups and reducing the number of overdue payments. |

| Streamlined Payment Processing | Allows customers to pay directly through integrated payment options, speeding up the collection process. |

| Real-time Reporting and Analytics | Provides instant insights into collection trends, outstanding invoices, and payment delays, helping businesses make informed decisions. |

| Integration with Other Systems | Connects with CRM and ERP systems, improving workflow and reducing the need for duplicate data entry. |

| Customisable Payment Plans | Allows businesses to offer tailored payment options to customers, improving customer satisfaction and timely payments |

Here are some commonly asked questions:

The purpose of the accounts receivable process is to ensure that businesses receive payments on time. It intends to keep invoices from becoming overdue. This helps maintain steady cash flow and supports the business's profitability.

Accounts receivable (AR) play a key role in managing working capital and influencing business relationships. Effective AR management boosts liquidity, improves operations, and increases customer satisfaction.

The most successful collection strategy involves taking early action, offering flexible payment options, and maintaining open and clear communication. It should focus on understanding the customer's needs and provide financial guidance to ensure a positive outcome for both parties.

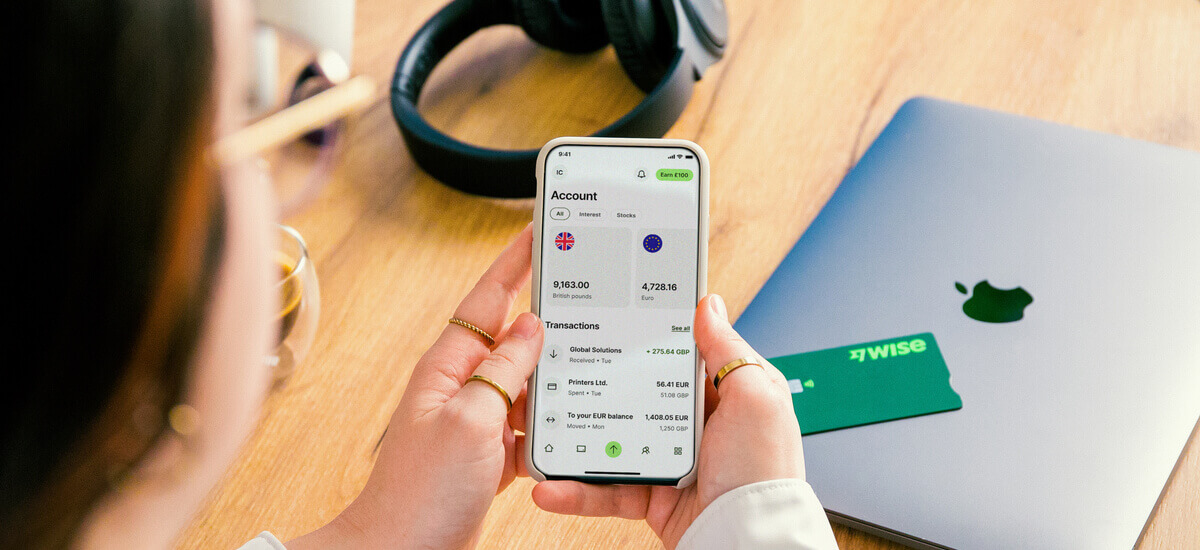

Wise can help UK businesses, freelancers and sole traders get paid by customers in multiple currencies, with low fees and the mid-market exchange rate.

Your Wise Business account comes with local account details to get paid in 8+ major foreign currencies like Euros and US Dollars just as easily as you do in Pounds.

All you need to do is pass these account details to your customer, or add them to invoices, and your customer can make a local payment in their preferred currency. You can also use the Wise request payment feature to make it even easier and quicker for customers to pay you.

Get started with Wise Business 🚀

Sources used:

Sources last checked on date: 05-Jun-2025

Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn about the corporate tax system in Austria, its current rates, how to pay your dues and stay compliant, and best practices.

Learn about the corporate tax system in Botswana, its current rates, how to pay your dues and stay compliant, and best practices.

Learn about the corporate tax system in Chile, its current rates, how to pay your dues and stay compliant, and best practices.

Understand the essentials of terms sheets in business. Learn the key components to help you negotiate your next deal.

Learn about the corporate tax system in Montenegro, its current rates, how to pay your dues and stay compliant, and best practices.

Learn about the corporate tax system in Monaco, its current rates, how to pay your dues and stay compliant, and best practices