Austria corporate tax - guide for international expansion

Learn about the corporate tax system in Austria, its current rates, how to pay your dues and stay compliant, and best practices.

Your UK Business produces a lot of data, but how can you make sense of it? Accounts receivable analysis helps you understand what your data is saying and make decisions that grow your business.

Chances are, you are reading articles on accounts receivable analytics because you want to:

This article will explore how accounts receivable analytics can help you achieve these goals, especially for businesses in the UK. It covers why accounts receivable analytics are important, how to perform an accounts receivable analysis, how to create an accounts receivable analysis report, and FAQs on accounts receivable analytics.

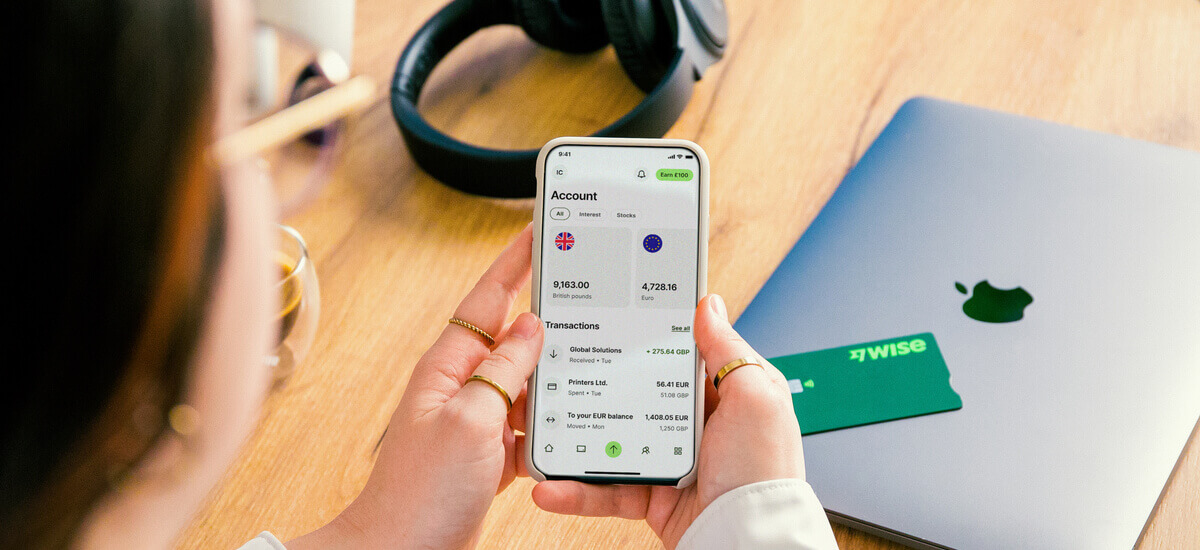

And while you’re looking for how best to analyse your AR, check out Wise Business, a cost-effective way to send business payments and receive money from abroad in multiple currencies, with conversions using the mid-market exchange rate.

💡 Learn more about Wise Business

Here are key reasons every small business should consider using AR analytics:

Streamline cash flow management: AR analytics gives you real-time visibility into all your AR processes, from invoices to payment status. This ensures that you effectively monitor and manage your cash flow.

Helps understand customer behaviour: With AR analytics, you can understand your customers' behaviour to pinpoint early payers and track how quickly customers settle invoices. Additionally, you can segment your customers into groups and distinguish your best customers from the high-risk accounts.

Improve operational efficiency: AR analytics help you uncover bottlenecks in your credit and collection processes. Additionally, it provides insights on how you can improve your AR operations to make it run smoothly and efficiently. For instance, if your AR team heavily relies on manual processes, AR analytics can pinpoint areas where automation is needed.

Mitigate bad debts: With AR analytics, businesses can pinpoint and identify high-risk accounts and take proactive steps to avoid extending credit to them. By doing so, AR teams can minimise bad debts.

Review your payment terms: Analysing your AR data also gives insight into how your customers respond to different payment terms to find the payment terms that work best for you and your customers.

