Austria corporate tax - guide for international expansion

Learn about the corporate tax system in Austria, its current rates, how to pay your dues and stay compliant, and best practices.

Businesses offer credit options to trustworthy customers as a way to increase sales. When this happens, these businesses build up accounts receivable (AR). However, late payments reduce cash flow, making it harder to pay bills. For instance, customers owed UK small and medium-sized businesses an average of £27,214 in 2023¹.

These businesses reported that the reduced cash flow hurt their operations. This is unsurprising because cash flow relies on the timely collection of accounts receivable.

Therefore, accounts receivable must be managed to keep cash flow efficient. This is where a cash flow statement (CFS) comes in handy. It’s an important document that records your cash flow and helps you understand your business’s finances.

Read on to learn everything you need to know about accounts receivable and how it affects the cash flow statement. We’ll also touch on Wise Business, a cost-effective way to send business payments and receive money from abroad in multiple currencies, with conversions using the mid-market exchange rate.

💡 Learn more about Wise Business

A cash flow statement is a financial document that shows how much money goes in and out of your business in an accounting period. It basically records the cash flow (inflow and outflow) of your business.

The cash flow statement is one of the three main financial statements, complementing the balance sheet and the income statement. This document enables businesses to monitor liquidity, understand cash flow patterns, and make informed financial decisions.

The cash flow statement divides financial activities into three parts: operating, investing, and financing. In the subsequent section, we will discuss more about the three parts of the cash flow statement but before that let’s talk about accounts receivable which is a component of operating activities.

Accounts receivable is the total amount of money customers are owing your business for services or goods delivered but not yet paid for. The timeframe for payment depends on the agreement between you and your client. It can range from a few days to 30 days, 60 days, 90 days, or, in some cases, up to a year.

You can therefore record this transaction as an asset on your balance sheets because it is a legally enforceable transaction. Accounts receivable are also considered liquid assets because they can be used as collateral to secure a loan to help the company meet its short-term obligations.

Receivables are part of a company's working capital. Just like cash, inventory and securities, accounts receivable are also classified as current assets, because the account balance is expected from the debtor in one year or less.

So many businesses provide this for example if you are a marketing agency and set clients up on 30-day payment terms. So, you send an invoice after the project is delivered, and your client promises to pay 30 days from when you sent it. This makes the transaction legally enforceable because it is specified in a contract.

You need to properly manage accounts receivable because it affects your business’s financial health. It’s best to start with clear payment terms. Issue invoices quickly and reach out with reminders as payment dates draw close. You should also verify customers’ creditworthiness before offering credit to reduce the risk of non-payment or delays.

Think of your cash flow statement as your business’s financial traffic report. It doesn’t gloss over anything because it accounts for every penny. As mentioned earlier, the cash flow statement is divided into three main sections: operating, investing, and financing activities.

Together, these sections reveal how cash is generated, spent, and retained, but the operating activities section is particularly relevant to accounts receivable (AR). Let’s break it down:

Below are the sections included in the cash flow statement to give you a clear snapshot of how your cash flows.

Operating activities: It tracks the money coming in and out from routine operations, such as:

Note: When accounts receivable increases (e.g. more sales are made on credit), it reduces operating cash flow because the cash hasn’t been received yet. Conversely, when accounts receivable decreases (e.g. customers pay their invoices), it boosts operating cash flow by converting credit sales into actual cash.

Investing activities: This reflects your business’s long-term decisions. This section includes cash spent on or earned from investments in assets. They include:

Financing activities: It tracks how your business finances its operations and growth. This section comprises cash flow relating to borrowing, paying off debts, or transacting with investors. It includes:

Your net cash flow serves as the bottom line that tells you whether your cash reserves are increasing or decreasing. Overall, your cash flow statement helps you determine if you can cover your bills or plan your next big move.

Accounts receivable may look good on paper, but its value depends on how quickly you can turn it into actual cash. While extending credit to your customers can boost sales and strengthen relationships, it ties up funds that can be used in your business operations.

Accounts receivable only benefits your business when payments are made on time.. An increase in accounts receivable cash flow improves liquidity, enabling your business to cover expenses like supplier payments, wages, and rent without delays. Businesses that use efficient invoicing systems, implement clear payment terms, and follow up consistently often see positive effects on cash flow.

Delayed payments, however, can strain your finances. When customers don’t pay on time, the money you’ve already earned remains inaccessible. This can make it challenging to meet financial obligations and maintain smooth operations. If accounts receivable grows faster than cash collections, your business may look profitable on paper but struggle to pay its bills in reality.

In such cases, you might need to rely on cash reserves or take on debt, adding unnecessary pressure to your finances and limiting your ability to invest in growth.

Managing cash flow with international accounts receivable (AR) brings unique challenges that go beyond domestic transactions. While international customers offer exciting growth opportunities, they also introduce factors that influence when and how you receive payments.

