Guide to sending large payments with Santander Business UK, including transfer limits

Read our essential guide to sending large payments with Santander Business UK, including maximum transfer limits, fees, security and transfer times.

Without clear visibility into when payments are due or exactly how much you owe, your business can easily end up in constant firefighting mode–scrambling to cover unexpected cash shortages, delaying critical investments, and unintentionally straining relationships with vendors and suppliers.

A well-defined and efficient accounts payable process ensures you know what’s coming, can manage cash flow with confidence, and maintain strong, trust-based partnerships with those you do business with. In this article, we’ll walk you through how to streamline your AP process so you can save time, reduce errors, and protect your bottom line.

While you’re here, consider how Wise Business can simplify payments to vendors, especially those outside the UK. With Wise Business, you can hold and convert multiple currencies in one account, and send payments to suppliers in 140+ countries while avoiding hefty bank fees and delays.

💡 Learn more about Wise Business

The accounts payable (AP) process is a comprehensive system designed to help companies manage their short-term debts to suppliers and vendors. Also known as the "full cycle of accounts payable," this process covers every step from getting a purchase order (PO) to invoicing and making the final payments to your supplier.

Having an accounts payable (AP) process helps your AP department ensure that your vendors and suppliers get paid on time while ensuring that your company maintains a healthy cash flow.

Typically, here’s what a full cycle accounts payable looks like in practice:

For small businesses in the UK, an effective accounts payable process helps them track all outstanding bills and expenses, manage their finances, and send payments on time to vendors. This way, they can maintain a healthy cash flow, settle their payables efficiently, and maintain a strong relationship with their vendors.

Now that you understand how the accounts payable process works, let's examine why the accounts payable process is essential for your business and how it can benefit your organisation:

Additionally, having an effective accounts payable process enables you to pay your suppliers on time and avoid paying duplicate invoices using a strategy like the three-way matching. This means you incur no additional costs on your invoices by paying on time and vetting each payment before going out, thereby allowing you to have better cash flow.

Mitigate financial risks: An effective accounts payable process minimises the risk of financial fraud, duplicate invoices, or unauthorised payments to vendors. It serves as an internal control system that your AP department and procurement team must follow before releasing payments to vendors. Additionally, there’s also a multiple-level authorisation to help mitigate fraudulent activities and unauthorised payments to ghost vendors.

Avoid legal disputes and penalties: According to the UK Late Payments Laws, suppliers have the legal right to charge a statutory interest¹ when you pay your suppliers late. This means that your suppliers are entitled to claim interest on unpaid invoices for goods and services. Paying vendors on time helps you avoid incurring penalties from late payments. Also, the accounts payable process allows you to properly handle invoice disputes so it doesn’t escalate into a full-blown litigation.

Ensure accurate financial reporting: Conducting accounts payable gives you an accurate picture of your company’s financial health and liquidity. It ensures that all your liabilities are accurately recorded, helping you keep an accurate and up-to-date financial record.

Below is a full breakdown of the steps involved in a typical accounts payable workflow:

An accounts payable process begins when a department in your company identifies that it needs goods or services. For instance, if the marketing team needs a videographer to shoot a new campaign, they would have to make an internal request to the accounts payable or procurement team.

Making an internal request involves the department requesting the creation of a purchase requisition, a formal internal request to purchase the needed goods and services. The purchase requisition is then submitted to the procurement or finance team for approval.

Once a purchase requisition is approved, the finance or procurement team then goes ahead to create a purchase order, which will be sent to the vendor. A purchase order is a document that indicates items, quantities, prices, credit terms and types of goods and services that are to be purchased.

Purchase orders serve two primary purposes. First, it ensures that the goods and services ordered match the ones that are received from the vendor. Secondly, it serves as a legally binding contract between the buyer and supplier.

Once the vendor delivers the requested goods or services, the accounts payable team will then inspect them against the original purchase order. They check quantities, examine the condition of items, and document any discrepancies or damage found during inspection.

Another essential aspect in this stage is matching your purchase order, delivery receipt, and your vendor's invoice. This verification process protects you from billing errors and ensures accurate payments.

There are two major matching systems:

After verifying the invoice, the next step is to record the invoice in the company’s accounting system. Your accounting system will then assign the appropriate general ledger codes to the invoice.

At this stage, the company processes payments for the invoice per the payment terms agreed upon. After payment has been made, your accounts payable team then reconciles the payment with the invoice and updates the accounting system to reflect this.