When conducting AR analysis, here are some important types of reports and KPIs to look out for:

Days Sales Outstanding (DSO)

This metric measures how long it takes for a company to collect receivables from its customers after sales. A lower DSO usually indicates a company’s collection process is working well, while a higher DSO signifies delays in payments. Day Sales Outstanding is also known as the average collection period.

AR Turnover Ratio

This financial metric measures the efficiency of a company’s collection process. It calculates how often a company can collect its receivables within a specific period, usually a year. A higher turnover ratio indicates a company has a better collection process, and a lower turnover ratio indicates the opposite.

AR turnover ratio gives companies an insight into whether or not they are extending credit to the right customers.

Collection Effectiveness Index (CEI)

The Collection Effectiveness Index (CEI) measures the percentage of receivables a company has collected over a given period. A higher CEI indicates that your credit and collection teams are doing an impressive job.

Average days delinquent (ADD)

Average Days Delinquent (ADD) refers to the average number of days that pass between due dates for invoices and the receipt of payment. This metric helps businesses know the average days outstanding and delinquent for credit payments.

Number of revised invoices

This is the total number of revisions done by your AR team over a specific period. These revisions might occur because of an administrative error or due to a customer dispute.

Bad debt

This is the amount that a company will write off as uncollectible. It’s categorised as an expense on a company’s balance sheet. Doing this lets a company forecast how much bad debt to expect and how that would impact their bottom line.

Here’s a quick walkthrough of how you can perform an accounts receivable analysis:

The bottom line of AR analysis is better decision-making. It's possible to obsess over numbers without improving your collections process. To make the most of AR analytics, spend more time on the metrics that help you make decisions to improve collections and cashflow. This differs from business to business.

To make sense of your AR data, you need to understand the context behind the numbers. A metric can be good or bad depending on your AR practices. There's no overarching basis to assess what a metric means for your business.

For example, to interpret your Day Sales Outstanding (DSO) accurately, consider the average payment terms you offer to customers.

If your DSO is 65 days and your average payment terms are 60 days, this indicates your collection period is reasonable. However, if another company has the same DSO of 65 days but their average payment terms are only 30 days, this suggests their collection process is inefficient and slower than expected.

Analyse accounts receivable metrics by different customer segments. This analysis helps you to understand and differentiate your best-paying customers from the ones that aren’t.

You can segment them by location, industry, or region. For instance, segmenting your customers can reveal to you that customers in the manufacturing industry pay faster than those in hospitality.

Monitor trends in your AR analysis to determine whether your AR team's performance is improving or declining over time.

Say you evaluate the Collections Effectiveness Index (CEI) of your company over six months, it'll be clear if the effectiveness of your collections is improving or deteriorating.

After you’ve conducted an AR analysis, you need to create a detailed report of your findings. Here’s a step-by-step process on how to create an AR analysis report:

Here are some commonly asked questions:

AR analytics helps companies evaluate their AR data to see how effective it is and uncover ways to make its process even better.

Some of the key metrics to consider during AR analysis include Days Sales Outstanding (DSO), Aging Reports, and AR Turnover Ratio.

Automation streamlines AR analytics in the following ways:

Wise can help UK businesses, freelancers and sole traders get paid by customers in multiple currencies, with low fees and the mid-market exchange rate.

Your Wise Business account comes with local account details to get paid in 8+ major foreign currencies like Euros and US Dollars just as easily as you do in Pounds.

All you need to do is pass these account details to your customer, or add them to invoices, and your customer can make a local payment in their preferred currency. You can also use the Wise request payment feature to make it even easier and quicker for customers to pay you.

Get started with Wise Business 🚀

Sources used:

N/A

Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn about the corporate tax system in Austria, its current rates, how to pay your dues and stay compliant, and best practices.

Learn about the corporate tax system in Botswana, its current rates, how to pay your dues and stay compliant, and best practices.

Learn about the corporate tax system in Chile, its current rates, how to pay your dues and stay compliant, and best practices.

Understand the essentials of terms sheets in business. Learn the key components to help you negotiate your next deal.

Learn about the corporate tax system in Montenegro, its current rates, how to pay your dues and stay compliant, and best practices.

Learn about the corporate tax system in Monaco, its current rates, how to pay your dues and stay compliant, and best practices