Outsourcing to Romania: Clear Guide & Top Tips for US Businesses

Outsource to Romania with confidence. Discover the benefits, costs, and practical steps for US businesses.

Invoices are a critical part of any business operation. They act as a standard accepted document detailing products and services supplied, as well as agreed prices.

But what are invoices, and what is invoicing? It’s important to understand exactly what an invoice is, and how a professional invoice should look. Creating correct and professional invoices can also make a big difference to getting paid on time. This can be especially important with international customers.

Create professional invoices

with free invoice templates from Wise

| This piece has been written in collaboration with Esther Friedberg Karp, an esteemed bookkeeper and QuickBooks ProAdvisor. |

|---|

A basic invoice definition is an itemized list of goods shipped or services provided, usually specifying the price and the terms of sale. It is sent from a business to a customer, establishing an obligation for the customer to pay.¹

But what exactly is an invoice?

An invoice is a document that specifies, for a particular period, any products sold or services provided to a customer.

It acts as a notification that the customer should pay for these products or services. The invoice will detail the amount to pay, a timeframe for payment, and, if applicable, any amounts already received for this sale.

Invoices are essential in business accounting. They not only inform customers what they owe, but they also act as a method of tracking sales and inventory, sales forecasting, and tax records.

An invoice and a bill are essentially the same, seen from different perspectives. An invoice is sent from the supplier to the customer. Once the customer receives the invoice, it becomes a bill that they must pay.

For example, in QuickBooks, the term ‘invoice’ is used when accounts receivable is affected, e.g. for sales. The term ‘bill’ is used when accounts payable is affected, e.g. for purchases.

Connect QuickBooks and Wise:

Save time on reconciliation

The origins of the word ‘invoice’ also demonstrate this. It comes from the French word ‘envoyer’ meaning ‘to send.’ ²

An invoice is different from a receipt.

An invoice is a statement of products and services provided and a request for payment for them.

A receipt provides proof of payment. It will detail the products and services received and paid for, and the method of payment. And if you need to send receipts to your clients, get your free receipt templates from Wise.

The main role of an invoice is to provide a record of sales of products and/or services. This will formalize any previous dealings and act as a notification for the customer to pay.

But invoices also serve several other useful purposes, including:

Accounting and record-keeping. Invoices track all revenue coming into the business. This helps record and track cash flow.

Inventory tracking, forecasting, and marketing. Invoices contribute to tracking how much stock is available. Past data can help predict future requirements or plan effective marketing strategies.

Legal protection. An invoice formalizes any agreements with a customer. As such, it provides a record of prices agreed and timeline in the event of disputes.

Sales taxes. If sales taxes are to be charged on any portion of the sale, the invoice indicates the sales tax jurisdiction and amount

Tax record. It is an IRS requirement in the US (and with similar tax authorities in many other countries) to keep records for annual filings. Invoices provide a record of business activity and transactions.

Invoice payments are submitted by customers to pay for products and services. Invoice management involves sending invoices to customers, and managing payments of invoices received.

Good organization, reminders, and the use of software can help with timely payments.

Get international invoices paid faster with Wise

There is no fixed standard for an invoice. Companies often use different styles and content.

There are, however, several common types of invoice that you may come across, with differing uses. These include:

| Invoice type | Use case |

|---|---|

| Commercial invoice |

|

| Pro forma invoice |

|

| Timesheet |

|

| Past due or memo invoice |

|

| Recurring invoice |

|

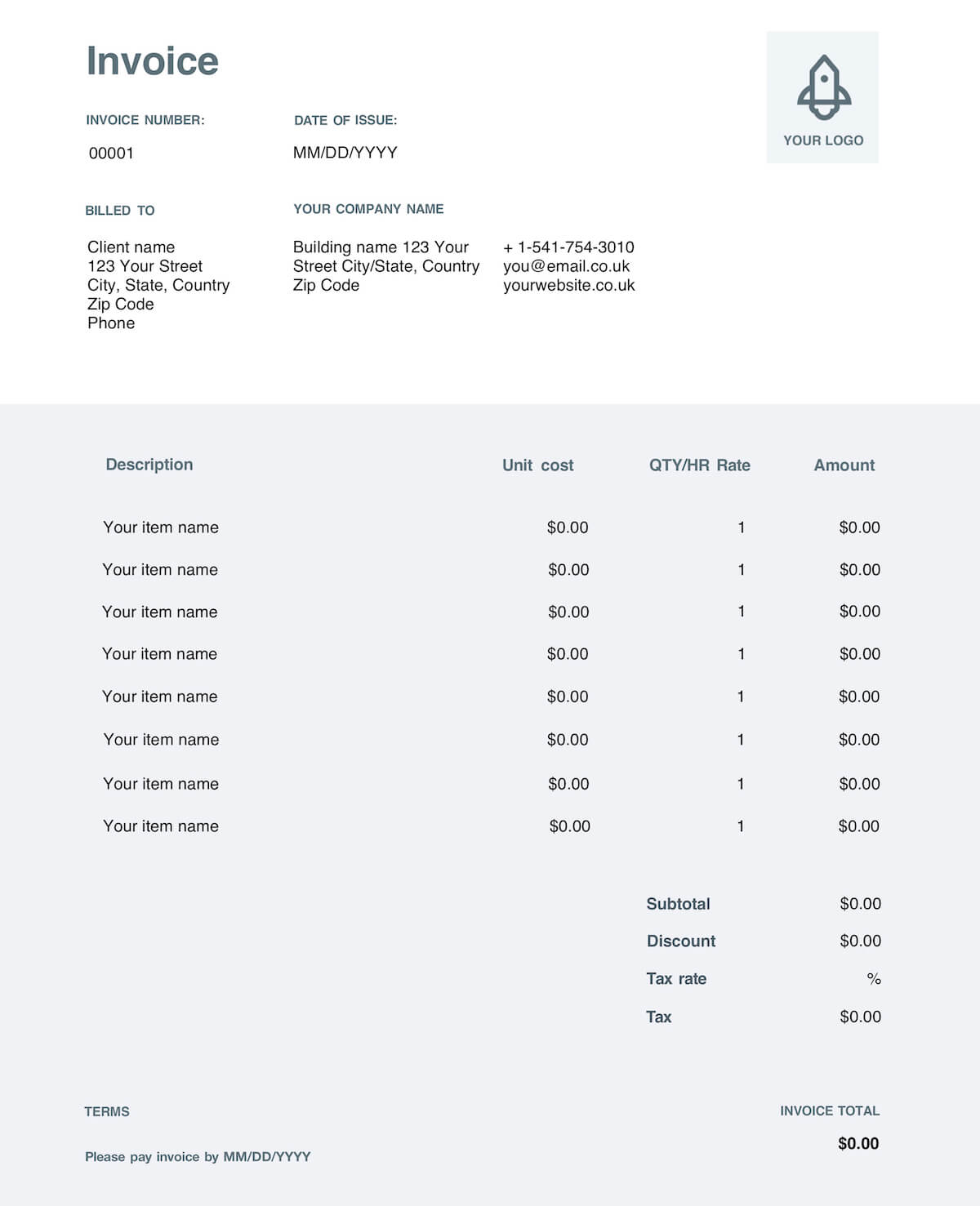

Although there is no fixed standard, there is certain information that any invoice should contain.

It can also be useful to use an invoice template to keep a consistent, professional, and branded style.

| 💡For free invoice templates that you can use – see this Wise guide. |

|---|

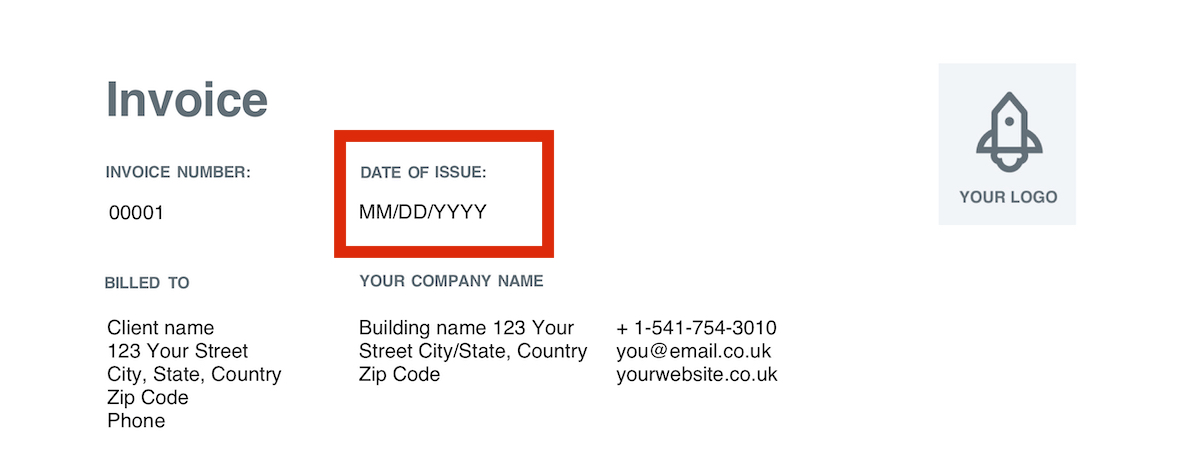

As seen on the example template, invoice requirements (including international invoices) include:

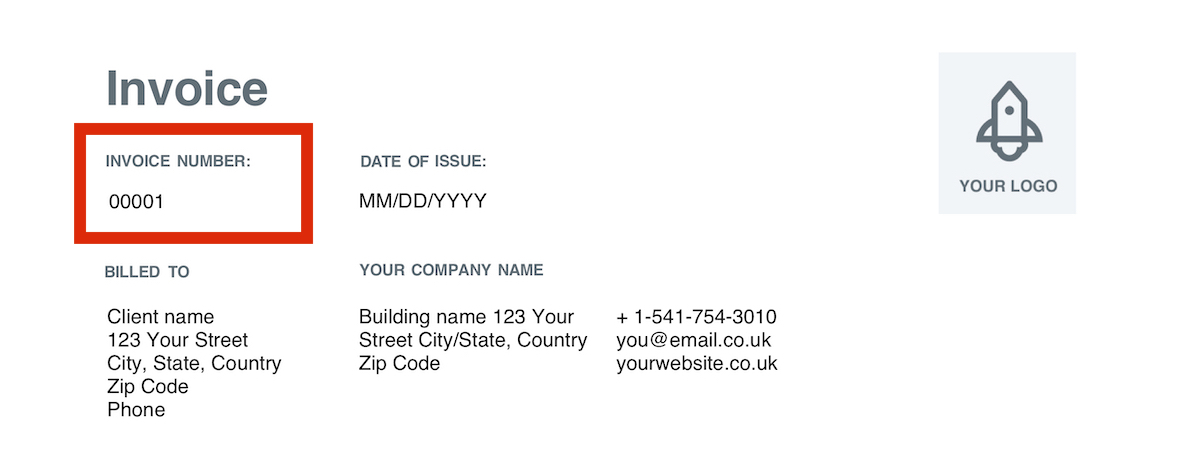

An invoice number, or invoice ID, is a unique identifier assigned to each invoice. This is important for both supplier and customer as it helps track and record invoices.

There are different ways to assign invoice numbers. The important thing is to make sure that the same invoice number is not assigned more than once.

There are several common numbering methods:

There are two important addresses required when providing an invoice for shipped goods. The first is the billing address, and the second is the delivery address. It is important to bear in mind that they might not be the same.

The billing address is the registered address of the company or customer. This must be correct for record-keeping and tax purposes.

The shipping address is where the goods are delivered. This could be a different company office address, a home address, or even another customer address.

The date of an invoice is essential information. It is important for accurate record-keeping as well as tax and accounting requirements.

An invoice is usually dated at the date goods are shipped, or service is provided. The payment date is then set relative to this invoice date.³

Invoicing software can also be used to automate and keep track of invoice processing. Such software makes it easier for companies to prepare, manage, and store invoices.

If you wish to use an invoice template, you may be able to create one or upload your existing one within the invoicing software. The invoicing software will then add the essential details to each invoice to ensure that no manual mistakes are made.

It can also make it easier for customers to pay, as such software products often support several payment methods.

For example, you can add your Wise Business USD bank details to your invoice template to get paid with ease.

Making things simpler for customers can help you get paid faster, which can in turn improve your cash flow.

| 🔍 Did you know? |

|---|

| Research shows that companies are 30% more likely to get paid if they offer easy online invoice payment.⁵ |

There are several great invoicing software options, including:

| Software | Key features |

|---|---|

| Xero |

|

| QuickBooks Online |

|

| FreshBooks |

|

| 💡 You can also check out the full guide to invoicing software options to compare the top choices. |

|---|

If you have international bills to pay, not only can you pay them at the real mid-market rate with Wise, but now you can also sync Wise with QuickBooks.

Sound amazing? See for yourself how much time and hassle you can save.

When invoicing internationally, different currencies can cause some headaches.

If the invoice is paid in the wrong currency, the bank will likely charge a conversion fee. With invoice and accounting software, you can add your Wise account details to the invoice to get paid in the currency of choice without the high fees.

Invoices can be sent on paper or electronically - Wise offers invoice templates for this in several formats.

Some companies may prefer paper invoices - but there are limitations to this method. These limitations are especially important to bear in mind when invoicing international customers.