Here are some common challenges of accounts payable:

Here are some practical tips to improve your company's accounts payable process:

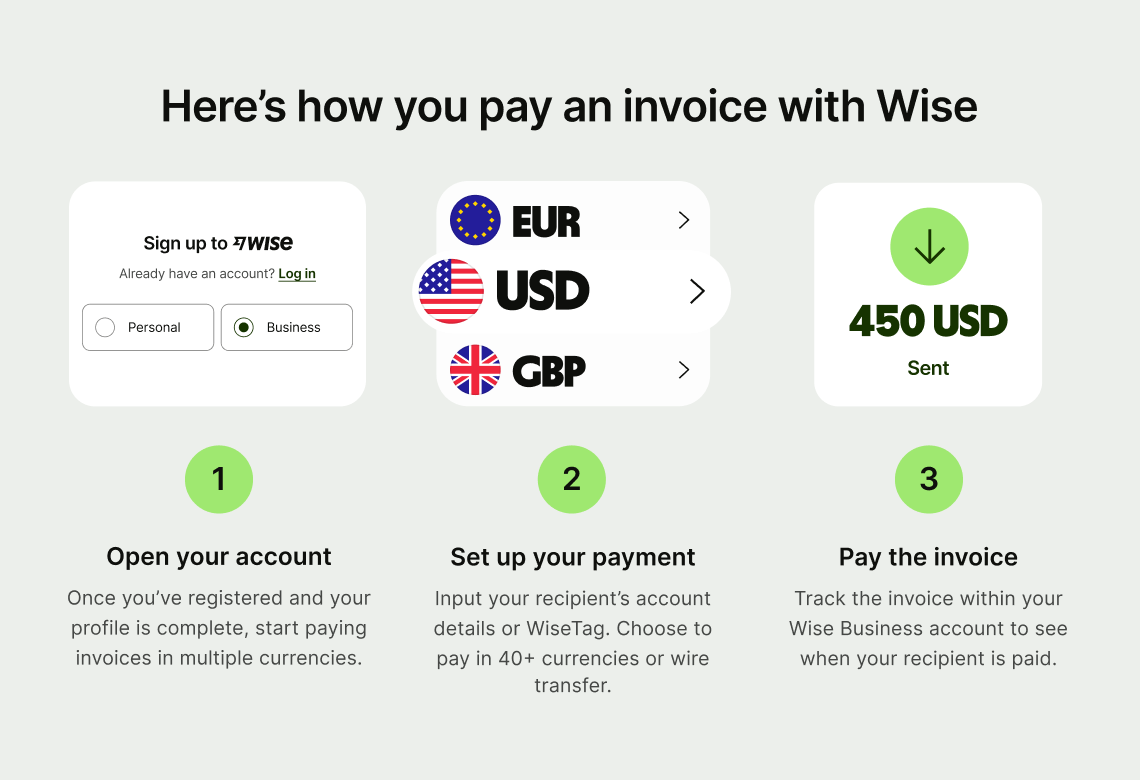

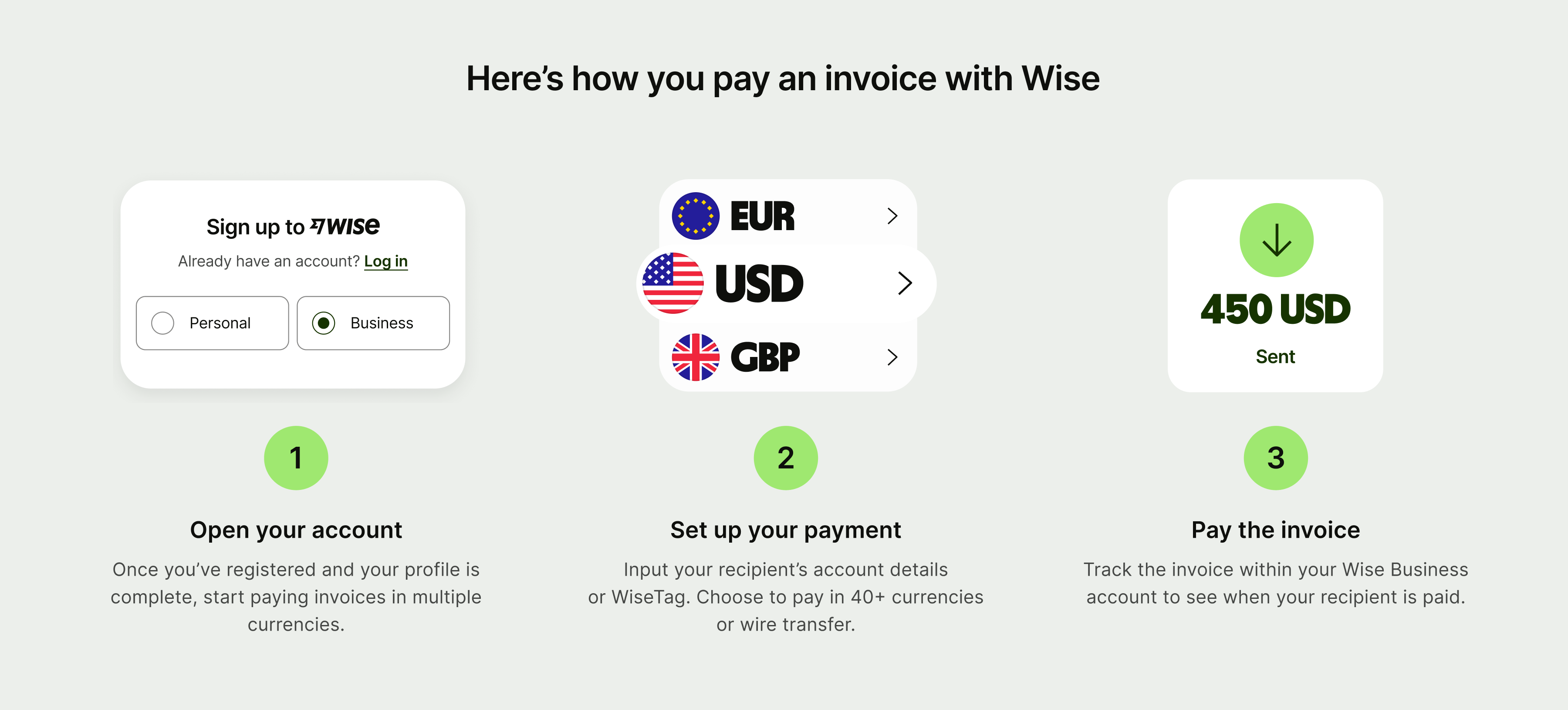

Open a Wise Business account and you’ll be able to pay suppliers in their own currency. You can send Euros, USD or 40+ other currencies in just a few clicks.

Disclaimer: Invoicing features are only available with Wise Business Advanced, which you can access for a one-time fee of £50.

You can easily make batch payments when paying multiple vendors at once, and even automate the process using the Wise API to save even more time.

Wise payments are fast and fully secure (even for large amounts). Best of all, you’ll only pay low, transparent fees and always get the mid-market exchange rate.

Get started with Wise Business 🚀

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

The manual accounts payable process puts you at risk of data entry errors and duplicate or late payments. Using this process is also labour-intensive, requiring a significant amount of manpower to handle invoices, enter data manually, route documents for approval, and file paperwork. This consumes the time that your AP team could have spent on more productive activities.

One effective way to handle invoices is by using automation software to optimize your approval workflows. Automating some of the most time-consuming aspects of your invoice approval workflows not only saves time but also reduces the possibility of errors and enhances fraud detection.

Here are some ways you can improve your invoice approval workflow using automation software:

When handling exceptions and discrepancies in the AP process, start by thoroughly reviewing the invoice to understand the issue and reassure the vendor or client that it will be resolved promptly. Investigate the root cause without assigning blame, then correct the problem internally to prevent future errors.

