PNC international wire transfer: Fees, limits, and rates

Read on for everything you need to know about sending and receiving international wire transfers with PNC.

As a major credit union in the United States with more than 11 million members, Navy Federal Credit Union (NFCU) also offers wire transfer services to its customers.

If you’re a Navy Federal customer, here’s everything you need to know about sending an international wire transfer.

Wise may be able to save you money and hassle on your international money transfers - you could save money compared to banks, but more on this later.

| International Wires | Regular fees |

|---|---|

| Incoming international transfer | $0¹ + possible exchange rate mark-upⁱ + likely other bank chargesⁱⁱ |

| Outgoing international transfer | $25¹ + possible exchange rate mark-upⁱ + likely other bank chargesⁱⁱ |

| Exchange rate mark-ups² | This can be the highest cost of the entire transaction. And Navy Federal notes that there is a spread involved.² See the next section for more information. |

| ⁱOther bank charges | Often $10-$50 deducted from the transfer by up to 4 banks. You may be able to decide with the recipient who pays these fees. |

Keep in mind that fees ultimately depend on what country you’re sending money to, what kind of account you have, and Navy Federal’s terms and conditions, which can change at any time. Though the information taken above was correct at the time of writing, It’s always a good idea to double-check that the above information is the most up to date.

When you send money internationally, usually the currency needs to be converted from the sender’s home currency to the recipient’s home currency. But is that exchange done at the mid-market rate or the exchange rate you see on Google? Generally, no.

As Navy Federal partners up with correspondent banks to carry out international wire transfers, there is an additional markup added to the bank’s exchange rate.

| 💡 But there are other options if you want a better rate. A specialist provider like Wise gives you the same rate you see online. And Wise tells you all the fees you’ll be paid upfront, so there aren’t any surprises. |

|---|

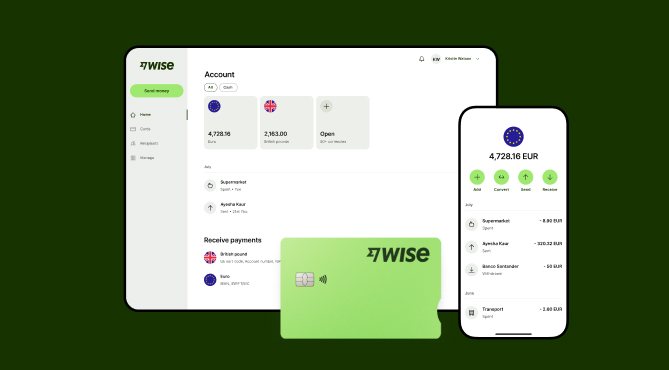

Wise only moves money at the mid-market rate — there are never any markups, hidden fees or intermediary bank fees. To send money online with Wise, you'll only pay a small, flat fee and a percentage of the amount that’s converted.

Wise also offers multi-currency accounts, which allow you to send, receive, and manage money in multiple global currencies all at once.

With a Wise Account, you’ll get:

See how much you can save with Wise:

Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information.

Navy Federal estimates that funds wired internationally should be available in the destination account within 5-7 business days.²

As stated on Navy Federal's official website, any wire transfer requests surpassing the amount of $5,000 need to be submitted in writing, either via a secure message or by visiting a branch in person.²

You’ll have a few options on how to make your transfer with Navy Federal.

You can log into your Navy Federal online banking and send your completed form in a secure eMessage. Once the message is received, someone from Navy Federal will contact you to process your wire transfer.

Once you’ve found a branch nearby that processes international wires, head there with your completed request form and a representative will assist you.

Another option is to call Navy Federal’s customer support number at 1-888-842-6328 where they should be able to help you with your wire transfer request.

| 💡 Navy Federal’s SWIFT code is NFCUUS33 or NFCUUS33XXX. |

|---|

Navy Federal offers an international wire transfer checklist⁴ to make sure you have all the information you need, including:

To receive an international wire transfer at Navy Federal, you’ll need to give the sender:²

If you still have questions or need more help with your Navy Federal international wire transfer, these resources should help:

Hopefully, with this guide, you have a better idea of what to expect when making an international wire transfer with Navy Federal.

You should also now have the information you need to decide whether Navy Federal is the best service for your transfer needs, or if you might want to go with an alternative, like Wise. Whichever you choose, best of luck!

All sources checked on 26 May 2023

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Read on for everything you need to know about sending and receiving international wire transfers with PNC.

Read on for everything you need to know about sending and receiving international wire transfers with First Horizon.

Read on for everything you need to know about sending and receiving international wire transfers with First Republic.

Read on for everything you need to know about sending and receiving international wire transfers with Chase Bank.

Read on for everything you need to know about sending and receiving international wire transfers with Varo Bank.

Read on for everything you need to know about sending and receiving international wire transfers with Wells Fargo.