How to Open an IBAN Account

Find out how to open an IBAN account with our step-by-step guide. Understand the requirements, benefits, and best practices.

Invoices and receipts are part of day-to-day operations for every business.

They’re often used interchangeably but are two distinct documents that are issued at different stages of a sales cycle and serve different purposes.

It’s important to understand the differences, particularly when it comes to preparing your financial records for tax season with the Internal Revenue Service (IRS).

For IRS and tax purposes, you must know the difference between invoice vs receipt.¹

This post will cover the key differences between invoices and receipts.

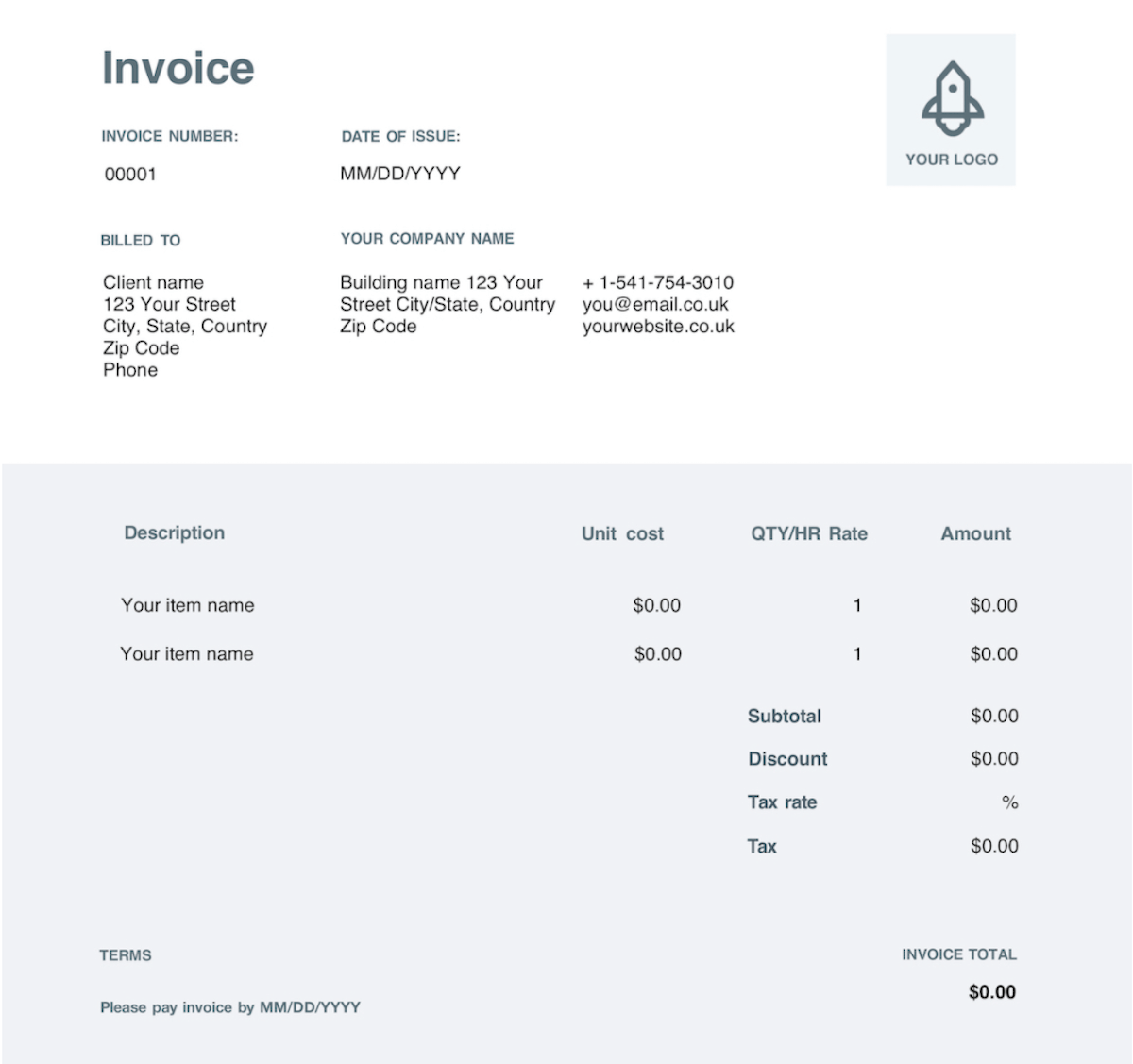

Get your free invoice template from Wise

Get your free receipt template from Wise

In a nutshell:

An invoice itemizes services or goods provided by a vendor and is an official request for payment.

A receipt, on the other hand, is confirmation of the buyer’s purchase.

An invoice is a list of services you have provided to a customer and is sent after the goods or services have been delivered but before payment has been received. Next to each, you should include the price and units (if applicable) associated with the service.

An invoice can be on paper or made and sent electronically as ane-invoice. The main benefit of the e-invoice is that it can be sent abroad without the expense and slow delivery speed of postage.

An invoice does not serve as a receipt. The invoice itself cannot be used as proof of purchase, since the customer hasn’t yet paid it.

There are several components you need to include on any invoice:

| 💡 Do you handle your own invoicing as an entrepreneur or small business owner? You can create professional invoices using Wise’s free invoice templates. Wise Business is here to make global business more straightforward. |

|---|

A receipt is proof of purchase and should be issued immediately after payment. It’s a document that proves that money or goods have been received.

Depending on the nature of the goods or service delivered, not all businesses will need to issue an invoice beforehand, but they must provide a receipt.

The receipt, like the invoice, can be printed on paper or sent electronically. Electronic receipts are often used by e-commerce sites as proof of purchase.

Receipts are important for proving company expenses. For example, if your business is US based, but you need to buy particular tools from overseas in Euros, then a receipt can serve as proof of purchase.

Here are the key components of a receipt:

It isn’t uncommon to also include a payment method on the receipt, which details how the customer paid the invoice.

A receipt can also have the customer’s details on it along with an order number if the payment was made against a purchase order.

To clarify, the main difference between the two is that an invoice is a payment request and a receipt is proof of payment.

However, there are several differences between an invoice and a receipt, such as the following:

| Handling international expense claims can be time-consuming and complicated. With Emburse Global Reimbursements powered by Wise, you can submit, pay, and track international expenses - without the stress. |

|---|

This post has covered the differences between invoice vs receipt, but one thing in common is that both can be a pain to manage. This is especially true if your business has overseas customers or suppliers.

Wise Business is here to make international invoice payments easy. The Wise Business account lets you pay invoices, accept payments, manage expenses, and more without losing out on costly FX fees.

The best part is that you can manage all your different currencies and payments from one place, meaning less time on admin and more time to focus on your business.

Save time & effort by using Wise

You can even get local account details in up to 10 major currencies, so you can pay and get paid like a local.

Register for free online, and get 24/7 support along the way.

| 💡 For all you need to know about invoices, don't forget to read and bookmark the ultimate guide to invoicing from Wise! |

|---|

| 🤓 Read more invoicing articles: |

|---|

Sources:

All sources checked 20 October 2021.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Find out how to open an IBAN account with our step-by-step guide. Understand the requirements, benefits, and best practices.

Explore the top business bank accounts for international payments in the US. Compare features, fees, and benefits.

Discover how to invest in commercial property with our comprehensive guide.

Understand your tax obligations as a sole proprietor. Essential information and guidance for filing and compliance.

Learn how to get a tax ID number and EIN for your business with this essential guide.

Small business tax filing. Essential steps for preparing and submitting your company's taxes.