You should also communicate the resolution clearly and professionally. If necessary, you can offer discounts or incentives to maintain the relationship.

Yes, it’s entirely possible to eliminate paper from the accounts payable process by transitioning to a fully digital workflow. This involves using electronic invoicing (e-invoices), automated AP software for approval workflows, secure digital document storage, and electronic payment methods like ACH or wire transfers.

Wise Business makes it easy to pay vendors, especially for international payments. With a Wise Business account, you can hold and exchange 40+ currencies all in one place. You can also send payments to 140+ countries, making it simple to pay your suppliers anytime, anywhere.

Sources used in this article:

Sources last checked 23/09/2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Read our essential guide to sending large payments with Santander Business UK, including maximum transfer limits, fees, security and transfer times.

Read our essential guide to sending large payments with Tide Business UK, including maximum transfer limits, fees, security and transfer times.

Read our essential guide to sending large payments with Chase Business UK, including maximum transfer limits, fees, security and transfer times.

Read our essential guide to sending large payments with HSBC Business UK, including maximum transfer limits, fees, security and transfer times.

Read our essential guide to sending large payments with PayPal Business, including maximum transfer limits, fees, security and transfer times.

Read our essential guide to sending large payments with Lloyds Business, including maximum transfer limits, fees, security and transfer times.