Paper invoices can be harder to track and keep records of. They are also more expensive to send to customers, as you need to pay for the office supplies and postage. Postal services take time and the invoice could get lost along the way.

Electronic invoices solve many of these problems. They can be stored and searched for digitally, and there is no postal service or office supplies expense or delay.

More and more companies are moving to electronic invoices. The global e-invoicing market is expected to grow over 16% a year up to 2027.⁴

| 💡Like the sound of e-invoicing? There's an app for that 🤓Check out the top ten invoicing apps! |

|---|

When working with international invoices, it’s important to establish clear payment terms. This ensures that both parties are clear on what to expect, when payment is due, and any late fees that may arise.

Importantly, it also sets an agreement for the currency of the invoice.

Invoicing internationally will often involve dealing with different currencies. This comes with several challenges:

Transaction fees and margins added to the exchange rate reduce the amount received. Costs can affect both the seller and the customer.

There are often additional bank fees involved with making a deposit in person, or in making a deposit in foreign funds, especially if the bank's client doesn't maintain an account denominated in that foreign currency.

If the customer arranges to pay by wire, they pay a wire fee to their bank, and the seller pays a fee for receiving a foreign currency wire.

Anything that adds complexity will lower the chances of fast and easy invoice payment.

For example, the customer may have to pay by check. The postage can be slow and costly. The customer will also likely have to trudge to the bank and make an old-school deposit in person at a teller. Many banks cannot allow customers to deposit foreign checks using a mobile app.

It is important to consider offering several payment methods to remove these barriers.

If the exchange rate changes after the invoice date, the business can lose money. The use of a forward exchange contract (FEC) can mitigate this.

An FEC locks down the current exchange rate until the date set by you. This safeguards you from losing money due to exchange rate changes. The downside is that you may also miss out on any positive shift in the rate.⁶

It can also be unnecessarily costly to break the contract (especially if you don't end up needing to lock in a rate for the full amount).

| 💡 Another way to ensure you get the real, mid-market rate is to use a multi-currency account, such as Wise. With Wise Business, you can have up to 10 local currency account details to get paid without losing money on conversion fees. |

|---|

Businesses also need to take taxes and fees into account.

If buying from, or supplying, customers in the EU or the UK for example, international VAT (Value Added Tax) needs to be included. It may be necessary to register for VAT (or other sales tax) in the country where you are doing business.⁷

| ⚠️ Check with government agencies of the foreign countries in question, or consult an accountant who specializes in international sales to be sure. |

|---|

Invoicing and getting paid in foreign currency can add costs and lags to the payment process on both the seller's end and on the end of the customer.

Oftentimes, there are additional bank fees involved with making a deposit in person, or in depositing foreign funds, especially if the bank's client doesn't maintain an account denominated in that foreign currency.

And, let's face it: the banks never offer their customers a proper foreign currency exchange rate, as they always take a "piece of the action."

If the customer takes the extra time and arranges to pay by wire, they pay a wire fee to their bank, and the seller pays a fee for receiving a foreign currency wire. In other words, everybody loses except the banks.

|

|

Invoicing international customers can be problematic. The extra costs, time, and complexity all need to be considered.

One way to speed up the payment process is to accept payments in the foreign currency of the invoice. This makes it easier for customers to pay you on time. Unfortunately, it can also be costly if you have a traditional bank account.

Luckily, Wise Business offers a multi-currency business account that can hold 10 local currency account details all in one place. Customers can pay in their local currency, which can speed up the invoice payment.

You can add your Wise account details to your invoice and even connect your business tools to Wise, to save you time and money.

Hopefully the next time someone asks 'what is an invoice?’, you'll now have all the answers, and even the tools to show them your own example.

Get started with Wise Business:

Easy to set up, easy to use

| 💡 For all you need to know about invoices, don't forget to read and bookmark the ultimate guide to invoicing from Wise! |

|---|

Sources:

All sources checked 18 August 2021.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Outsource to Romania with confidence. Discover the benefits, costs, and practical steps for US businesses.

In this US guide to buying commercial property in Singapore, navigate the process, costs, and unlock foreign investment opportunities with expert insights.

Discover the most secure and convenient online payment methods for your business.

Learn the essentials of how to invest in commercial property in the UK as a US investor.

Compare Mollie vs Stripe to find the best payment gateway for your business. Our guide covers fees, features, and integrations to help make the right choice.

Find out how to open an IBAN account with our step-by-step guide. Understand the requirements, benefits, and best practices.