One key issue is currency fluctuations. Exchange rate changes can mean receiving less money than expected, even if the invoice amount remains unchanged. Additionally, cross-border transactions often come with processing fees and longer settlement times, delaying cash inflows and affecting your ability to cover expenses promptly.

Payment systems and local banking regulations add further complexity. Differences in banking networks and compliance requirements can slow payments, creating uncertainty around cash flow timing.

Calculating cash flow is easy once you break it down to its basics. Below is a step-by-step guide on how to calculate cash flow to make it easier for you.

If the result is positive, great. It means your business is making more money than it’s spending, which is a healthy financial sign. If it’s negative, it means your business doesn’t have enough revenue to cover the cost of doing business. This means you need to rethink your budget.

Recording accounts receivable properly lets you keep your cash flow on track and your books accurate. It also helps you to receive payments quickly. Below are steps to get it right:

Following these steps helps your accounts receivable process work better while reducing errors and keeping your money moving smoothly.

Here are some of the most commonly asked questions answered:

You can call them receivables for short.

They are opposite terms. Accounts receivable refer to the money customers owe your business. Accounts payable, on the other hand, is what your business owes suppliers and vendors.

Accounts receivable cannot be considered revenue in cash based accounting. Accounts receivable represents money expected to be received in the future but not yet received. However in accrual accounting it is considered revenue because in this form of accounting revenue is recorded when a sale is made, not when payment is received³.

Hence it is recorded on the balance sheet as revenue at the same time as the sale. Then when your business receives the cash is reclassified as cash and the account receivable as credit.

An aging report groups unpaid invoices by their specific payment due dates. This tool shows you which invoices are overdue, letting you contact customers right away to keep your cash flowing smoothly.

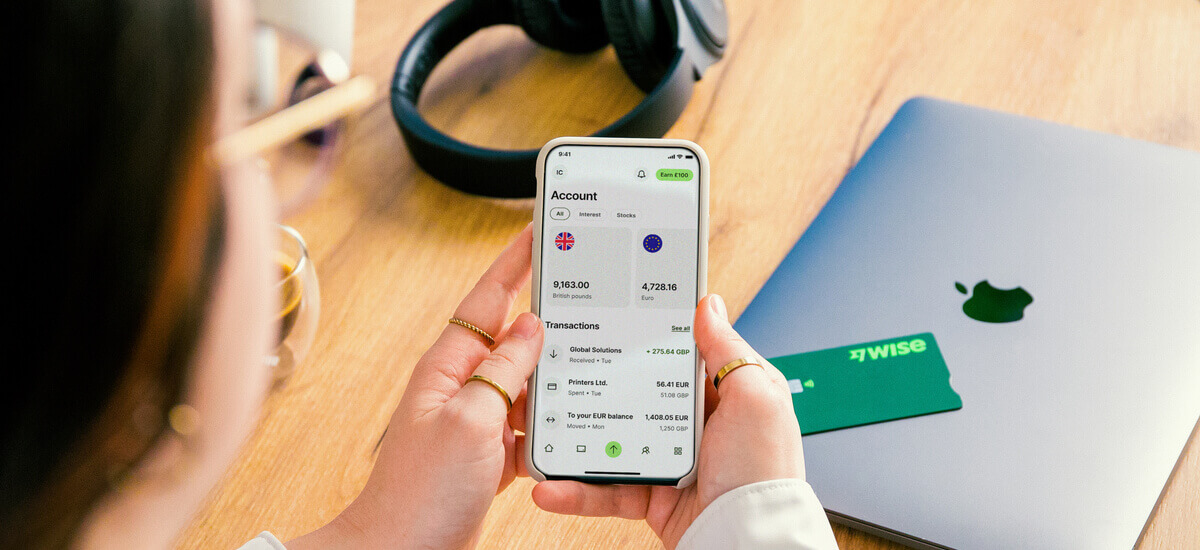

Wise can help UK businesses, freelancers and sole traders get paid by customers in multiple currencies, with low fees and the mid-market exchange rate.

Your Wise Business account comes with local account details to get paid in 8+ major foreign currencies like Euros and US Dollars just as easily as you do in Pounds.

All you need to do is pass these account details to your customer, or add them to invoices, and your customer can make a local payment in their preferred currency. You can also use the Wise request payment feature to make it even easier and quicker for customers to pay you.

Get started with Wise Business 🚀

Sources used:

Sources last checked on date: 25-Jun-2025

Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn about the corporate tax system in Austria, its current rates, how to pay your dues and stay compliant, and best practices.

Learn about the corporate tax system in Botswana, its current rates, how to pay your dues and stay compliant, and best practices.

Learn about the corporate tax system in Chile, its current rates, how to pay your dues and stay compliant, and best practices.

Understand the essentials of terms sheets in business. Learn the key components to help you negotiate your next deal.

Learn about the corporate tax system in Montenegro, its current rates, how to pay your dues and stay compliant, and best practices.

Learn about the corporate tax system in Monaco, its current rates, how to pay your dues and stay compliant, and best practices