How to Open a Business Bank Account in Finland: A Guide for U.S. Entrepreneurs

Learn how to open a business bank account in Finland with this guide. Get essential info and steps for setting up your business finances.

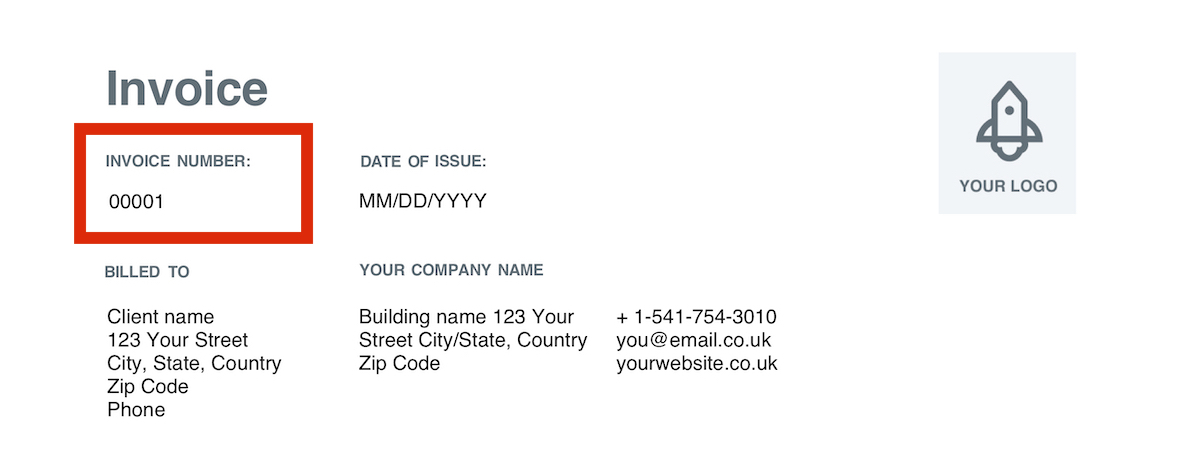

An invoice number, in a nutshell, is a unique series of digits that makes each document unique.

You can find the invoice number at the top of an invoice. This number is useful for both the issuing business and the recipient.

A unique invoice number allows for the identification of each invoice to confirm payments have been made correctly.

In this guide, you’ll learn how to number invoices, so you can document them for tax and accounting purposes.

No two invoices you send should have the same invoice number. This means, in theory, you and the recipient should be able to categorize and organize invoices with ease.

The invoice number is also essential for tax purposes, so you must know how to assign it correctly to each document you send out.

⚠️ Some countries, such as the UK, have strict regulations on providing invoice numbers.¹ If you do business abroad, then including the invoice number can spare you or your customers from legal issues down the line.

The type of invoice numbering system used will vary from one business to the next.

The main rule to follow is that your invoice numbers need to follow a sequence, they can’t be randomly assigned based on arbitrary criteria.

The invoice number is typically placed at the top corner of an invoice under the heading ‘invoice number’.

The first step to numbering invoices is finding a system that works best for your business.

There are four commonly used systems for assigning invoice numbers, which are as follows:

The most popular invoice numbering system is the sequential format.

If, for example, you start with ‘00001’ as a five-digit identifier, then the next would be ‘00002’ and then ‘00003’.

Another common approach is to use the current year as an identifier, and then add a sequence of numbers from there, such as ‘210001’ followed by ‘210002’.

The next system requires you to input invoice numbers in chronological order.

Chronological order means assigning invoice numbers according to the date. For example, an invoice on January 1st, 2021 may be written as ‘20210101’.

In this system, you have the year, followed by the month, and then the day.

You might also like to include customer numbers in this system to distinguish one customer from another. ‘20210101-300-01’ could represent customer number ‘300’ in this system.

To add another invoice for that same customer, it would be a case of changing the ‘01’ to ‘02’.

The next system is to start with your customer number, which will help you quickly identify invoices on a customer basis. As such, it’s a good system to use if you have a lot of customers on the books.

This might look a lot like the chronological system. Instead of ‘20210101-300-01’, you would reverse it to include the customer number at the beginning: ‘300-20210101-01’.

The final popular option for invoice numbering is the project number system.

If you carry out a series of projects in your company, then this system could work well for you.

You could start with a code for the project followed by a customer number and a sequential number.

For example, ‘CONS1000-20-01’.

Try the free invoice generator from Wise

Whichever system you decide to use for your business, there are some best practices to bear in mind to number your invoices correctly.

The number one rule with numbering invoices is that each one needs to be unique.

While it’s tempting to start at ‘01’, this method will soon get out of hand depending on how many invoices you issue. It’s a good idea to use several digits to allow room for growth.

Each new invoice must follow a sequence such as ‘0001’, ‘0002’, ‘0003’, building from the previous invoice.

Use an identifier to make your invoices truly unique, e.g. if your business is called ‘Steve’s Woodworking’, you could use the letters ‘SW’ to form a unique code.

There is also accounting software that can help maintain your invoice numbering system after you decide on an identifier to use.

If you don’t know where to start or numbers aren’t your thing, invoicing software might be worth your while.

When you rely on invoice software to do the leg work, you can eliminate human errors and speed up the process. There will be no risk of numbers skipped or duplicated, which is always a concern when you enter the numbers manually.

The software will work as an invoice number generator, automatically assigning invoice numbers. This means you don’t have to worry about keeping track of where you’re at.

|

|---|

While it’s up to you, most people would agree that the most convenient first invoice number should be ‘01’.

Though, others prefer to add another zero, making the first number in the sequence ‘001’.

From there, you can add unique identifiers such as customer numbers, a code for your business, or the date.

Many businesses opt for a system of invoice numbering that takes the current year, such as 2021, and goes up from there starting with ‘202101’ or ‘210001’.

Using the chronological system (current year, month, day - customer number - sequential number), here’s an invoice number example of what your first invoice might look like:

20211020-01-01

| Current year, month, day | customer number | sequential number |

|---|---|---|

| 20211020 | 01 | 01 |

In short, no, the invoice number and order number refer to different codes.

The order number can be created once an order is confirmed. The business, and often the customer, can use the order number to check the status of the order.

The invoice number is created once the service or good has been delivered, and the invoice is created to request payment.

Now that you know how to number invoices, you’ll want to make sure they get paid on time.

With overseas customers, getting paid in a different currency can slow the process down. With Wise Business, though, your customers can pay in their local currency, taking the hassle (and cost) out of needing to convert before paying.

You can receive the payment in one stress-free account that holds multiple currencies.

Use Wise Business to get paid with ease

You can also get local account details, such as a UK sort code and account number, even if you’re a US citizen. Moving money between currencies is simple, too, and you’ll always get the mid-market rate you can see on Google.

It’s free to register as a US business for an account, and there’s 24/7 support on hand to guide you through the whole process.

| 💡 For all you need to know about invoices, don't forget to read and bookmark the ultimate guide to invoicing from Wise! |

|---|

Source:

Source checked November 25, 2021.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn how to open a business bank account in Finland with this guide. Get essential info and steps for setting up your business finances.

Learn how to open a business bank account in Switzerland. Discover the essential steps to set up your business finances.

Learn how to open a business bank account in France. Get essential tips and steps for setting up your business finances.

Learn how to open a business bank account in Germany. This guide offers localized steps for setting up your business finances efficiently.

Discover the best client onboarding software to streamline your process, enhance client experience, and boost efficiency. Find your ideal solution today!

Find the best returns management software to streamline your business operations. Discover top solutions for efficient product returns.